Less global markets show RevPAR growth, but Olympics and concerts produce highlights

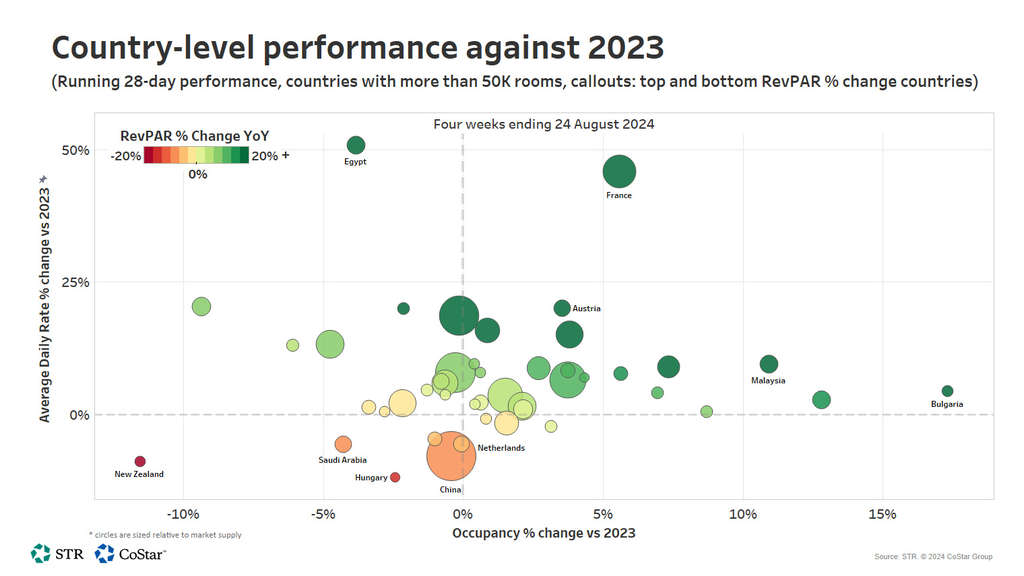

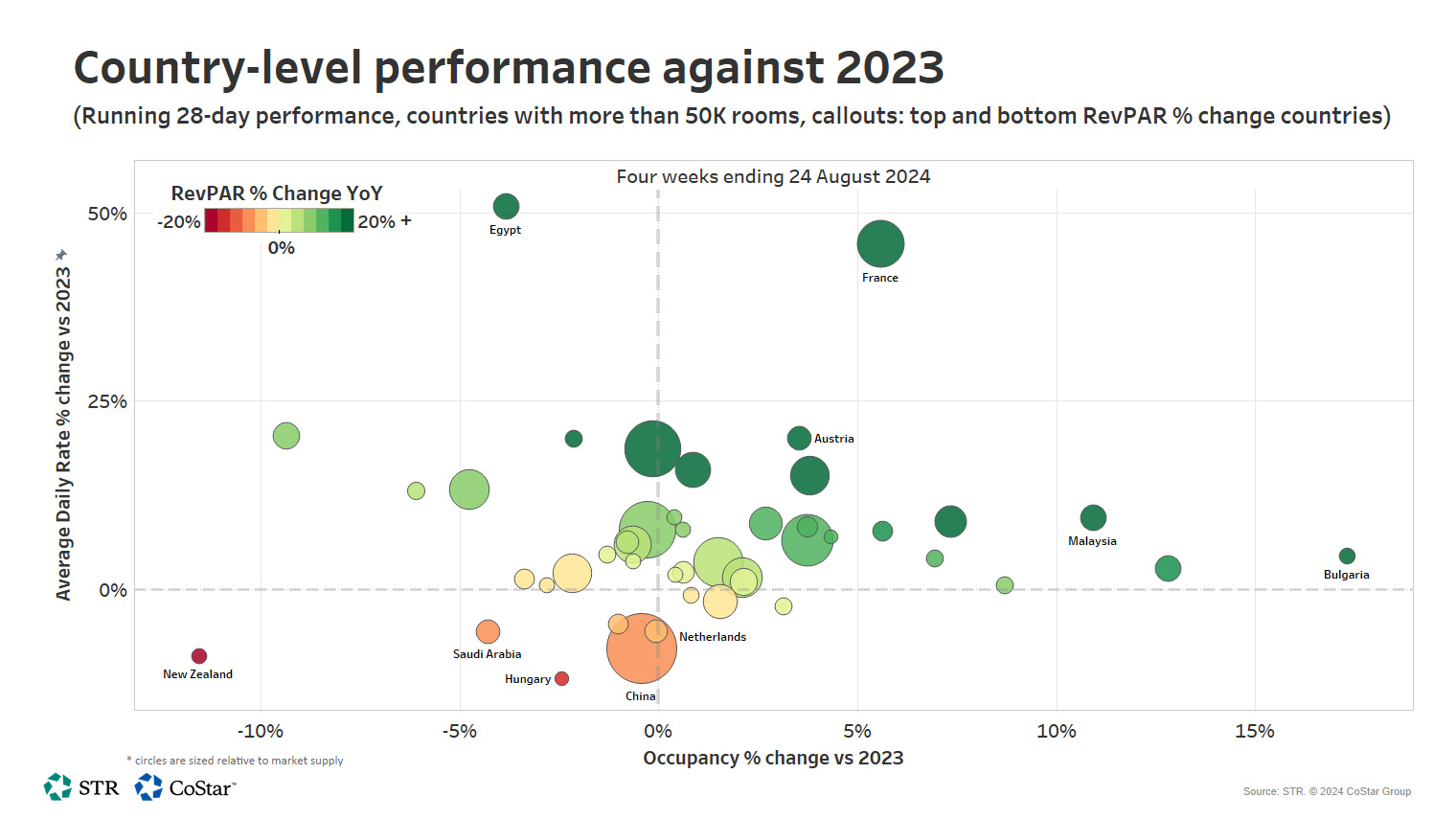

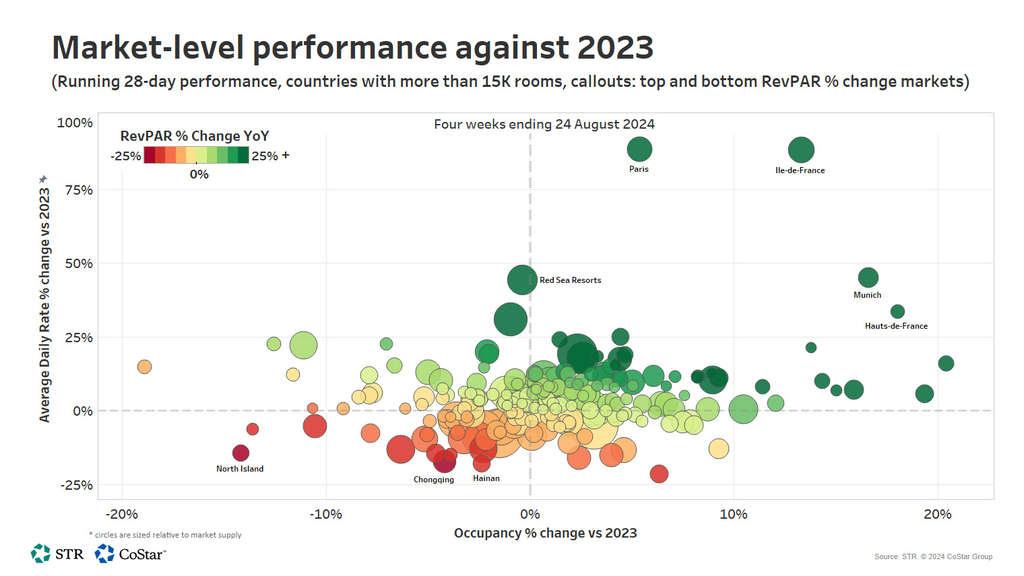

