Qatar’s hotel industry set to win big during the FIFA World Cup

With the 2022 FIFA World Cup kicking off on Sunday, 20 November, Qatar’s hotel industry is looking forward to a nice performance lift from this “mega event” as fans from all over the world are set to visit the Middle East for a game (or several) of football.

Qatar has been preparing for this moment for years, including building up the market’s hotel supply. Growth in inventory has continued up to the last minute with more than 3,000 rooms added to the total supply over the last three months.

While that growth in hotel supply is not unique for a World Cup host market, Qatar’s version of the World Cup is unique for several reasons.

One key differentiator is the requirement of arrivals to have at least one match ticket to enter Qatar during the group stage. Starting on 2 December, fans will be allowed to enter the country without a ticket. The exception to the rule during the group stage is that up to three fans can enter by invitation of a ticketholder, yet an entry charge will apply to those 12 years and older who adopt this approach. These rules have been implemented to ensure all ticketholders can secure accommodation for their required dates. Even with that policy, hotels are still set to experience significant levels of demand, which will drive significant growth in average daily rate (ADR).

Another difference in Qatar is the short distance between host stadiums. A total of eight stadiums, in and around Doha, will host the 64 matches, all of which is likely to create an exciting atmosphere for attendees. The proximity of the stadiums means much of the hotel demand will be focused in the same area.

Rise in bookings as event draws near

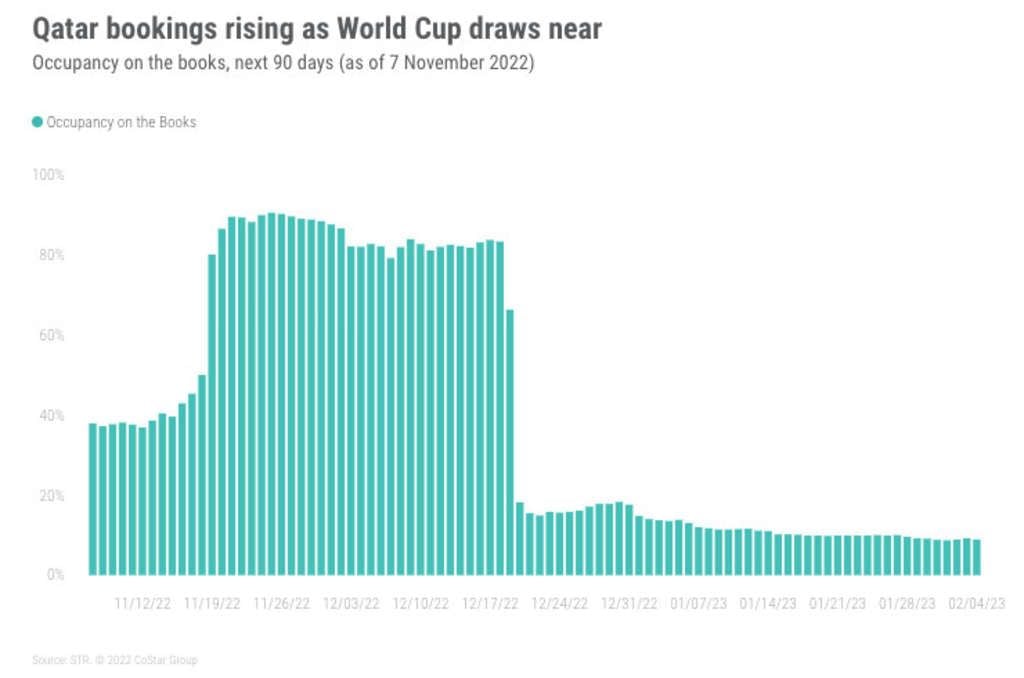

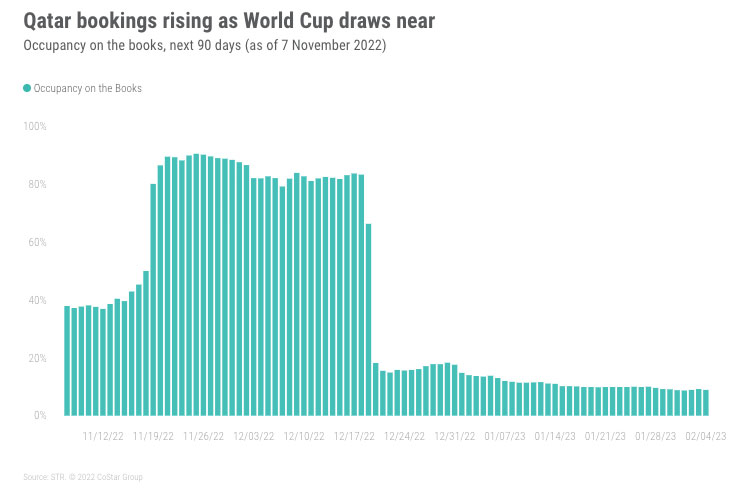

Utilizing STR’s Forward STAR data from 7 November, Qatar’s occupancy on the books has risen a healthy amount since our last update. Last month, the metric was averaging out at 70% from 20 November to 18 December with a peak of 83% on 26 November.

The latest data, however, shows occupancy on the books averaging 85% during the event period, with the metric dropping no lower than 66.3% and peaking at 90.5% on 25 November – the day host Qatar takes on Senegal and the U.S. competes against England. The second-highest occupancy-on-the-books level (90.2%) occurs on 26 November, when neighboring Saudi Arabia faces Poland, and Argentina matches up with Mexico.

This forward-looking data is now higher than the actualized occupancy for the comparable time period in 2019, where the metric remained at least 65% and peaked at 86%.

We can also expect occupancy on the books to rise further for later event dates as fans wait for their teams to advance from pool play before committing to travel. With this being the first World Cup post-pandemic, pent-up leisure demand will surely make a show during this “mega event” period.

Hoteliers likely to score on ADR

The last FIFA World Cup, which occurred in a pre-pandemic world, took place in Moscow and other Russian cities. How did ADR shape up for the last “mega event”? Find out in our previous blog update.

Over the coming month, STR will shift the focus to actualized data for the World Cup period, not only in Qatar but surrounding destinations. Be sure to check our Data Insights Blog for further updates.

Over the coming month, STR will shift the focus to actualized data for the World Cup period, not only in Qatar but surrounding destinations. Be sure to check our Data Insights Blog for further updates.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.