PwC: Increasing economic headwinds to impact hotel performance for balance of this year and into 2024

US Hospitality Directions: May 2023

Despite worries of recession, bank failures, and a liquidity crisis affecting the macroeconomy, US hotels continue to outperform expectations. In Q1 2023, US hotels exceeded Q1 2019 (pre pandemic) RevPAR levels by 13.0 percent, based on data from STR. Room rates continue to be the primary driver in this performance recovery. While occupancy in Q1 2023 was still down 2.1 points from the same period in 2019, ADR increased 17.0 percent. Leisure travel continues to be strong, even though growth levels are slowing, and individual business travel and group business has slowly re-emerged, contributing more significantly to future growth expectations.

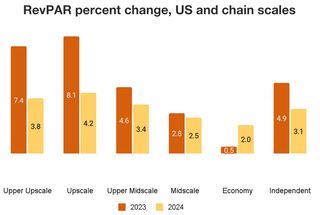

The Fed’s continued increases in its policy rate, the failure of three banks, and a liquidity crisis, has caused greater uncertainty in the public markets, which is expected to have a downstream impact on hotel demand for the remainder of this year and into next. We now expect annual occupancy for US hotels this year to increase slightly less than in our November 2022 outlook, increasing to 63.4 percent. With slowing growth in occupancies for the balance of this year, we now expect average daily room rates to increase 4.1 percent for the year, with resultant RevPAR up 5.5 percent – approximately 114 percent of pre-pandemic levels, on a nominal dollar basis.

While US hotels have continued to outperform expectations, recent bank failures, a liquidity crisis and rapidly slowing economy are expected to have a downstream impact on hotel performance for the balance of this year and into next. Warren Marr, US Hospitality & Leisure Managing Director

Trends and highlights

- Since our November 2022 outlook, the Fed’s monetary policy has resulted in continually elevated interest rates and an unexpected fallout of several large regional banks has occurred, both of which have contributed to a limited availability of debt. This tightening credit market has resulted in a steep slowing of construction starts for new hotels.

- For the remainder of 2023 and into 2024, demand growth from individual business travel and groups is expected to offset a softening in leisure demand, with outbound international leisure travel outpacing inbound, given the relative strength of the dollar. With flattening occupancy levels in 2024, growth is expected to come almost entirely from ADR, with an expected year-over-year increase in RevPAR of 3.5 percent – approximately 118 percent of pre-pandemic levels.

- Significant risks to this outlook include the pace and magnitude of changes in the macroeconomic environment, continued high vacancy rates in office spaces nationwide, and increasing geopolitical tensions.

About PwC US

PwC US helps organizations and individuals create the value they're looking for. We're a member of the PwC network of firms in 157 countries with more than 195,000 people. We're committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com/US. PwC refers to the US member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details.