STR Weekly Insights: 8-14 October 2023

Countries included: China, Curaçao, French Polynesia, Ireland, Japan, Jordan, United Kingdom, and the United States

U.S. Performance

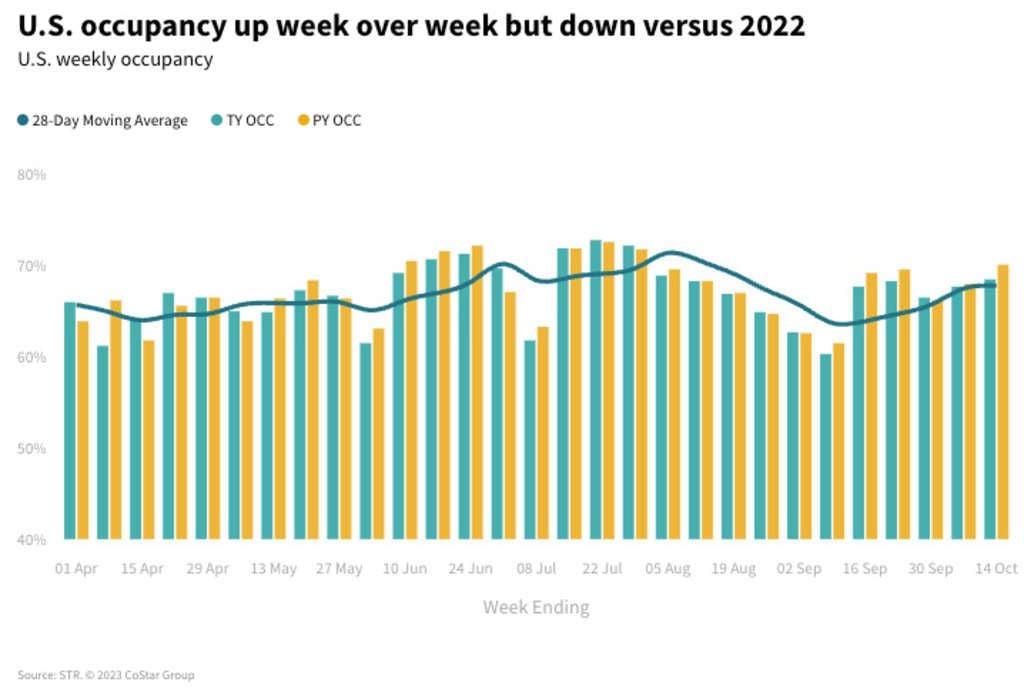

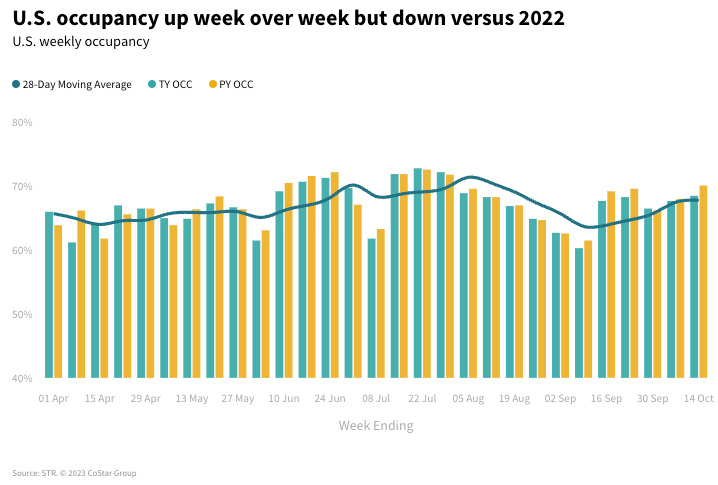

U.S. hotel industry occupancy increased 0.9 percentage points (ppts) week over week to 68.5% but was down 1.6ppts versus last year. The year over year softness was somewhat surprising given the week had the most schools out of session for fall break, according to STR’s School Break Report, and it included the Columbus/Indigenous Peoples’ Day holiday. The weakness was seen across all days with the largest declines coming during the latter half of the week. While it is possible that outbound international travel is a contributor to the decrease given its recent strength (+18% in September compared to 2019), we believe that the industry is still in a rebalancing/normalization period from the post-pandemic leisure travel surge.

