STR Weekly Insights: 7-13 April 2024

Countries (markets) mentioned:

- United States: Phoenix, Philadelphia, Dallas, Cleveland, Augusta

- Global: China, Canada (Montreal, Toronto), Germany, Mexico

Highlights

- Solar eclipse delivered record-breaking performance Sunday and Monday

- RevPAR comparisons turned negative Thursday through Saturday – a solar eclipse hangover?

- Group demand remained strong.

- Sporting events ruled the day across markets large and small.

- Normal patterns return in next week’s data, providing insight into Q2 performance.

U.S. Performance: 7-13 April 2024

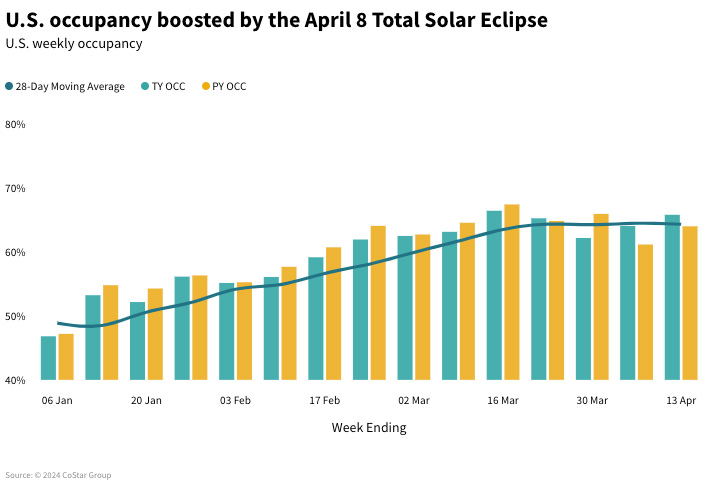

Similar to the previous week, U.S. hotel performance ending 13 April 2024 reflected an easy comparison to Easter last year and the impact of the solar eclipse. Revenue per available room (RevPAR) rose 5.8% driven by nearly equal gains in occupancy and average daily rate (ADR). However, the growth was not equally distributed across all days of the week.

RevPAR gains came primarily from Sunday and Monday, which were up 42.3% and 23% respectively. Thereafter, growth tapered to 8.3% on Tuesday and 2% on Wednesday. More concerning, RevPAR decreased from Thursday through Saturday.

The impact of the solar eclipse cannot be understated. Despite only 17% of U.S. submarkets (120 of 687 U.S. submarkets) being in the path, those submarkets accounted for 59% of the total U.S. demand growth. Most of the increase came on Sunday and Monday.

Occupancy on Sunday and Monday surpassed 80% in the Luxury/Upper Upscale and Upscale/Upper Midscale classes and was near 70% in the Midscale/Economy classes. In the remaining submarkets, occupancy hit 61% in Luxury/Upper Upscale, 58% Upscale/Upper Midscale and 50% in Midscale/Economy.

Eclipse submarket two-day ADR was US$295 in Luxury/Upper Upscale, US$195 in Upscale/Upper Midscale and US$115 in Midscale/Economy. ADR was even higher on Sunday, the day before the eclipse. We believe that the performance seen with the eclipse adds validity to the idea that we have transitioned from “revenge” to “selective” travel. In-depth analysis of the eclipse and comparisons to the 2017 eclipse can be found here.

While it is true that year-over-year comparisons were easy due to Easter 2023, the growth in non-eclipse areas was not that impressive as weekly RevPAR was up by only 1.8% with Sunday and Monday growing in the low teens. In the eclipse markets, weekly RevPAR increased 35.9%. All areas of the country saw RevPAR decrease Thursday through Saturday.

Occupancy was robust in most of the Top 25 Markets, led by Las Vegas (86.6%) and New York City (82.7%). Many others were above 70% including Los Angeles, Nashville, and Washington, DC.

Weekly RevPAR growth was highest in Philadelphia (+45.7%), which saw double-digit gains every day starting with Sunday (+180%) as WrestleMania 40 concluded. Dallas had the second highest weekly RevPAR gain (+38.9%) among the Top 25, propelled by the eclipse. Phoenix also had a good week as it hosted the NCAA Final Four, resulting in RevPAR rising by 129% on Sunday, 78.5% on Monday and finishing the week up 19.9% with occupancy near 80%.

Outside the Top 25 Markets, Cleveland hosted the NCAA women’s basketball championship game and saw RevPAR rise by 519% on Sunday. Cleveland was also in the eclipse path which drove performance exponentially with weekly RevPAR up 85.1% on an occupancy level of 72.1%.

