STR Weekly Insights: 22-28 September 2024

Countries/markets mentioned:

- United States: Alabama North, Chicago, Columbus, Indiana North, Louisiana South, Louisville, Michigan South, New York City, Pittsburgh, San Diego, Syracuse

- Global: Germany (Berlin, Munich), Australia (Adelaide, Sydney)

Highlights

- Highest U.S. RevPAR gain since early-April 2023

- Record week in New York City during the U.N. General Assembly

- Football markets scored weekend RevPAR gains

- Robust Group room demand continues

- Hurricane Helene impact to be seen in future weeks

- Oktoberfest and trade fairs provide a boost in Germany

Highest U.S. RevPAR gain in 18 months

Revenue per available room (RevPAR) rose 10.2% year over year (YoY) for the week ending 28 September 2024, driven by a 7.5% increase in average daily rate (ADR). The ADR gain was the largest of the past 80 weeks.

New York City contributed 3.7 percentage points (ppts) to the national RevPAR growth rate due to the U.N. General Assembly. Its contribution to national ADR was nearly the same amount. While historically a strong week for New York City, calendar shifts of both the U.N. as well as the Yom Kippur observance helped drive overall U.S. performance.

Even excluding New York City, U.S. performance was strong with RevPAR increasing 6.5% on ADR (+4%) and occupancy (+1.5ppts) with benefit from the Yom Kippur shift. Weekdays (Monday – Wednesday) were the primary beneficiary with RevPAR rising 9.4% followed by shoulder days (Sunday and Thursday), up 5.6%, and the weekend (Friday/Saturday) up 3.6%.

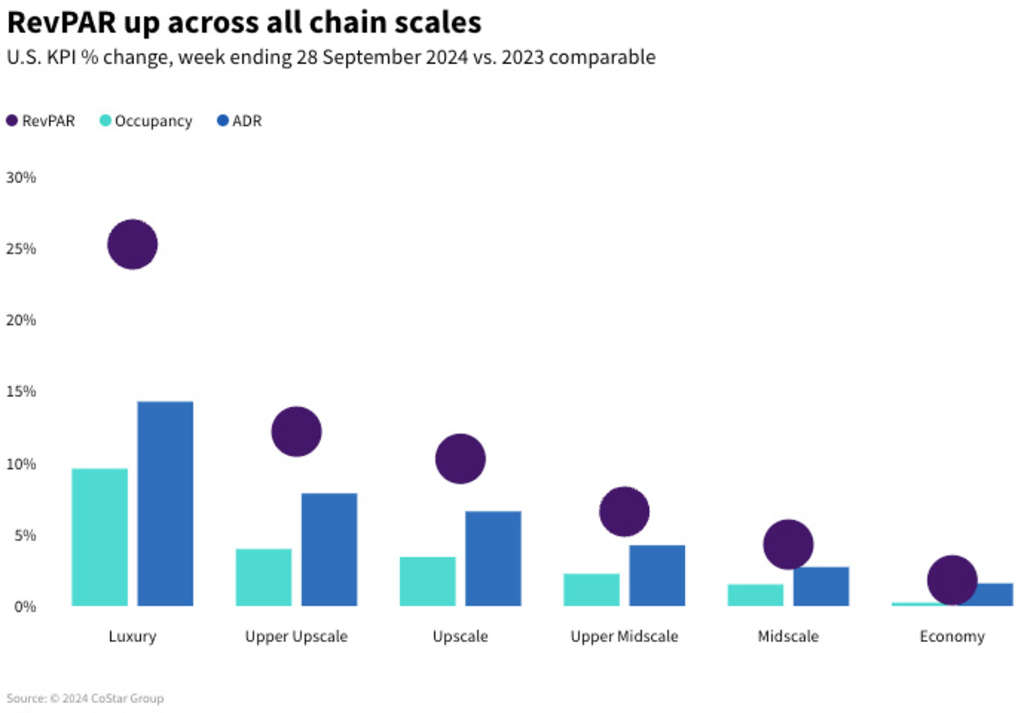

All chain scales posted RevPAR gains ranging from Luxury (+25.3%) to Economy with the lowest increase at +1.8%. Most RevPAR increases were driven by ADR at twice the rate of occupancy.

