Market Recovery Monitor - 18 June 2022

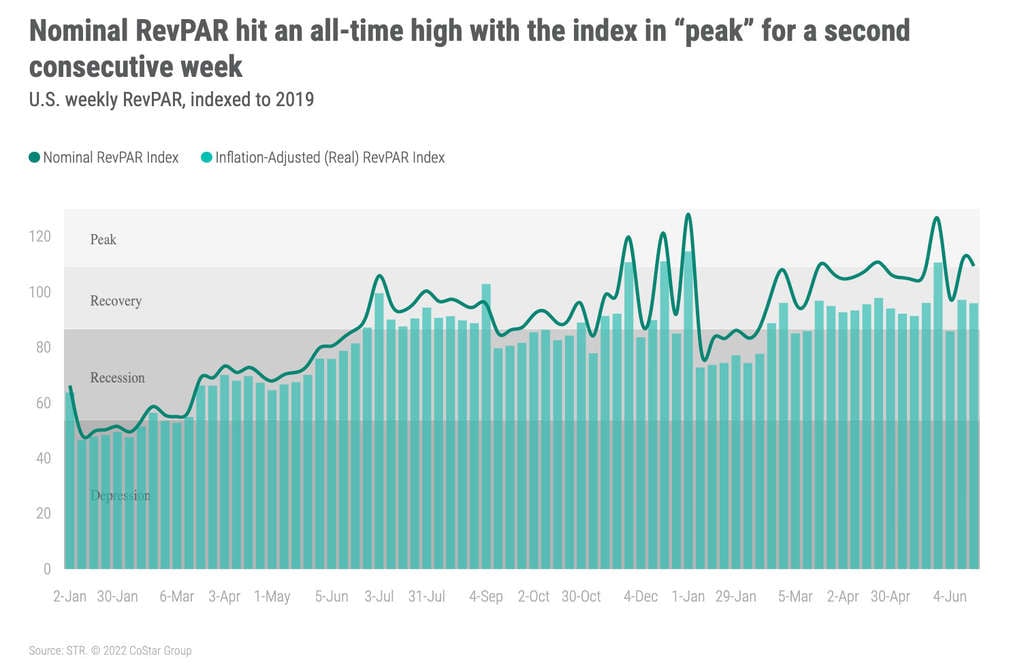

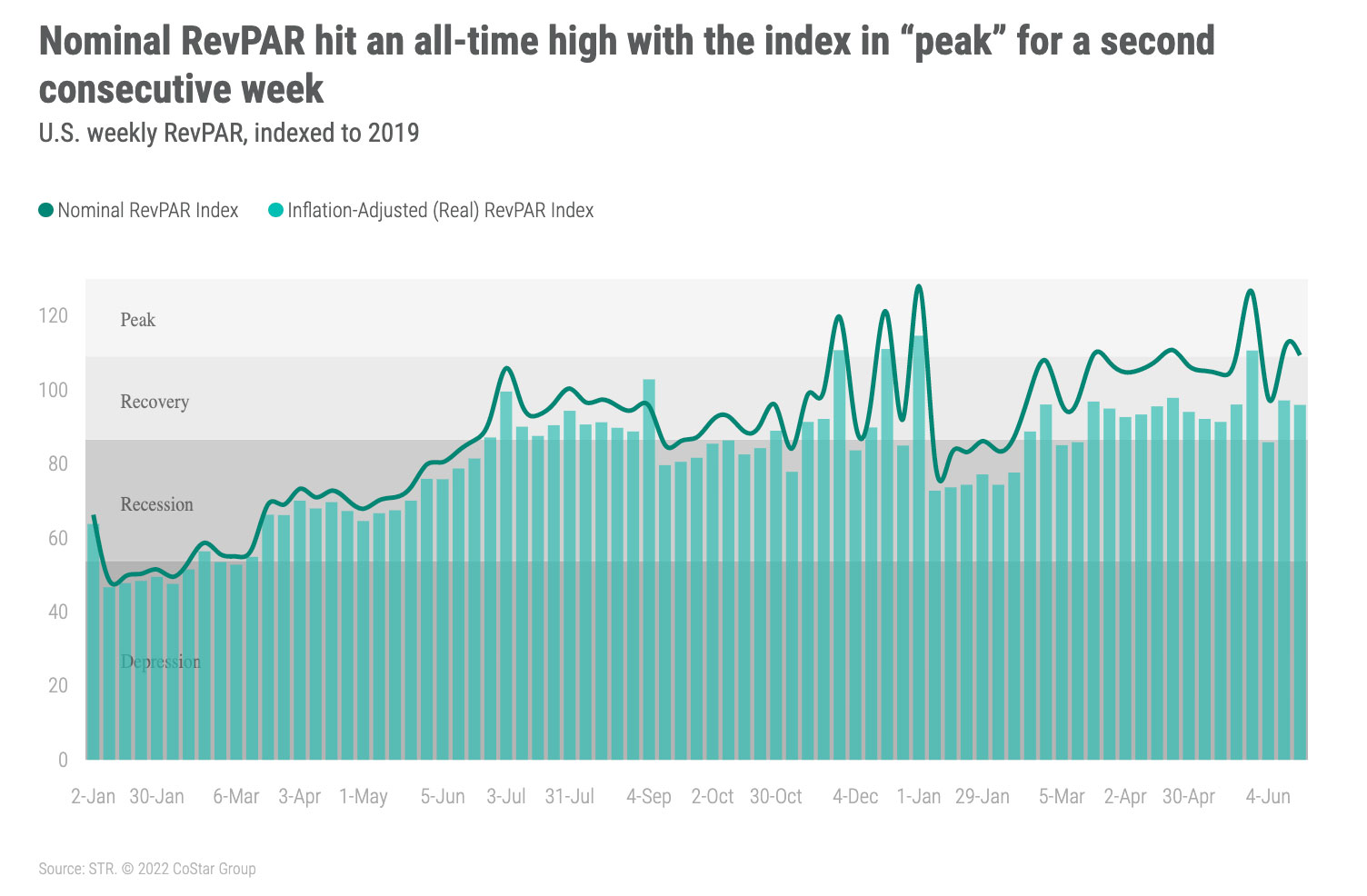

U.S. hotel performance strengthened further with occupancy for the week ending 18 June 2022 at a pandemic-era high of 71.8%, which was up 1.2 percentage points from the prior week and 4.1 percentage points versus the matching week last year. Weekly room demand, 28.1 million, was the highest since the week ending 10 August 2019 and 98% of the level seen in the comparable week of 2019. Demand has been at 90% or greater of the levels seen in 2019 for the past 18 weeks, 97% on average. Nominal average daily rate (ADR) was flat (US$155) week on week but up 19% compared with last year and 15% better than in 2019. Nominal revenue per available room (RevPAR) hit an all-time record (US$111), surpassing the previous high set just one week earlier. Prior to the last two weeks, the record for nominal weekly RevPAR was in the period ending 28 July 2018 (US$107). This most recent week’s nominal RevPAR was 9% higher than what it was in 2019 and 27% greater than a year ago.

