Spanish Hotel Barometer - Q1 2024

Produced By Str And Cushman & Wakefield

Spanish hotels recorded a robust increase in revenue per available room during Q1 2024, surpassing the same period last year by 17.1%

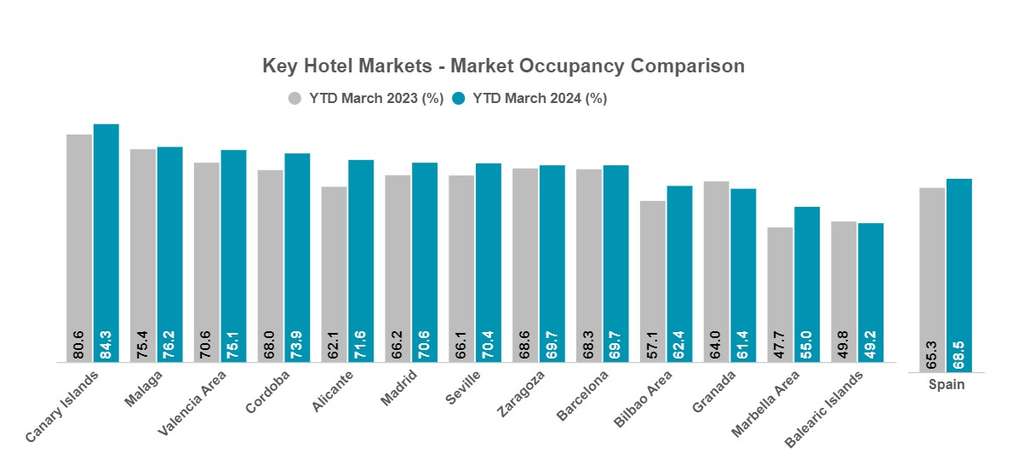

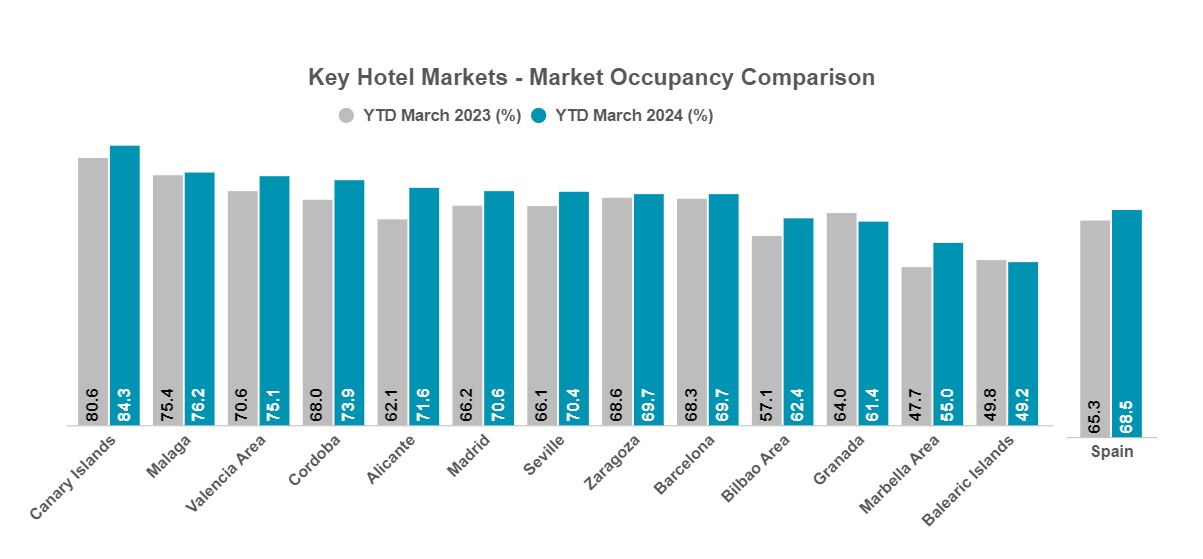

- In line with recent reports, indicators for the hotel industry continue to trend upwards with occupancy of 68.5% during the first quarter, a rise of some 4.9% over the figure for January-March 2023. Strong demand is driving both average daily rates and RevPAR (revenue per available room), the latter growing by 17.1%.

