Taylor Swift impact grows to $208M in U.S. hotel room revenue

There’s no shortage of debate when discussing U.S. hotel performance or the country’s economic prospects headed into the final months of 2023. One portion of those discussions not requiring debate, however, is the massive lift provided by Taylor Swift’s The Eras Tour. Best believe U.S. hotels were still “bejeweled” when Swift came to town, as concert dates after our previous update (June through early August) increased the tour impact to $208 million in additional U.S. hotel room revenue.

Methodology

The starting leg of Swift’s U.S. tour, analyzed here, began in mid-March with a total of 28 shows in 10 cities. The second half of the star’s 2023 dates in the U.S. pushed those totals to 53 shows in 20 cities.

Concert stops were typically 2-3 nights, always including a Friday and Saturday. Los Angeles was the major exception with six nights of concerts wrapping up on Wednesday, 9 August. Sunday night shows occurred in nine of Swift’s tour stops, which provided those markets an added boost as Sunday is typically the slowest demand night each week.

The analysis used the average of matched days in shouldering weeks as a performance baseline. Additional adjustments were made for three markets to account for the reduced performance levels typical of the Fourth of July holiday.

Putting $208,000,000 in context

As outlined in our previous Taylor Swift impact analysis, the first 28 shows of the tour added $98.2 million in added room revenue on top of normal seasonal levels. The overall $208 million estimated impact now three months later is conservative, accounting only for the 53 concert nights. What can’t be measured on top of that impact are extended fan stays, extra lift stemming from show advance/breakdown crews, the broad range of other economic activities beyond concert-night room revenues, or added impact on other hotel revenue streams, like P&L, parking, etc.

To put the impact into context, $208 million is basically the combined room revenue generated in New York City and Philadelphia in one week. Another way to look at it, $208 million is the average daily room revenue reported by the country’s 17 largest markets.