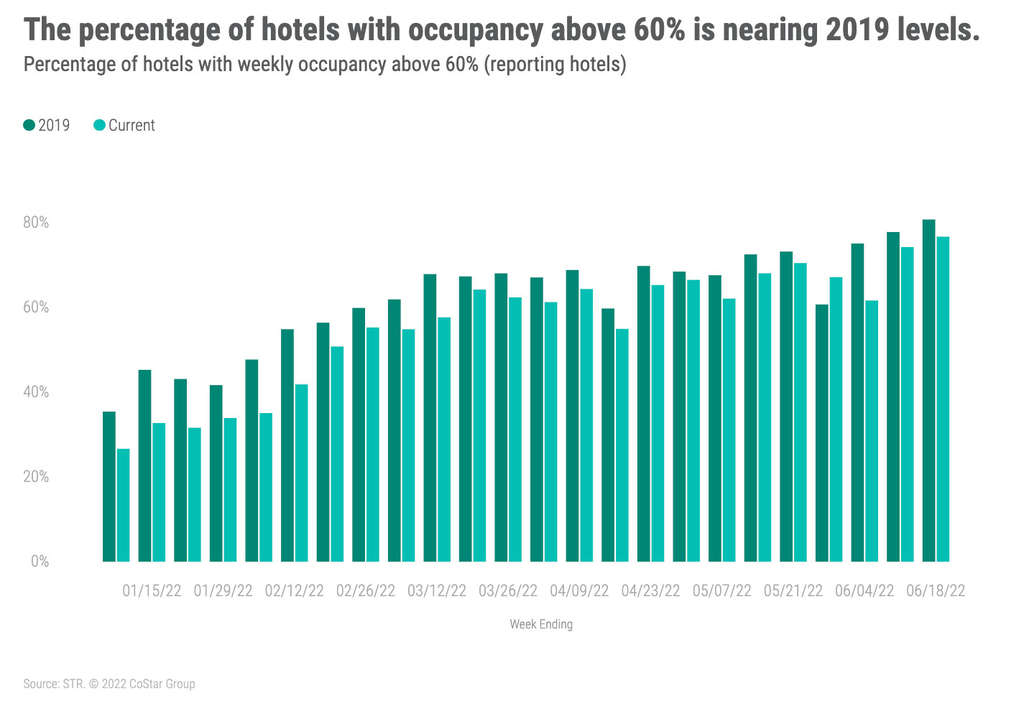

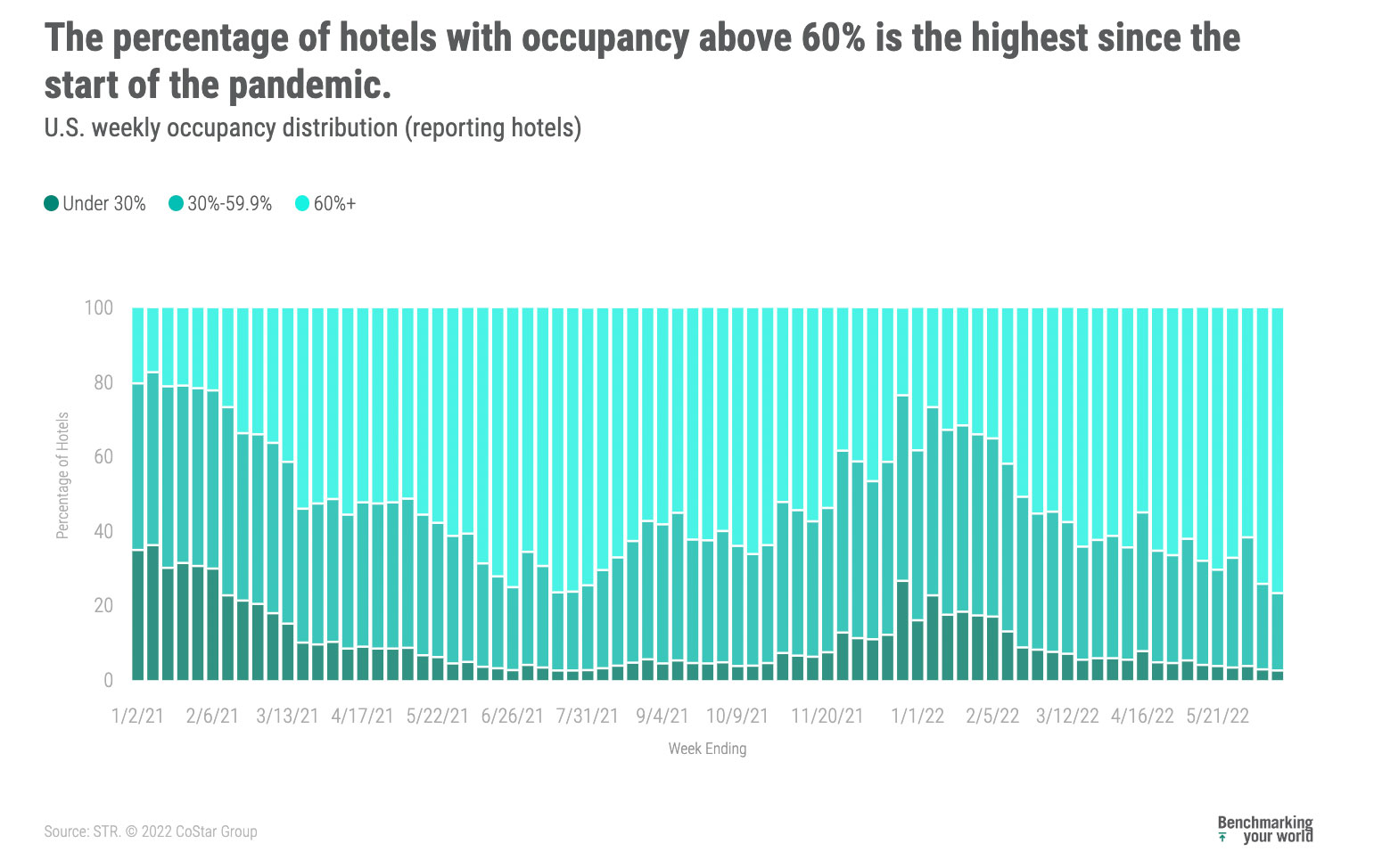

Nearly 40% of reporting hotels saw occupancy surpass 80% for the week. This was the highest percentage since last summer. More notable, 39% of large hotels (300+ rooms) were above 80%, up from the week before, and the highest such percentage since the start of the pandemic. While this is good, there is still plenty of room for further recovery. In the comparable week of 2019, 64% of large hotels were above 80%. In the Top 25 Markets, 47% of all hotels, regardless of size, were above 80%, which was the highest percentage of the pandemic-era but 13 percentage points lower than what was seen in 2019. Forty-six percent of large, upper upscale hotels in the Top 25 Markets surpassed 80% occupancy. This group of hotels is seeing a good recovery trend, but it is still 25 percentage points below 2019 when 71% of large, upper upscale hotels in the Top 25 Markets were above 80%. A year ago, the gap was 59 percentage points.

