European Real Estate Market Outlook 2024 - Hotel

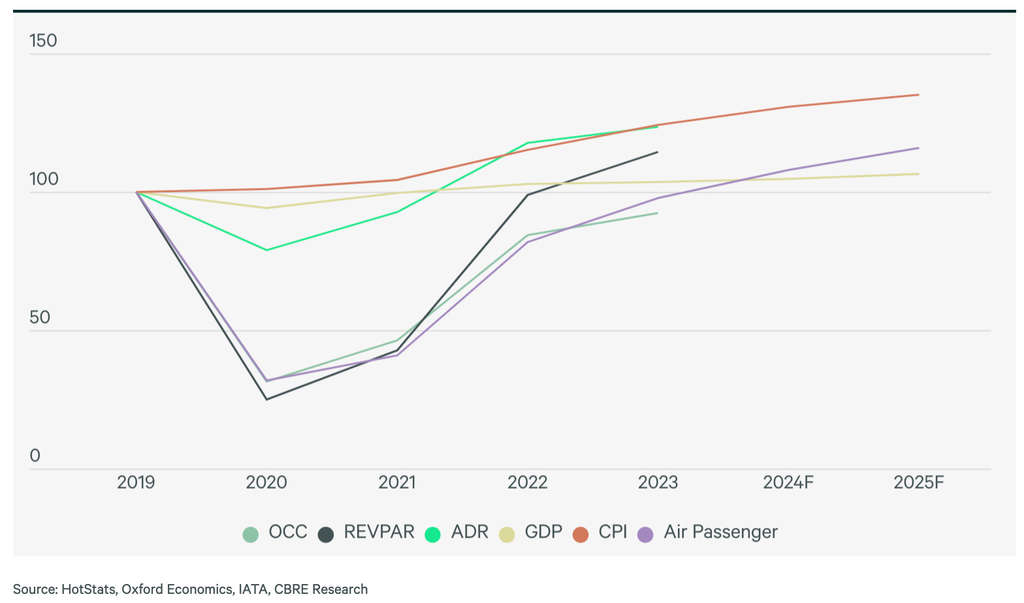

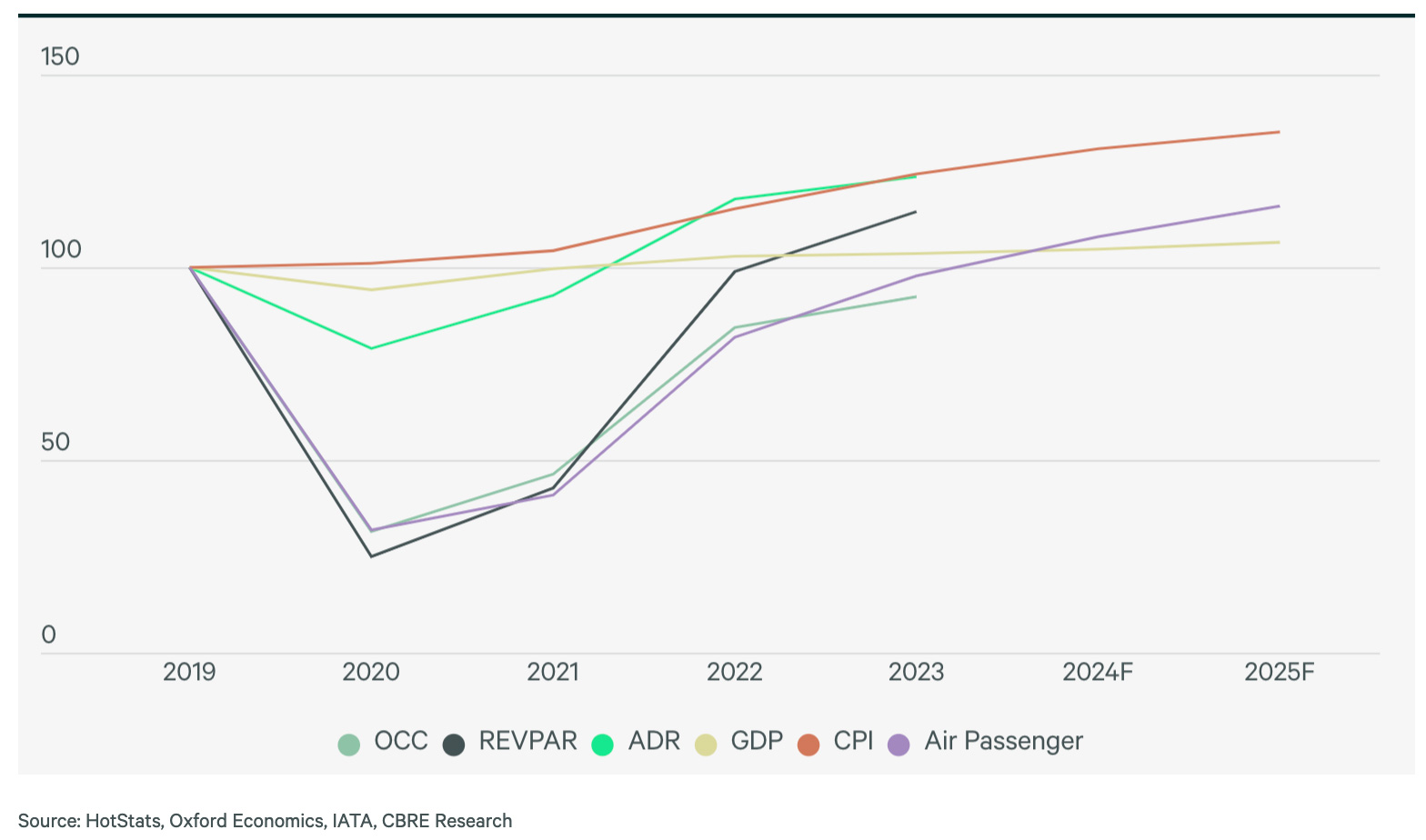

Europe’s hotel and tourism sector is poised to gain further momentum in 2024. This is driven by a rise in leisure travel, including from Asian markets, and a more gradual recovery of corporate and group travel. After outsized growth of 20% in 2023, Revenue Per Available Room (RevPAR) in 2024 is expected to increase at a brisk but more moderate rate in the high single-digits.

Key Takeaways

- Domestic and short-haul leisure travel will continue to be the primary driving forces for hotel demand. There is also an upside from international long-haul leisure travel from Asian markets, supported by a gradual revival of travellers from China and Japan, which had been lagging.

- Growth in Revenue per Available Room (RevPAR) is likely to ease to a high single-digit rate in 2024. This indicates a return to more normalised levels of demand growth. Given the outlook for sustained demand and moderating inflation, we expect 2024 to be another year of both profit increases and margin expansion.

- We expect hotel demand growth to outpace supply given recent increases in construction and borrowing costs. This difference is likely to be most marked in popular tourism locations that already offer prime hotel space, and where demand will remain robust.