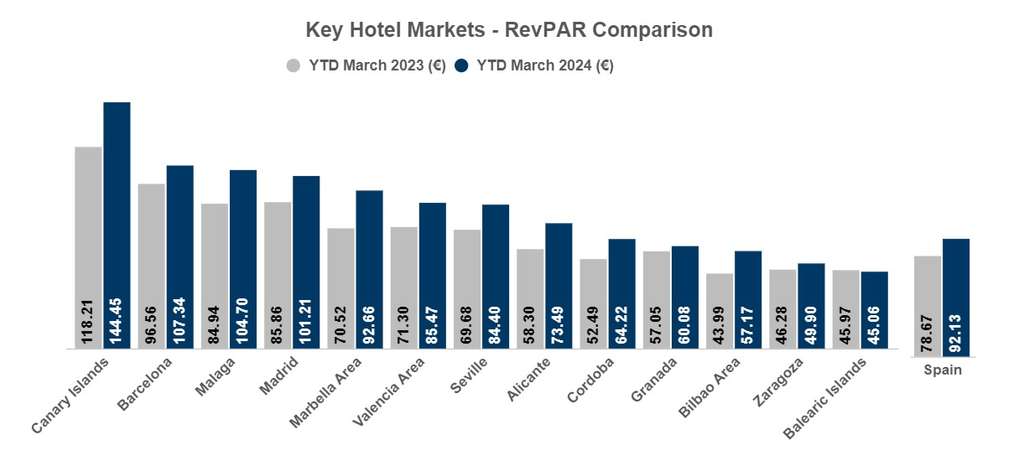

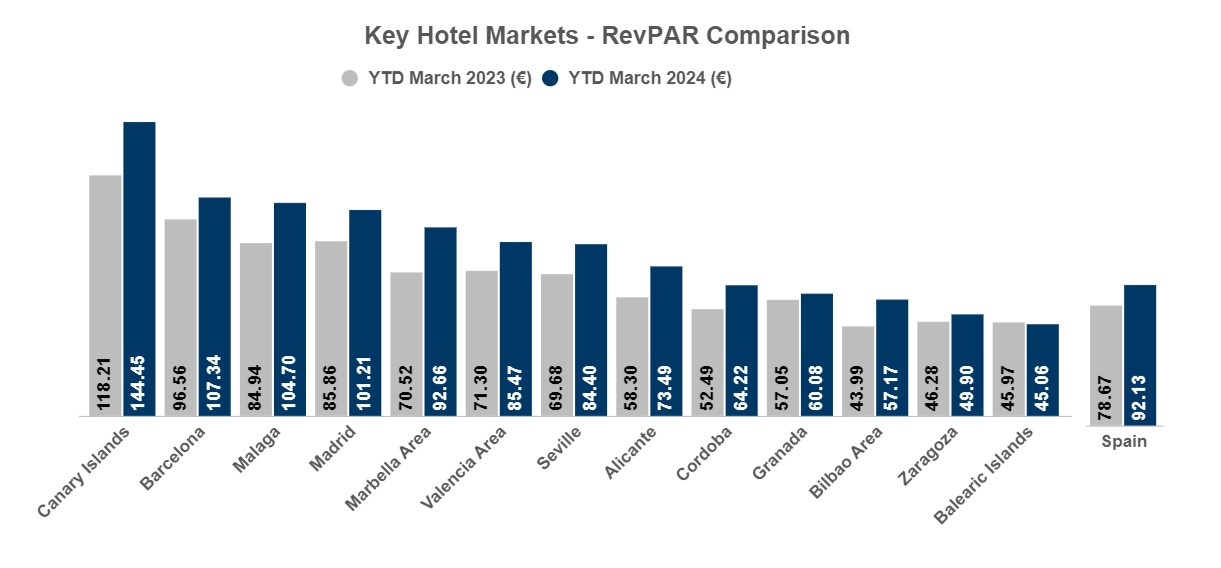

- The fact that Easter fell during the first quarter improved the results of destinations with greater holiday demand, the Canary Islands topping the RevPAR table with a figure of €144.40, followed by Barcelona at €107.30 and Malaga with €104.70. Taking advantage of one of its high seasons, the Canary Islands recorded an occupancy rate of 84.3%.