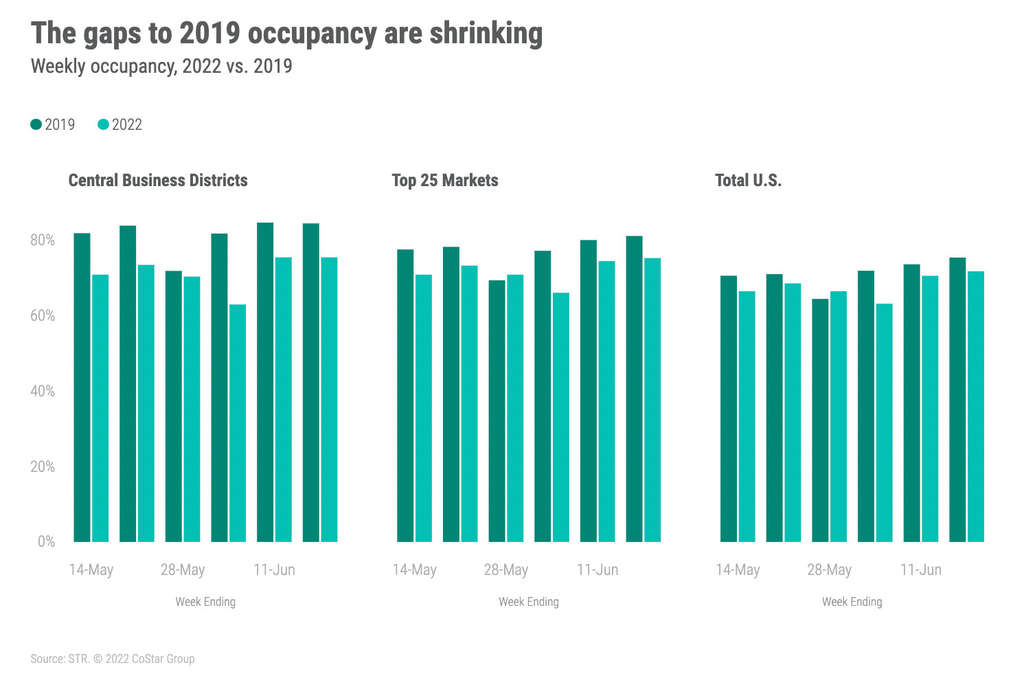

For the second consecutive week, Alaska led the nation in weekly market occupancy (90.3%) followed by New York City (86.6%). Ninety-one markets, the most of the pandemic-era, reported occupancy of more than 70% with 13 above 80%. Twenty markets reported their highest occupancy of the pandemic-era, including Boston (84.7%), Chicago (79.1%), Nashville (78.7%), San Diego (86%), Philadelphia (71.1%) and Washington, D.C. (76.3%). Occupancy in the Top 25 Markets reached a pandemic high (75.3%), including during the weekdays (76%). Across the entire U.S., weekday occupancy (71.9%) was the best seen since late October 2019. Occupancy in central business districts (CBDs) was virtually unchanged week to week for the full week (75.5%) but at a pandemic high for weekdays (79%).

Nominal ADR showed little change week on week finishing at the third highest level since the start of COVID-19. However, ADR fell week on week in the Top 25 Markets and CBDs (-1.9% each) but was up year over year 32% and 45%, respectively. Inflation-adjusted ADR (real) increased 11% year on year and was slightly above 2019’s level. This was the second consecutive week that real ADR was above 2019 and the ninth time this year. Real ADR in the Top 25 and CBDs was right under what it was in 2019. Nearly all markets (96%) had nominal ADR above 2019 with 57% reporting real ADR above 2019 in the current week. Over the past 28 days, 61% of markets had real ADR above 2019.