Occupancy for the three-day holiday weekend was 71.8%, which was 1.9ppts lower than a year ago. That occupancy level was the ninth highest for the holiday weekend over the past 24 years. Last year’s level (73.7%) was the sixth highest ever. The highest occupancy seen for this holiday weekend was 74.9%, which occurred in 2017. Even though this year’s occupancy was not as high as last year, room demand was the third highest behind last year, down 255,000 room nights. Thinking about it differently, each U.S. hotel sold approximately 1.8 less rooms per day this holiday weekend than in 2022, which we believe still points to a vibrant traveling public—but one that is traveling differently.

Average daily rate (ADR) rose 3.2% year over year (YoY), holding above 3% for a fourth consecutive week and close to the rate of inflation. Revenue per available room (RevPAR) increased 0.8% YoY with the occupancy decline offsetting the ADR gains. ADR over the holiday weekend increased 3.5% as RevPAR rose by the same amount as the entire week (+0.8%).

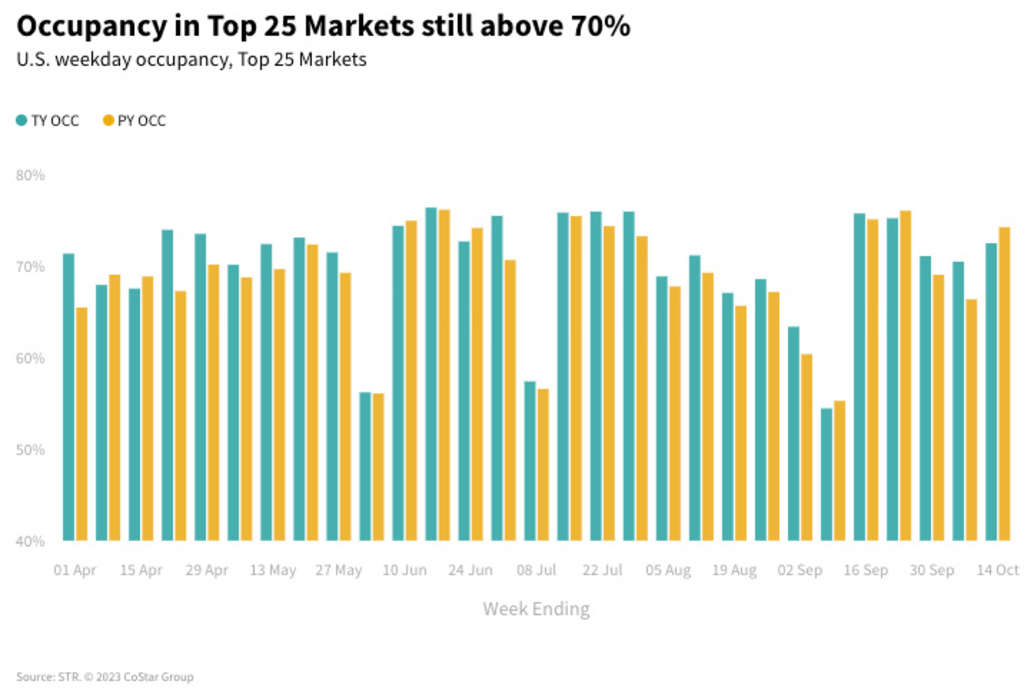

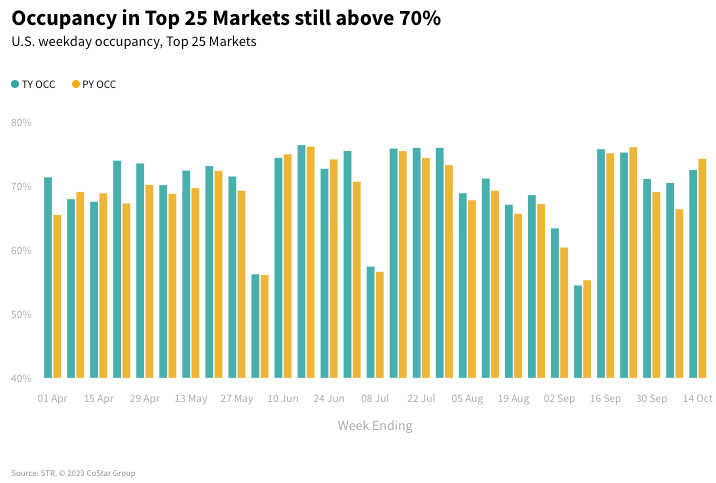

Occupancy in the Top 25 Markets fell 1.6ppts WoW to 74.0%, down 1.9ppts from a year ago. Even with the week-over-week decrease, this was the grouping’s fifth week with occupancy above 70%. Only eight of the Top 25 Markets saw occupancy rise versus last year. ADR increased 3% YoY with RevPAR rising 0.4%.

All days in the Top 25 Markets produced an occupancy decline with shoulder days (Sunday & Thursday) down the most (-2.3ppts) followed equally by weekends (Friday & Saturday) and weekdays (Monday-Wednesday), each falling 1.8ppts. ADR increased every day with the weekend seeing the greatest gain (+3.9%), lifting weekend RevPAR 1.6%. Shoulder and weekday RevPAR was flat (-0.4% & +0.1, respectively).

