STR, TE upgrade U.S. ADR and RevPAR forecast

HENDERSONVILLE, Tennessee — STR and Tourism Economics lifted year-over-year growth projections for average daily rate (ADR) and revenue per available room (RevPAR) in the final U.S. hotel forecast revision of 2023.

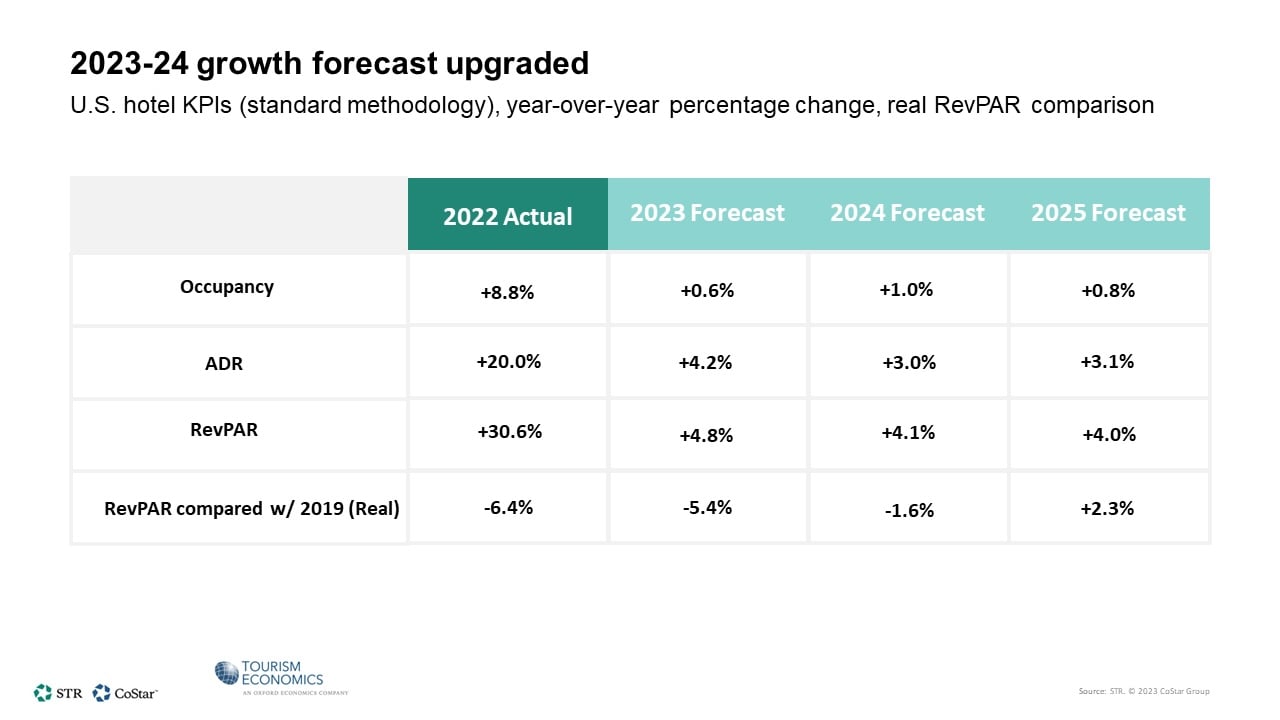

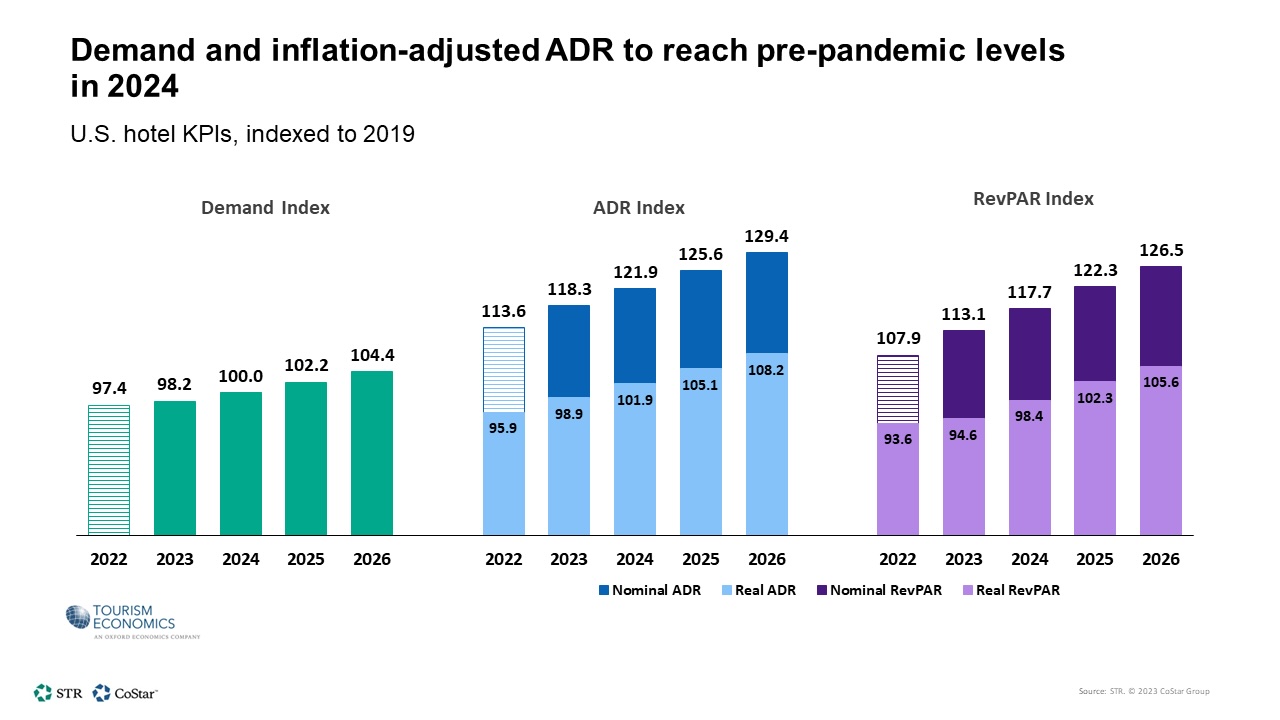

For 2023, growth in RevPAR was raised by 0.3 percentage points, due to a 0.6ppt lift in ADR growth. Recent RevPAR trends demonstrate that rate continues to be the primary driver of performance. Occupancy was downgraded slightly (by 0.2ppts). For 2024, the growth projections for each of the key performance metrics remained flat from the previous forecast due to the above long-term average trends beginning to stabilize.

Our latest projections reflect the continued buoyancy of travelers, as room rates outperformed our previous forecast, which built in a mild recession,

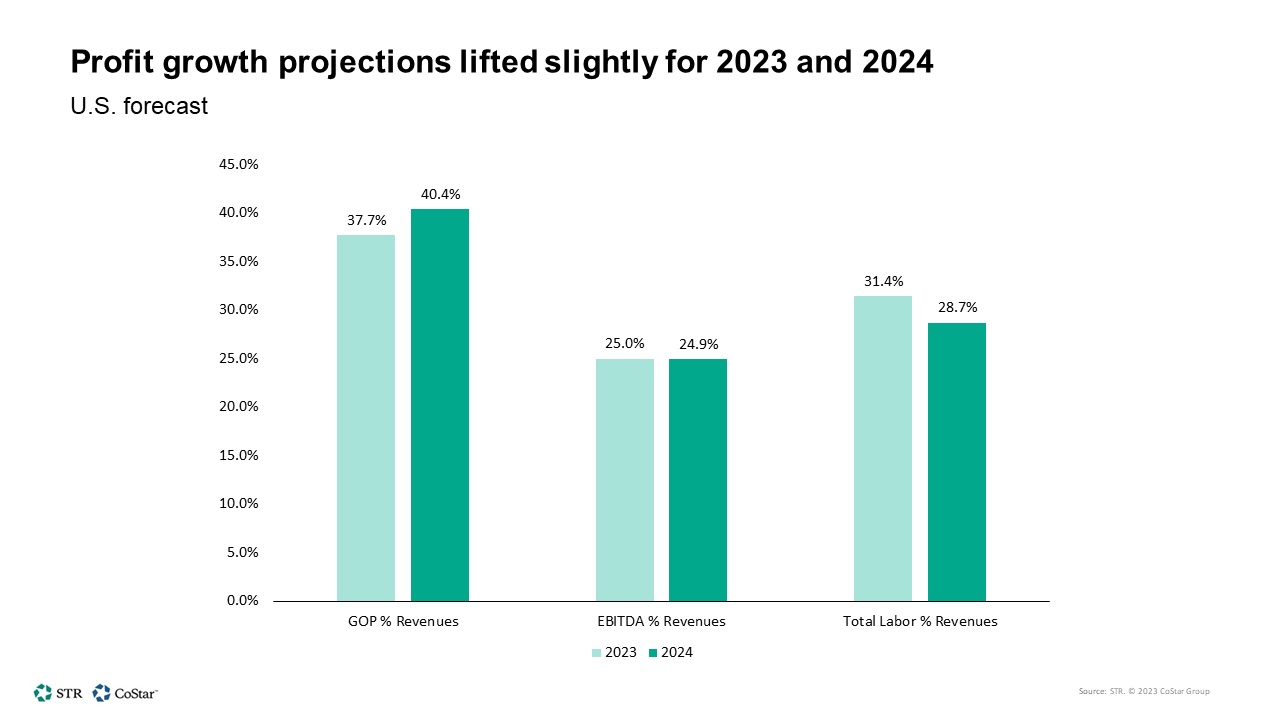

said Amanda Hite, STR president. As a result, we have raised RevPAR for the remainder of 2023, with risks on the upside. Looking ahead to the new year, we expect to see continued growth in RevPAR. The latest economic outlook calls for a stalling economy with growth well below the levels seen toward the end of the pandemic. Despite the potential dip, we see strong traveler fundamentals, including low unemployment among college-educated individuals, an increased volume of households above $100k in income, a rise in real personal disposable income, and a somewhat stable corporate environment. The projected increase in ADR will result in higher TRevPAR, which combined with less spend on labor, lifts our expectation for GOP as well. The gap in hospitality employment levels coupled with increased operational efficiencies brought down our labor cost forecast.

Decelerating factors, including higher interest rates, more restrictive lending, tighter fiscal policy, and weakened household finances will lead consumers to rein in spending and firms to cut back on hiring and investment, likely causing the economy to skirt with recession,

said Aran Ryan, director of industry studies at Tourism Economics, Travel sector improvements, including stronger group activity and returning international visitors, will help offset economic factors, supporting still-solid RevPAR gains.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base with direct access to the most comprehensive set of historic and forecast travel data available. And our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models.

Haley Luther

Communications Manager

+1 (216) 278 0627

STR