Maui remains top hotel market despite slow recovery after fires

A year after a series of tragic fires in Maui, the island’s hotels and Hawaii's governor want visitors to return to the destination to help support the local economy and regain a sense of normalcy.

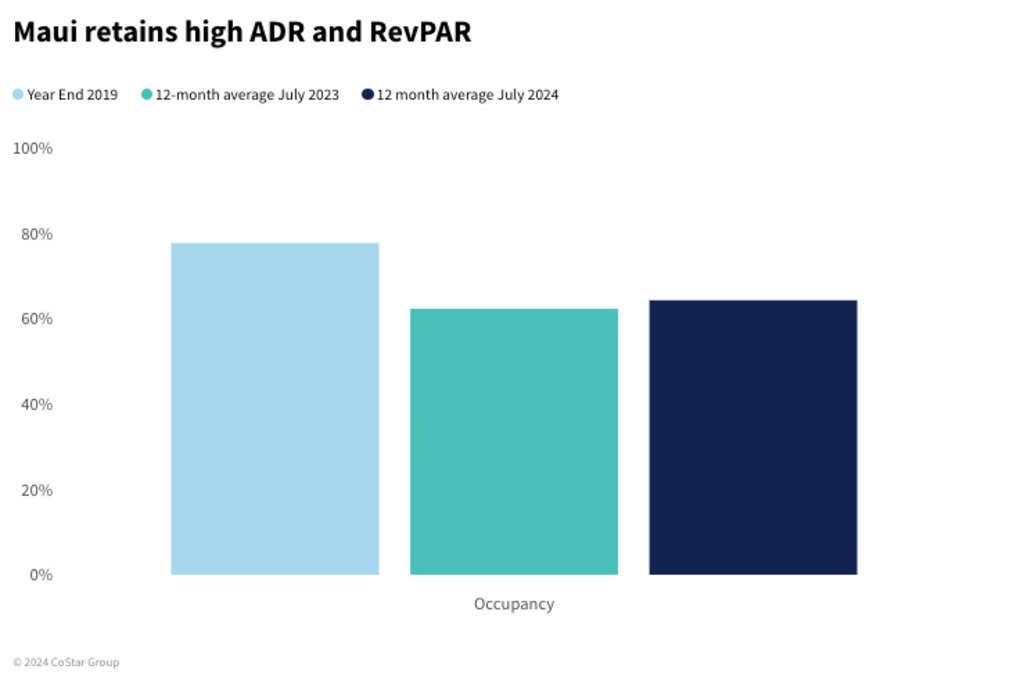

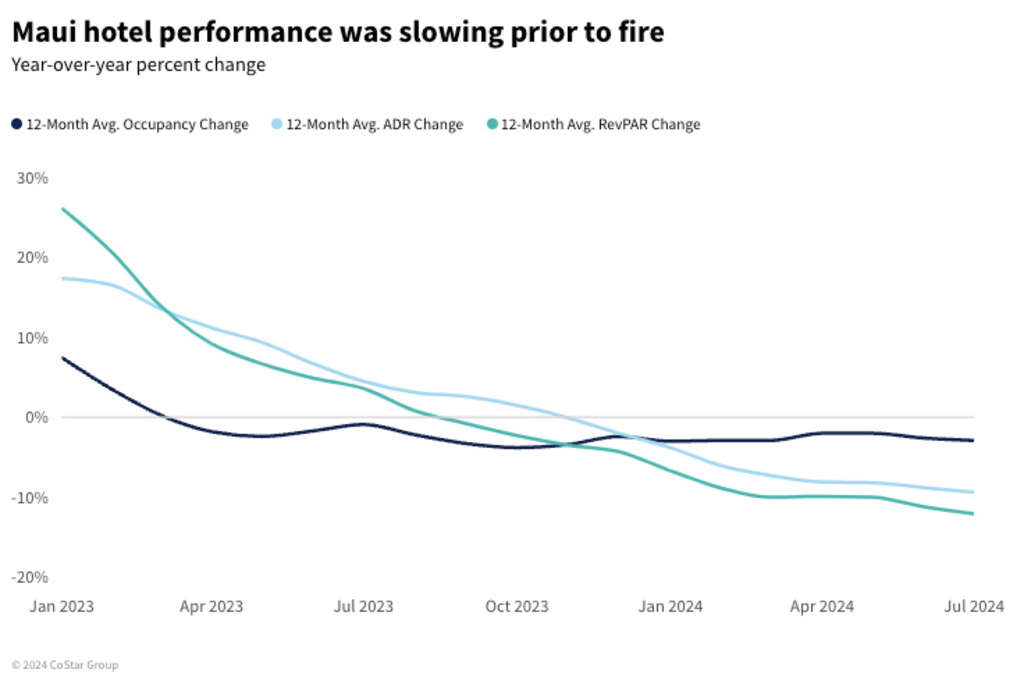

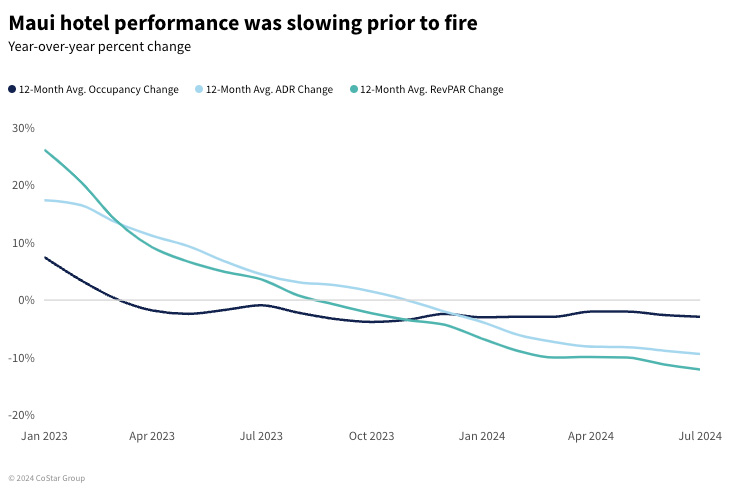

Topline hotel performance across the island remains below 2023 levels. While most of the hotel performance decline was due to the devastating fire, performance was already starting to slow before the fire, similar to many U.S. leisure destinations. Nationally, domestic leisure demand has slowed due to Americans traveling abroad or travelers being more budget-conscious, causing them to take fewer trips or pick less expensive destinations. The lagging international visitor recovery, mainly from Japan and China, also hinders hotel performance.