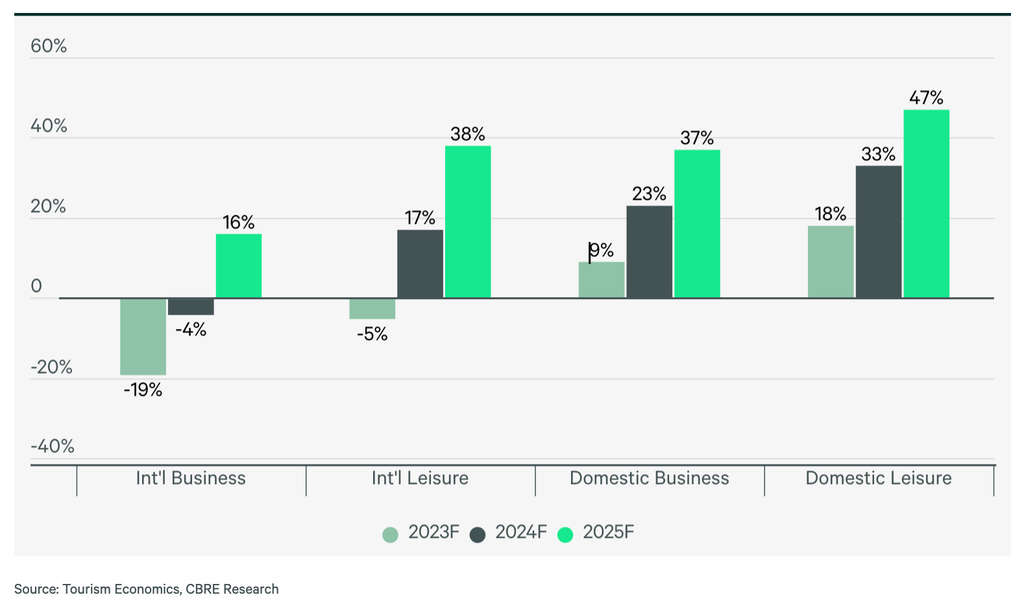

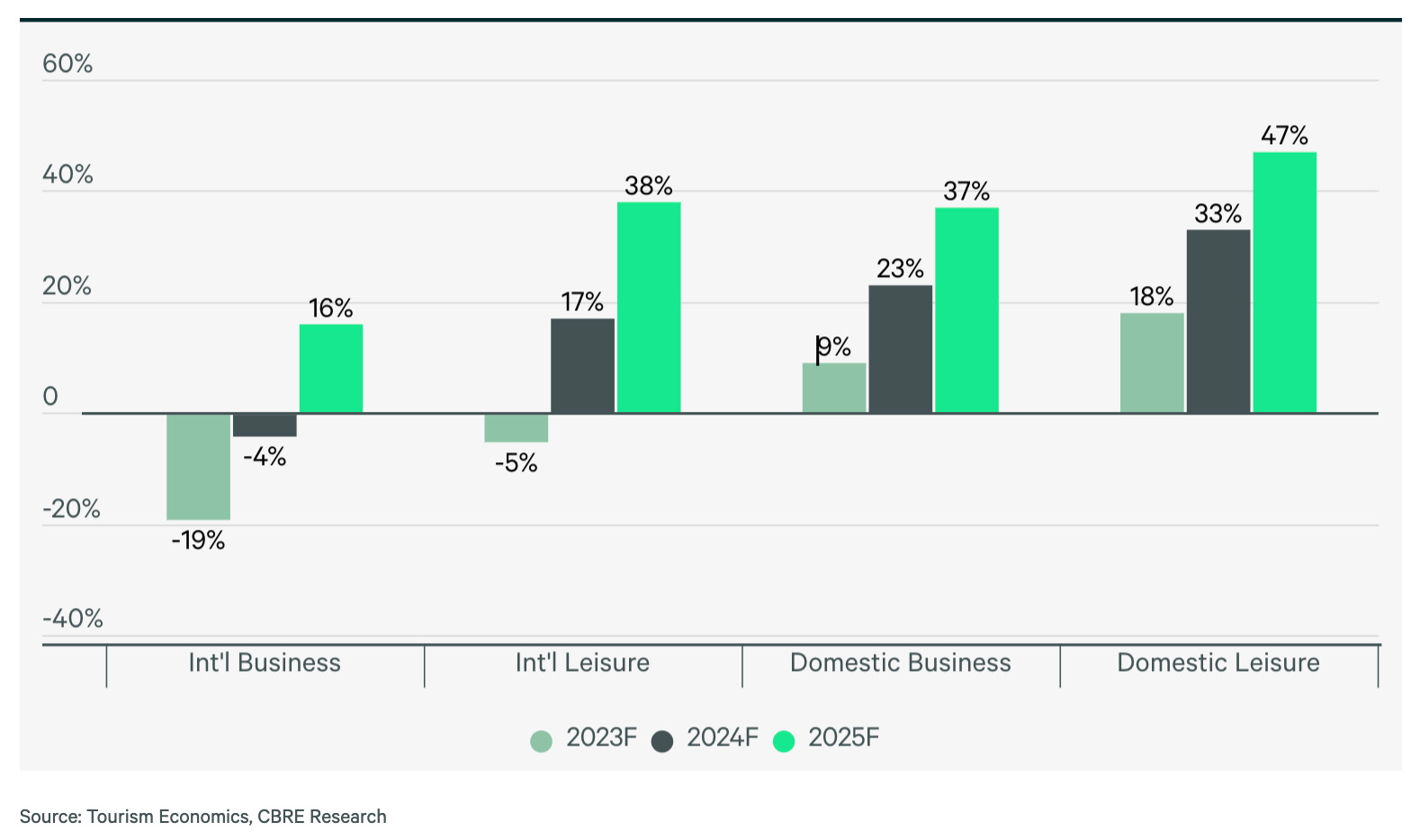

Continued recovery in international long-haul leisure travel

Propelling hotel demand through major events

Europe's hotel and tourism sector continues its journey to full recovery, primarily driven by domestic and intra-regional leisure travel.

International leisure travel is expected to stage a meaningful recovery in 2024. The addback of long-haul flights from Asia Pacific should help support the improvement in international leisure demand.

Business travel, particularly international long-haul, is expected to show meaningful year-over-year growth but is likely to lag leisure due to the delay in returning to the office in some markets and the ongoing prevalence of virtual meetings.

Several major sporting and entertainment events are expected to further operators’ ability to increase room rates and raise occupancy in the hosting cities. These include the 2024 Paris Summer Olympics and UEFA Euro 2024 in Germany, as well as major music tours by artists such as Coldplay and Taylor Swift.

Figure 1: Europe - International Arrivals (% relative to 2019)

Figure 2: Europe - Performance & Key Indicators (2019=100)

The conflicts in Ukraine and the Near East may cause some travellers to shift their travel plans to Northern and Western Europe, as was seen during prior periods of conflict. As these are generally higher ADR markets, this shift could be yet another catalyst for occupancy growth and rate compression during peak periods.

RevPAR growth will continue to moderate

After enjoying strong gains fuelled by inflation and surging demand in 2023, the pace of gains from an operator’s perspective is likely to moderate. We expect RevPAR growth in 2024 to decelerate to a high single-digit rate.

Throughout the pandemic, operators demonstrated their ability to adapt quickly to changing market conditions, leading to improved operational efficiency. This is set to position them well to maintain profitability in the face of potentially challenging economic conditions ahead.

The luxury and resort segments are expected to continue performing better relative to other segments. The key drivers - strong wealth creation and consumer demand from high-income groups – are less vulnerable to macroeconomic headwinds.

Favourable supply and demand dynamics anticipated

Growth in visitor arrivals to outpace supply growth

From 2009 to 2022, overall European hotel supply grew at a 1.4% compound annual growth rate (CAGR). Beginning in 2024, supply growth is expected to moderate to just a 1% CAGR, well below the estimated 3% annual growth in visitor arrivals supporting further RevPAR gains.

