Formula 1 races are shifting hotel performance into high gear in 2024

Set on a global stage, Formula 1 spans across multiple continents, with 12 of the 24 races so far this year having taken place on F1’s biggest ever calendar. We take a look at how host market hotels performed during this year’s races and what occupancy on the books looks like for races set for later this year.

Note: all race weekends take place Friday-Sunday unless otherwise noted; all currency is in US$

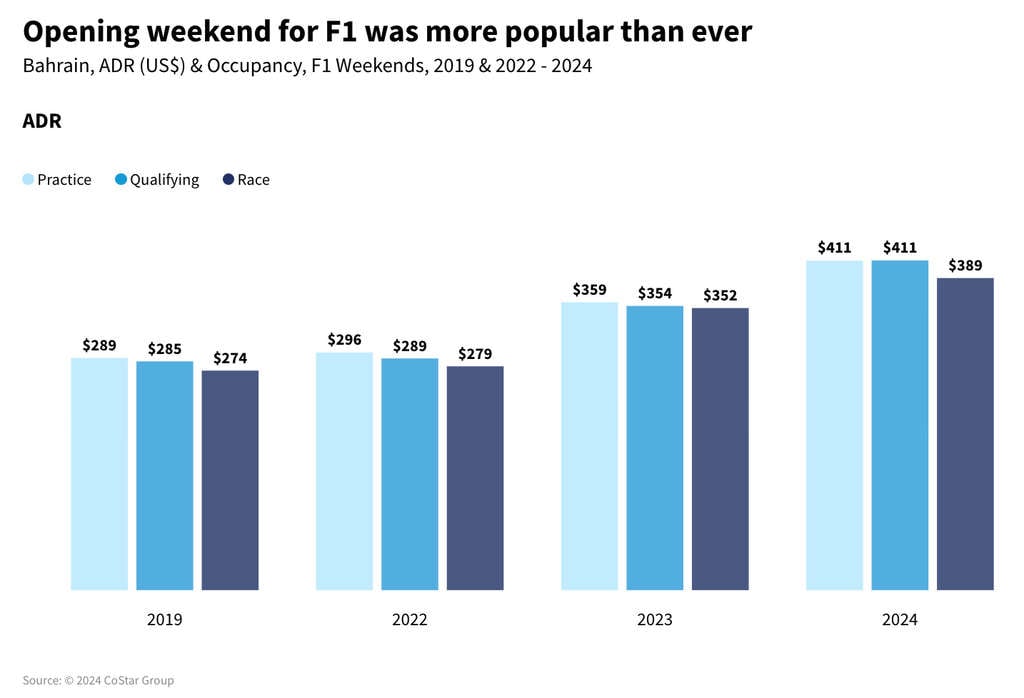

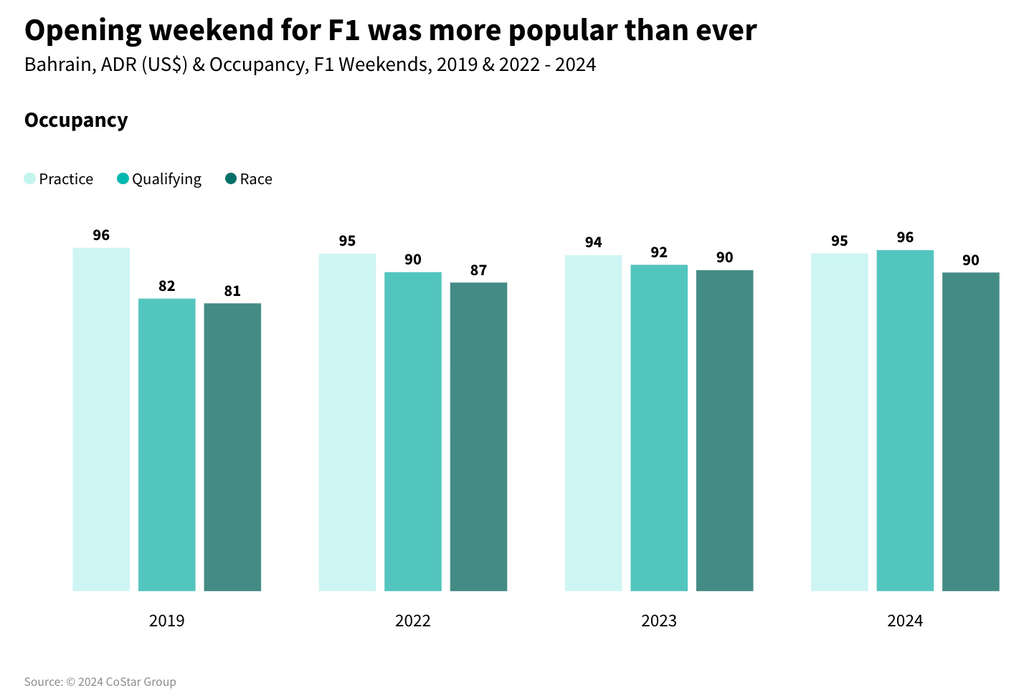

Bahrain Grand Prix

Kicking off the 2024 season in Bahrain, hotel performance during the race weekend (29 February - 2 March) followed consistent patterns from previous years. Occupancy and average daily rate (ADR) in the capital of Manama were the highest on Thursday night (Practice 1 & 2), at 95% and US$411, respectively. That room rate level was a new high in the market, up 14% year over year (YoY). Friday and Saturday nights also saw positive YoY growth of 16% and 11%, reaching $411 and $389, respectively. Occupancy on Friday increased year over year (+4.1 ppts to 95.8%), while race night saw a slight decrease of 0.7 ppts to 89.5%.

