Tourism After Lockdown: Shifting Preferences By Accommodation Types

Research late last year indicated that travelers' accommodation preferences had been drastically impacted by the pandemic. However, there is now greater optimism for the eagerly awaited exit from the pandemic as vaccinations continue to expand and more parts of the world "reopen." With more reason for optimism in the travel and tourism industry, we set out to examine if sentiment toward accommodation type had once again shifted.

To better understand this issue and study everchanging attitudes towards travel, STR conducted a quantitative survey in February 2021 using its Traveler Panel.

Accommodation winners and losers

Overall, accommodation was still seen in a negative light as more travelers stated that they were less, as opposed to more, interested in accommodation than before COVID-19. However, there were a few exceptions to this rule.

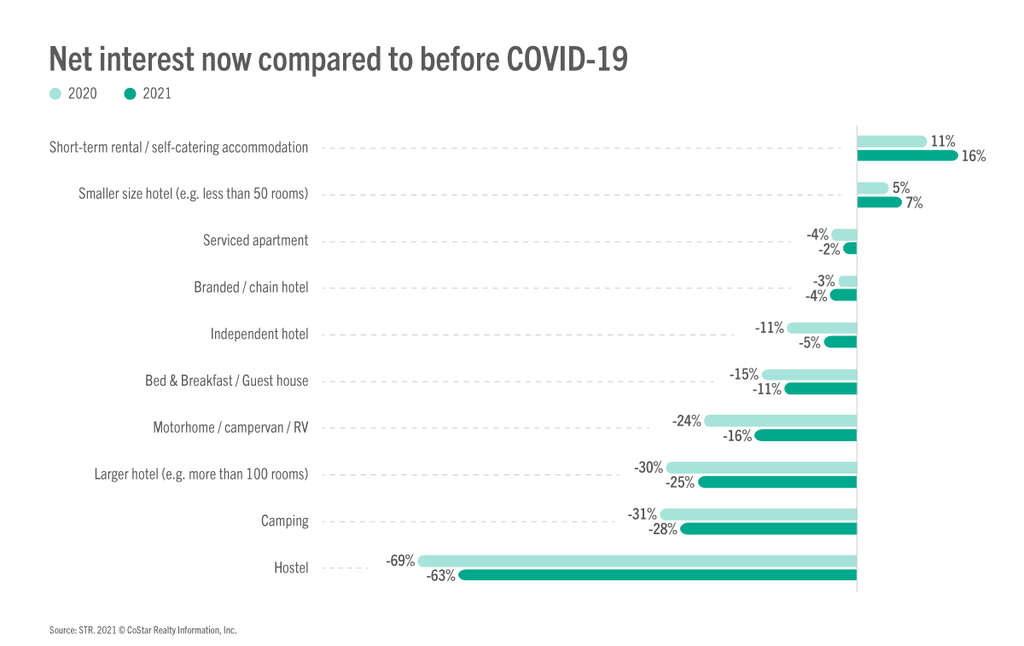

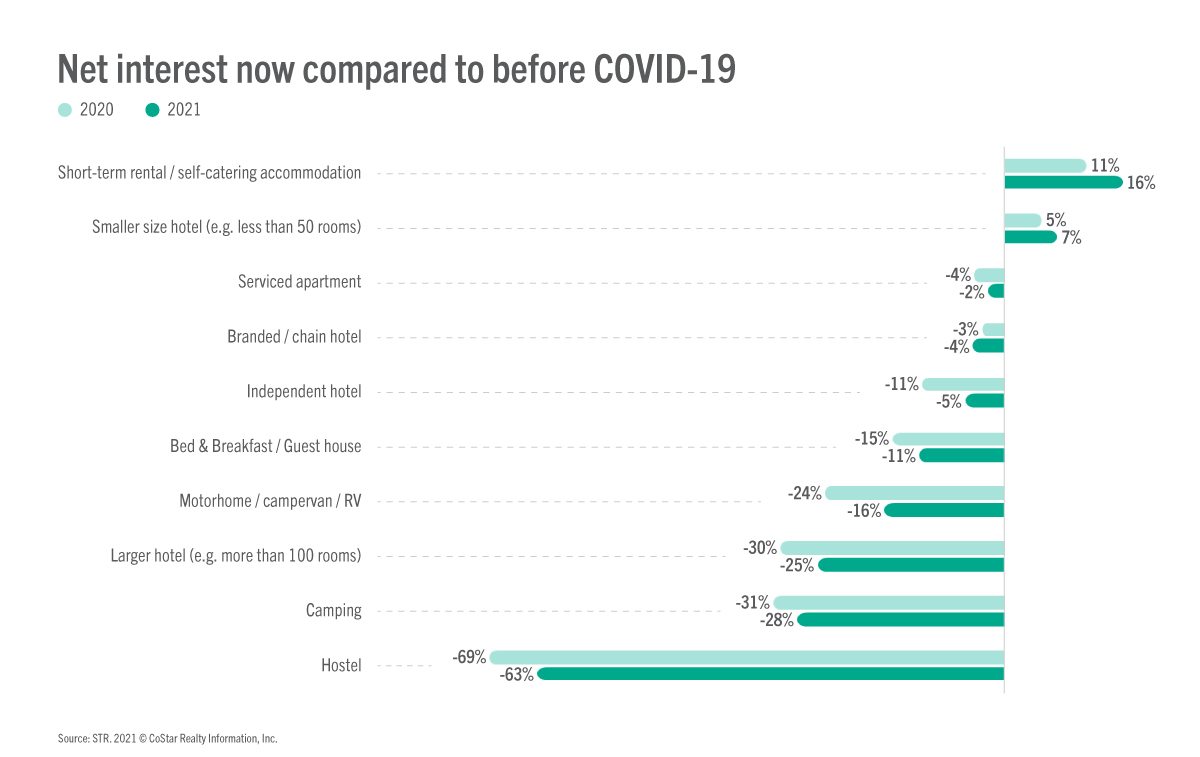

The pandemic has had a radical impact on how we view and appreciate our own personal space. Consequently, short-term rentals with their contained amenities and detached spaces have become more appealing. As a result, this form of accommodation continues to lead the way in terms of consumer perceptions during the pandemic as travelers are significantly more interested in this accommodation compared to before COVID-19. Indeed, this form of accommodation has become even more popular as the pandemic has progressed. Our research shows an increase in net interest from 11% in 2020 to 16% in 2021.

Along with short-term rentals, smaller sized hotels have also seen an uptick in interest, albeit marginal. Social and physical distancing has been a key theme of the pandemic thus far. Unsurprisingly, smaller sized hotels continue to be perceived more positively than larger properties.

Meanwhile, hostels continue to see the steepest decline in interest compared with before the pandemic. Unlike short-term rentals and smaller sized hotels, the communal nature of these accommodations has drawbacks when minimizing interactions with others is important.

Still bad, but less bad?

There are few winners when it comes to accommodation right now. The pandemic has made travel much less desirable, and concerns around personal safety understandably foster negative sentiment regarding almost all forms of accommodation.

However, when compared with 2020 responses, a softer and less negative opinion can be seen. Nearly all types of accommodation show improved sentiment when compared to earlier in the pandemic. These findings highlight improving fortunes for the industry and signal that travelers are warming to the idea of travel again.

