Hotel Market Beat 2023 H2 - Greece

Strong Recovery of the Tourism Sector in Greece in 2023

- Greece’s tourism sector saw a 17.6% increase in international arrivals and a 10.7% increase in hospitality turnover in 2023.

- Major brands like Six Senses, Radisson Blu, Ikos, and Elounda Hills are making substantial investments in Greece.

- The upper upscale hotel sector in Athens and Thessaloniki saw a 25% increase in RevPAR in 2023, indicating promising prospects.

TOURISM DEMAND: A Tourist Surge Ignites Economic Boom and Job Growth in 2023

In 2023, Greece's tourism sector flourished significantly, witnessing remarkable growth in total international arrivals, which surged by approximately 17.6% compared to 2022, as reported by the Bank of Greece, but also 4.4% higher than the pre-Covid record of 31.3 million in 2019. Moreover, the promising trend extended to the employment landscape, with unemployment rates plummeting first time since 2009 in single digit. Additionally, statistics from the Hellenic Statistical Authority (ELSTAT) reveal that turnover within the hospitality industry amounted to a substantial €10.8 billion for the period spanning January to December, which is 10.7% higher than last year. Given Greece's strong historical performance in tourism, it's anticipated that 2024 will set a new record, with tourism revenue nearing €22 billion. The surge in arrivals at Athens International Airport, reaching 95% of capacity in April 2023 and maxing out during the summer, has triggered the 33MAP expansion plan. This plan involves expanding the terminal by 81,000 square meters to accommodate 33 million passengers annually, with financing already secured. Completion is slated for 2028, while projections suggest that within the decade, the 40MAP expansion may be triggered, necessitating an increase in capacity to 40 million passengers per year.

HOTEL SUPPLY: A Look at Six Senses, Radisson Blu, Ikos, and Elounda Hills

Six Senses is embarking on its second venture into the domestic hotel market with "Six Senses Porto Heli" in Porto Heli, backed by a projected investment exceeding €150 million, supported by CBE Capital in London, in collaboration with Golden Land Goutos, Taconic Capital Advisors in New York, and Cedar Capital Partners in London. Opening in 2026, the property will offer 60 rooms and suites, along with ten residences for sale ranging from five to eight bedrooms. Additionally, Gythio's historic Lakonis Hotel is undergoing transformation under the esteemed Radisson Blu brand, set to welcome guests in 2025 with 150 rooms, representing an investment exceeding €10 million. Meanwhile, Chania in Crete is preparing for its first Ikos Hotel, Ikos Kissamos, expected to debut in spring 2025, featuring 400 rooms and villas along a 600-meter beachfront, with a total investment of €125 million under the Ikos Resorts brand. Moreover, the mega-project Elounda Hills in Crete has commenced construction in November 2023, comprising five phases set to be completed within a decade, with a total investment of €700 million, including a €70 million land acquisition cost. The envisioned plan includes over 250 residences, an ultra-luxury resort under the 1Hotels brand, and a marina with a minimum of 200 berths.

OUTLOOK: Upper-upscale performance of city Hotels in Athens and Resorts in Greece

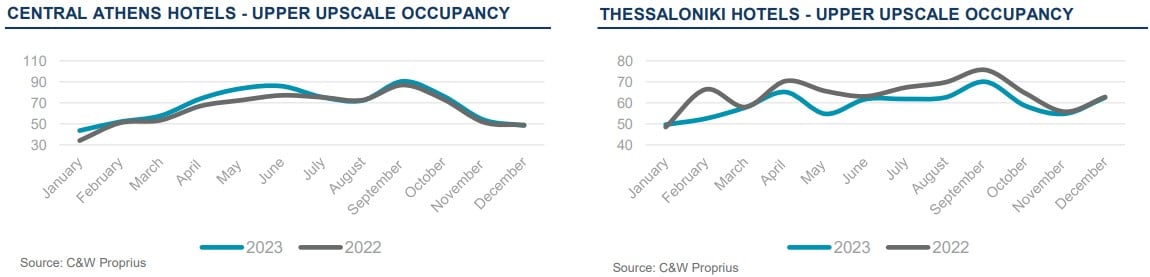

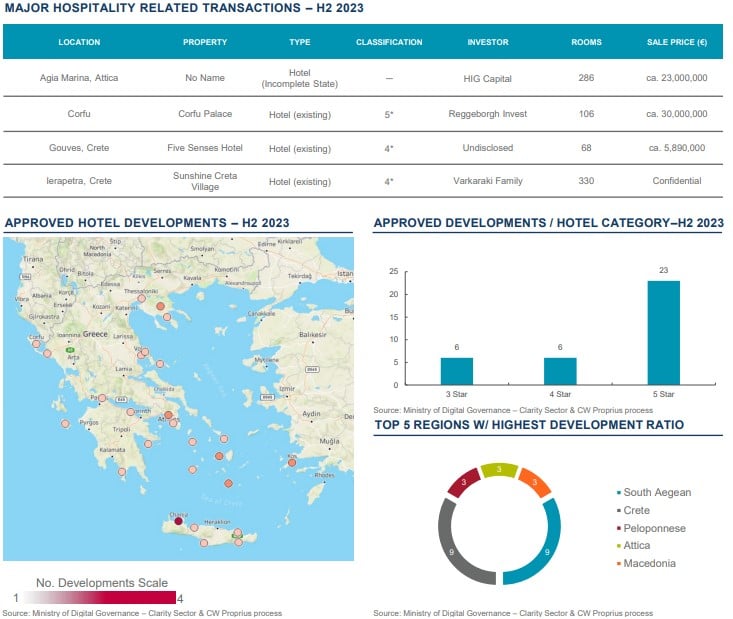

The five-star upper upscale hotel sector in Athens and Thessaloniki saw significant growth in the latter half of 2023, leading to a RevPAR increase of over 25% compared to 2022 for both cities, on an annual basis. Average daily rates (ADRs) in Athens and Thessaloniki reached €260 and €150, respectively, with occupancies ranged between 60% and 70%. For seasonal selected upper-upscale resorts, in Corfu, Crete and Rhodes, preliminary results indicated an average summer season occupancy slightly exceeding 75%, while ADRs where in the areas of €250, which is approximately 8% higher than 2022. Overall, as Greece continues to position itself as a top choice for luxury accommodations and upscale resort experiences, future prospects for the hospitality industry appear promising, with opportunities for further expansion and development on the horizon, given that the tourism seasonality seams to extend.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity, and Inclusion (DEI), sustainability and more. For additional information, visit www.cushmanwakefield.com.

Nicky Simbouras

Managing Director at Cushman & Wakefield Proprius

Cushman & Wakefield