Saudi hospitality ADR and RevPAR rise in first half of 2024

Saudi Arabia Real Estate Market Review Q2 2024

In the second quarter of 2024, Saudi Arabia’s hospitality sector demonstrated robust growth, reflecting the Kingdom’s ongoing efforts to enhance its tourism and travel industry. According to the latest CBRE Middle East Real Estate Market Review, key performance indicators (KPIs) for all major hospitality markets in Saudi Arabia have surpassed pre-pandemic levels.

The General Authority of Civil Aviation (GACA) reported a 20.0% increase in total passenger numbers as of May 21, 2024. This follows a 26.0% growth rate in 2023, when passenger numbers reached 111 million. The Kingdom’s connectivity has also improved significantly, with 148 new national and international destinations added in 2023, resulting in a 48% increase in connectivity.

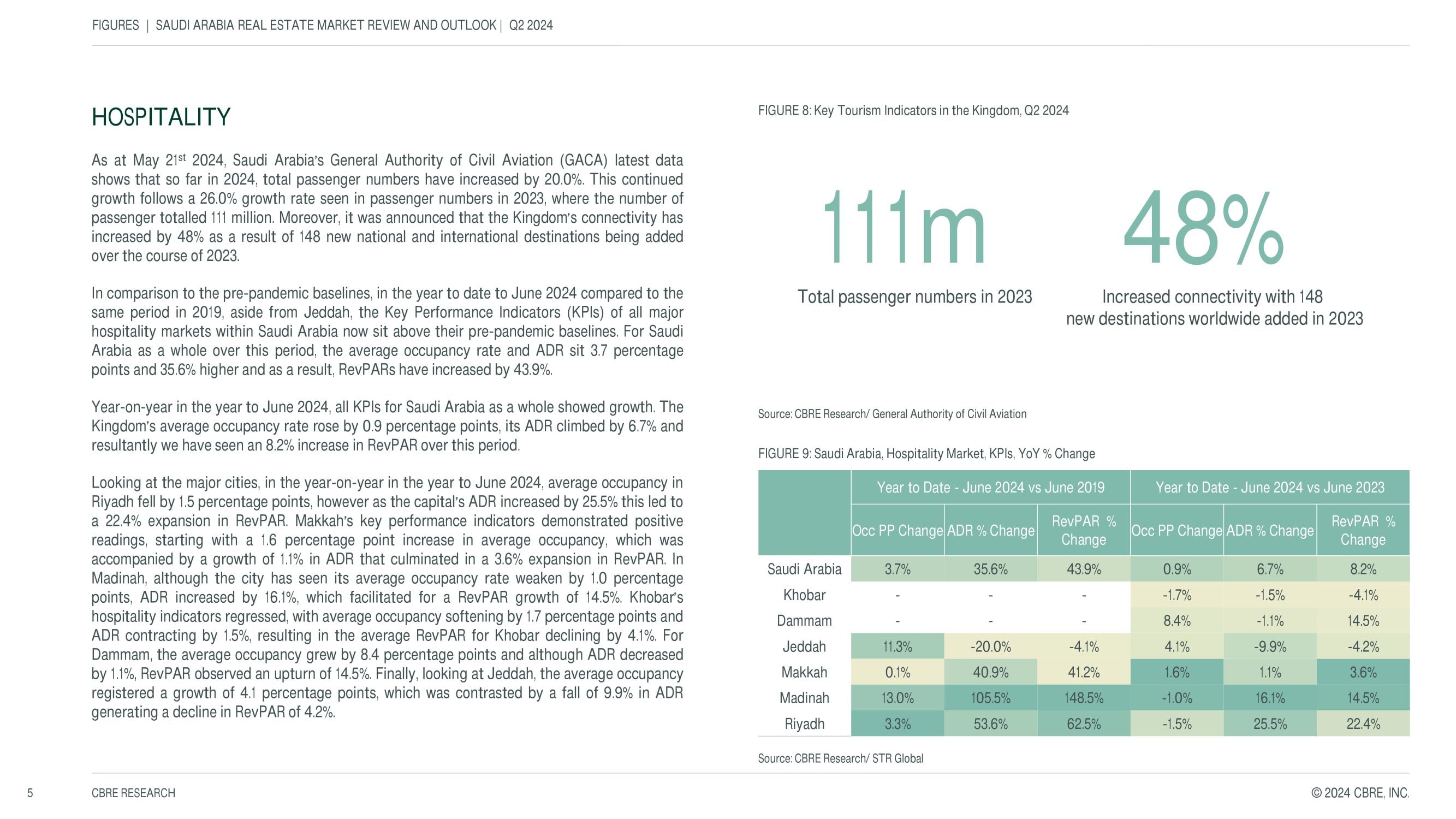

Year-on-year to June 2024, the Kingdom’s average occupancy rate rose by 0.9 percentage points, average daily rate (ADR) climbed by 6.7 percent, and revenue per available room (RevPAR) increased by 8.2 percent. These figures indicate a positive trend in the hospitality sector, driven by increased tourism and travel activities.

In Riyadh, however, the average occupancy fell by 1.5 percentage points year-on-year to June 2024. Despite this, the capital’s ADR increased by 25.5 percent, leading to a 22.4 percent growth in RevPAR. Makkah showed a 1.6 percentage point increase in average occupancy and a 1.1 percent growth in ADR, resulting in a 3.6 percent rise in RevPAR. In Madinah, although average occupancy weakened by 1.0 percentage points, ADR increased by 16.1 percent, facilitating a 14.5 percent growth in RevPAR.

Khobar’s hospitality indicators regressed, with average occupancy softening by 1.7 percentage points and ADR contracting by 1.5 percent, resulting in a 4.1 percent decline in RevPAR. Dammam, on the other hand, saw average occupancy grow by 8.4 percentage points, and despite a 1.1 percent decrease in ADR, RevPAR increased by 14.5 percent. In Jeddah, average occupancy grew by 4.1 percentage points, but a 9.9 percent decline in ADR led to a 4.2 percent drop in RevPAR.

While we are seeing strong levels of activity within Saudi Arabia’s real estate market, which in turn is bolstering rental and price performance in the vast majority of market segments, the lack of available quality stock is somewhat hampering the potential of the market. Taimur Khan, Head of Research MENA in Dubai