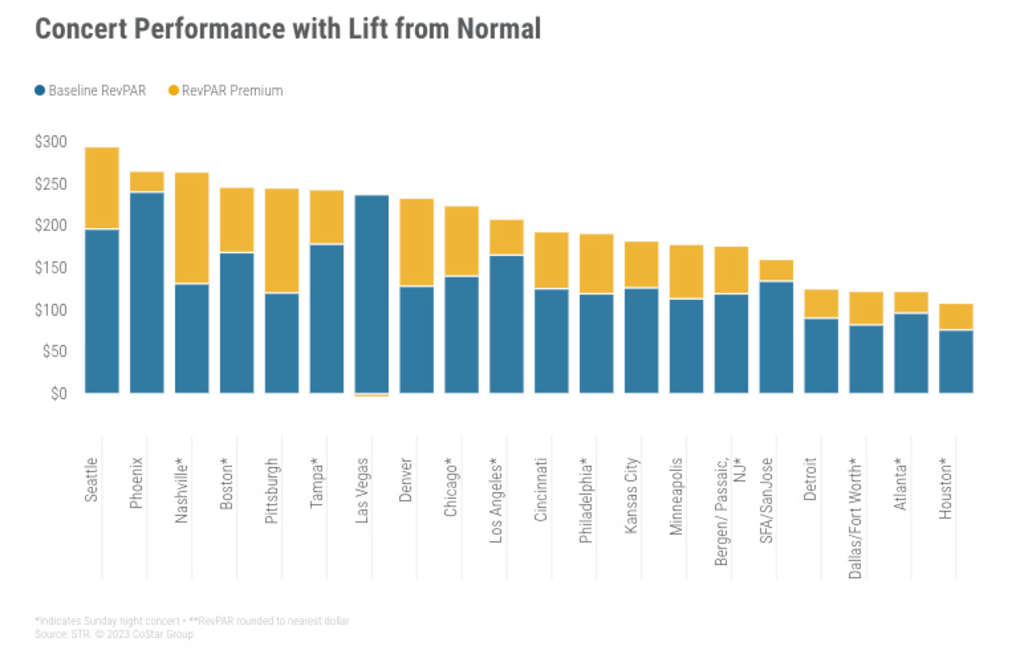

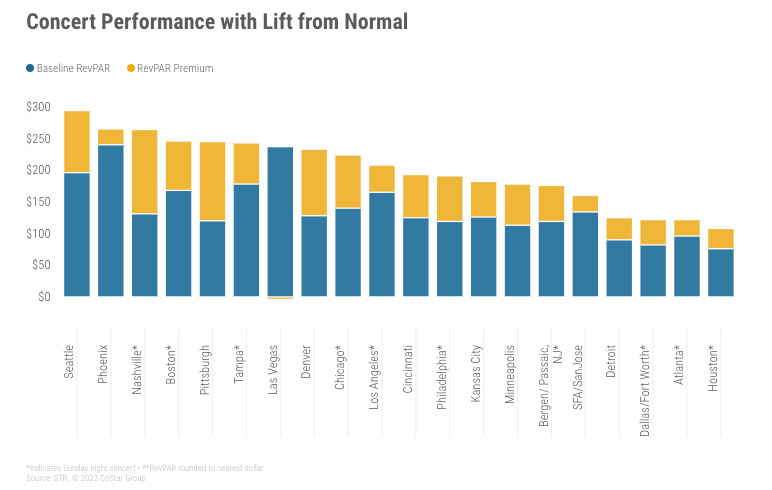

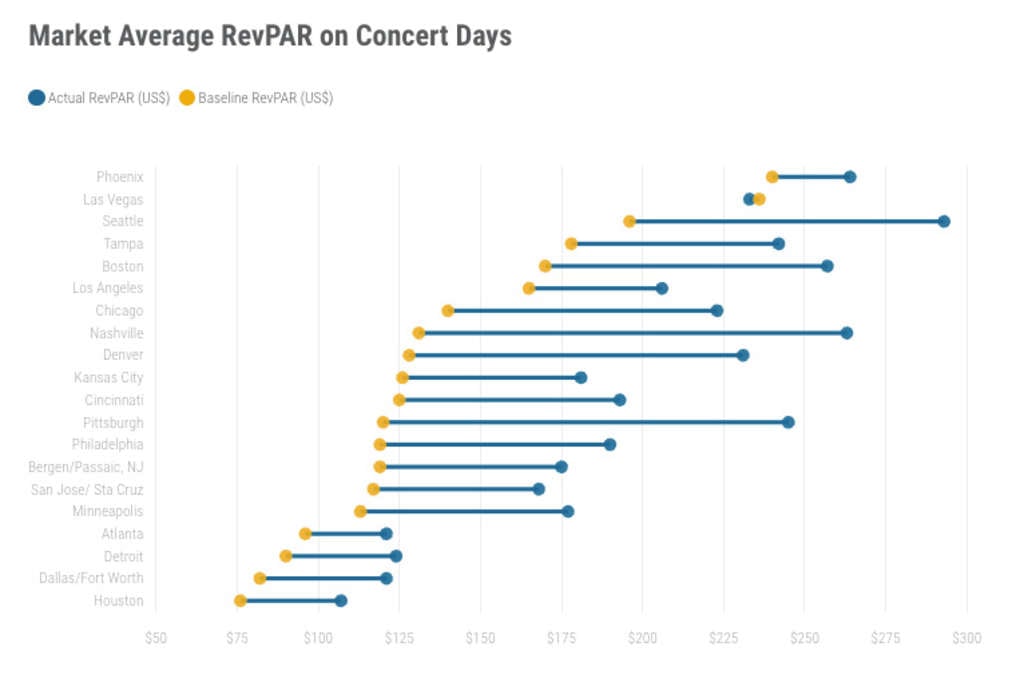

While that makes the total U.S. impact modest, many host markets experienced unprecedented windfall beyond baseline levels. Two markets—Pittsburgh and Nashville—doubled their revenue per available room (RevPAR) from shoulder weeks. Eight markets overall reported RevPAR premiums of 50% or higher.

By all accounts, all but a single tour market “found wonderland” with an enviable increase in RevPAR above seasonal expectations. Seattle, which led all host markets in absolute RevPAR ($293), shattered its record with Saturday, 22 July RevPAR of $317. That level was 38% better than the previous daily market record from two weeks prior during the MLB All Star Game.

Nashville led all markets in total RevPAR gain with a three-day $132 average boost to $263.

Finally, as a percentage of lift above normal, Pittsburgh experienced a 103% premium in RevPAR.