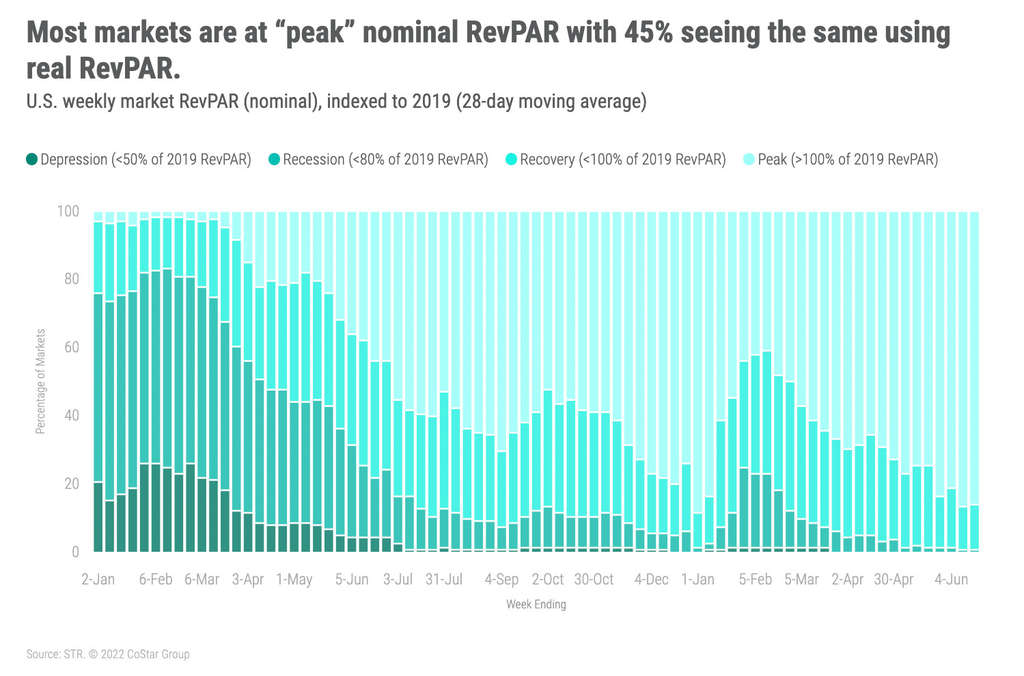

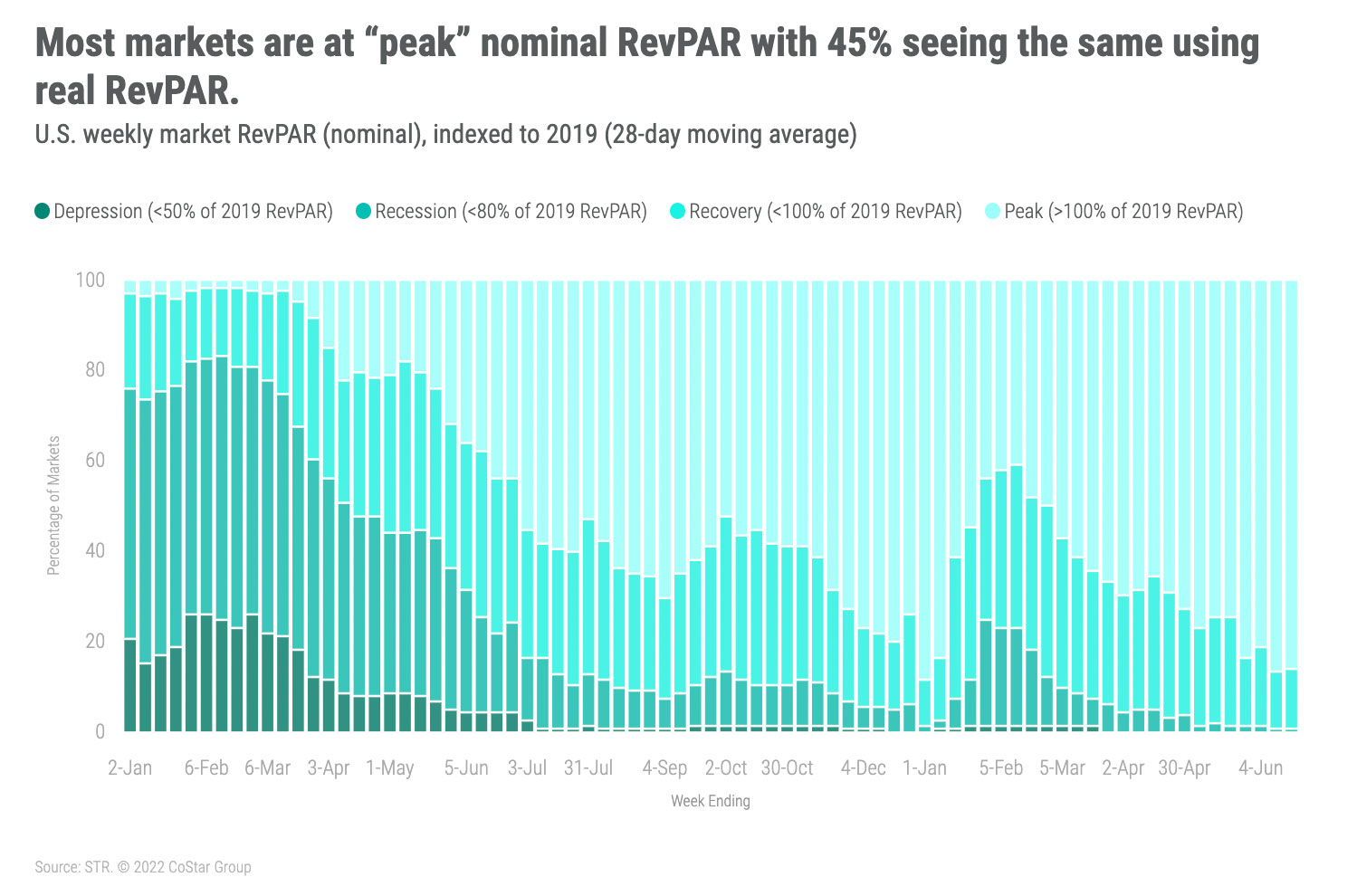

Along with achieving a new record for the highest weekly nominal RevPAR ever recorded by STR, real RevPAR was the best of the pandemic thus far, but far from an all-time record. Among the Top 25 Markets and CBDs, nominal and real RevPAR was the second highest since March 2020. Seventy-eight percent of markets reported nominal RevPAR above 2019 with 45% seeing the same based on real RevPAR. Across the last four weeks, 46% of markets had real RevPAR above 2019, which we label as “peak.” Another 49% had real RevPAR in “recovery” (RevPAR indexed to 2019 between 80 and 100). The good news is that only 5% of markets were in “recession” (RevPAR indexed to 2019 between 50 and 80) over the past 28 days.