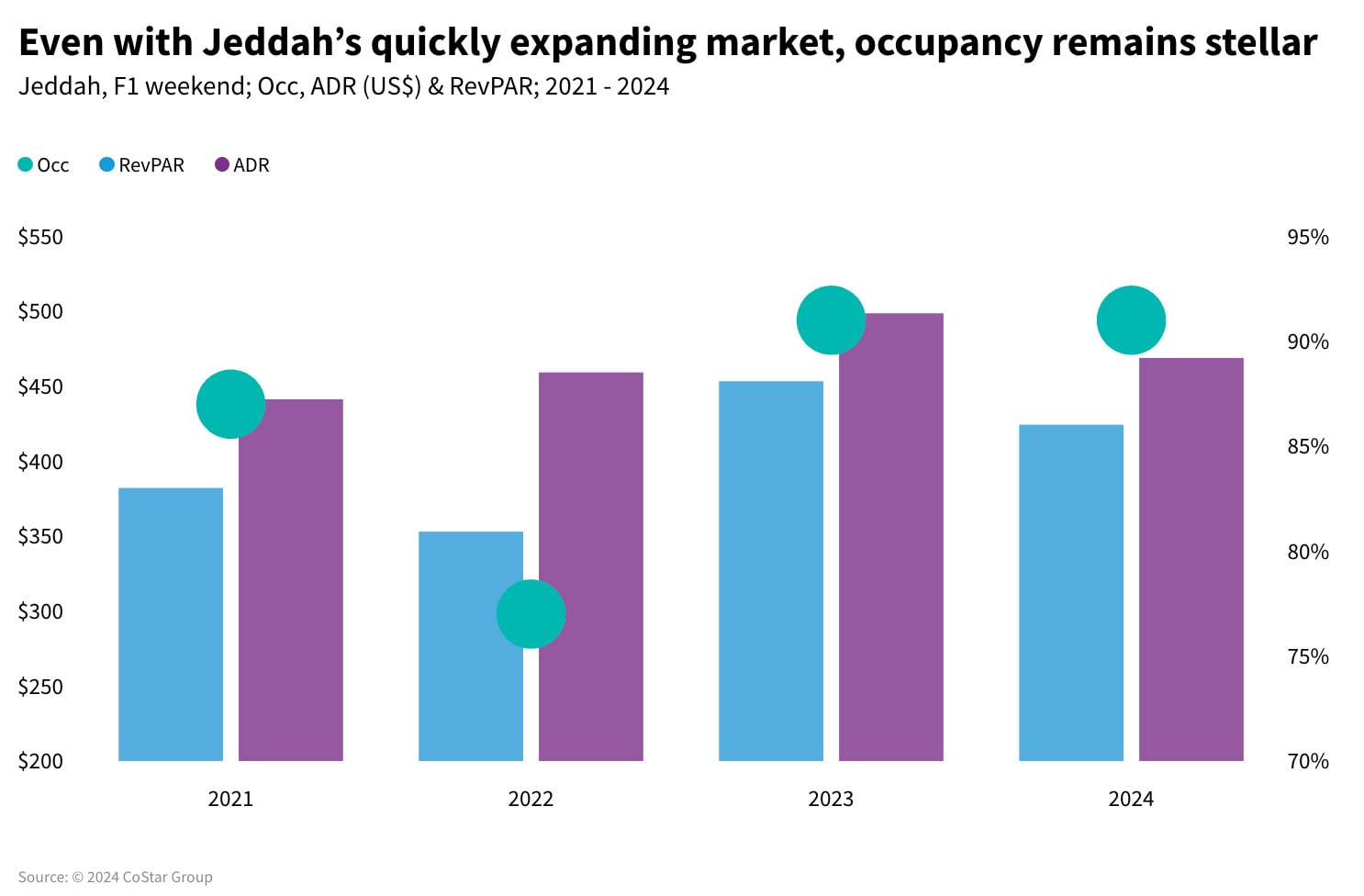

Saudi Arabian Grand Prix

The following week (7-9 March) and 900 miles across the Middle East, Jeddah held its Saudi Arabian Grand Prix. The market has seen significant hotel growth over the last year, particularly in the lower tier. Despite this expansion, the occupancy rate remained robust at 90.5% over the 2024 race weekend. Although this is slightly lower than the 2023 figure, it marks an increase of +13.6ppts compared to 2022. Similarly, ADR was US$469, reflecting a 6.0% decrease from the previous year but a 2.1% increase compared to 2022.