As noted in our mid-tour update, the earliest two concert stops of Phoenix and Las Vegas showed more muted performance as these performance dates corresponded to those markets’ high travel/performance seasons, and both of those locations were running persistently strong performance in the first half of the year. Moreover, Las Vegas is a particularly large market with 168,000-plus rooms, so it takes a little more “oomph” than a stadium full of fans to significant impact performance.

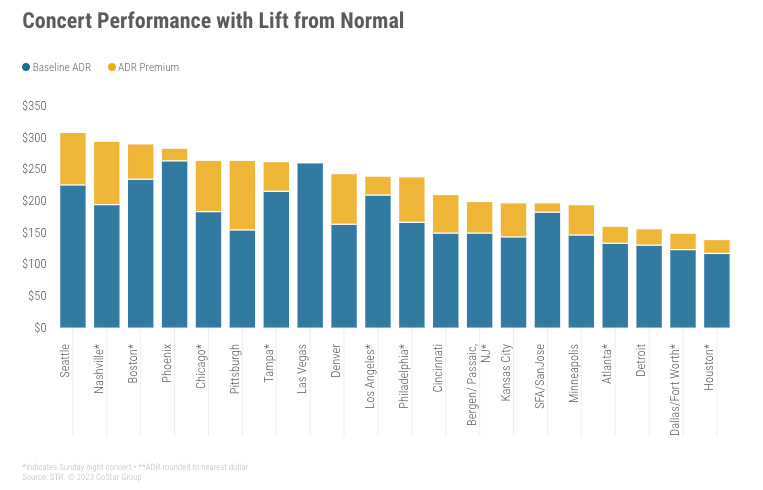

Concert day ADRs ranged from a high of $307 (Seattle) to a low of $138 (Houston), and ADR premiums varied extensively depending on the markets’ normal seasonal patterns. Most markets "played their ace” with double-digit ADR gains as the norm, led by Pittsburgh with a 70% increase followed by Nashville with a 51% increase.

On average, Friday-Saturday concerts corresponded with a 23% rise in ADR to $230. Sunday concerts raised ADRs above normal level by 32% to $187.

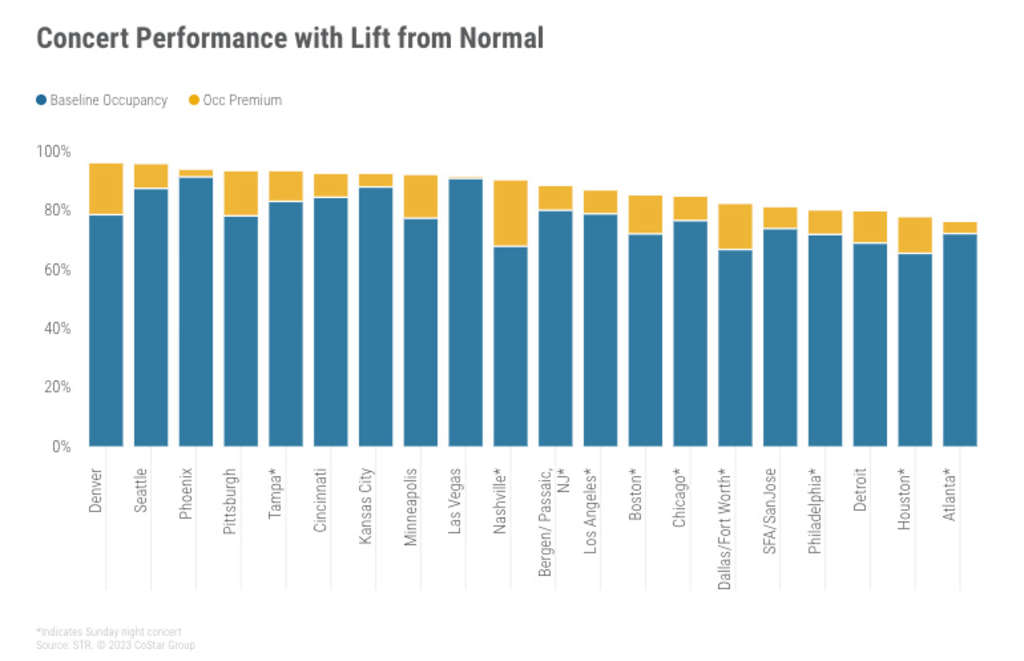

Occupancy gains not as broad

Substantial occupancy gains were the concert night norm but not necessarily to the stratospheric degree of ADR increases. Half of the tour stops averaged a market occupancy of 90% or higher across weekends (Friday-Saturday). The more surprising fact was that two of those high occupancy markets – Nashville and Tampa – included a Sunday performance, which contributed a massive lift above baseline levels.