Around the Globe

Outside of the U.S., occupancy increased 2.3 percentage points week over week to 64.9% with ADR rising 2.6% to US$142. That resulted in a 6.4% RevPAR gain and the highest RevPAR of the pandemic-era (US$92). Thirty-three of the countries tracked on a weekly basis saw a week-over-week drop in occupancy—relatively flat with the prior week’s performance.

Hungary reported strong occupancy growth compared with the prior week, up 8.7 percentage points, supported by the Aquatic World Championships taking place in Budapest from 17 June-3 July. Budapest also saw an occupancy boost of 9.7 percentage points and an ADR uplift of 10.5%. Occupancy in Belgium increased 8.7 percentage points, driven by the Meeting of NATO Ministers of Defence in Brussels. ADR in Switzerland showed robust growth (+19.4%) as Art Basel kicked off on 16 June. China saw continued improvements with occupancy rising 5 percentage points to 55.3%. The country remains behind 2019 levels for the comparable week by 16.4%. This is due to Shanghai and Beijing, which remain substantially behind 2019 levels, while Chengdu, Guangzhou and Hangzhou are in a significantly better position.

Ireland and United Kingdom achieved strong occupancy levels at 87.1% and 82.5%, respectively. Northern Europe again saw the highest occupancy (82.5%) of any subcontinent, up 5.3 percentage points from the prior week, with Southern Africa with the lowest (51.7%)