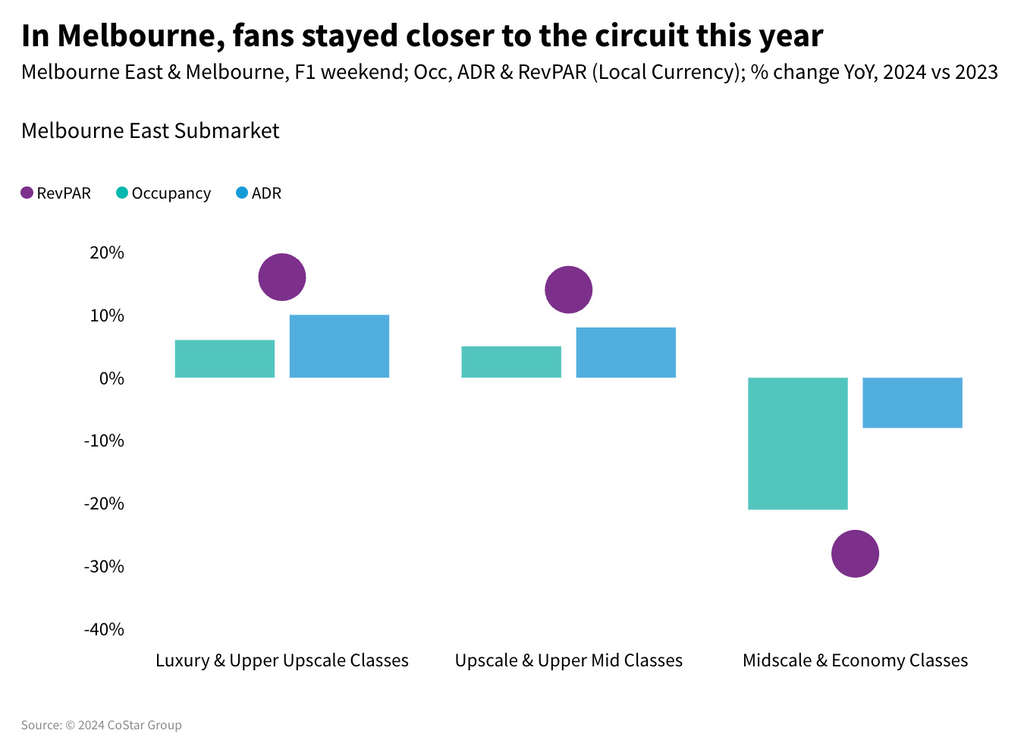

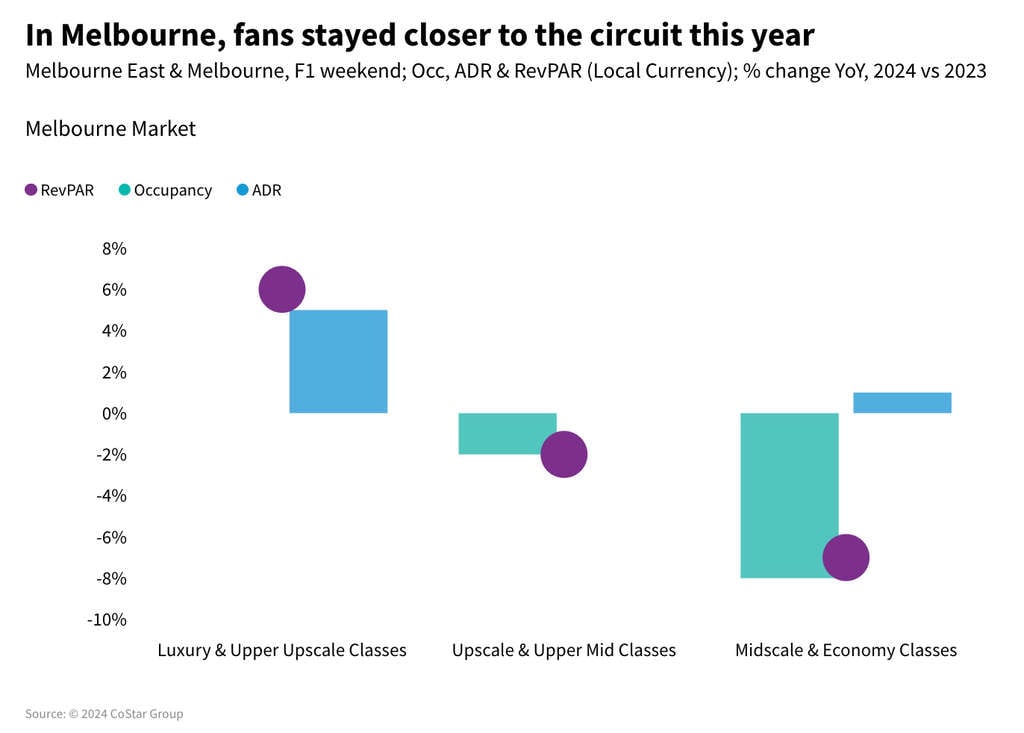

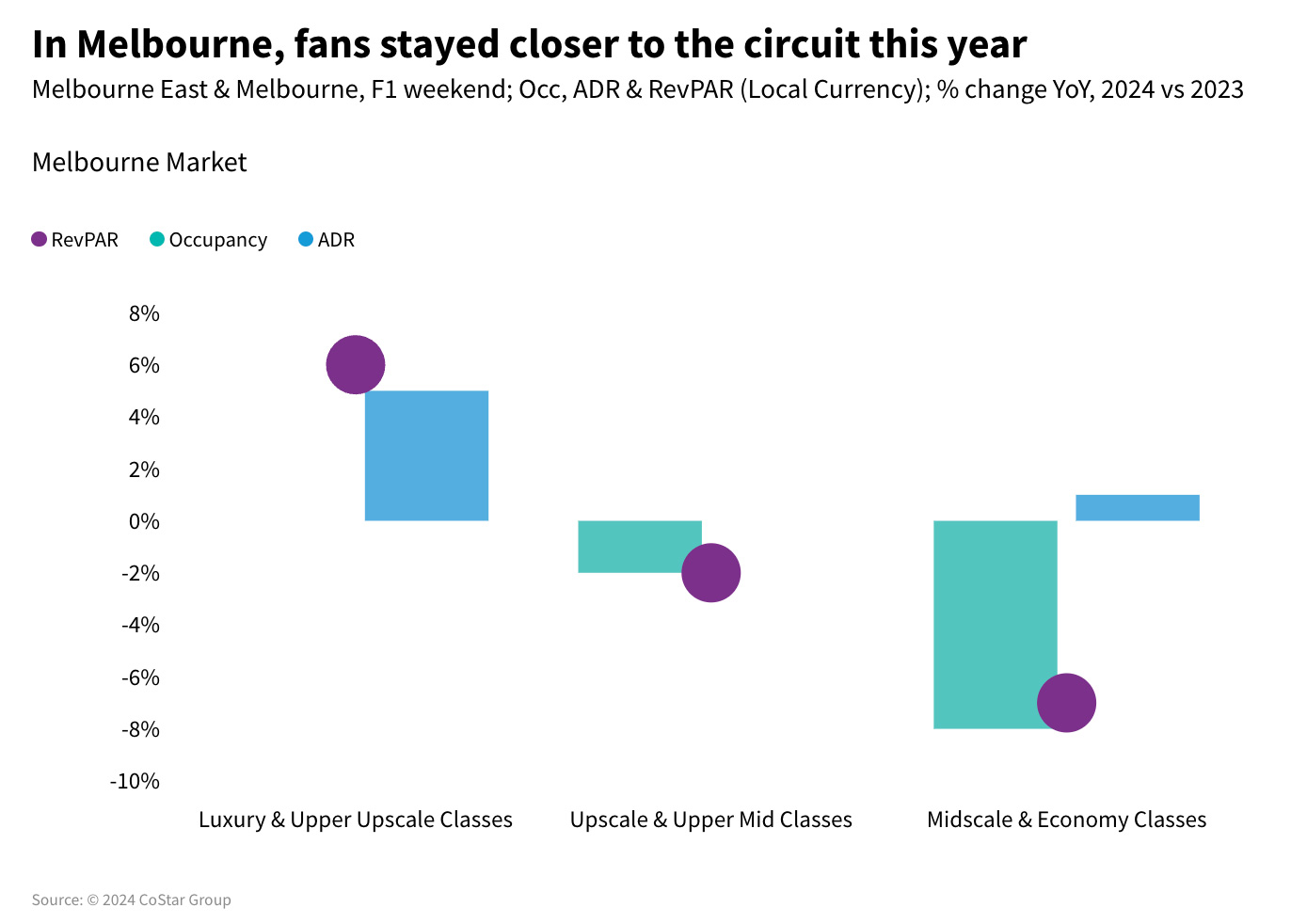

Australian Grand Prix

The last race in March was held in Melbourne at the Albert Park Circuit on the east side of the city. Hotel performance shows that fans willing to pay higher prices opted to stay closer to the racetrack. Excluding midscale and economy classes, occupancy in the Melbourne East submarket grew over 4ppts YoY, while the wider Melbourne market’s occupancy results were either flat for luxury and upper upscale or down 1.6ppts for upscale and upper midscale.

