U.S. hotel profitability lower in May but above 2019 levels for third consecutive month

U.S. hotel gross operating profit per available room (GOPPAR) fell from the previous month, but surpassed the pre-pandemic comparable for a third consecutive month, according to STR‘s May 2022 P&L data release.

- GOPPAR: US$88.63

- TRevPAR: US$219.58

- EBITDA PAR: US$67.80

- LPAR (Labor Costs): US$66.27

The EBITDA PAR level was also down from April.

“After the top-line metrics showed mixed results in May, it wasn’t a surprise that the bottom-line metrics came in a bit lower,” said Raquel Ortiz, STR’s director of financial performance. “Regardless, each of the four key P&L metrics showed improvement when indexed to 2019, with GOPPAR and EBITDA PAR coming in higher than May 2019 levels. We continue to keep a close eye on F&B as group demand levels rise. F&B revenues are gradually moving closer to 2019 levels, but catering and banquet revenues continue to lag.”

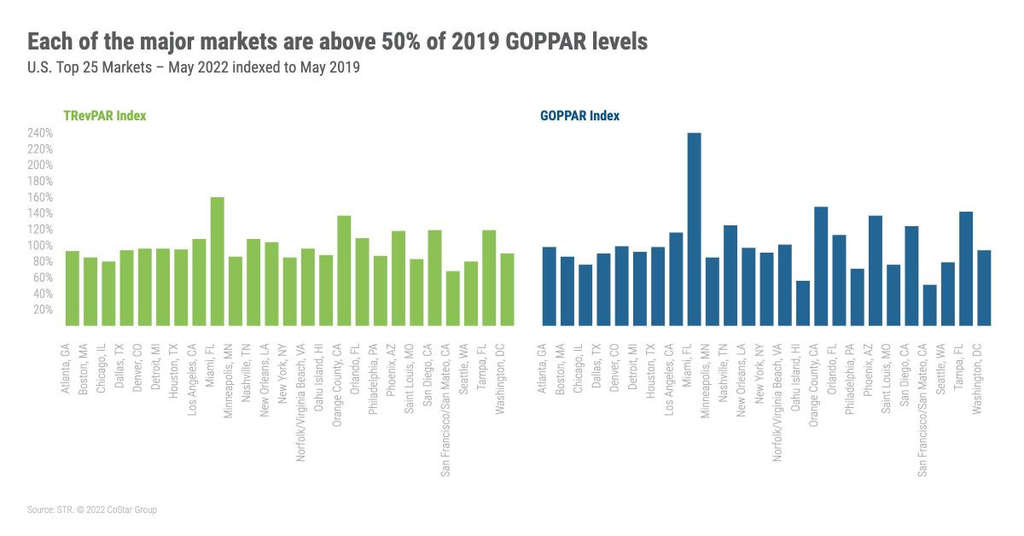

Eight of the major markets realized both GOPPAR and TrevPAR levels higher than 2019 comparables.

“With increased business demand, the Top 25 Markets are showing improved profit levels. Miami, primarily because of higher room rates, continues to lead in both GOPPAR and TrevPAR recovery, reaching 240% of 2019 GOPPAR levels. Markets with the lowest GOPPAR index in May included San Francisco and Oahu Island,” Ortiz said.

Industry stakeholders interested in Monthly P&L participation should contact [email protected]. Those interested in subscribing to reports should contact their account manager or [email protected].

Key profitability metrics:

TRevPAR - Total revenue per available room

GOPPAR - Gross operating profit per available room

EBITDA - Earnings before interest, income tax, depreciation, and amortization

LPAR - Total labor costs per available room

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.