European Hotel Deal Volumes Surge To Five-Year High

- European hotel transaction volumes amounted to more than €11.6 billion in H1 2024, the highest six-month volume since 2019

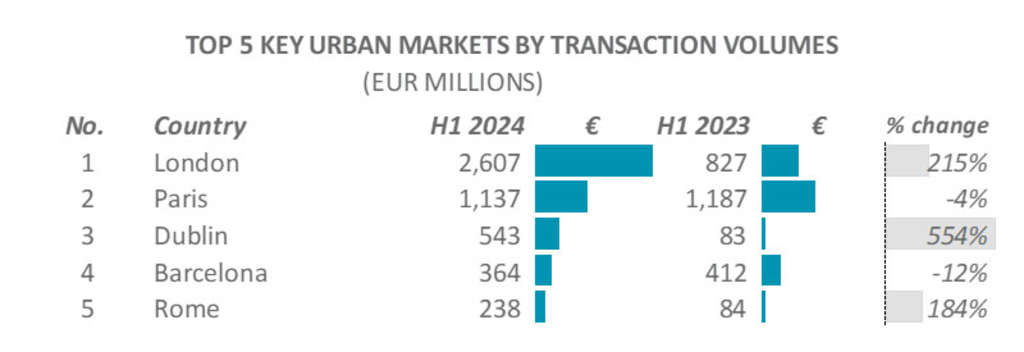

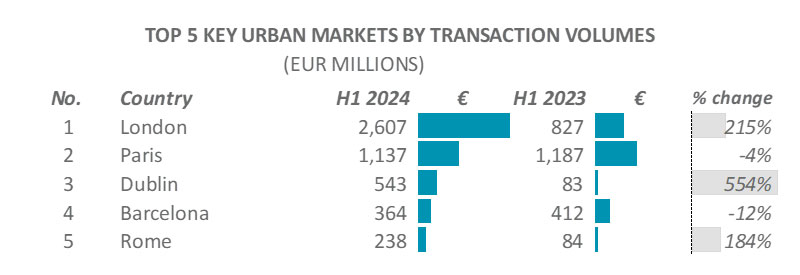

- London remains the leading destination for investor activity, followed by Paris and Dublin

- Looking ahead, volumes are projected to surpass the €20 billion threshold in 2024, supported by increasing debt liquidity and strong hotel performance

London – European hotel transactions reached a five-year high in the first half of 2024, according to new data from Cushman & Wakefield. Transactions in the first half of the year grew to over €11.6 billion, the highest six-month volume since 2019.

In the second quarter, European hotel transaction volumes hit €5.8 billion, nearly double the level reached at the same time last year (€3.0 billion in Q2 2023). Volumes were boosted by several landmark hotel transactions, including the sales of the Pullman Paris Tour Eiffel, the Hilton Paris Opera, Six Senses London, the Shelbourne Hotel Dublin, and the Park Hyatt Zürich. Overall, luxury and upper upscale hotels represented nearly half of H1 2024 volumes.

The UK, Spain and France were the most active markets, accounting for €7.8 billion of transactions – over two thirds of the European total, and 62% more than H1 2023. London registered the highest volume of transactions by city, with Paris, Dublin, Barcelona and Rome completing the top five. Looking ahead, volumes are projected to exceed €20 billion in 2024, driven by increasing debt liquidity and strong hotel performance.

The trading performance of European hotels experienced a ‘Taylor Swift bounce’ in the first half of this year, with high customer demand partly linked to the major events that took place across the continent, such as Euro 2024, the Olympic Games, and Swift’s Eras tour.

On investment, the sharp pick-up in activity has been long awaited and reflects not only clear confidence in the hotel sector, but more importantly an alignment of pricing between vendors and purchasers. With the recent reduction in base rates, now is the time for investors to step back into the market to take advantage of expected performance and capital growth. Jon Hubbard, Head of Hospitality, EMEA at Cushman & Wakefield

A relatively high number of hotels are in various stages of divestment across the continent, primarily in the core markets of Western Europe, but we also see a restart of the transaction activity in the Central, Eastern and South Eastern regions. This trend is driven by improved access to financing and attractive yields in the hotel sector, which peaked in 2023 and have since stabilised over the past two quarters. Coupled with robust income growth, this has created a favourable environment for both sellers and buyers to engage in transactions. Frederic Le Fichoux, Head of Hotel Transactions, EMEA at Cushman & Wakefield

While economic and geopolitical concerns remain, raised capital needs to be deployed and the hotel real estate sector is gaining popularity among investors, being the only asset class in Europe with growing transaction volumes. The increased allocation of capital towards hotels has been driven not only by recent positive performance trends and adjustments in pricing, but also long-term structural changes such as the shift from spending on goods to experiences, and a growing global population with more income and time to travel. Borivoj Vokrinek, Head of Hospitality Research & Strategic Advisory, EMEA at Cushman & Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity, and Inclusion (DEI), sustainability, and more. For additional information, visit www.cushmanwakefield.com.