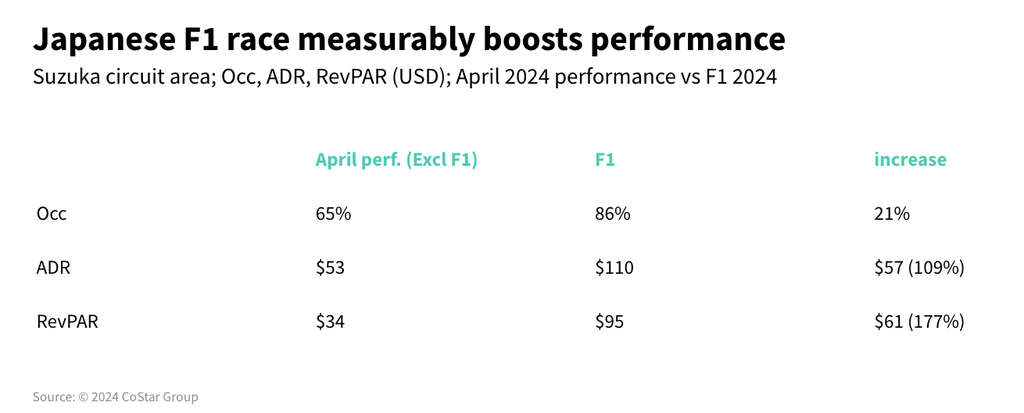

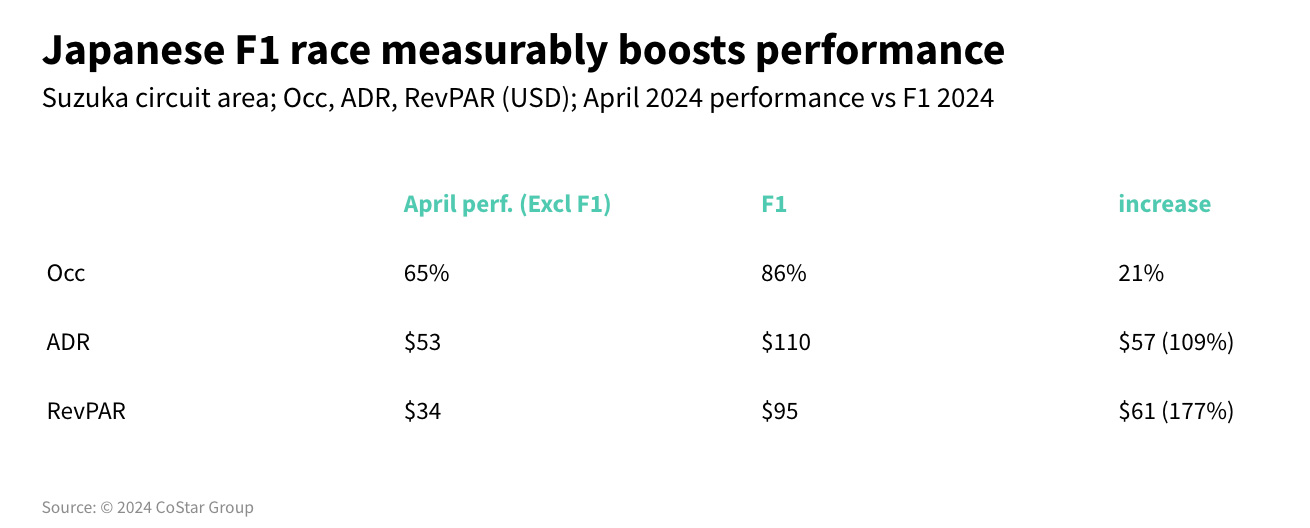

Japanese Grand Prix

Hotels in the surrounding area of the Suzuka Circuit saw a considerable performance lift during the race weekend when compared to the rest of April. Room rates were nearly double than the rest of the month, at $110, while occupancy was 86%, 21 ppts higher than the rest of April. Similar benefits were seen across the wider Chubu regional area, the STR-defined market where Suzuka sits, where ADR for the F1 weekend compared to the rest of April increased 24% to $116, while occupancy grew 6ppts to 76%.