Produced jointly by STR and Cushman & Wakefield, the Hotel Sector Barometer confirms the upsurge in tourism and hotel activity in Spain, with outstanding results across all indicators showing growth over the figures for the first quarter of 2023. Spain’s hotels achieved occupancy of 68.5% between January and March (+4.9% compared to the same quarter in 2023), with average daily rates (ADR) standing at €134.60 (+11.7%) and revenue per available room (RevPAR) of €92.10 (+17.1%).

In terms of destinations, the Canaries topped the table for all three indicators. Given that the first three months of the year represent high season for the islands, occupancy understandably reached 84.3%. For their part, ADR hit €171.30 and RevPAR €144.40. These figures represent significant growth over the figures for the first quarter of the preceding year, amounting to 16.7% with respect to ADR and 22.2% in terms of RevPAR. The fact that the Easter holidays fell in March enabled the Canary Islands to add domestic tourism to the usual international visitors that come during the winter months.

Occupancy grows by 4.9% throughout Spain

Alicante and Marbella recorded the greatest year-on-year growth in occupancy during the first quarter of 2024, amounting to 15.3% for both. These were followed by Bilbao with 9.4% and Cordoba, with growth of some 8.7%. The only destinations to see a slight softening in occupancy were Granada (-4%) and the Balearic Islands (-1.1%).

In absolute terms and with growth of 4.7% on the figure for the preceding year, the Canaries topped the ranking with an outstanding 84.3%. Maintaining the strong performance of the previous year, Malaga took second spot with 76.2% and Valencia achieved 75.1%. For their part, Barcelona and Madrid also grew at 1.9% and 6.6% respectively, the pair achieving occupancies of 70%. The destinations experiencing the lowest occupancy rates at the start of the year were the most holiday-oriented locations, such as Marbella (55%) and the Balearic Islands (49.2%).

According to Elvira Arjona, Account Manager Spain at STR, “the hotel industry is corroborating forecasts that pointed towards figures for 2024 that could even surpass those of 2023. This first quarter has provided confirmation of the upsurge in occupancy and, consequently, outstanding ADR and RevPAR levels for a part of the year that represents low season in many regions”.

According to Albert Grau, Partner and Co-head of Cushman & Wakefield Hospitality Spain, “the trend over the first quarter and bookings recorded for the summer campaign make us optimistic with respect to 2024 as a whole. The foregoing, together with excellent operational management in terms of resource optimisation, point towards a highly positive close of year concerning returns for the sector".