The Masters Tournament in Augusta resulted in the nation’s largest RevPAR for the week (+389.6%).

Much has been written about the weaker ticket sales for the annual Coachella Music and Arts Festival in Indio, CA (Palm Springs), and hotel data showed the results as occupancy was down 5.7 percentage points on Friday and Saturday, the first two days of the festival. ADR also fell (-9.7%). Weekend two (19-21 April) will likely also see decreases as the festival had not sold out at the time of writing this analysis.

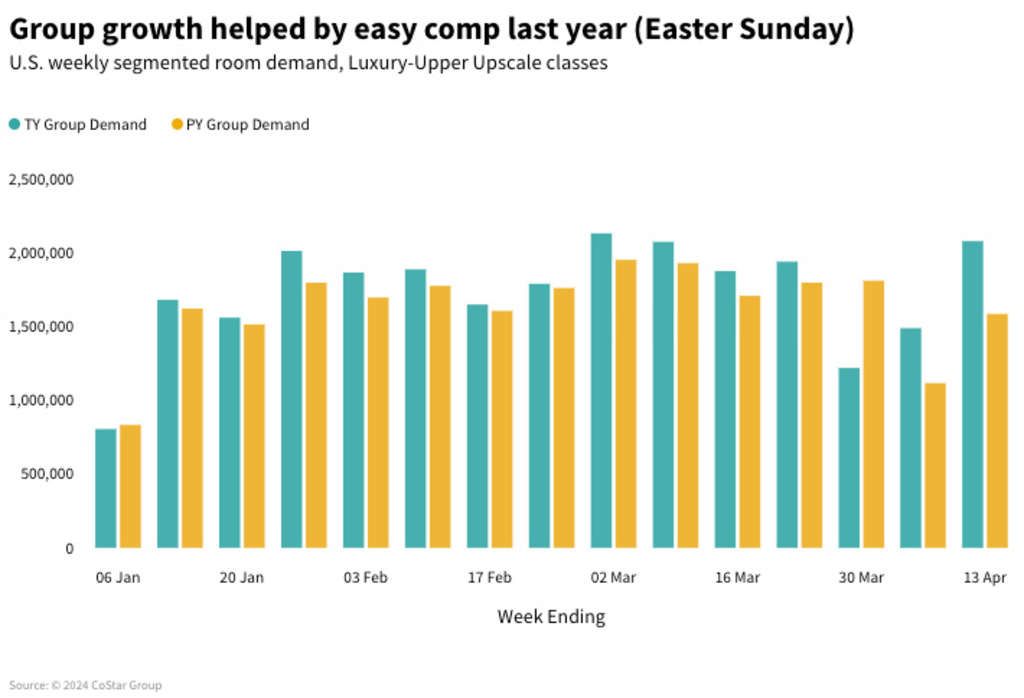

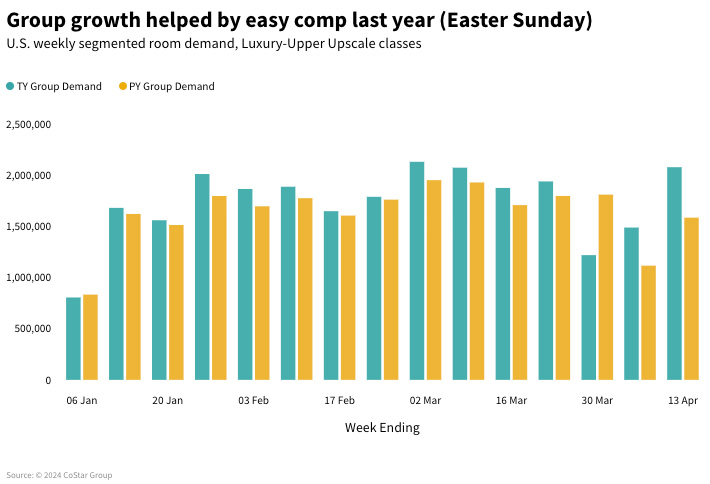

Group demand continues to shine bright

Group demand continued to be strong, reaching the second highest demand level of the year so far. Including the most recent week, group demand has surpassed 2 million room nights four times this year. San Diego, Philadelphia, and Nashville saw the greatest group occupancy gains. Group ADR increased a healthy 9.1% with Philadelphia and Phoenix seeing the largest ADR gains (20%+).

