Wall of U.S. hotel debt maturities to catalyze transactions

With the amount of maturing debt in critical stress expected to decline over the next few years, the opportunity to invest in the dislocation is now

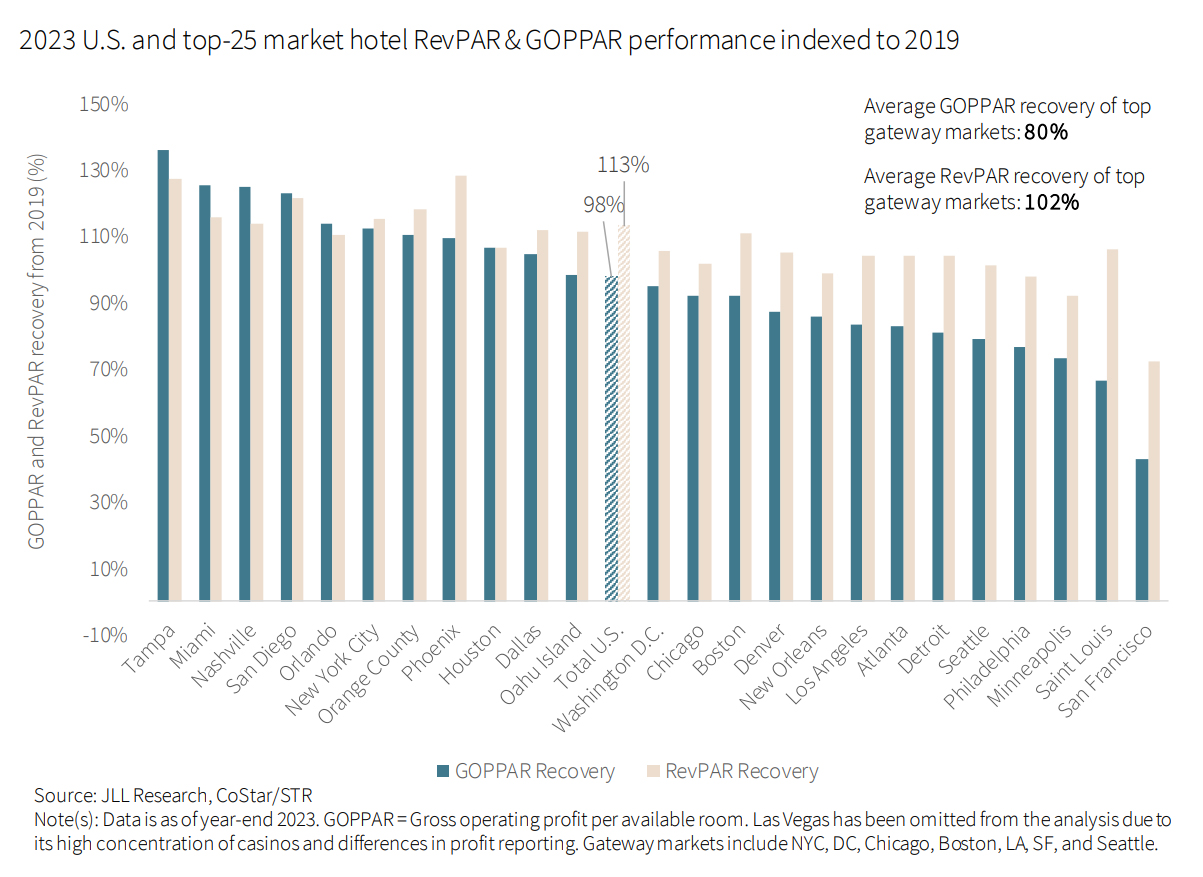

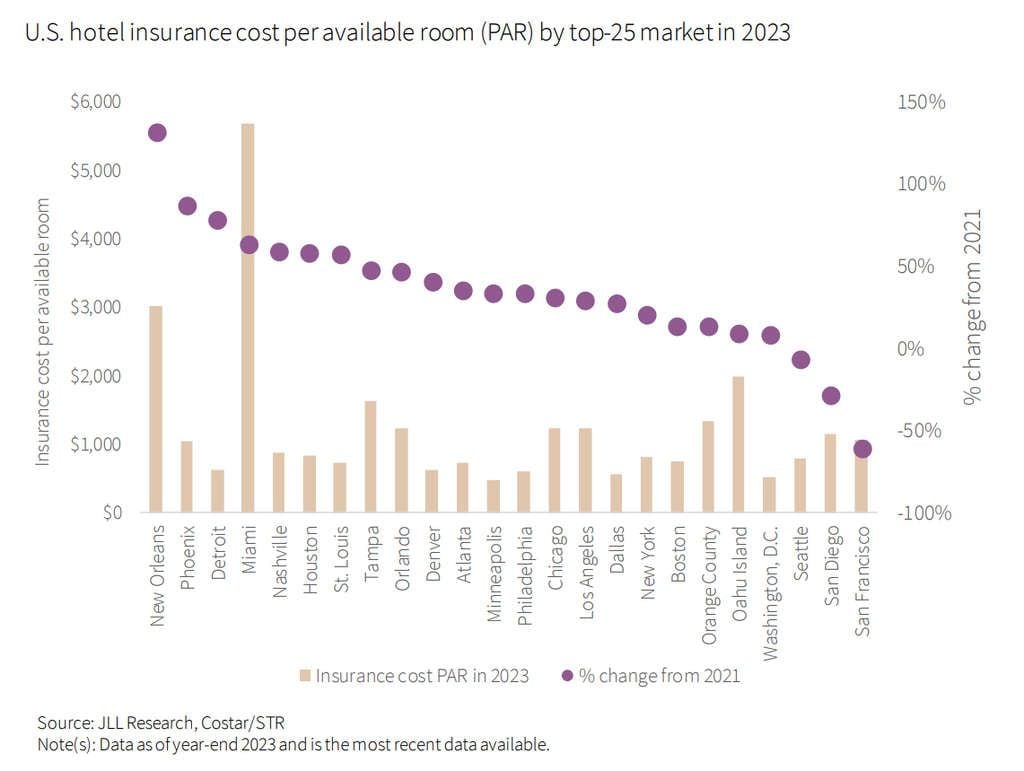

$5.8 billion of U.S. hotel single-asset securitized loans, including CMBS and CRE CLOs are coming due for maturity in 2024. Despite the U.S. hotel industry demonstrating strong RevPAR performance, there are multiple headwinds that could impede the refinancing of these securitized loans and compel owners to transact instead. These headwinds include the lagging profitability of U.S. hotels, persistently high interest rates, and historically high costs of property insurance.

As such, if the looming $5.8 billion “wall of maturities” in 2024 were to be refinanced at today’s interest rates, then a significant $4.2 billion of the total volume would be under critical stress, evidenced by a debt service coverage ratio falling at or below 1.0. This represents 71.4% of total maturing debt volume in 2024 that would not generate sufficient net operating income to cover debt service. With the amount of maturing debt in critical stress expected to decline over the next few years, the opportunity to invest in the dislocation is now.

Expect these loan maturities to predominantly catalyze transactions in top gateway markets as they observe the highest concentration of debt in moderate-to-critical stress if refinanced at maturity in 2024.