Most Top 25 Markets along with football host markets ruled the week

More than a third (63 of the 171) of markets saw double-digit RevPAR growth during the week. Across the Top 25 Markets, 20 saw RevPAR growth led by New York City with a RevPAR increase of 70.1% on a 52.8% ADR increase. Weekday RevPAR in the city was up 108.5%. This particular week is normally a strong one for the city. In the 10 years ending 2019, the “Big Apple” recorded its highest absolute RevPAR of the year seven times during this week—2024 will add to this list as RevPAR topped $488.

San Diego (+26.4%) and Chicago (+25.5%) were the next two top performers with double-digit RevPAR gains across all day categories. Among the next 25 largest markets, 19 saw RevPAR gains with Pittsburgh (+32.2%) and Columbus (+19.4%) seeing the largest increases driven by shoulder and weekday periods. With football season in full swing, weekend RevPAR growth soared with the measure increasing by more than 50% in the following six markets:

- Michigan South (home of the University of Michigan in Ann Arbor)

- Louisville (University of Louisville)

- Indiana North (home of Notre Dame in South Bend)

- Louisiana South (Louisiana State University)

- Syracuse (Syracuse University)

- Alabama North (home of the University of Alabama in Tuscaloosa)

The devastation brought about by Hurricane Helene’s flooding impacted multiple markets and submarkets late in the week. While the impact to the hotel industry is still being evaluated, immediate weekend RevPAR decreases due to the storm were seen in Gatlinburg/Pigeon Forge (-40%) and North Carolina West (-32.5%).

Group demand gains continue while Transient demand softens

Group demand for Luxury and Upscale hotels increased 14.3%, reaching its second highest level (2.4 million rooms) since Fall 2019 with the highest level achieved last week. Group ADR increased 18.1%. Excluding New York City, Group demand growth stayed in double digits (+13.5%), while Group ADR slowed to a still healthy +5.5%. Nineteen of the Top 25 Markets posted Group gains with all but three also posting ADR gains. Markets across the rest of the country also saw gains in Group demand, up 9.1% with ADR increasing 3.9%. Transient demand was up a modest 1.1% with markets outside the Top 25 driving this demand gain (+1.8%). Across the Top 25 Markets, Transient demand declined 1.2%.

Calendar shifts make a difference

There are four religious observances (Passover, Easter, Rosh Hashana and Yom Kippur) throughout the year that impact U.S. travel patterns due to their movement from one year to the next. Additionally, the day of the week they occur is a factor. Weekday observances have a more negative effect than weekend observances. In this most recent week, Yom Kippur’s change benefitted the industry. The observance began Sunday, 24 September 2023 and ended Monday, 25 September, reducing weekly room demand as Group and meeting planners avoided the week. This year, the observance occurs between Friday, 11 October and Saturday, 12 October. Because it falls on the weekend, the impact will be less.

Significant growth in Germany impacted by trade fairs and Oktoberfest

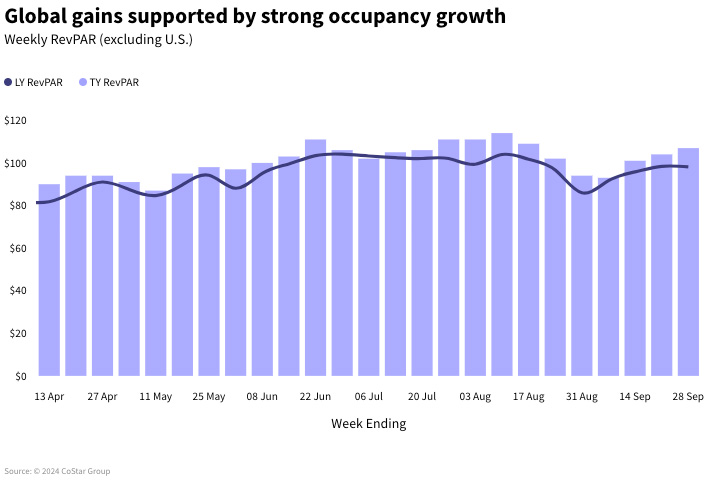

Weekly global RevPAR, excluding the U.S., increased 9%, driven primarily by a 4.1ppt increase in occupancy, which reached 72.8%, a six-week high. ADR increased 2.9%. Strong growth was seen in most of the 10 largest countries, based on supply.

