2024 U.S. Hotel Investor Intentions Survey

Half of U.S. Hotel Investors Plan to Buy More This Year

Executive Summary

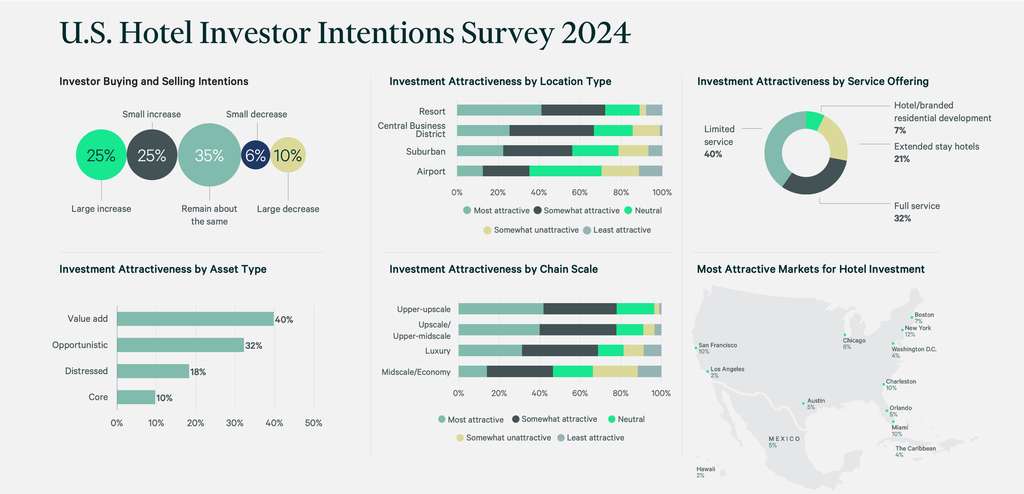

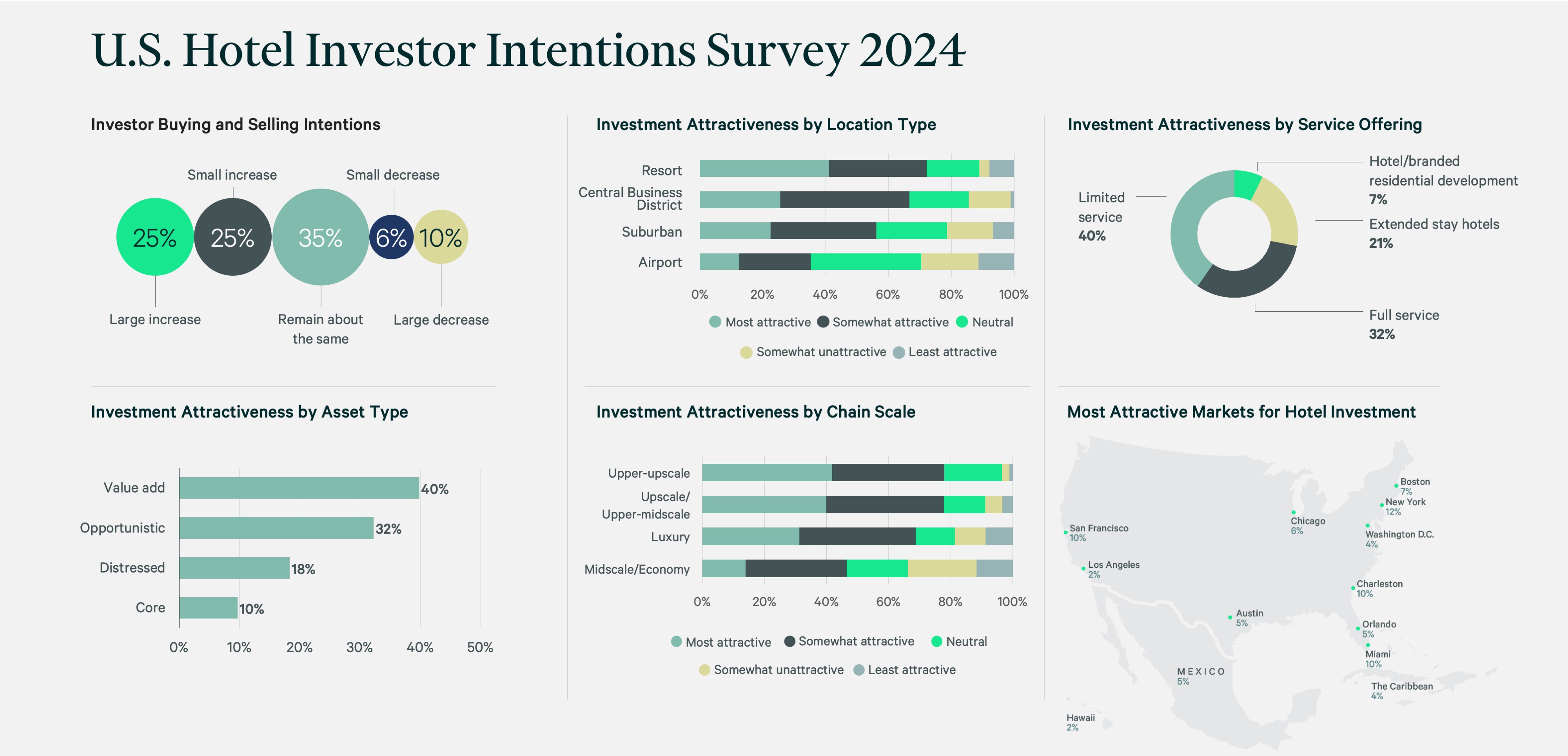

- U.S. investors have generally positive sentiment about the hotel market this year, with half of those surveyed planning to increase their hotel investments in anticipation of higher total returns and lower prices. Strengthening the balance sheet and difficulty in securing and servicing debt are the top challenges for those who plan to buy less this year.

- Central business districts (CBDs) and resorts are the most favored location types, while upper-upscale and upscale/upper-midscale are the most popular chain-scale targets in 2024. We expect RevPAR growth of 3.1% for urban locations from increased group, business and international travel. We also expect that steady leisure demand and modest ADR gains will support 1.6% RevPAR growth for resort locations.

- Increased borrowing costs and labor expenses are the biggest challenges for hotel investment this year, followed by higher insurance costs. These costs likely will lower margins. While we expect traditional hotel demand and pricing may be tempered by competition from alternative sources like cruise lines, short-term rentals and outdoor lodging, only 30% of those surveyed consider this a challenge.

- Major urban markets like New York and Washington, D.C. are expected to have the strongest hotel market fundamentals in 2024, along with leisure-focused locations like Miami, Charleston and Austin. Given limited new hotel supply and restrictions on short-term rentals, New York City is 2024’s most attractive investment market, followed by Miami, Charleston and Boston. Perhaps because more distressed assets could enter the market and make pricing more favorable, investors indicated interest in San Francisco—a market that has lagged in recovery since the pandemic.

Half of investors expect to increase their investments in hotels in 2024.

CBRE Hotels Research conducted a Global Hotel Investor Intentions Survey in early 2024 to assess the climate for hotel investment. In the U.S., hotel investor sentiment appears robust, with half of the respondents indicating that their allocation to hotel acquisitions would increase. Roughly 35% of respondents expect acquisition activity to remain the same as in 2023, while less than 16% expect it to decrease.

Read the full report here.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.

Robert Mandelbaum

Director of Research Information Services

CBRE Hotels