Of the eight Top 25 Markets posting occupancy growth versus last year, five saw growth of more than one percentage point.

- Boston had the highest occupancy of the Top 25 at 88.3%, up 3.8ppts YoY, with RevPAR up 18.5%, driven by a strong weekend (+7.0ppts in occupancy and +31.6% RevPAR YoY).

- Las Vegas saw occupancy of 88.1%, up 4.7ppts, with RevPAR up 21.1%, boosted by shoulder and weekday periods (+35.4% and +30.4%, respectively).

- Occupancy in Oahu reached 85.2%, +12.8ppts, with shoulder and weekday period RevPAR up 31.7% and 39.7%, respectively.

- Low occupancy markets that saw year-over-year growth included Minneapolis (67.1%, +5.7ppts) and Los Angeles (77.8%, +1.6ppts).

New York City posted the nation’s fourth highest occupancy at 88.0%, but it too was down slightly (-0.8ppts YoY), impacted by declines in shoulder and weekdays. New York RevPAR for the week increased 7.3%.

Outside of the Top 25 Markets, five markets saw occupancy above 80%, including Gatlinburg, TN (91.3%), which had the nation’s highest occupancy. Alburquerque (85.4%), Portland, ME (85.1%), Vermont (84.9%), and New Hampshire (81.0%) were the other markets above the 80% threshold. Of those five, only Alburquerque and New Hampshire saw occupancy rise versus last year. The former was due to the annual Balloon Fiesta, which led an occupancy increase of 15.7ppts YoY. The large gain included a calendar shift as the Balloon Fiesta took place a week earlier than last year.

