Airline Ancillary Revenue Plummets to $58.2 Billion in 2020, Erasing 5 Years of Annual Gains

The CarTrawler global estimate also holds good news for global aviation, with increased ancillary revenue per passenger and on a percentage basis.

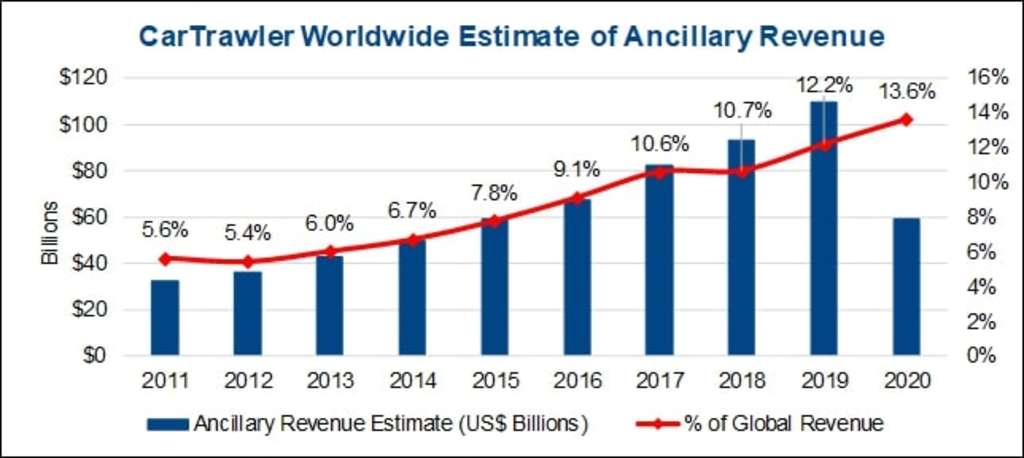

IdeaWorksCompany, the foremost consultant on ancillary revenue, and CarTrawler, the leading provider of online car rental distribution systems, project airline ancillary revenue will drop to $58.2 billion worldwide in 2020, compared to $109.5 billion in 2019. The CarTrawler Worldwide Estimate of Ancillary Revenue represents a 47% decrease, dropping slightly below the $59.2 billion amount for 2015.

Earlier this year, CarTrawler and IdeaWorksCompany reported the ancillary revenue disclosed by 81 airlines for 2019. These statistics were applied to a larger list of 134 airlines to provide a truly global projection of ancillary revenue activity by the world's airlines for 2020. This marks the eleventh year IdeaWorksCompany has prepared a projection of ancillary revenue activity.

Ancillary revenue is generated by activities and services that yield cashflow for airlines beyond the simple transportation of customers from A to B. This wide range of activities includes commissions gained from hotel bookings, the sale of frequent flyer miles to partners, and the provision of a la carte services − providing more options for consumers and more revenue for airlines.

"Covid-19's impact on the travel industry cannot be understated, but ancillary revenue has been a much-needed silver lining during an unprecedented year," said Aileen McCormack, Chief Commercial Officer at CarTrawler. "Even though the average fare has dropped steadily over the past decade, we have seen significant growth in ancillary revenue per passenger - a figure that has grown by over 200% since 2010 and whose trajectory has been unaffected by the pandemic. This shows that airline customers' appreciation of a true end-to-end travel experience is here to stay, and gives us a solid foundation on which we can recover and thrive again in 2021 and beyond."

The continued power of ancillary revenue, even during unprecedented airline industry upheaval, becomes obvious when viewing the graph below. The average fare presented by the International Air Transport Association (IATA) shows a declining trend with a significant drop projected for 2020. Ancillary revenue stands contrary to this trend with annual increases, to include the most challenging of aviation periods - the pandemic of 2020. In 2010, ancillary revenue per passenger was estimated to be $8.42; for 2019 this increased to $23.91, and the 2020 projection is $25.90.