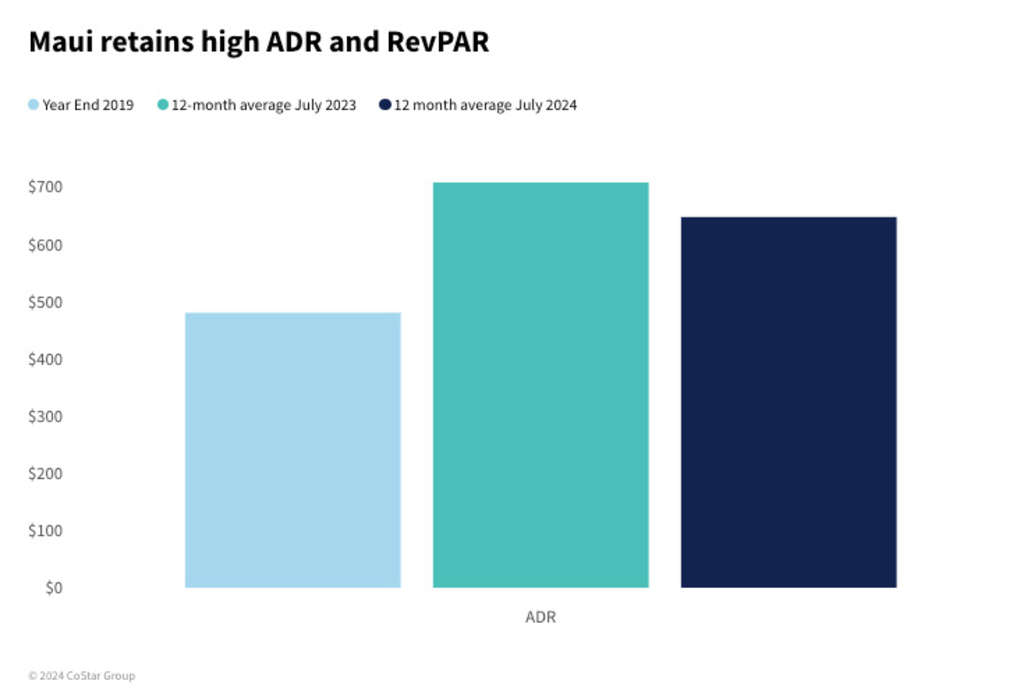

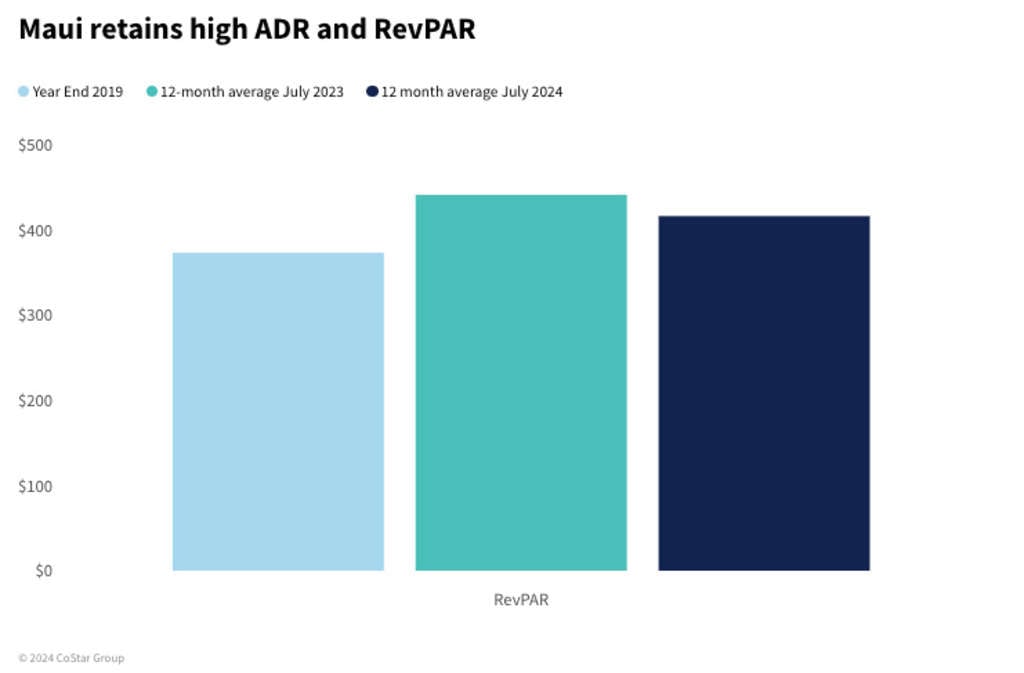

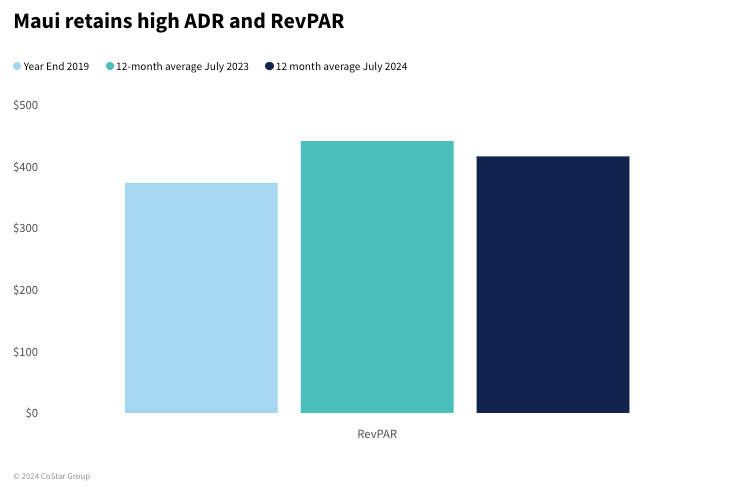

While hotel performance declined year over year, there is a bright side. Maui maintains the nation's highest 12-month average daily rate (ADR) at $551. The market was among the list of leisure destinations that experienced significant ADR growth over pre-pandemic levels, despite a lack of occupancy recovery. Maui's 12-month ADR is approximately $120 higher than the second-highest destination, the Hawaii/Kauai Islands, with the Florida Keys achieving the highest 12-month ADR outside of Hawaii, at $357.

