Hospitality Industry: All your questions answered

What is the Hospitality Industry?

The hospitality industry is a large subsection within the service industry and is comprised of four main areas: Food & beverage, travel & tourism, lodging, and recreation. As examples, the F&B category includes restaurants, bars and food trucks; travel & tourism covers different forms of transportation and travel agencies; lodging varies from hotel resorts to hostels; recreation refers to leisure activities such as sports, wellness and entertainment. While all sectors are interconnected and reliant on each other, many of these hospitality sectors are quickly evolving due to new technologies and changing customer mindsets.

Known for being one of the main industries that's easily impacted by external forces, many questions have recently come up regarding the state of hospitality today. What trends are shaping its future? What makes it still one of the world's fastest-growing industries? How can it remain competitive? How to deal with the post-Covid staff shortages?

Read on to find out the experts' guide on what is happening in this exciting, evolving and resilient sector.

A brief history of Hospitality

How has the Hospitality Industry evolved since its origins?

Derived from the latin word “hospes”, meaning host (one who provides lodging or entertainment for a guest or visitor), hospitality has its roots in ancient history. The ancient Greeks used the word "xenia" to define the sacred rule of hospitality: the generosity and courtesy shown to those who are far from home or associates of the person bestowing guest-friendship. Away from home, surrounded by strangers and yet feeling welcome.

Although the original concept of hospitality has remained largely unchanged since its origins (meeting travelers’ basic needs such as providing food and accommodation), the idea of building hotels for the sole purpose of hosting guests emerged alongside technological advances and better means of transportation towards the end of the 18th century. Since then, the sector been in constant expansion due to the very concept of hospitality being applicable to any sector that deals with customer service and satisfaction.

How fast is the Hospitality Industry growing?

Along with the overall economy, the global hospitality industry has enjoyed a spurt of massive growth over the last decade since the end of the financial crisis. According to the World Bank, the global economy has grown at a pace of more than three percent per year up until the global pandemic hit in 2019/20. Due to pent up demand during the beginning of the pandemic there was an acceleration of the global economy in 2021 of 5.5 percent growth, however it is set to decelerate to 4.1 percent in 2022 and 3.2 percent in 2023, arriving back at pre-pandemic levels.

This unprecedented expansion has benefited the hospitality and tourism industry by stimulating the world population’s travel activity, adding countless room nights in both leisure, and business travel.

Key hospitality and tourism statistics

1. International arrivals have increased from 900 million to more than 1.3 billion over a span of just ten years.

Not only has this boosted the number of rooms on offer, but has also led to a major contribution of global employment opportunities. Covid-19 had a severe impact and international tourist arrivals according to figures from UNTWO, which after years of steady annual growth saw a staggering -73% drop in arrivals in 2020 and -71% in 2021. This represents an unprecedented decrease as countries around the world closed their borders and introduced travel restrictions in response to Covid-19.

All in all 2020 is recognized as the worst year in tourism history with 1 billion fewer international arrivals and US $ 1.1 trillion in international tourism receipts. Around -74% drop according to the latest data from World Tourism Organization (UNWTO) a level of 30 years ago.

UNWTO’s extended scenarios for 2021-2024 suggest a return to 2019 levels in terms of international arrivals could take two and a half to four years. However, 2022 has so far seen an extremely positive bounce back.

2. The World Travel and Tourism Council (WTTC) names the hospitality industry’s importance as a main driver in global value creation.

Recent figures published by the WTTC suggest a global contribution of 8.6 trillion USD to the global economy in 2022, just 6.4% below pre-pandemic levels.

3. The hospitality and travel industry accounts for one out of every ten employment opportunities.

Bringing the number of people earning their living in the sector to a stunning 330 million in 2022, just 1% below pre-pandemic levels and up 21.5% up on 2020 representing a massive 58m more jobs.

The rise in revenue does not only benefit international companies and hotel owners, but also acts as a major factor in job creation for local populations and destinations. As of the latest data, around 173 million people were employed in the hotel and motel industry before the Covid-19 pandemic hit.