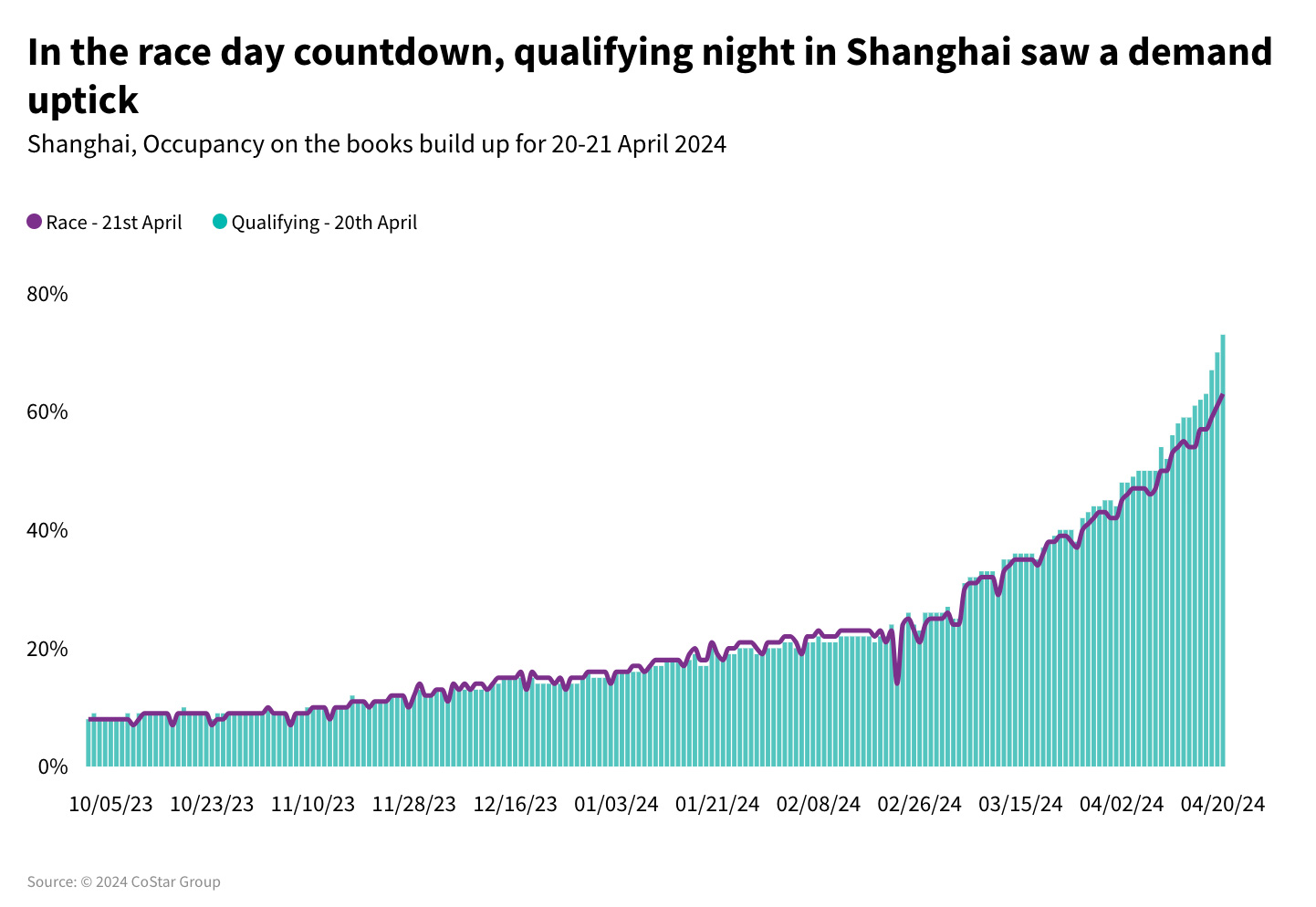

Chinese Grand Prix

China, which has seen a strong return to performance this year, equally exhibited a solid ramp up in demand for the 2024 F1 race weekend. We looked at occupancy on the books for 20-21 April 2024 in Shanghai starting at six months prior to the event. Notably, demand for the race night and qualifying night remained almost equal until the end of March, where a small divergence was seen with some last-minute bookings coming in for the qualifying night. This, in turn, resulted in a difference in performance, as actualized occupancy for 20 April was 87.2% compared to 72.6% for the race night. ADR similarly reached $91 on Saturday and $82 on Sunday.