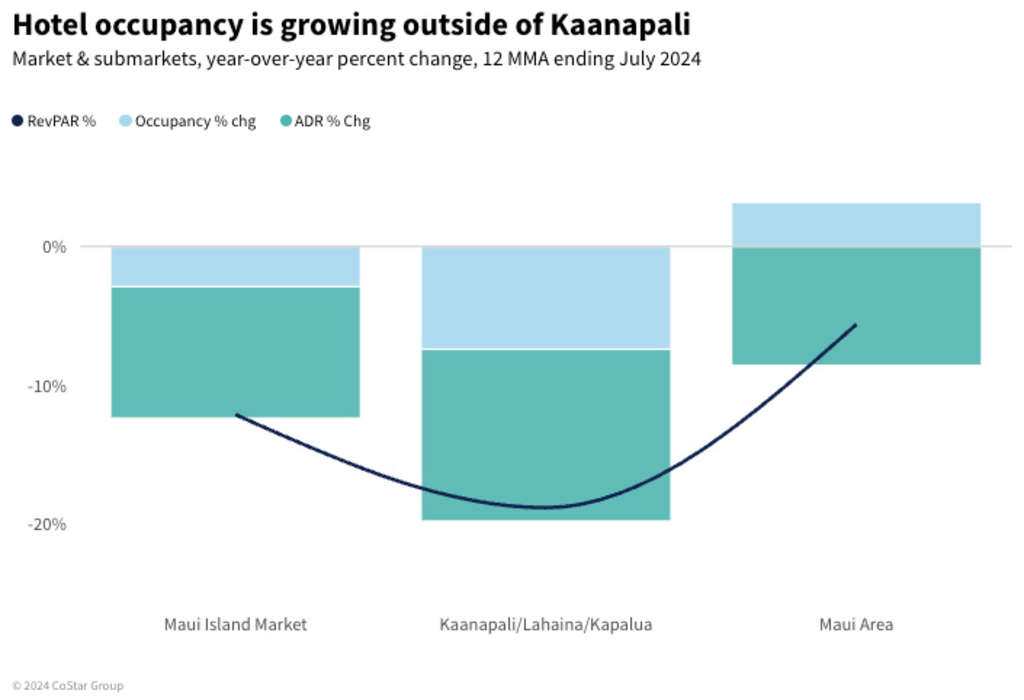

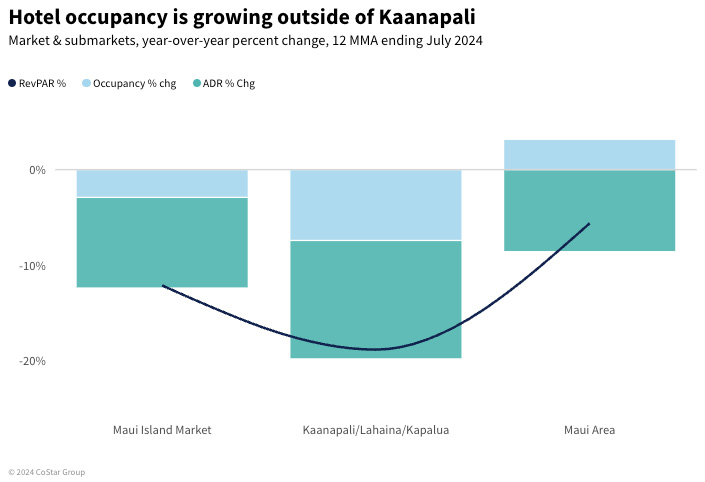

There have been more occupied hotel room nights outside of the Kaanapali area, which was the most impacted by the fire. Outside of the impacted area, the 12-month average occupancy increased year over year, while the decline in ADR was not as much as in the Kaanapali/Lahaina/Kapalua area.