4. The overall growth in the travel and tourism industry stands at 15.1%.

According to the Hospitality Global Market Report 2022 the global hospitality market is expected to grow from $3,952.87 billion in 2021 to $4,548.42 billion in 2022 at a compound annual growth rate (CAGR) of 15.1%. This large growth rate is in part the bounce back from global restrictions on travel. The market is expected to reach $6,715.27 billion in 2026 at a CAGR of 10.2%.

What macro trends are driving growth of hospitality and tourism?

1. The global economy growth has created positive momentum in the sector by contributing to the overall income per capita.

Since 2009, the global GDP has constantly increased at an average pace of almost two percent per annum, leading to a growing demand for both international and domestic travel spending. Whilst the Covid-19 pandemic led to a shock -3.12% decline in GDP in 2022 according to Statista, 2021 figures and subsequent projections for 2022 and beyond will average out losses from that year.

2. Airfares have consistently become more affordable over the last three decades, but will that last?

Thanks to lower fuel prices, carrier competition and the rise of low-cost airlines. While these are not happy news for the airline industry, which is using ancillary fees to increase profit margins, it benefits travelers who can get more from their purchasing power. However the emerging global energy crisis could put a halt to such a trend and airlines could pass on the price hikes to the consumer, which will in turn impact consumer travel behaviour.

3. Corporate travel is yet another contributor to the healthy outlook and is projected to keep growing.

In China and India, the growth of business travel is particularly steep due to the relentless pace of economic expansion in this part of the world.

4. Hotel operators are seeking to expand their portfolios through targeted acquisitions of smaller regional chains.

Mergers and Acquisitions activity in hospitality has somewhat cooled over the last few years, with operators seeking to expand business in a more controlled way.

What major challenges is the Hospitality Industry facing?

1. The threat of climate change

The threat of climate change will adversely impact many major tourist destinations. Threats resulting from climate change, safety and security issues, as well as unprecedented migration streams are tomorrow’s game changers. The main challenges for the hospitality industry are the lack of predictability and the magnitude of such events – and how fast the industry can react and adapt. Hybrid operations might be one of the hospitality industry’s possible responses to increased risks.

2. Industry consolidation

Corporate consolidation has led to increasing concentration of size and power among the top players. Hotel operators will seek to expand their portfolios through targeted acquisitions of smaller regional chains. While the ultimate goal is to create value through cross-organizational synergies, this development also comes with downsides, as the management of structures with a diverse selection of geographies and a plethora of brands generates more complexity and threatens to increase overall rigidity.

Hilton remains the world’s most valuable hospitality brand, with its value up by a 35% despite the Covid-19 pandemic.

3. New competition from tech and digital players

Are major technology firms such as Google or Facebook threatening to replace hotel brands by offering technological solutions and creating novel markets to attract new types of customers? Thanks to their control over all types of data related to customer behavior both off- and online, tech behemoths could oust traditional incumbents into niche markets. Companies that fail to identify their niche are at risk of becoming mere revenue generators for technology companies. Some big enough brands may survive, but their business will get tougher.

4. Skilled talent shortage

As the accommodation and restaurant industry is creating jobs at the fastest rate of any sector in the economy according to the International Labor Organization, fuelling this growth with the right skilled labor is yet another concern for owners. Attracting and retaining younger generations of hospitality professionals will require a lot of flexibility and attention from hoteliers in the future.

Covid-19: Impact on the Hospitality industry

The impact felt by the Hospitality industry was massive due to factors including, the migratory nature of the hospitality work force and the pause on global travel, tourism and restaurant services. But does the leisure and tourism workforce need to be rescued? Considering the industry contributed 10,4% of global GDP pre-pandemic, supporting one in ten jobs on the planet, we can affirm that the tourism industry is one of the principal job providers. Furthermore, business recovery is expected to be slow: the UNWTO has estimated a 20-30% global decline in international tourist arrivals.