National differences

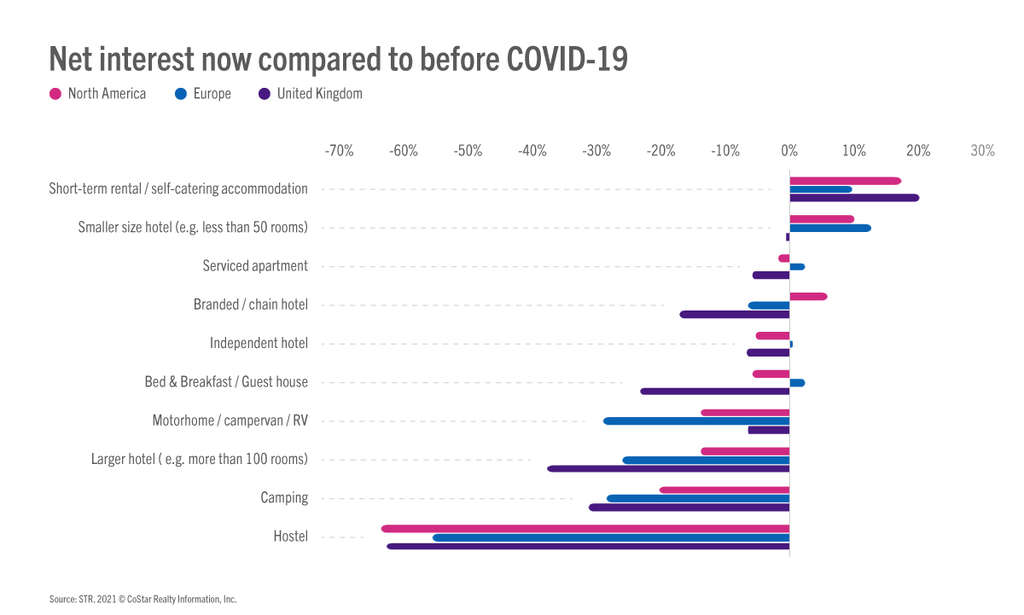

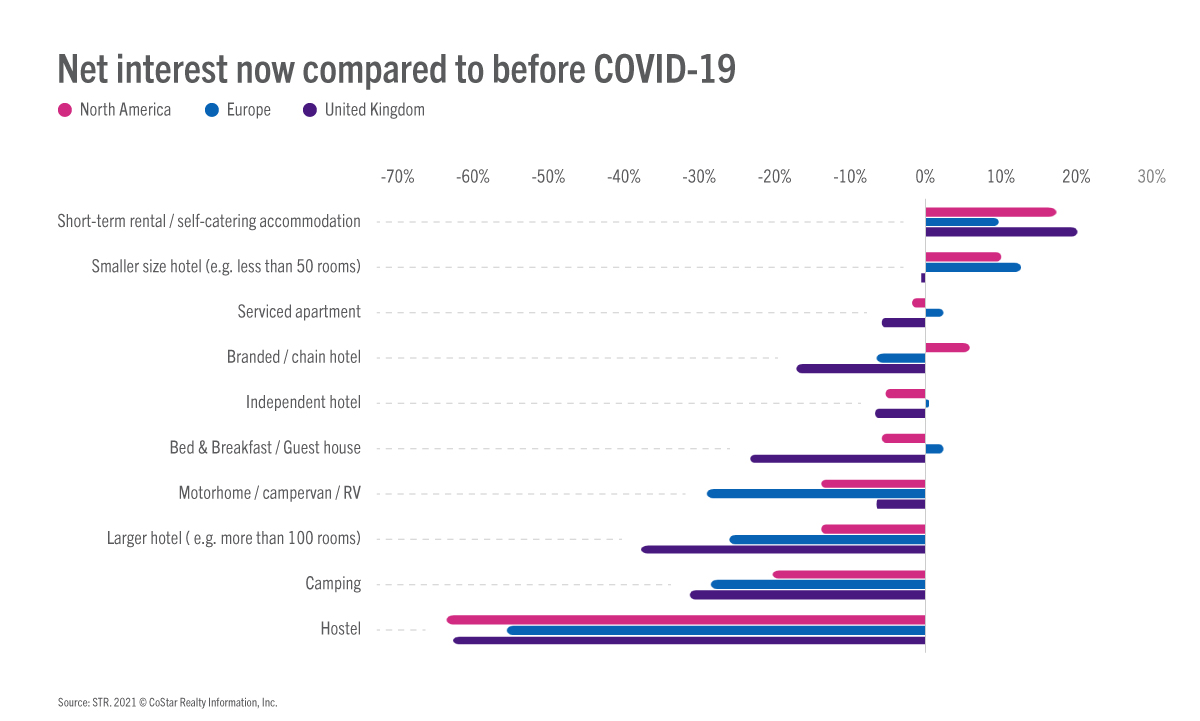

When the same data is broken down into national groups, there are some interesting cultural differences that can be seen.

British travelers are much less keen to stay in hotels compared with travelers from North America and Europe. Instead, the British favor short-term rentals and demonstrate higher interest in this accommodation than the other nationalities.

For North Americans, branded hotels are more favorable now than before the pandemic. This could be due to effective marketing and advertising deployed by branded hotels, demonstrating key changes relating to cleanliness and social distancing. Meanwhile, among U.K. and European travelers, branded hotels continue to be perceived negatively in the current environment.

Europeans show more interest in smaller serviced accommodation establishments such as small sized hotels and bed & breakfast accommodation. This finding is likely to be influenced by pre-COVID-19 travel behavior and preferences as well as current views on travel.

Does changed interest mean more or less bookings?

As discussed in an earlier blog, the main barriers to travel remain government legislation and restrictions, and the potential hassle of quarantine. As these barriers are removed it will be interesting to monitor if these shifts in perceptions crystalize into changes in traveler behavior.

Sentiment toward accommodation has improved in recent months as vaccinations have fueled interest and confidence in traveling again. The extent to which these views continue to soften in the coming weeks and months will be shaped by experiences as the industry continues reopening in many parts of the world after lockdown and travel restrictions.

If you would like to find out more about how STR can help you get closer to your customers during these volatile and uncertain times, please click here.

We were excited to share more in-depth findings during our recent Hotel Data Conference: Global Edition, which was a 13-hour event that covered APAC, Middle East & Africa, Europe, Central & South America and North America. Purchase access to the Attendee Hub to watch more than 50 sessions and view PDFs of the presentations here. All recordings will be available through 23 June 2021.

We do realize that since responses for this survey were collected, the situation is quite different in the U.S. because of rapid vaccination expansion. Because of this, it will be interesting to monitor changes in sentiment moving forward.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.