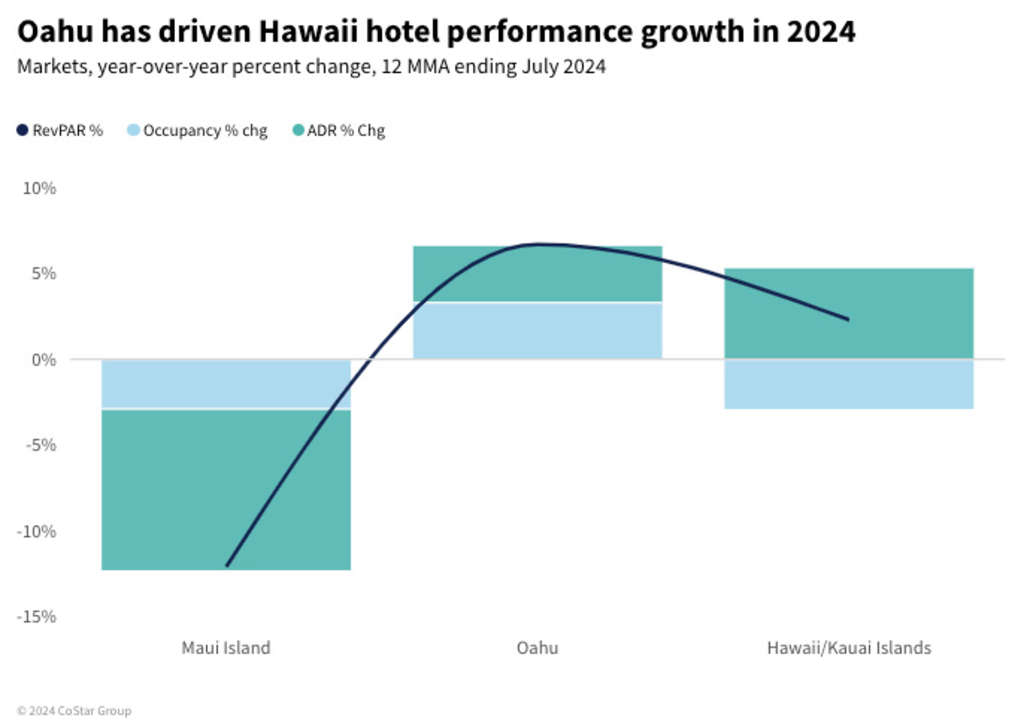

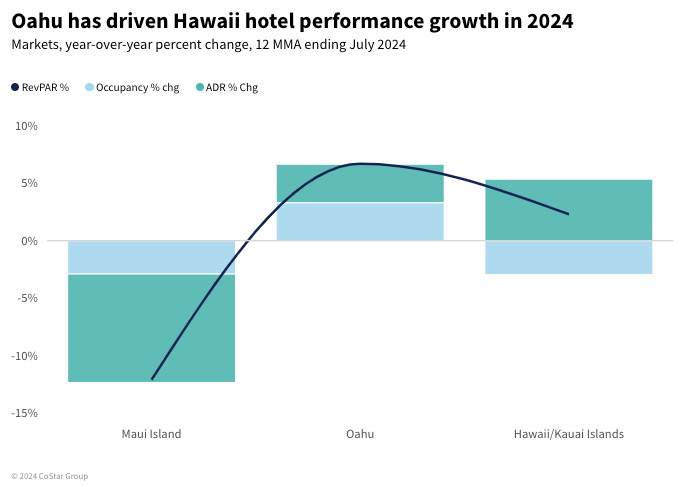

The Hawaii/Kaui Islands experienced similar results with less hotel room night demand, resulting in a decline in occupancy. However, Maui was the only Hawaii area to experience an ADR decline. Some of that room rate decline could be attributed to more reasonable prices for housing displaced residents and area recovery support workers.

Oahu was the only market in Hawaii that achieved hotel performance growth. Home to the state capitol and the Hawaii Convention Center, the destination also attracts the group and corporate travel segments, which continue to grow nationally. The diversified demand segments cause Oahu to have the second-highest 12-month occupancy in the nation at nearly 81%, only trailing New York.

Hotels in Hawaii have the highest topline performance metrics, with Maui, Hawaii/Kaui, and Oahu achieving the first, second, and fifth-highest 12-month average revenue per available room (RevPAR), respectively, in the U.S.

While travel demand contributes to higher ADR, it is also expensive to operate a hotel due to the high cost of living on the islands, which increases labor and supply operating expenses. Hawaii is a highly-desired destination due to its year-round temperate weather, sought-after beaches, and plentiful excursion options. As such, continued recovery in Maui is expected, with annual RevPAR expected to reach peak levels again in 2025.

*Analysis by Emmy Hise.

About STR

About STR

STR is the global leader in hospitality data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a robust global presence with regional offices strategically located in Nashville, London, and Singapore. In October 2019, STR was acquired by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.