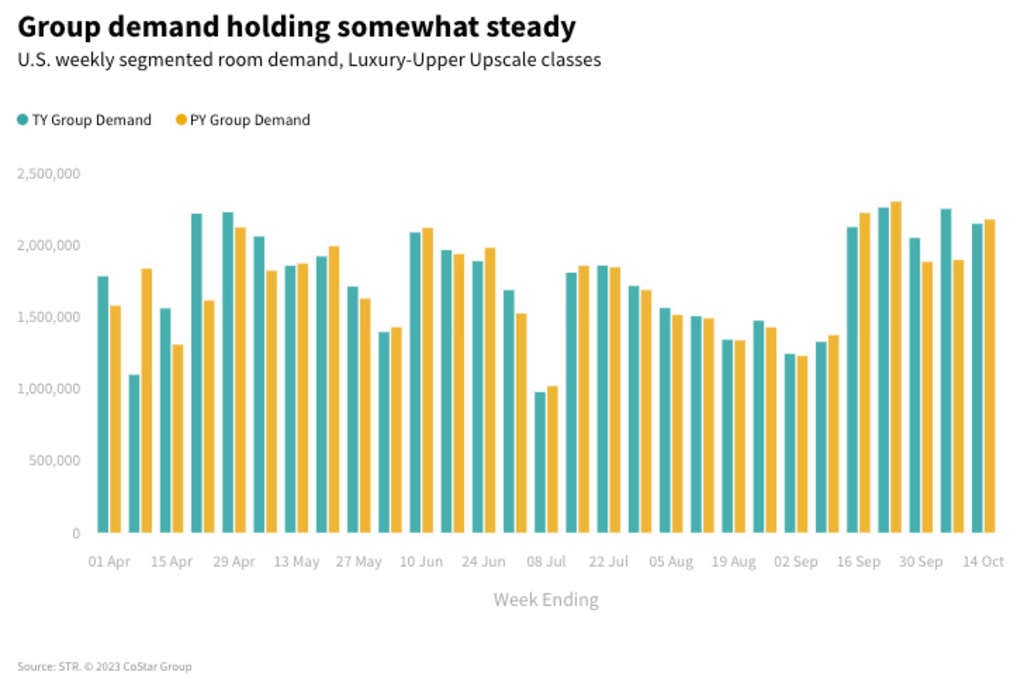

Group demand softened slightly, down 1.4ppts YoY. Group demand last year may have been boosted from the rebound post-Yom Kippur, making for difficult comparisons this year. Over the past four weeks, group demand has increased an average of 5.5% YoY and is essentially flat compared to the same four weeks in 2019. Group occupancy has increased 1.0ppts over the past four weeks compared to 2022, while coming in only 1.4ppts lower than 2019.

The Top 25 Markets posting the largest year-over-year group occupancy increases over the past four weeks were Boston (+5.1ppts), Philadelphia (+4.6ppts), Chicago (+4.1ppts), Oahu (+3.9ppts), Washington D.C (+3.0ppts), and Minneapolis (+2.9ppts).

The Upper Upscale and Upscale chain scales had the best performance for the week with RevPAR up 2% and 1.8% YoY, respectively, led by ADR increases of 2.5% and 3.6%, respectively. Occupancy, however, was down for both.

Upper Midscale also saw RevPAR growth during the week (+0.5%). The Luxury chain scale posted the worst RevPAR decrease (-7%), impacted by lower occupancy (-2.5ppts) and ADR (-3.8%). Midscale was also down (-1%). The Economy chain scale recorded an occupancy decline (-2.3ppts) for the 15th straight week, while ADR increased (+0.6%) for the first time in three weeks. RevPAR, however, fell 3.2% YoY.