Across all markets, weekend shows raised market occupancy performance above baselines, on average, by 9.8 percentage points from 80.7% to 90.5%. Sunday shows resulted in a more substantial boost of 14.5 occupancy ppts from 56.5% to 71.0%.

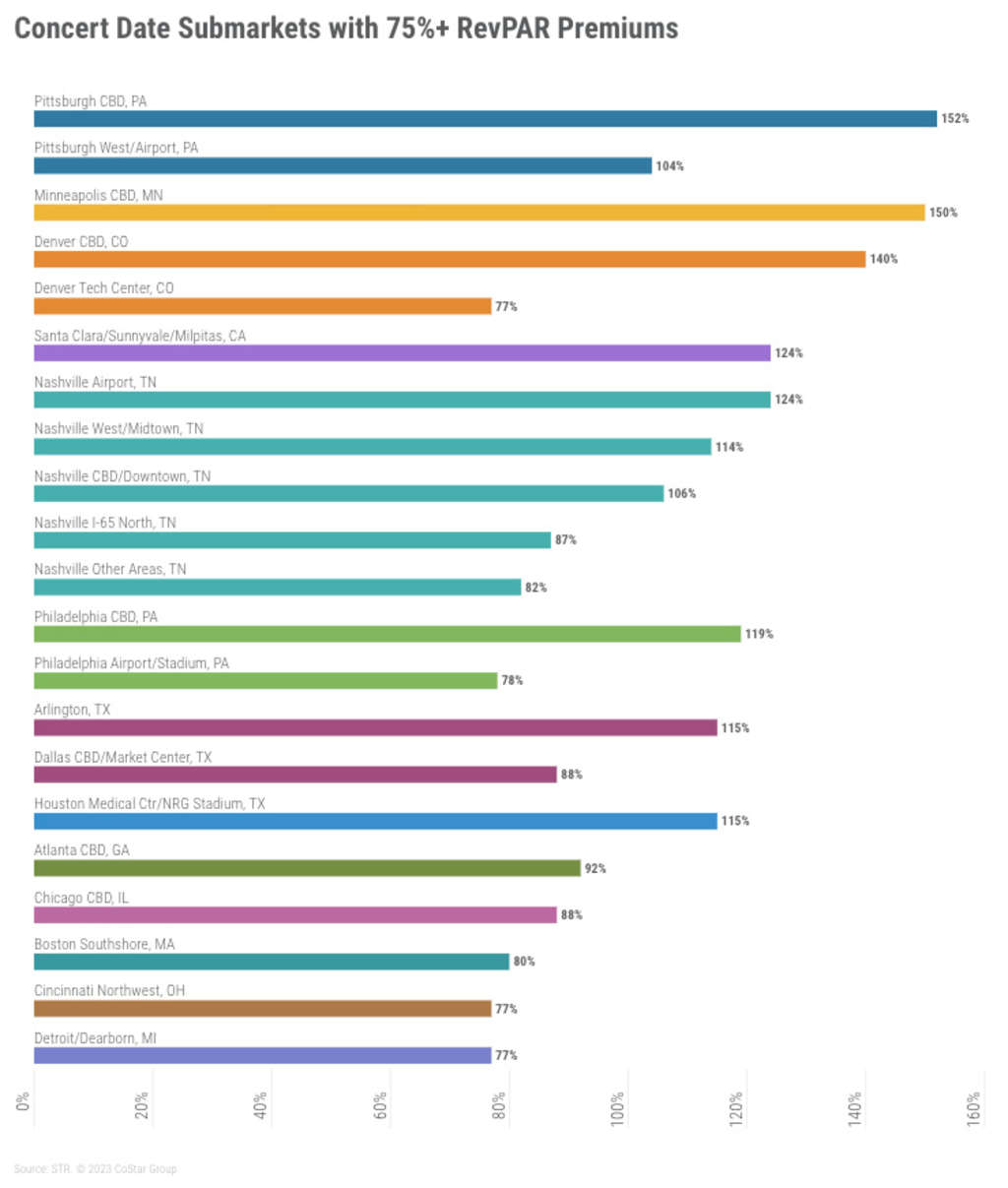

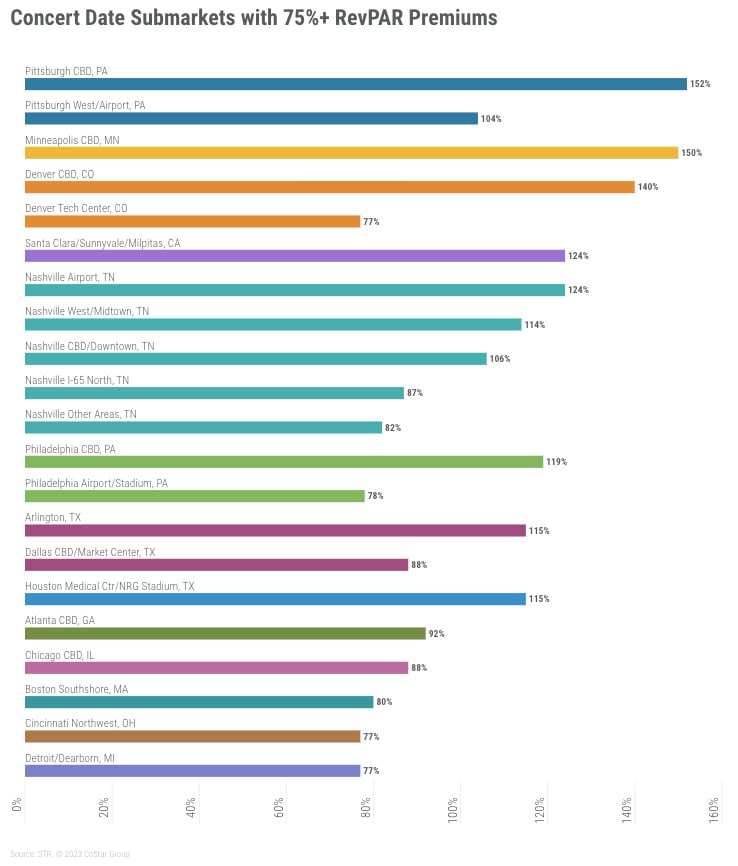

Impacts felt in more than immediate venue area

Eight of the 20 concert markets included submarkets that more than doubled their RevPAR performance. Both Pittsburgh’s and Minneapolis’ central business districts, for example, posted RevPAR two-and-a-half times above normal. But many other submarkets well beyond the immediate vicinity of the concert venue showed one-of-a-kind gains. Every submarket within the larger Nashville, Denver and Pittsburgh regions achieved a RevPAR lift more than 50% above normal.