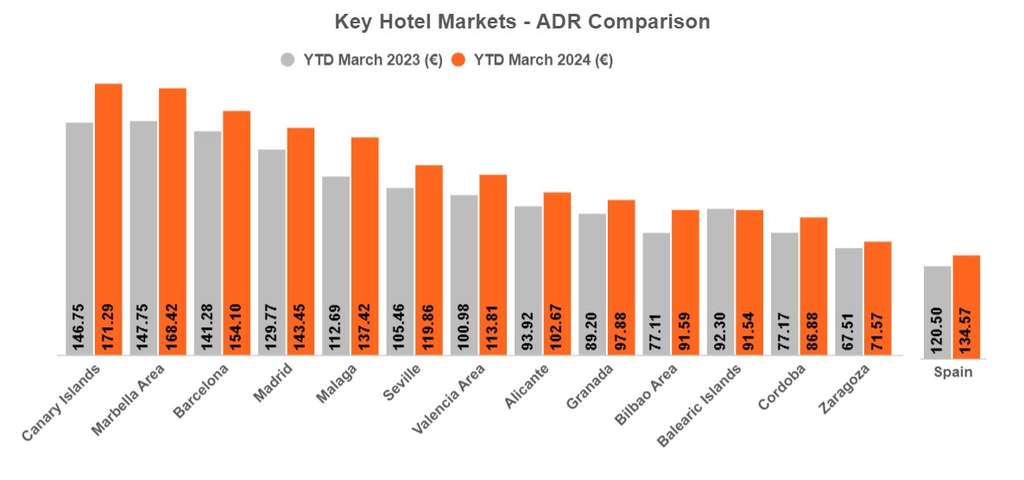

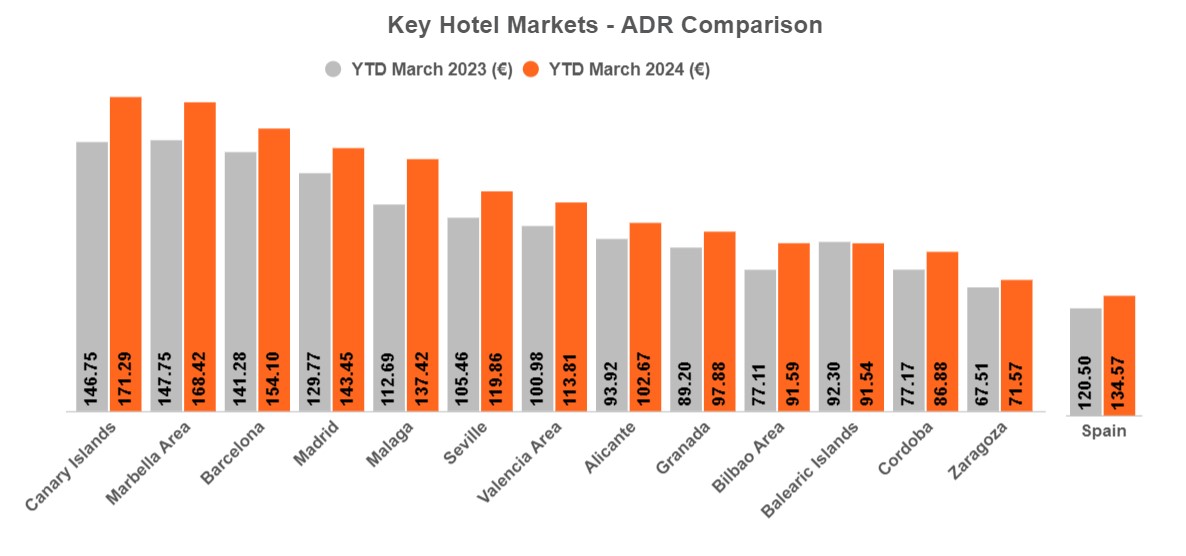

Led by the Canary Islands, Marbella and Barcelona, the ADR reached €134.50 during the first quarter

Since getting back to normal activity following the effects of the pandemic, average room rates in the Spanish market have grown consistently throughout 2022 and 2023 and it appears that this trend will continue during 2024. The ADR grew by some 11.7% for the country as a whole, going from €120.50 in the first quarter of 2023 to €134.60 this year. At 21.9%, the biggest boost in prices was recorded in Malaga, followed by Bilbao with 18.8% and the Canary Islands with 16.7%.

In absolute terms, the Canaries boasted the highest ADR during the first three months of the year (€171.30), followed by Marbella (€168.40) and Barcelona (€154.10). The most economic hotel rates in Spain between January and March were found in Zaragoza (€71.60) and Cordoba (€91.60).

In the opinion of Bruno Hallé, Partner and Co-head of Cushman & Wakefield Hospitality Spain, “although demand is proving to be particularly strong and prices may continue to rise throughout 2024, it would be logical to see some moderation already in this quarter in the absence of the Easter effect. The good news of a clear low season improvement confirms the trend towards reduced seasonality in many destinations”.

Spanish hotel RevPAR grew by 17.1% during the first quarter

Revenue per available room (RevPAR) hit an all-time high of €92.10 during the first quarter, some 17.1% up on the figure of €78.70 for the same period the preceding year. The growth was especially noteworthy in destinations such as Marbella (+31.4%), Bilbao (+30%) and Alicante (+26.1%). Occupancy growth over the figure for the preceding year also exceeded 15% in Alicante and Marbella, explaining the highly positive upswing in revenue.

In absolute terms, the highest revenue of €144.40 was achieved by the Canaries, coinciding with the high season for these islands. This was followed up by Barcelona (€107.30) and Malaga (€104.70). With a figure of €101.20, Madrid was the fourth and final Spanish destination exceeding RevPAR of €100 during the first quarter. At the lower end we find Zaragoza at €49.90 and the Balearic Islands with €45, the latter figure being dragged down by low occupancy.

The Hotel Sector Barometer brings together data from 1,200 hotels and around 150,000 rooms on the Iberian Peninsula. The study is the product of an alliance between STR, a worldwide provider of benchmarking, analytics and market knowledge specialising in the hotel sector, and Cushman & Wakefield Spain, the world leader in real estate services.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), sustainability and more.

For additional information, visit www.cushmanwakefield.com

Bruno Halle

Partner - Co-Head of Hospitality Spain

Cushman & Wakefield