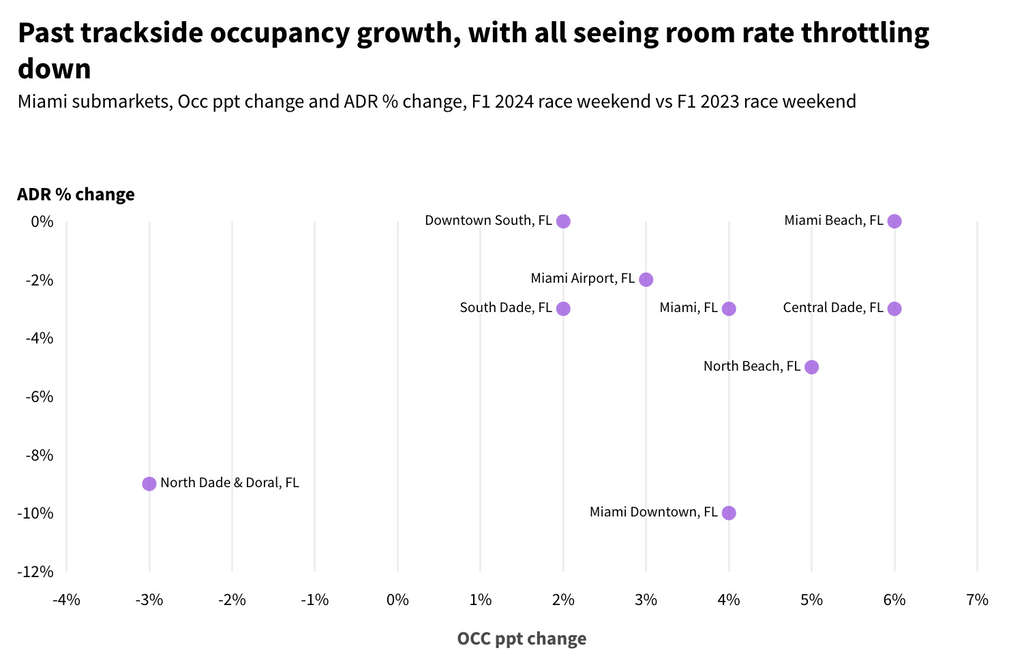

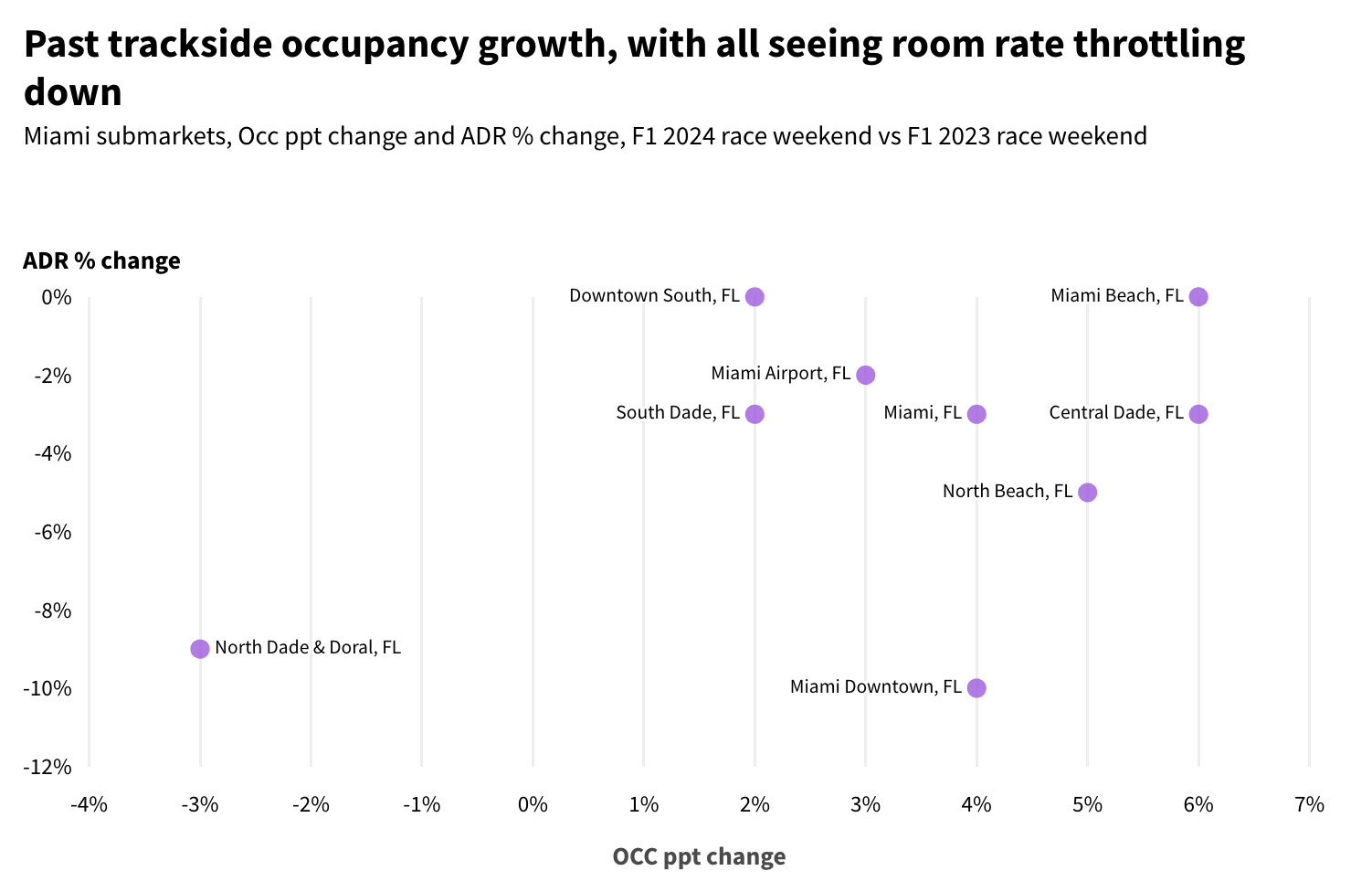

Miami Grand Prix

This year was just the third time F1 cars have hit Miami’s international Autodrome, and performance over the race weekend (3-5 May) versus last year was split between the submarket where the racetrack is located (North Dade & Doral) and the rest of Miami. North Dade & Doral was the only submarket to see a YoY decline in occupancy, -3ppts to 82%, while the overall Miami market occupancy increased 4ppts to 85%. All submarkets saw either an equal ADR result or slight decrease YoY with Miami Beach reporting the highest ADR at $487 (flat YoY). The Miami market recorded an ADR of $339, down 3% YoY.