This pandemic introduced many variables that overhauled the prospects of the hospitality industry. Due to the uncertainty of the changes in customer needs after the pandemic, hotels need to review their existing service offerings so as to adapt to the changes in:

- Customer experience

- Customer perceptions

- Shift in consumption patterns

- Quality asset management

On the human side many hoteliers and hospitality businesses were forced to streamline their workforce to adapt to lower demand. The difficulties lie in attracting back the skilled hospitality workforce who may have found work in other sectors. The answers may be found in ensuring better working conditions for staff, including higher base pay, sick and holiday pay and ample time off in order to be competitive in a overstretched jobs market.

Hotels, bars, restaurants, spas, etc... put in place many sanitary adjustments that increase the cost function of the supplier and many continue to do so today as the consumer expectation has adapted to this new sanitary world.

Covid-19 took the world by surprise and has had a drastic effect on the industry. Many hospitality businesses didn't survive this turbulent period whilst many surviving hospitality business owners have been left in poor economic positions. However, those that have emerged from the pandemic have a new found respect for employee welfare, have new processes and technologies, and have a greater level of readiness for when another disaster should strike. What is the impact that the global pandemic has had on the hospitality industry?

The future of Hospitality Industry post-Covid-19

The pandemic was an opportunity for hospitality industry players to reflect and reset and respond to new roadblocks created by the crisis, but are they prepared for a new found hunger for travel and leisure?

Hospitality leaders were strong and extremely agile in responding to all the roadblocks. During the pandemic there was a huge shift in human behaviour and thinking, which infiltrated business causing new trends to emerge.

Four main interconnected trends:

- Demand is evolving more than ever with a clear change in behaviors and preferences. Domestic and foreign travel is in flux, leisure is bouncing back to pre-pandemic levels but it can't be taken for granted. Outside activities are the main choice and hospitality industry is already embracing this.92% of consumers trust word-of-mouth recommendations from family and friends.

- Health, Safety and Hygiene are the keywords. Whilst social distancing and quarantining rules have relaxed globally, there's still an incentive to keep up the new hygiene standards and prevent further outbreaks of the virus.80% of travelers fear potential quarantine as much as contracting the virus.

- 69% of travelers mention cleanliness and health measures as a critical component of travel brands’ crisis response.

- Digitized and innovate. The integration of new technologies were an essential part of operations during Covid-19. Online purchasing, contactless technologies and food delivery services were the true 'winners' through the pandemic.45% of air travel passengers are ready to shed their paper passports for digital identities.

- 89% of travel and tourism companies think the skills gap in local labor markets is a barrier to adoption of new technologies.

- Social, environmental and institutional sustainability. Restoration of the natural habitats, unemployment, wildlife protection, anti-racism movements...there is a public awareness and advocacy of sustainability in different areas.58% of consumers say they are thinking more about the environment since Covid-19.73% of consumers are took note of brands that made a difference during Covid-19.

- 78% of conservationists have been negatively impacted by Covid-19.

Many challenges await the hospitality industry and the future may appear uncertain, however this can and will turn into opportunities for an industry that has demonstrated along the years to be extremely resilient, strong and adaptive.

Other external forces Impacting the Hospitality & Tourism industry

Whilst the hospitality industry is emerging from the pandemic, the macro-environment is full of new external threats hampering the recovery of a once booming industry. With global conflict mounting, supply chain issues and an energy crisis, consumer confidence is low and there are fears that recovery might be stifled.

On one hand, there has never been so much appetite among the public for wellness and the escapism travel can offer from life’s stresses - the pandemic taught us to slow down and not to take our health for granted with the wellness market reaching new heights valued at USD 1.5 Trillion, growing at a staggering rate of 5-10 percent each year. On the other hand, the economic consequences of many external forces have culminated in a squeeze on consumer pockets, at the same time that it is squeezing hospitality businesses’ balance sheets once more, many hospitality business owners wonder how much more they can take.