Global Performance

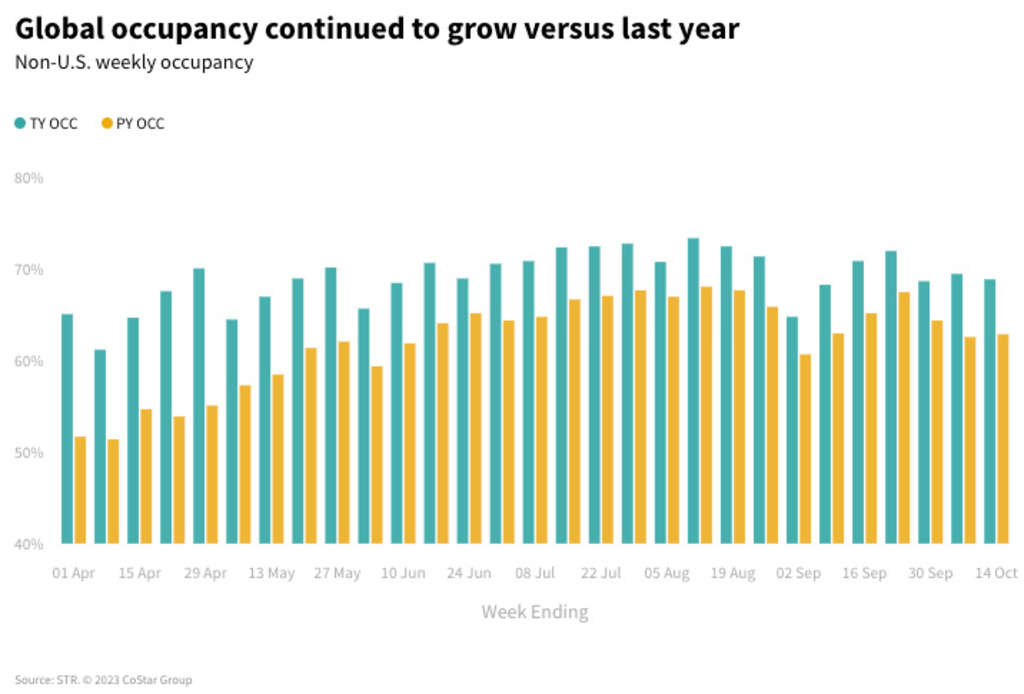

Global occupancy, excluding the U.S, fell slightly WoW (-0.6ppts) to 68.9%. The decrease was in line with seasonal trends as calendar shifts impact global occupancy week over week, particularly in the last months of the year. However, global occupancy continued to grow versus last year, up 6.1ppts. Global ADR decreased WoW by 8% to US$148 and increased 14.2% YoY. RevPAR grew 25.2% YoY to US$102.