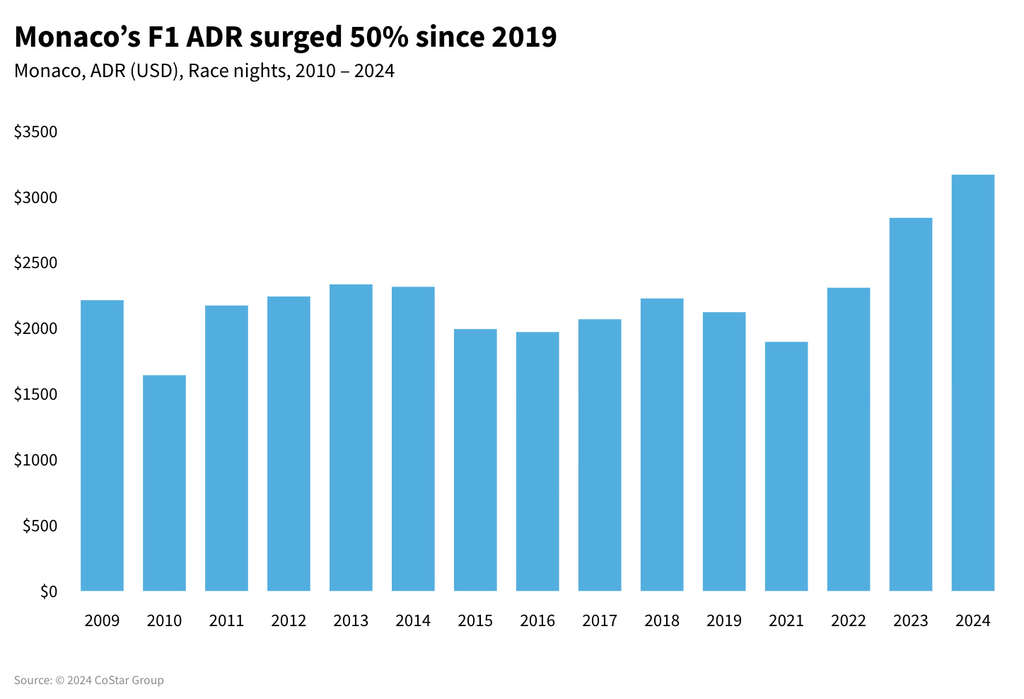

Monaco Grand Prix

Settling ADR is not the case for the most prestigious race of the calendar in Monaco. Room rates for the race night over the last five years has grown from $2,122 in 2019 to $3,169 in 2024 – an almost 50% increase, with the market also posting its highest daily ADR figures on record during the race weekend. Occupancy this year also climbed to 97.8% (a 3.8ppts increase YoY) which was its second-highest result back to 2010, only surpassed by 2022 with an occupancy of 98.6%.