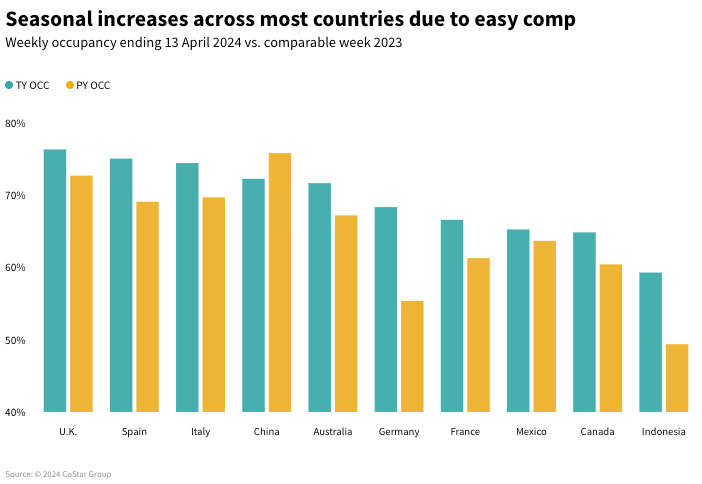

Global performance continued to grow

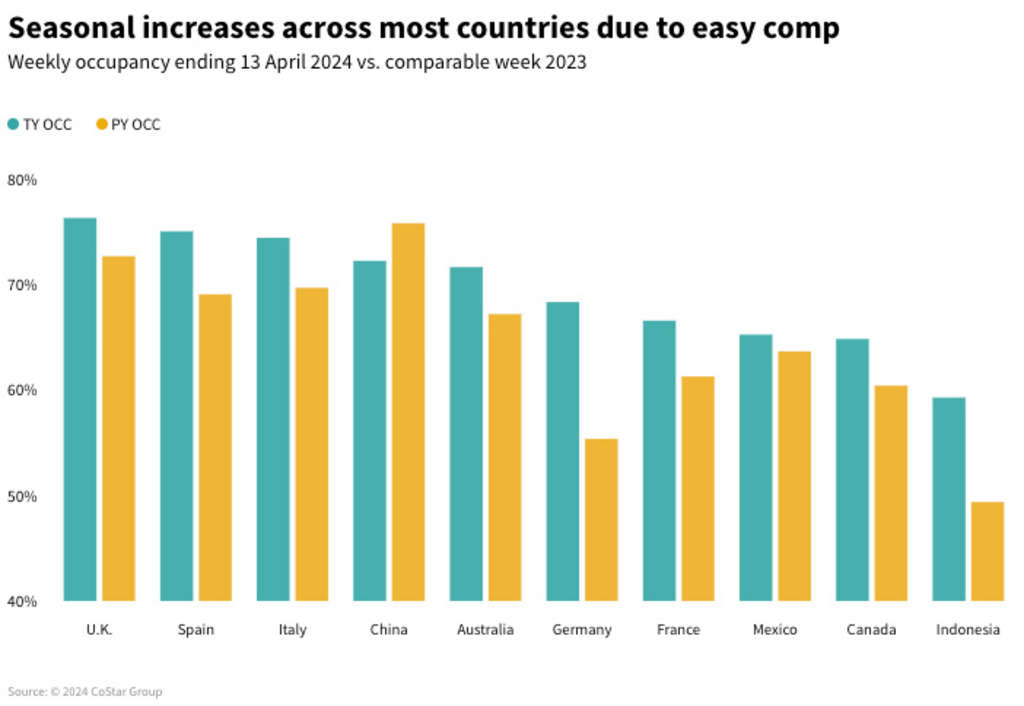

Global occupancy reached the highest level of the year (68.4%). Key country occupancy ranged from 76.4% in the U.K. to 59.3% in Indonesia. Spain, Italy and China all saw occupancy above 72%, with only China showing a year-over-year decrease. Canada benefited from the eclipse with RevPAR rising by 16.9%, as the eclipse was visible in two of Canada’s largest cities. Montreal’s RevPAR was up 34.4%, while Toronto saw a 27.6% gain. Mexico, also in the path of the eclipse, did not see a notable increase country-wide. However, the northern Mexican markets posted notable RevPAR gains that were offset by RevPAR declines in other parts of the country.

Looking ahead

The eclipse drove U.S. performance in addition to the easy year-over-year comparisons. Next week’s data should be more normal. Later in the month, we will see a pause in group demand due to the Passover observance. Last year’s Taylor Swift Eras tour from mid-March through August will create a performance hole, resulting in softness in those markets that benefited from it. Various indicators (rising debt, delinquencies, inflation, etc.) continue to point to slower leisure travel this year. We expect that special events will drive travel but that drive will be more selective than it was a year ago.

Globally, the industry continued to strengthen. The 2024 Paris Olympics along with rising international travel coupled with Taylor Swift’s tour bodes well for European markets.

*Analysis by Isaac Collazo and Chris Klauda.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.