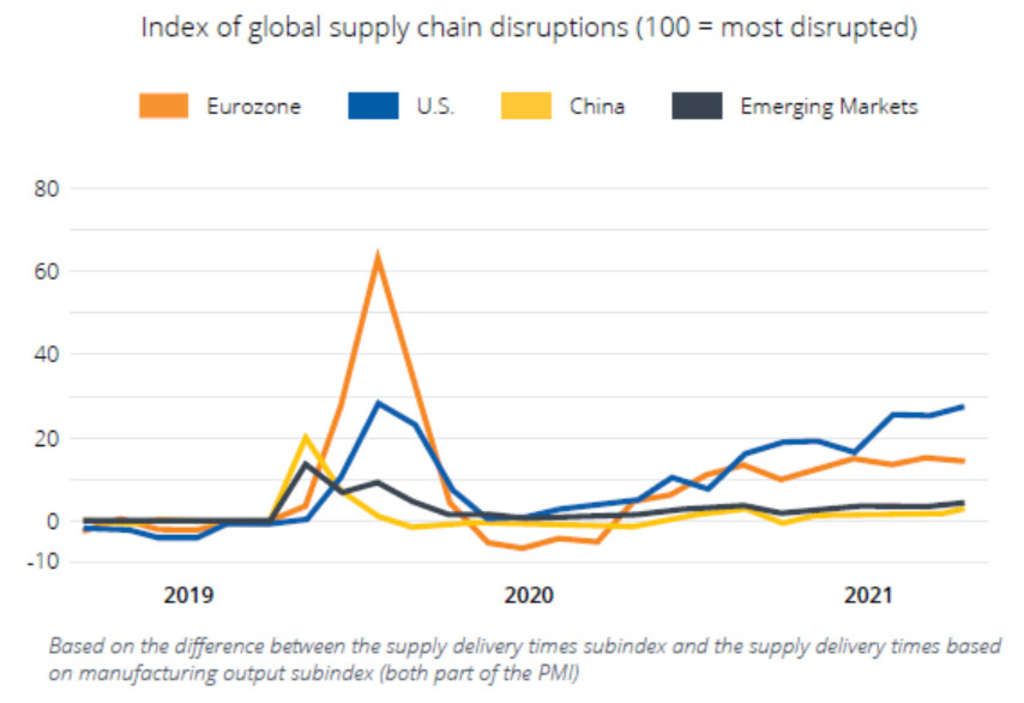

Supply chain issues have affected most of the world, although Europe was the hardest hit, according to data from the 2022 State of the Third-Party Logistics Industry Report by 3PL Central.

These issues are ongoing and are triggered by undulating demand, price volatility and uncertainty. The hospitality industry is affected on an operational level when bottlenecks cause delays on delivering food & drink, bed linen, housekeeping products and other replenishable goods. Running out of these items means giving customers a disappointing experience and leaving a poor impression that could diminish the business’s reputation.

The global energy crisis is the perfect storm of multiple factors causing a huge surge in energy demand which the limited global resources are struggling to fulfil. Added to this is Russia’s invasion of Ukraine, one of the main suppliers to Europe. Whilst the world grapples with accelerating the development of green infrastructure, the hospitality industry has an even bigger incentive to make efforts to switch to renewable energy sources where possible, not only as our environmental social responsibility but also to reduce the reliance on particular states which fuels the weaponization of energy.

Is there a silver lining? Well, we know that economic downturns make way for innovation and entrepreneurship! The public needs new solutions for new problems, so now may just be the time to start thinking of your next business venture.

What are the top trends in the Hospitality Industry?

1. Sustained disruption from online travel agents (OTAs) and digital players

Online Travel Agents (OTAs)

Well-established OTAs are continuing to look for new ways to challenge the hotel industry. Expedia, for instance, has been expanding its global presence by focusing on "brand-agnostic customers" through more relevant local offerings and content strategies. A world in which we no longer search for information via browsers and apps as we do now, but instead ask a virtual personal assistant – whether it be Amazon’s Alexa, Apple’s Siri, or Google Assistant – to book holidays or business trips for us - may not be too far off.