There is plenty of evidence to indicate the level of 2019 customer support for a la carte purchases will continue through 2020. For example, AirAsia and Wizz Air made specific disclosures in 2nd quarter 2020 financial filings that describe positive recent ancillary revenue activity. AirAsia observed the following for operations in Malaysia and Thailand regarding higher take rates (percent of passengers buying) for the April - June 2020 period:

- Tune Protect (trip insurance): Take rate of 14%, up 88% from pre-pandemic.

- Baggage: Take rate of 47%, up 72% from pre-pandemic.

- Santan Pre-Order Meals: 43% higher revenue per passenger.

- Assigned Seating: Take rate of 26%, up 15% from pre-pandemic.

Jozsef Varadi, the CEO of Wizz Air, disclosed the company originally planned for ancillary revenue (on a per passenger basis) to have an overall increase of €0.50 to €1 for 2020. As of 03 June 2020, he did not anticipate the pandemic would affect this. The airline said it was not discounting ancillary revenue to boost demand.

Second quarter 2020 financial disclosures collected from 17 airlines revealed the ancillary revenue average among the carriers was 21.7% for the first quarter of 2019 and 22.1% for 2020. In addition, feedback from airline executives all over the world indicates consumer buying behavior related to a la carte services is comparable to 2019. Baggage and seating will remain the major categories. The following are a sample of the comments received:

- Baggage revenue is up, because passengers have more bags due to increased family travel, more days away, and relocations.

- Seat location has become an important feature, as passengers want to be in the front of the cabin for a quicker and smoother exit upon arrival.

- Extra leg room seating, which provides more personal space, is more popular with consumers.

- Buy-on-board is determined by airport options. Where airports have limited food availability due to retail closures, onboard café sales are higher.

- Onboard sales are depressed if hot food preparation is discontinued, or menu selection is limited, during the pandemic as a measure to limit staff exposure.

- Airport lounges are less attractive due to limited food offerings.

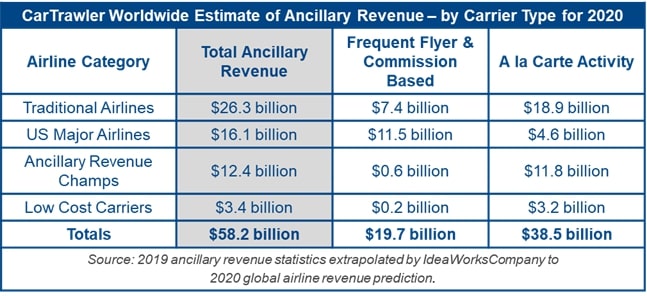

Low cost carriers and "ancillary revenue champs" are important generators of ancillary revenue. But as a single category, these airlines are behind traditional airlines in total ancillary revenue. Traditional airlines represent the largest category of passenger traffic and revenue and have treated ancillary revenue as a crucial source of support for many years. The below table displays ancillary revenue by carrier type as well as the split between a la carte activity and frequent flyer & commission based sources.

Emirates is one example of an airline in the traditional category which now emphasizes ancillary revenue. The carrier made a giant first-time ancillary revenue disclosure of more than $844 million, but did not specify what it was. In addition, other items were identified such as excess baggage charges and revenue from their holiday package company. For prior years, the only disclosure found was excess baggage. Clearly, Emirates has embraced ancillary revenue as an essential activity. It's a trend supported by traditional airlines, which has helped lift global ancillary revenue results every year.

IATA estimates global airline revenue will drop 50.4% for 2020. IdeaWorksCompany predicts ancillary revenue will drop nearly 47% for the same period. The difference between the two numbers might seem small. but when it involves billions of dollars, the better performance of ancillary revenue can save jobs and routes and provide some cushion for the hard landing the industry is experiencing. Where ancillary revenue once provided padding for better profit, it now operates as a reliable cushion to help protect airlines from the violent weather of the pandemic.

The tables appearing on page one and two of this press release are available as JPG image files at the press release section of the IdeaWorksCompany.com website.

The full definition of ancillary revenue, upon which this worldwide estimate is based, may be viewed online at: https://ideaworkscompany.com/industry-definitions/