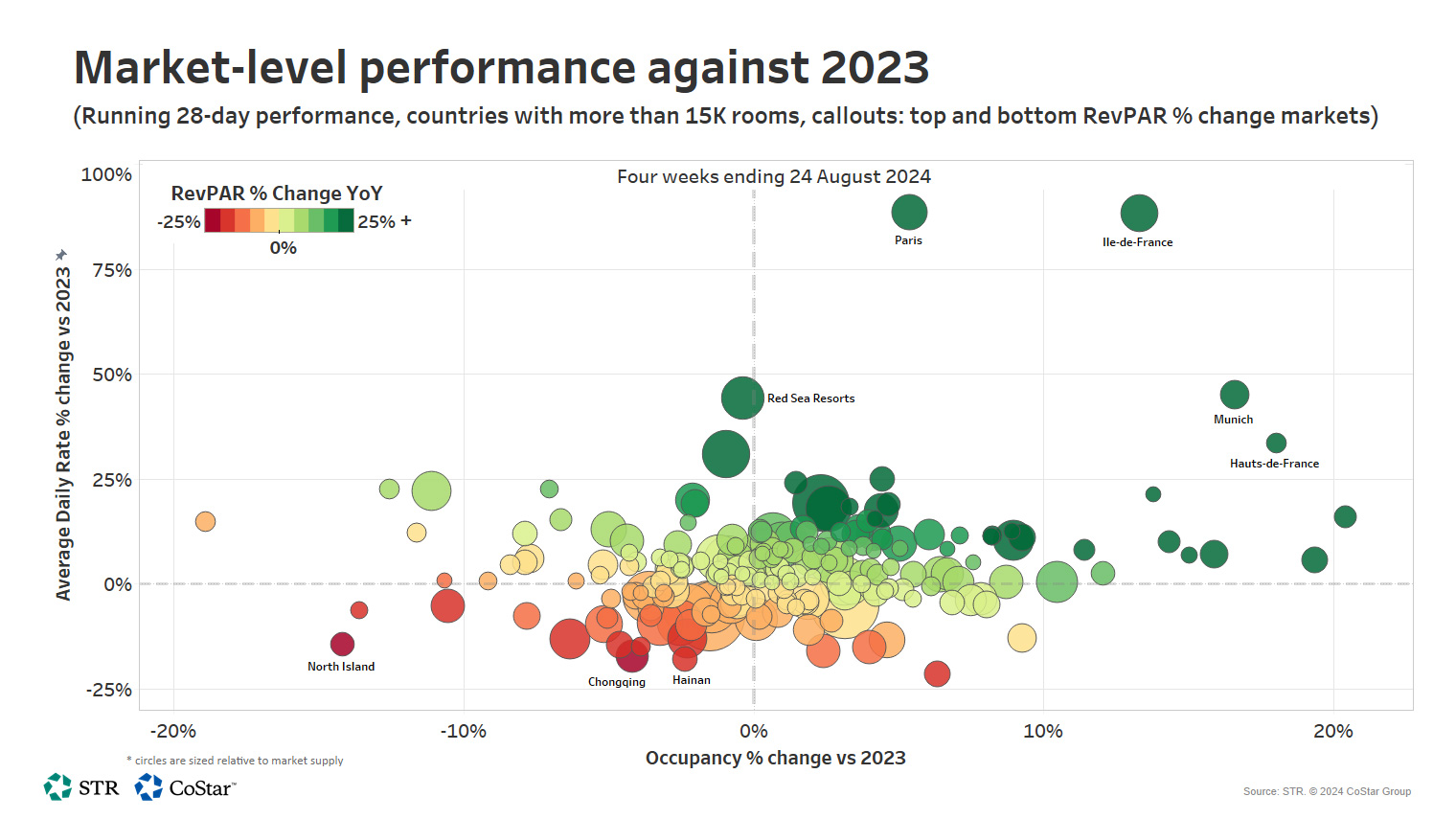

STR's global "bubble chart" update for the four weeks ending 24 August 2024 shows 61% of markets with year-over-year growth in revenue per available