Lodging Analytics Research & Consulting (LARC)’s 2Q-2024 Hotel Industry Outlook and Market Intelligence Reports

U.S. economic growth slowed during 1Q-2024 with Real GDP increasing 1.6%, well below 4Q-2023 growth of 3.4%. Despite positive economic growth, U.S. RevPAR only increased 0.2%, as both demand and occupancy declined for the fourth consecutive quarter. January and February RevPAR increased by1.0% and 2.4% respectively, while March decreased 2.2%, largely tied to the Easter calendar shift. While this quarter’s RevPAR growth was negatively impacted by the Easter calendar shift by roughly 100 bps, the second quarter should experience a similar tailwind.

Moving forward, Moody’s Analytics expects Real GDP growth to increase 2.5% in 2024, and while growth will accelerate from the low 1Q-2024 level, it may prove to be more volatile than previously expected. On a positive note, economic growth seems to be the consensus. As of April, only 29% of economists surveyed by the Wall Street Journal expect a recession to materialize within the next twelve months (the lowest level since April 2022). However, signs of a softening consumer continue to mount, which is discouraging heading into the leisure-centric summer travel season. April retail sales disappointed, with no growth. Additionally, the April Visa Spending Index dropped 5%, with Visa’s Discretionary Spending Index declining 4% in the month. This was the sharpest monthly decline of either metric since early 2022. Meanwhile headline inflation rose 3.4% in April, consistent with expectations, but still well-above the Fed’s target, limiting the likelihood of any near-term interest rate cuts that might stimulate economic growth.

In addition to those challenges, an uncertain U.S. presidential election could lead consumers and businesses alike to curtail spending in 2024. In fact, since 2000, presidential election years have seen Real GDP growth decline by 110 bps on average vs. the prior year. In each of the past four presidential election years, both demand growth and RevPAR growth slowed from the prior year. As such, despite our baseline view of no near-term U.S. recession, our outlook for the lodging industry remains somewhat cautious.

In 2024, lodging industry growth will be fueled by corporate transient, group, and inbound foreign travel while domestic leisure demand continues to wane. Group trends remain solid, helping generate a base level of demand that will further support pricing power. Nationally, we estimate that the convention center booking pace is up 4% on a year-over-year basis in 2024, following the 15% increase in 2023. However, the booking pace is down 3% in 2025, so there is risk of modest group headwinds next year. Corporate transient demand trends are modestly positive, supported by growing corporate profits, stock prices and limited (very limited in some markets) improvements in office utilization.

Additionally, foreign inbound travel to the U.S. was still 16% below 2019 levels in 2023, providing an opportunity for ample recovery in 2024. In fact, momentum in foreign inbound travel remained strong in early 2024, with YTDApril levels just 9% below 2019 levels and up 15% yearover year. Unfortunately, trends in U.S. outbound international travel also remain strong, with YTD-April levels 20% above 2019 levels and up 11% year-overyear. As such, while U.S. outbound international travel comparisons will be much easier as we progress through 2024, trends are not encouraging.

International Travel Growth Rates vs. 2019 Levels

It is important to note that not every market will benefit from foreign inbound travel recovery. Not even every gateway-oriented market will benefit. Every market has experienced a different level of recovery of foreign travel and understanding these nuanced details is critical to understanding which markets will have tailwinds from inbound foreign travel and which ones will not.

Moody’s Analytics economic forecast incorporates the following key national assumptions that drive our outlook:

- The Fed has paused rate increases until cuts begin in September and drop 25 bps per quarter into 2027.

- U.S. GDP will increase 2.3% in 2Q-2024 and 2.5% in 2024.

With that backdrop, our current 2024 RevPAR outlook moderates to 1.8% year-over-year growth, fueled by a 2.6% increase in ADR and a 0.8% decrease in occupancy. The good news is that we expect 1Q-2024 to be the softest quarter of the year. As the calendar anniversaries the demand declines that began in 2Q-2023, and the nation experiences some modest tailwinds from the Easter calendar shift, 2Q-2024 will be the strongest quarter of the year.

However, should any of the above core macroeconomic assumptions meaningfully change, it could have a substantial impact on our U.S. lodging industry forecast.

We continue to expect there to be U.S. lodging markets that materially outperform as well as those that underperform national averages. Generally, we expect markets with outsized exposure to corporate transient, group, and inbound foreign travel recovery to be the outperformers, while markets with the greatest exposure to domestic leisure demand and those underperforming from a group pace perspective to be the laggards.

Furthermore, we anticipate financing costs to stabilize and transaction volumes to rebound. Expense pressures will become a substantial factor in identifying markets that are winners and those that are losers, especially with several major cities embarking on new union negotiations in the coming years. Wage and expense growth and their strain on margin growth materially shapes our views on markets that are best and worst for investment today.

Transparency surrounding forecasting is critical to the lodging industry. We believe the best business decisions are based on the highest quality data and information available at the time of making such conclusion(s). We take that approach with our forecasts, using the best and most relevant available information to provide the most likely outcomes.

LARC’s industry-leading market intelligence is available to help all industry participants navigate the current environment and position themselves for success. Please contact us to learn more about our services and products, or if there is any other way we may be able to serve you.