In the wake of these changes, there are many aspects for hoteliers to pay attention to, but there are also lessons to be learned in order to better equip traditional providers for what lies ahead.

Airbnb

Airbnb’s rapid expansion, embodied by its strategy roadmap aptly dubbed “Airbnb For Everyone” is another example of aggressive efforts for non-traditional hospitality industry players to play on traditional hotel business’s territories. The digital giant has drastically expanded the type of properties available to customers - from vacation homes and B&Bs to experiences or collections. The company cut 2,000 employees in May 2020 and refocused on its core services: home rentals and activities hosted by locals in their respective cities. Airbnb is putting emphasize on the fact that now that business meetings are attended virtually, people will travel more often for pleasure rather than business. Airbnb is still considered a highly valuable leisure brand, with a value of $10.5 billion.

Google has clearly been placing bets on the travel and hospitality industry by consolidating various offerings into its Google Trips interface - tapping into its gigantic trove of user data and delivering highly relevant information to users across the various stages of their trip planning. Its tools range from Google Assistant to flight and travel data, and put the company in a comfortable position when competing not only with major hotel chains but also OTAs.

2. Big Data, AI and customization in the hospitality industry

Data is everywhere, and for companies that know how to collect and store it correctly, it can be a major success factor. Big Data Analytics can help operators correctly predict whether high-rolling guests spending thousands of dollars on expensive food and drinks are merely celebrating a special occasion or if this is the clients’ usual behavior while traveling. This sort of information is crucial in efforts to determine a customer’s lifetime value.

A deep understanding of customer needs through collected information also enables hoteliers to stay relevant through their ability to offer personalized services to every guest, thus increasing their likeliness to return.

Unfortunately, many hotel owners tend to confuse personalization with simply selling upgrades or improving their email marketing. Hoteliers need to understand the limitations set by these challenges, but should not be discouraged since there are multiple steps that can be taken to stay relevant.

When it comes to ensuring that each room is sold at the highest price possible, revenue management is used to focus primarily on setting room prices and optimizing room inventory. Today, Revenue Management strategy goes beyond those aspects, and revenue managers should look for new ways to optimize revenue growth and profitability through data integration.

Digital advertising budgets increased up to 78% in 2021 as businesses communicated more with consumers.

3. Digital transformation in the hospitality business

In today’s ever-connected environment, addressing current challenges head on means embracing the possibilities offered by an end-to-end customer experience. It is not about merely relying on a loyalty program anymore, it is about creating a broad and connected ecosystem across all brands and touchpoints.

Major players in the industry - such as Accor - have already realized the immense potential of new technologies and are currently looking for ways to incorporate them into their client offering.

An area where traditional hoteliers are lagging behind their more advanced counterparts is online visibility and brand recognition. In the past some brands were able to create their markets based on the number of properties or an outstanding service offering. With the dawn of the internet and the connected rise of OTAs however, this trend has been disrupted. Because of the immense amount of indifferentiable hotel brands, hotel chains can already barely compete with online travel and booking players, making new competitive strategies inevitable.

4. Millennials and Gen Z travel trends: experience economy & customization

Millennials are a hugely attractive market, representing two billion people globally. Their collective spending is set to overtake Generation X by 2020, so it is not surprising that hotels have picked up on this trend.

Many hoteliers are discussing how to best approach this group of customers and how to stay attractive in the light of changing values and behavior. Hotel chains have launched brands designed to appeal to this demographic segment, often reducing guest room sizes and putting more emphasis on creating convivial common areas.

On the horizon however, the post-millennials of Generation Z are already picking up speed. Both generations’ need for unique experiences has led to the surfacing of the experience economy. This buzzword describes the transition from a product- and service-driven economy to an experiential one. The combination of advances in technology with the changing values of consumers have led to the success of social media and sharing networks as commercial platforms. This provides an opportunity for traditional hotel brands to leverage their existing brand equity to offer a range of more focused services and experiences that go beyond hotel stays.

