U.S. Hotels State of the Union October 2023 Edition

A Pictorial Update on Our Latest Thoughts and the Facts and Figures Influencing Our Industry

Key Takeaways:

Top Line Metrics

- August RevPAR declined 0.7% on a 1.7% decline in occupancy. Urban locations posted the strongest RevPAR growth, up 3.7% but remained below 2019 levels. Summer travel trends remained consistent in July and August.

- Real RevPAR continues to decline as nominal RevPAR lags inflation. The spread between real and nominal RevPAR increased to 17.3 p.p. versus 14.1 p.p. in August of 2022. However, the pace of the spread widening appears to have abated.

- Total revenue growth continued to outpace RevPAR growth. In July, total revenue rose 2.5%. Unfortunately, gross operating profit margins and profit dollars remained under pressure declining 1.8 p.p. and 2.5%, respectively, year over year.

Current Trends

- U.S. loan origination was down again in August versus 2022. The pace of loan origination slowed in August to 11 vs. 17 a year ago. Hotel spreads narrowed to 419 bps from 478 bps in July and below the post-pandemic average of 458 bps.

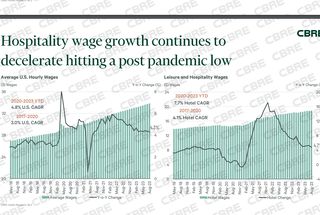

- Hotel job openings continue to decline, lowering wage growth. July hotel job openings fell to 19 from a high of 29 in December. August hotel wages increased 4.7% vs. 9.0% in 2022. National wage gains are still outpacing RevPAR and airfare growth.

- CBRE raises combined 2023/2024 GDP outlook. CBRE raised its 2023/2024 outlook from 1.9% in June to 2.7% in September. The 2025 GDP forecast was negatively revised from 2.3% to 2.0%.

Food for Thought

- The international inbound and outbound travel gap is narrowing. While still a headwind, the spread between inbound and outbound international visitation narrowed to 25.1 p.p. as Asian travelers continue to return to the U.S., now 69% of 2019 levels.

- Office attendance rose post Labor Day but not materially. Office attendance rose to 50.3% in the week following Labor Day, suggesting that material gains in the near-term are unlikely. Houston posted the strongest office attendance at 61%, while San Jose was 40%.

- STR demand growth continues to exceed hotel demand growth. Hotel demand growth declined 1.3% in August while short-term rental demand rose 7.6%, suggesting that short-term rentals continue to take share from hotels.

Looking for a PDF of this Content?

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.