US Hotels State of the Union - July 2022

Key Takeaways

- New this month – nominal consumer credit card balances are at an all-time high, and at a ratio of 2 to 1, the number of job openings to job seekers is the highest in 20 years.

- ⎻ Macroeconomic indicators are softening. CBRE forecasts a steep decline in GDP growth. Inflation is expected to remain elevated through the end of the year, and unemployment is expected to increase.

- For now, ADR continues to outpace elevated inflation levels, however, we expect ADR growth to moderate in the second half of the year and beyond.

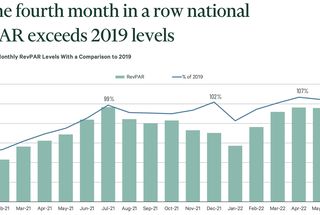

- June RevPAR growth continued to exceed 2019 levels for the fourth month in a row because of strong leisure travel and high ADR growth. All location types exceeded 2019 RevPAR levels except for urban hotels.

- Internaonal outbound expenditures have continued to rise as inbound expenditures have dropped off because of a strong dollar. Geographic disparities remain as international travel continues to rebound. Inbound international travel remains strongest in the East, but the West Coast is gaining steam.

- Short-term rental demand has normalized. Similarly, to hotel markets, southern leisure drive to markets are outperforming urban markets.

- Brand.com continued to gain market share during Q2 from 19% to 21% compared to 2019.

Click here to download the report

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.