5. Beyond the traditional hotel brand

After detaching themselves from physical assets, the time seems right for hotel brands to capitalize on their brand equity and find opportunities beyond traditional hotel stays to become universal travel and service brand. Wherever service and design elements are key to the experience delivery, hospitality brands have an opportunity to add and improve on the existing product.

In turn, this allows hospitality brands to create significantly more customer touchpoints with their target markets and collect more insights to help them create an ecosystem of services that could leverage off each other. As a way of circumventing hypercompetitive markets, hotels will also increasingly have to focus on niche markets, where customers are looking for a specific experience or service.

We categorize niche markets in the sense they could be royalty, they could be fashion, art, entertainment. They could be anyone of those items and we’ve actually been operating our business based on that for a long time.

Mathew Nixon, Business and operations transformation at Dorchester Collection.

6. Towards sustainable hotels

With the impact of climate change becoming more and more apparent, societal pressure on providers in all industries is mounting. First steps are being taken, for instance, in the fight against single-use plastic products that are part of the roughly 300 million tons of plastic produced each year. Many major corporations and businesses are opting to ditch single-use plastics from their day-to-day operations and the hospitality space is no different.

Hotels and airlines find themselves with a unique opportunity to really impact the effects of global plastic consumption as they often provide disposable products at mass scales. Many critics say that the practice of reducing plastic waste is, while commendable, not nearly enough to make a true impact in the fight against rising temperatures.

A growing number of hotels are rising up to the challenge of running a sustainable business. Beyond plastic usage, general waste production, food waste, usage of local produce, energy and water consumption and many other factors are to be considered for operators that are serious about their claim. Going one step further, the term sustainability is also often used in relation to not only environmental protection, but also corporations’ approach to managing their people and their finances. All across the board, resources of all kinds are being used more efficiently in the hospitality industry and while there are various strategies being adopted by hotels, a paradigm shift is becoming more recognizable.

What the top CEOs are saying about the future of the Hospitality and Tourism Industry

As an industry that depends on a stable environment in order to successfully operate - societal and environmental changes are having a greater impact on hospitality businesses compared to other industries. A recent global survey among CEOs by PwC has shown that heads of hospitality and leisure companies are notably less confident about their companies’ prospects for revenue growth in the near future than their counterparts in other sectors.

With disruptors in the industry, a wave of consolidation, and many external factors impacting their operations, hotel operators must find new ways to overcome these hurdles. Solutions to future challenges that companies are currently coming up with are the result of new thinking among the world’s business leaders and CEOs.

In a crowded field of competitors, hotels must find ways to distinguish themselves and position their property as distinctive destinations for customers, to develop preferences and loyalty in order to drive direct bookings. To do so, hotels must offer more highly personalized experiences that anticipate and go beyond the needs of their target customers – and count on word of mouth and allegiance to not only retain their customer base, but also grow it with more potential customers.

We have been a super good hospitality group for the last 50 years. We are not shying away from it. We are shifting and expanding the hospitality notion to Augmented Hospitality. We are being even more audacious and going one step further by saying: Since people want to be recognized, want to have something extremely personalized, why don't we try going from Augmented Hospitality to a Lifestyle Augmented Hospitality player?

Sébastien Bazin, Chairman and CEO of Accor (Source: Accor TV - New Accor Strategy).

Other ways that are often discussed when dealing with the impending changes are the implementation of new technologies, training employees to move away from standard SOPs to become true high-touch experience providers and modernizing the service offering towards individualization and “lifestyle” to create true differentiation.

What hospitality leaders can do to remain competitive in an ever-evolving market environment

Fully take advantage of technology and personalization to create experiences

A generational shift towards how travelers are consuming hospitality services is making hotels evolve from being mere suppliers of accommodation to experience providers, leading to a need for outstanding customer relationship across all stages of their guests’ customer journeys.

Focus on talent acquisition and retention

From targeted recruitment efforts to a meaningful interview process and to the actual hiring and onboarding process, organizations that are well-equipped to recruit in the era of millennials think holistically about the overall experience delivered to potential hires.