Next up, the rest of the world

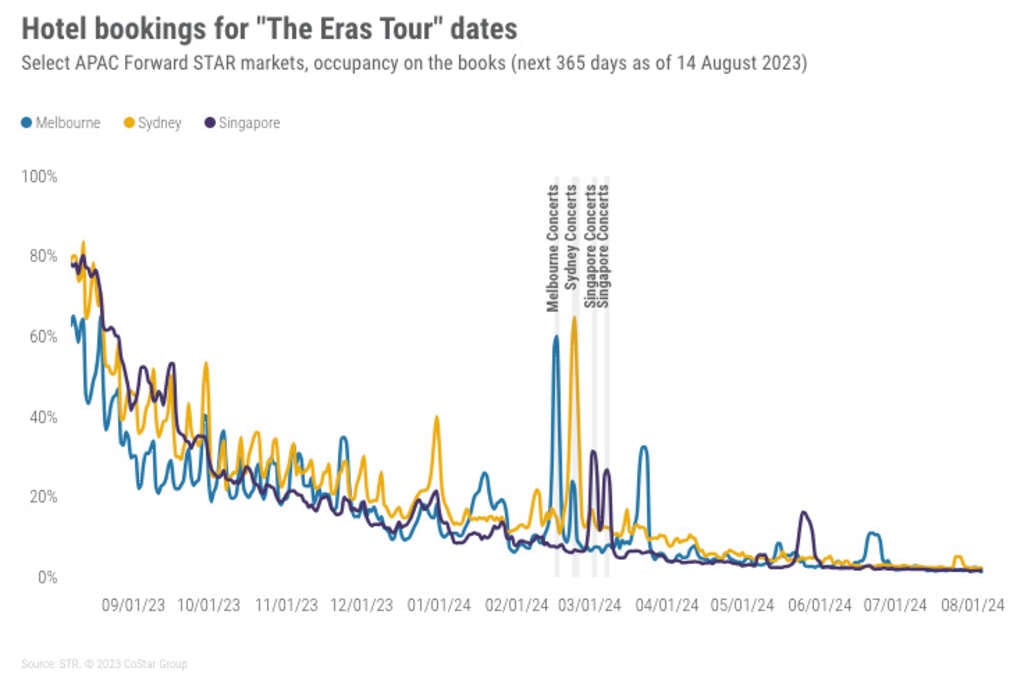

The Eras Tour now heads to Latin America, Asia and Europe before returning to North America in Fall 2024. That means hoteliers in three additional world regions will reap the benefits seen by their U.S. counterparts.

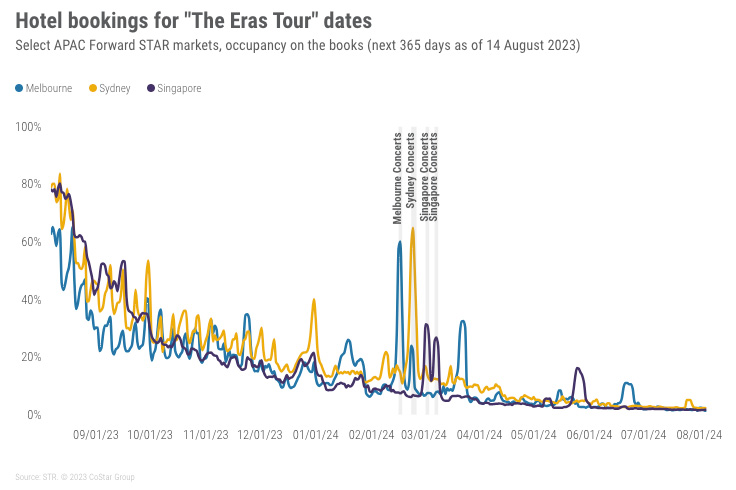

Among active Forward STAR markets in the Asia Pacific region, Melbourne, Sydney and Singapore are showing significant levels in occupancy on the books for their respective tour dates. As of 14 August, Melbourne’s highest level in the metric for the next 365 days comes on 17 February (at 60.1%), the second night of Swift’s tour in the market. The same pattern is showing in Sydney, with occupancy on the books at 64.9% on 24 February. In Singapore, the market’s booking levels are lower, but remain the highest when looking at the first eight months in 2024. Swift will perform for six nights in the market, with the first night showing the highest occupancy on the books (at 31.4%).

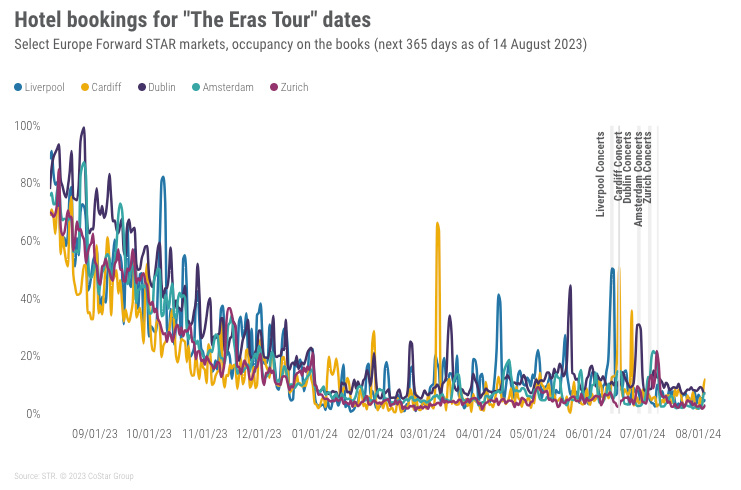

In Europe, it will be anything but a “Cruel Summer” as select markets are already showing strong figures for June 2024, with both Liverpool and Cardiff reporting levels above 50% (at 50.4% on 14 June and 51.0% on 18 June, respectively). Markets with shows further in July (Amsterdam, Zurich, Munich, etc.) are showing levels in the 20% range, but with all markets, we can expect levels to increase as the event dates draw closer.

*Analysis by M. Brian Riley

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.