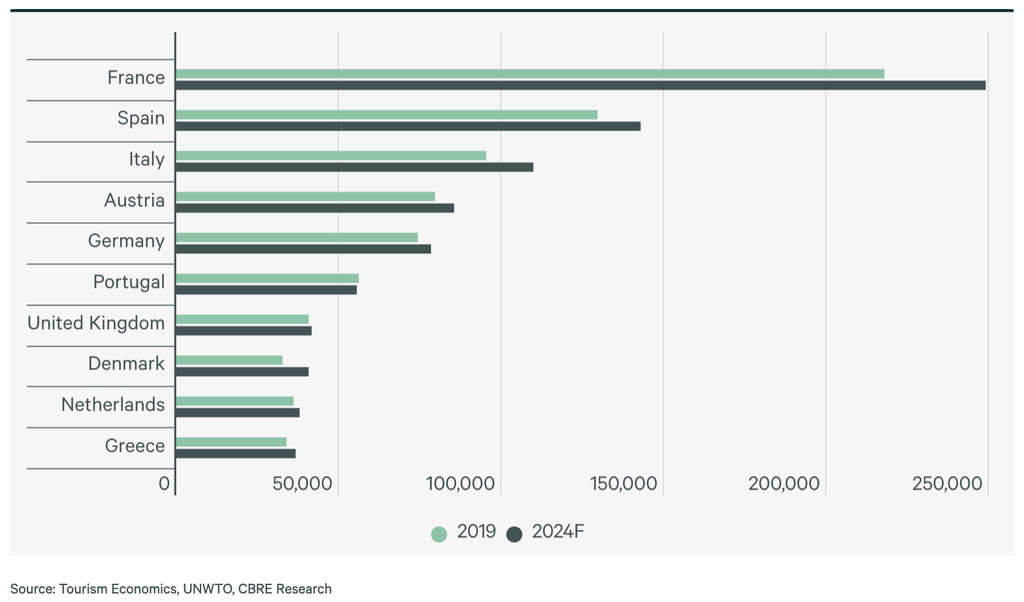

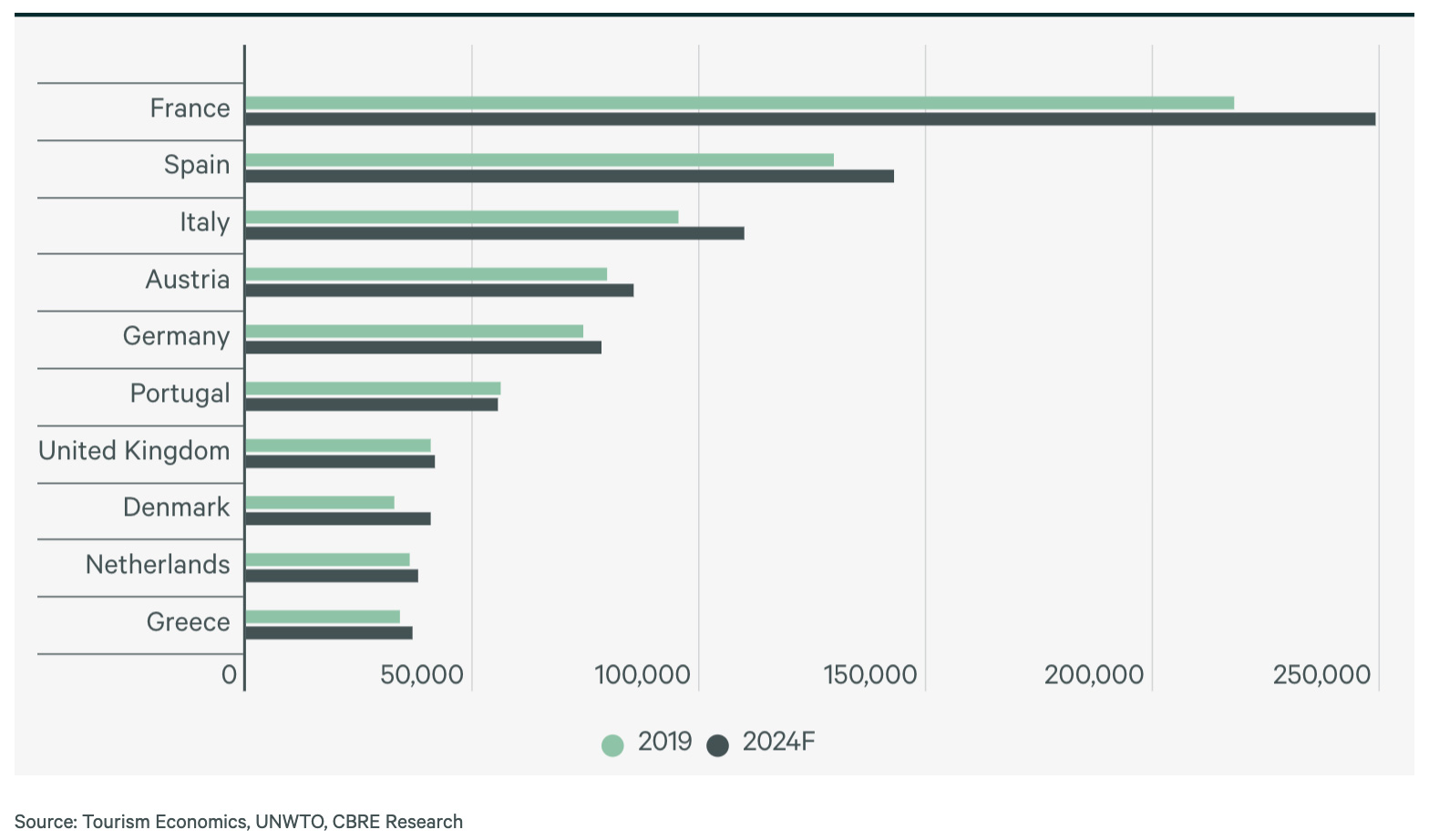

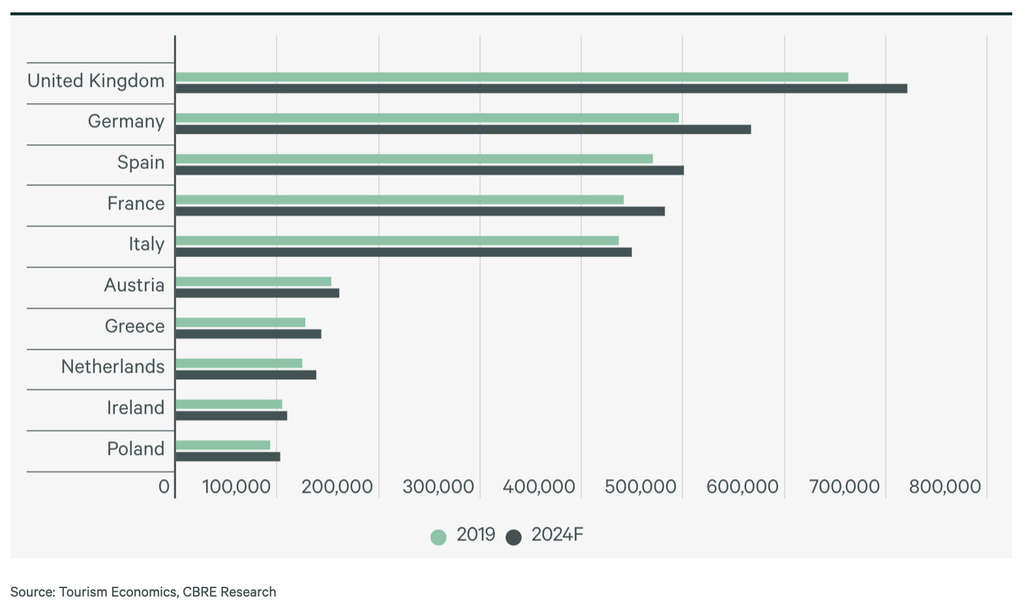

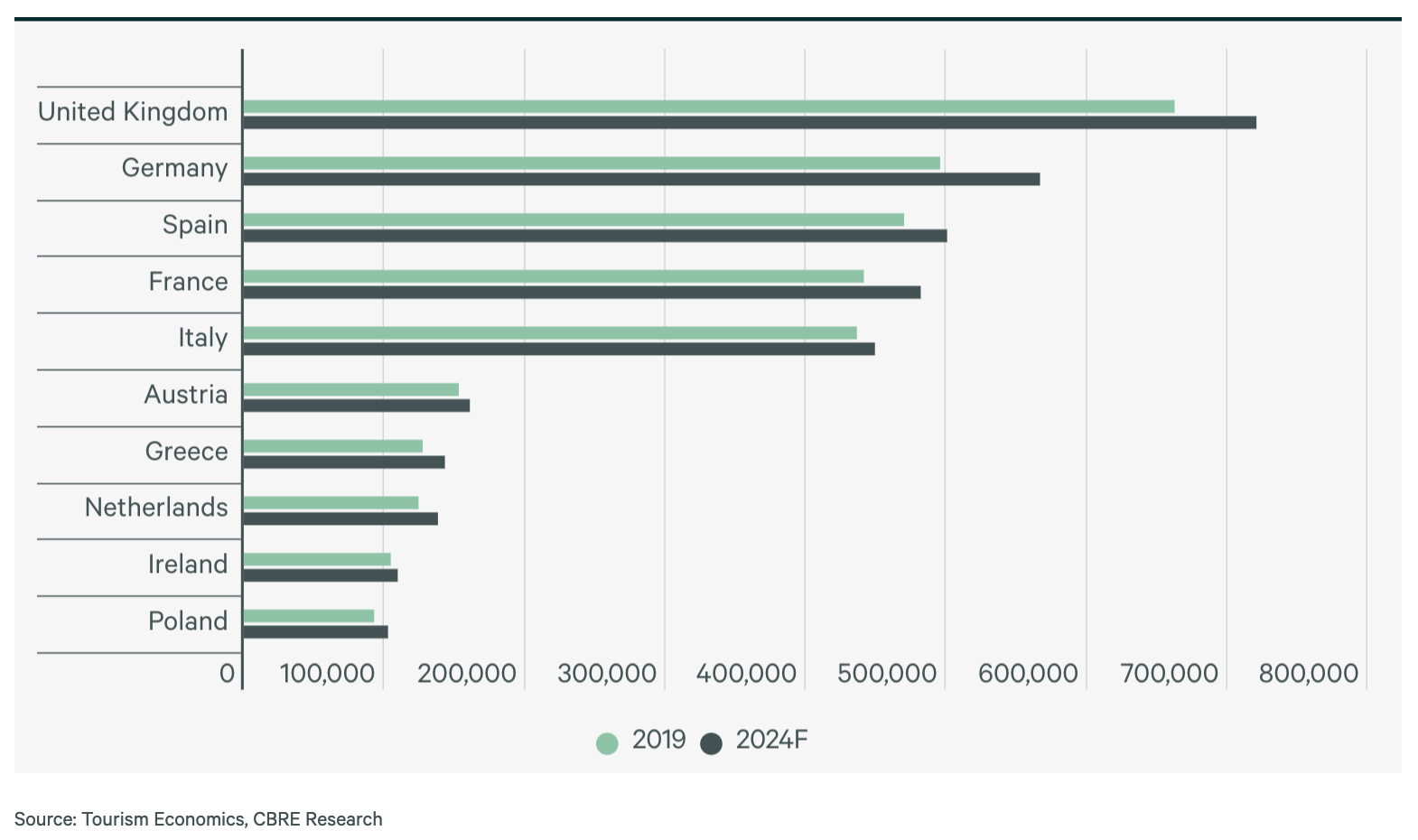

The UK and Germany are at the forefront of European hotel developments. Between them, they account for over a third of the total hotel pipeline from 2024 to 2028, and hence they will experience above-average rates of supply growth.

Other markets may see a more favourable supply and demand balance. France, Spain and Italy are particular bright spots, and are forecast to see a relatively low level of new hotel development and the highest number of international inbound visitors in 2024 and beyond. This highlights the potential for further gains in RevPAR and operating income in these markets and supports their position as attractive investment targets.

Figure 3: Top 10 European Countries: Total international inbound visitor arrivals (‘000)

Figure 4: Top 10 European Countries: Total overnights stays in all accommodation (’000)

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2021 revenue). The company has more than 105,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.