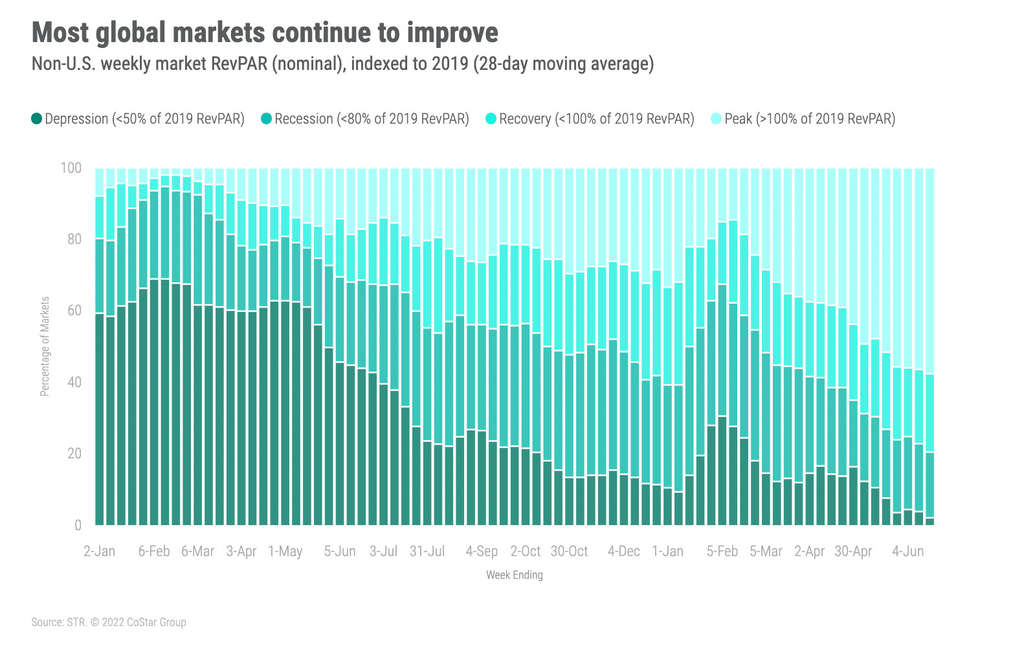

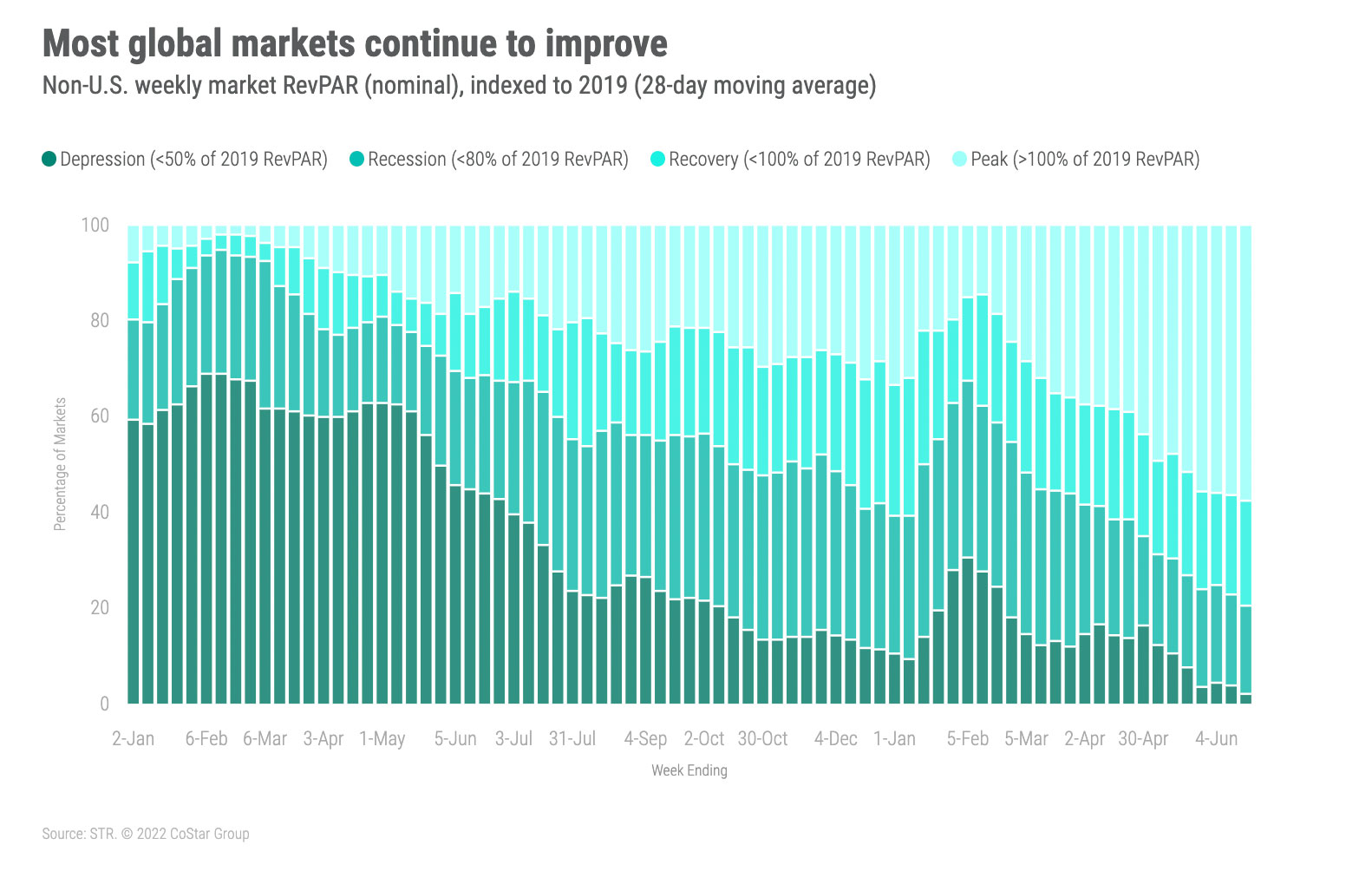

Over the past 28 days, 18% of non-U.S. markets remained in “recession” with another 2% in “depression” (RevPAR indexed to 2019 under 50). Both percentages are trending down.

Big Picture

The hotel industry is heading to its annual occupancy apex, which normally occurs in mid-July for the U.S. and mid-August for the remainder of the globe. Despite rising prices, the U.S. industry is on track to see record demand in June. If the trend continues, July could see the highest U.S. monthly demand ever recorded by STR. However, we are concerned that travel hassles (airline disruptions) combined with rising prices may impact the industry and dampen demand, especially once the summer leisure season is over. It’s not difficult to imagine a decline based on all the news reports, but it is tough to quantify the impact given the current surge in travel and spending.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.