CBRE U.S. Hotels State of the Union - September 2022

Economy:

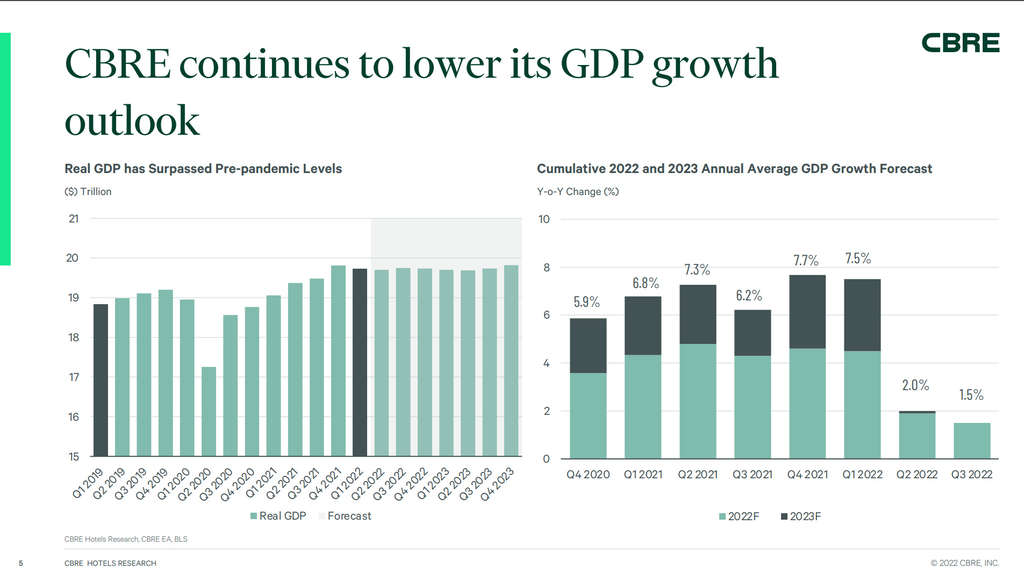

- CBRE calls for a mild recession in 2023. GDP is expected to be flat in 2023 with negative growth in H1 2023 and positive growth in H2 2023.

- Unemployment remains low but is expected to increase. Full employment and worker shortage will lead to further wage pressures.

- CBRE expects higher and more persistent inflation. Inflation is expected to remain above the long-run average of 3.3% until 2024.

Current Trends:

- August RevPAR weakens. Most chain scales and location types saw a pullback relative to 2019.

- TSA throughput data remains above 90% of 2019 post Labor Day. TSA data and Google search trends data continue to be positive.

- Consumer and business outlook is softening. Credit levels are on the rise while business and consumer confidence wane.

Food for Thought:

- Post Labor Day return-tooffice disappoints. A disappointing return-to-office is a headwind to business travel.

- International travel continues to rebound. Despite FX headwinds, we expect international travel to drive demand.

- The inflationary environment is leading to margin pressures. July margins declined 420 basis points year over year.

Click here for the full report

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2021 revenue). The company has more than 105,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.