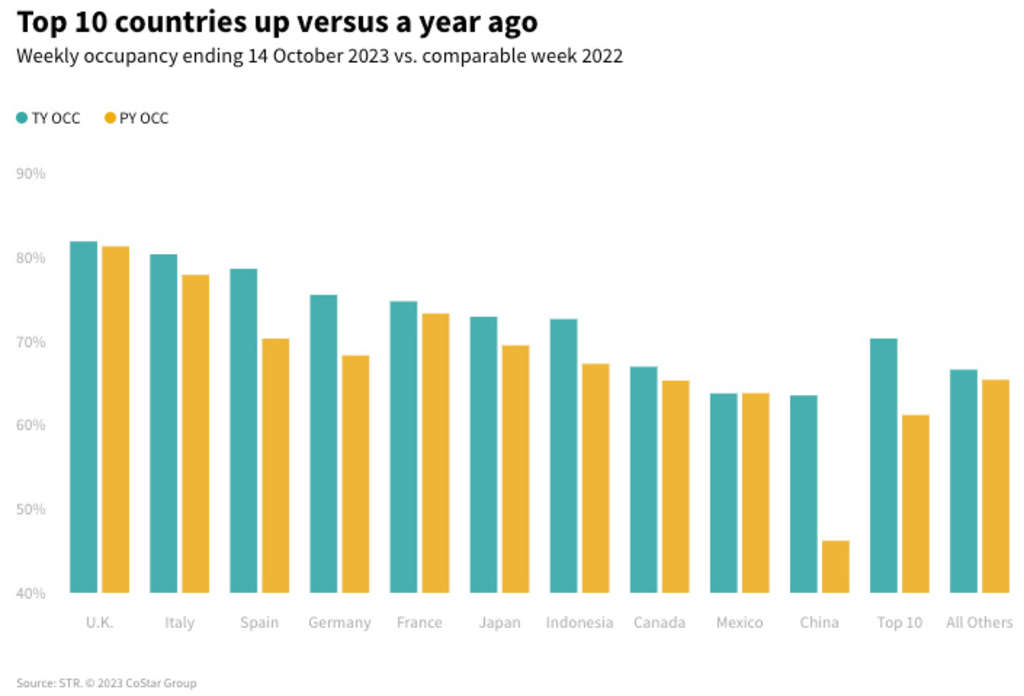

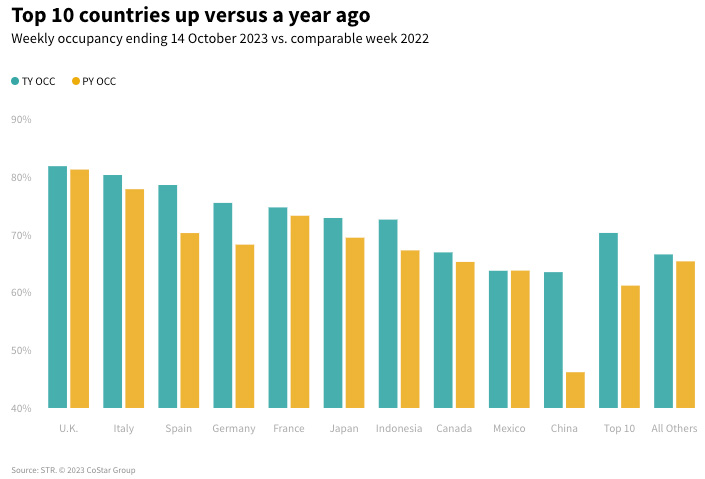

Among the top 10 countries, based on supply, occupancy was flat week over week at 70.3%, with an annual increase of 9.1ppts. ADR for the same countries was down US$17 WoW to US$139, also in line with seasonal trends, but up 12.2% YoY. Overall, top 10 RevPAR was up 28.9% YoY to US$97.

All countries within the top 10 had flat to increasing year-over-year occupancy changes with the largest gain occurring in China, up 17.3 ppts YoY to 63.5%. Strict COVID measures were still in place across China this time last year, particularly in Beijing ahead of the national party conference. As a result, along with strong ADR improvements, China had the highest RevPAR growth of the top 10 at 72.7% (US$50), followed closely by Japan at 72.2% (US$139). Conversely, the United Kingdom showed the highest occupancy of the top 10 this week at 81.9%, up 0.6ppts YoY with RevPAR increasing 8.9%.

Outside of the top 10, the highest occupancies in each continent were:

- Curaçao in the Americas at 77.3%, up 12.1% YoY.

- In Asia Pacific, French Polynesia led at 78.4%, down 3.3ppts YoY.

- Ireland had the highest occupancy in Europe of 85.1% up 3.2ppts, and also posted the highest weekly occupancy across the globe.

- In the Middle East and Africa, Jordan saw an occupancy of 76.4%, up 4.1ppts YoY.

Final thoughts

A return to normal seems to remain the key point to this week’s results. Weekdays, group demand, and the Top 25 Markets are driving performance gains as was the norm in the pre-pandemic days. The slower return of international travel, especially from China, along with new business travel patterns continue to hold back stronger performance. Outside of the U.S., performance continued to see strong but slowing growth as it too returns to normal.

Looking ahead

For the week ending 21 October 2023, we expect business and group demand to pick up and remain high for the following week before declining ahead of Halloween, which falls on a Tuesday this year and will disrupt weekday business travel. Looking further ahead to this year’s major holidays (Thanksgiving, Christmas and New Year’s), we expect slightly softer performance more in line with previous ones versus what we saw in the previous two years.

*Analysis by Isaac Collazo, Chris Klauda, Will Anns

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.