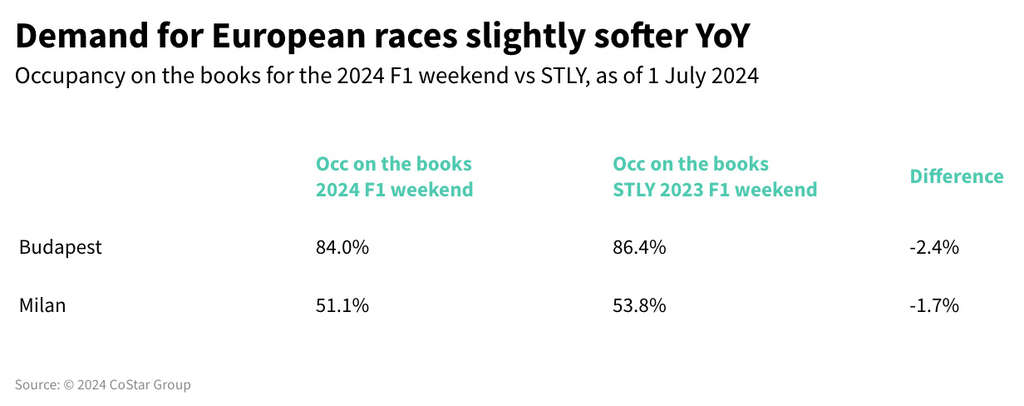

Looking ahead

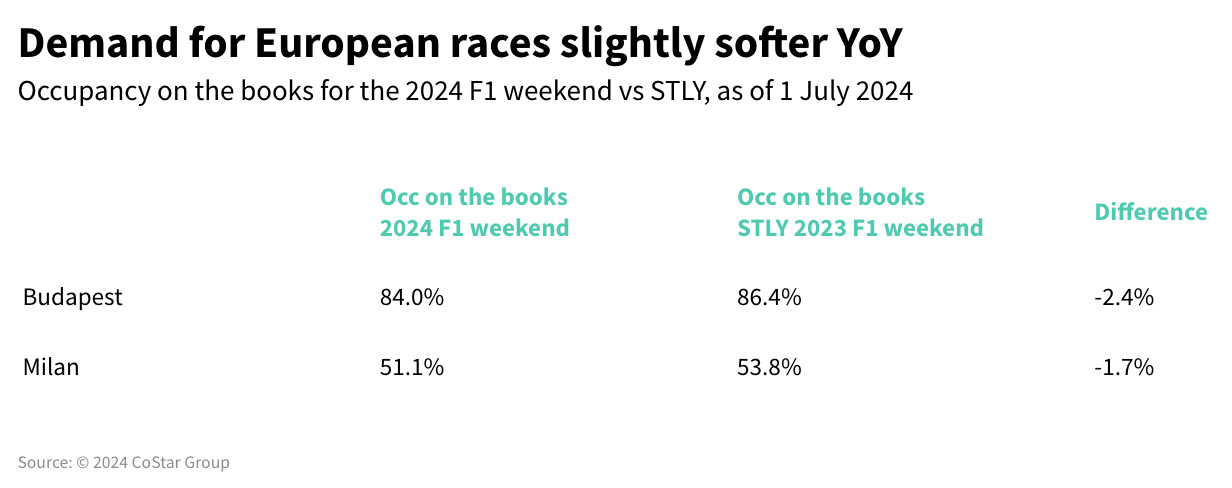

Looking ahead to future races, using Forward STAR data, occupancy on the books as of 1 July in Budapest for the upcoming Hungarian Grand Prix weekend currently stands at 84%, marginally below the forward bookings during same time last year (86.4%).

Hotel bookings surrounding the Italian Grand Prix, which takes place outside Milan, are at 51.1%, down slightly (-1.7 ppts) from the same time last year.

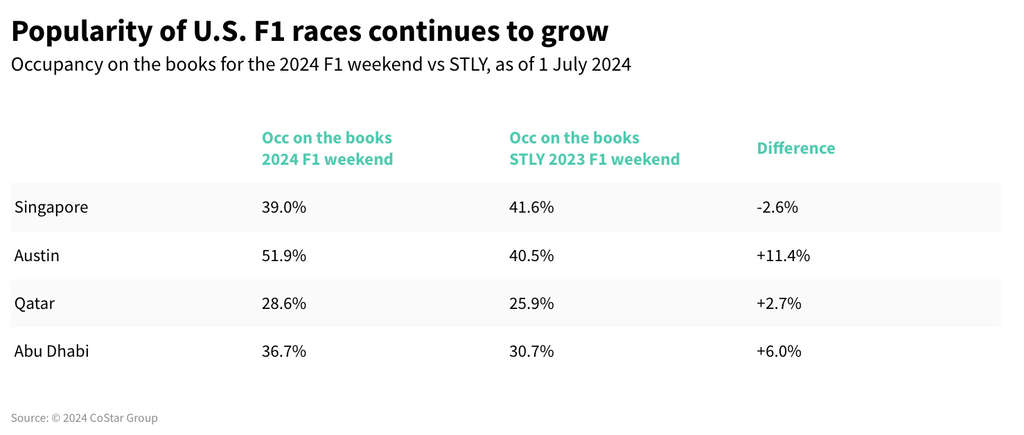

Later in the race season, the Singapore Grand Prix (20-22 September) shows occupancy on the books at 39%, down 2.6% from last year.

Popularity of American F1 races continues to grow with Austin as the standout – booking levels are up +11.4% over last year.

The last two races of the season in Qatar and Abu Dhabi, show increased booking levels as well, +2.7% and +6.0% year over year, respectively.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.