Germany recorded a notable RevPAR gain (+27.7%), driven by a 23.3% rise in ADR. Two events drove the increase: Oktoberfest and InnoTrans. In Munich, the start of Oktoberfest propelled ADR by 16.8% with occupancy rising 7.6ppts. Additionally, the biennial InnoTrans event in Berlin drove ADR up by 77.2% while occupancy remained steady at 87.2%, down slightly (-0.5ppts).

Australia saw performance wane with occupancy down 1.6ppts and ADR falling 5.9%. Sydney saw a more significant drop (occupancy: -5.1ppts and ADR: -8.3%), while the surrounding region dropped 13.9ppts in occupancy and 18.7% in ADR. Performance in the area was impacted by difficult comparisons due to last year’s World Academic Summit. In contrast, Adelaide's performance improved, with occupancy rising 11.6ppts to 80.2%.

China saw a positive RevPAR comparison (+5.6%) driven primarily by occupancy (+18ppts) while ADR fell. Note, because of the Golden Week holiday that began 1 October, some properties did not report results this week, which likely impacted overall country and global results. However, even when excluding China, global RevPAR was still up (+9.6%) on strong ADR gains (+7.7%) with occupancy reaching its highest level of the year so far (74.4%).

Looking ahead

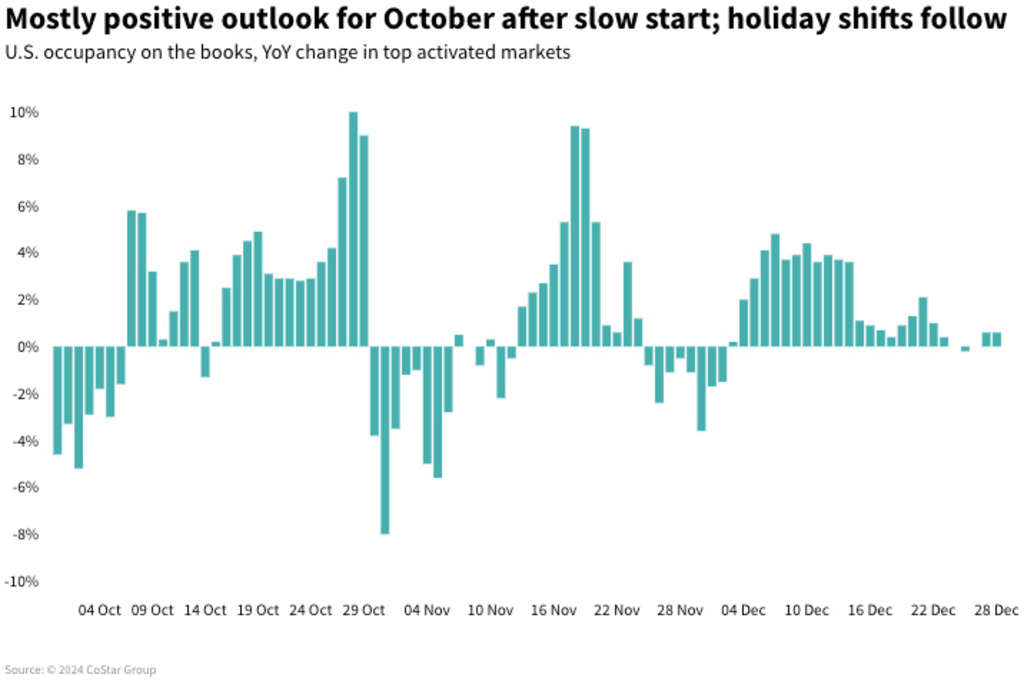

Room demand for the week ending 5 October 2024 is expected to be flat to down based on STR’s Forward STAR data, due to the Rosh Hashanah observance. Performance is expected to pick up in the week ending 12 October 2024, even though Yom Kippur occurs at the end of that week. The remainder of October also looks good up until the week of Halloween, which occurs on Thursday this year.

Global performance is expected to remain strong at a more modest pace as it returns to normal with the impact of shifting holiday calendars continuing to produce week-over-week volatility.

*Analysis by Isaac Collazo, Chris Klauda, Will Anns.

About STR

STR is the global leader in hospitality data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a robust global presence with regional offices strategically located in Nashville, London, and Singapore. In October 2019, STR was acquired by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.