Embrace sustainability as part of your business model

As a result, a growing number of international hotel companies have developed sustainability and corporate social responsibility strategies. These initiatives can be perceived as the beginning of a paradigm shift toward a positive form of hospitality.

The hospitality management careers of tomorrow

Reshaping the future of hospitality jobs

Over the past two decades, the hospitality industry has experienced significant growth, with international arrivals doubling from 600 million to over 1.4 billion in 2016.

In 2018, the travel and tourism industry saw a growth of 3.9%, outpacing that of the global economy (3.2%). In that same year, the hospitality and travel industry accounted for one out of every ten employment opportunities – bringing the number of hospitality professionals to a remarkable 319 million. End of 2019 we were filled with excitement and optimism about the amazing tourism opportunities and growth that the new decade will bring.

In the 1st half of 2020 as Covid-19 restrictions were enforced we had a drop of 65% international tourist arrivals. The predictions from the experts mention we may have to wait 2024 before international travel returns to 2019 levels.

However, many people across the world are seeing the return of international travel within the short term. Based on the latest available data, global international tourist arrivals more than doubled (+130%) in January 2022 compared to 2021. However paired with the increasing economic uncertainty with the energy crisis resulting from Russia's invasion of Ukraine causing the cost of living to sky-rocket, the recovery effort is long but over.

Confidence from a quicker return has come from the tourism expert community of the Middle East as well as the many vaccination policies started worldwide.

Travel and tourism may be up as global levels of wealth increase, but there are fewer qualified hospitality workers across the entire industry and the ever evolving market dynamics are leading to the creation of brand new types of jobs in the sector.

On the horizon for current and future hospitality professionals:

Employers across the board are looking for professionals with a combination of both hard and soft skills. In hospitality, developing skills such as cultural awareness, multitasking, customer service and communications - is paramount to effectively deliver outstanding customer experiences.

The increasing complexity of the hospitality sector and evolution of its modus operandis - due to the expanded use of technology and data, the evolution of business models with the separation of management from operations or the ever-increasing trend of brands becoming publishers - is leading to the creation of new job profiles, such as; asset managers, data scientists, or content marketing specialists.

The Covid-19 crisis has underlined the global importance of the travel and tourism industry economically as well as its interconnection with other industries. From small tour operators to multinational hotel chains and major airlines, everyone in the industry have been impacted by border restrictions as well as social distancing and lockdowns.

Covid-19 has impacted jobs and many trillion in GDP, the longer-term damage in livelihoods of those in this industry remains to be seen. To every negative repercussions of a crisis there is also some positive change that could be foreseen for the future. The World Economic Forum’s recent “Rebuilding Travel and Tourism panel” at the “Sustainable Development Impact Summit” explored the intersection of consumer consciousness, acceleration of technology and destination management and found some solutions that could have the potential to reshape the way we market, manage and plan our travel:

- Travelers are becoming more impact-conscious

- Tourists are looking for experiences in nature

- Digital solutions are improving sustainability

- Long-term progress requires cooperation

The end result is in an industry that will recover as it is an essential part of modern human lives that derives much pleasure and enlightenment. It is simultaneously undergoing huge digital transformation and other shifts to adapt to consumer sentiment, therefore a career in hospitality won't necessarily be a quiet one, but it will be an exciting adventure with a multitude of possible career paths to explore.

About EHL Group

EHL Group is the global reference in education, innovation and consulting for the hospitality and service sector.

With expertise dating back to 1893, EHL Group now offers a wide range of leading educational programs from apprenticeships to master's degrees, as well as professional and executive education, on three campuses in Switzerland and Singapore. EHL Group also offers consulting and certification services to companies and learning centers around the world. True to its values and committed to building a sustainable world, EHL Group's purpose is to provide education, services and working environments that are people-centered and open to the world. www.ehlgroup.com

EHL Hospitality Business School

Communications Department

+41 21 785 1354

EHL