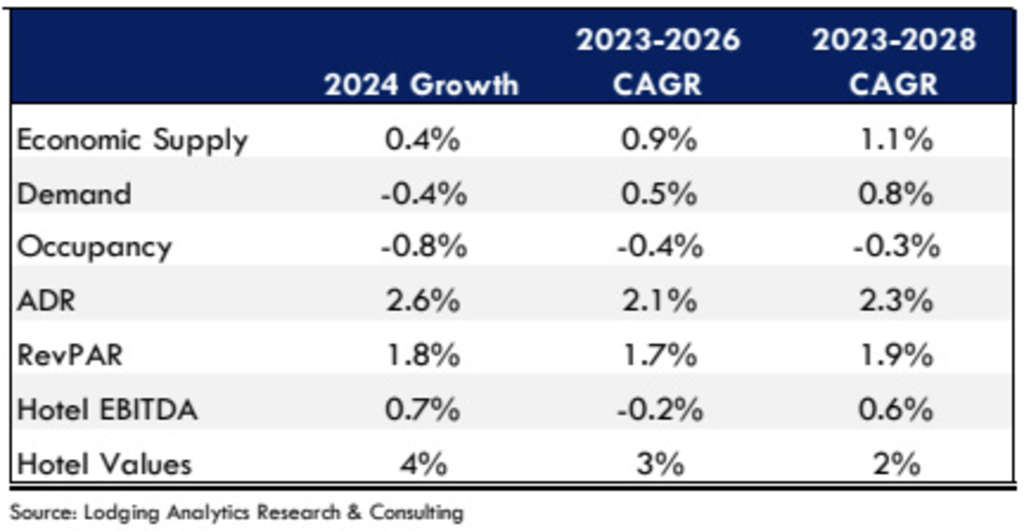

LARC’s Industry Outlook

Currently, Lodging Analytics Research & Consulting (LARC) expects U.S. RevPAR to increase by 1.8% to $99.88 in 2024, driven by ADR growth of 2.6% to $159.92 while occupancy declines 0.8% to 62.5%.

LARC forecasts 2024 U.S. Hotel EBITDA to grow 0.7%, with slight margin erosion, and Hotel Values to increase 4%. Over the next five years, LARC expects Hotel Values to increase 11%.

June 2024 U.S. Hotel Industry Forecast Summary

LARC’s U.S. RevPAR model has an R-squared of 98.7% with a standard error of 2.7%, back-tested to 2000. LARC’s U.S. Cap Rate model has an R-squared of 98.5% with a standard error of 26 bps, back-tested to 2005.

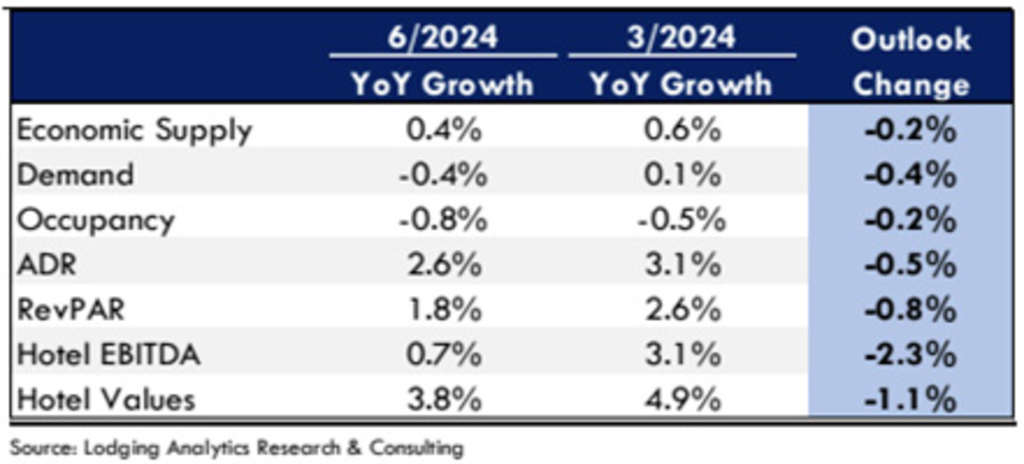

2024 U.S. Hotel Industry Forecast: June 2024 Edition vs. March 2024 Edition

The above table illustrates a summary of LARC’s current U.S. Hotel Industry Outlook in contrast to last quarter’s outlook. Note that the vast majority of our outlook change was driven by softer 1Q-2024 results than expected. The remainder of the year is minimally changed, with RevPAR growth averaging about 2.5% for the last three quarters of the year, which is consistent with the prior forecast outlook. Ultimately, our 2024 view for supply and demand both moderated, driving our occupancy forecast lower. Our outlook for ADR slightly declined, which combined with our reduced occupancy growth outlook, drives a 0.8% decrease to our 2024 RevPAR outlook. The top-line negative revision translates to a reduction in our Hotel EBTDA outlook, which in turn reduces our outlook for Hotel Value forecast.

Market Outlooks

Listed below are the best and worst performing markets based on our forecasts. Similar to LARC’s U.S. forecast, our market level forecasts are structured on multi-variable regression models with a high level of historical accuracy.

Additional detail regarding our market outlooks can be found in LARC’s Market Intelligence Reports. Please contact us if you are interested in purchasing any of LARC’s offerings.

2024

Top Markets for RevPAR Growth:

San Jose, Philadelphia, Seattle, Honolulu & Minneapolis

Bottom Markets for RevPAR Growth:

St. Petersburg, Kauai, Omaha, Los Angeles & Denver

5-Year Outlook

Top Markets for RevPAR Growth:

Maui, Raleigh, Portland (OR), Mobile & Honolulu

Bottom Markets for RevPAR Growth:

Cincinnati, Omaha, Kansas City, Indianapolis & Austin

Top Markets for Value Change:

Puerto Rico, Las Vegas, Seattle, Orlando & San Francisco

Bottom Markets for Value Change:

Chicago, Boston, San Diego, Austin, & St. Louis

Ryan Meliker

President

Lodging Analytics Research & Consulting, Inc