room (RevPAR). That was a three-point decline in the proportion of global markets (64%) experiencing matched four-week RevPAR gains in last month's update.

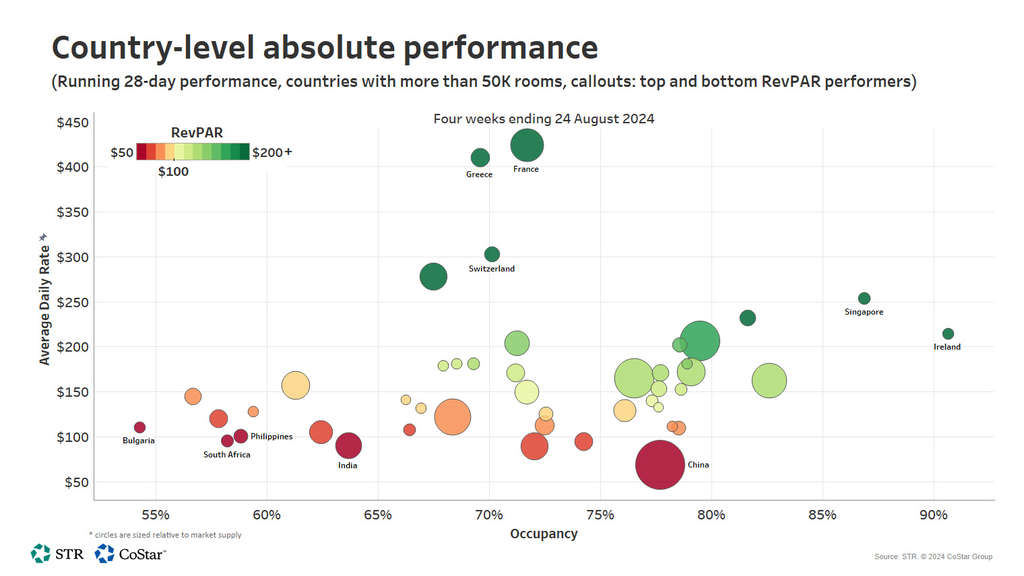

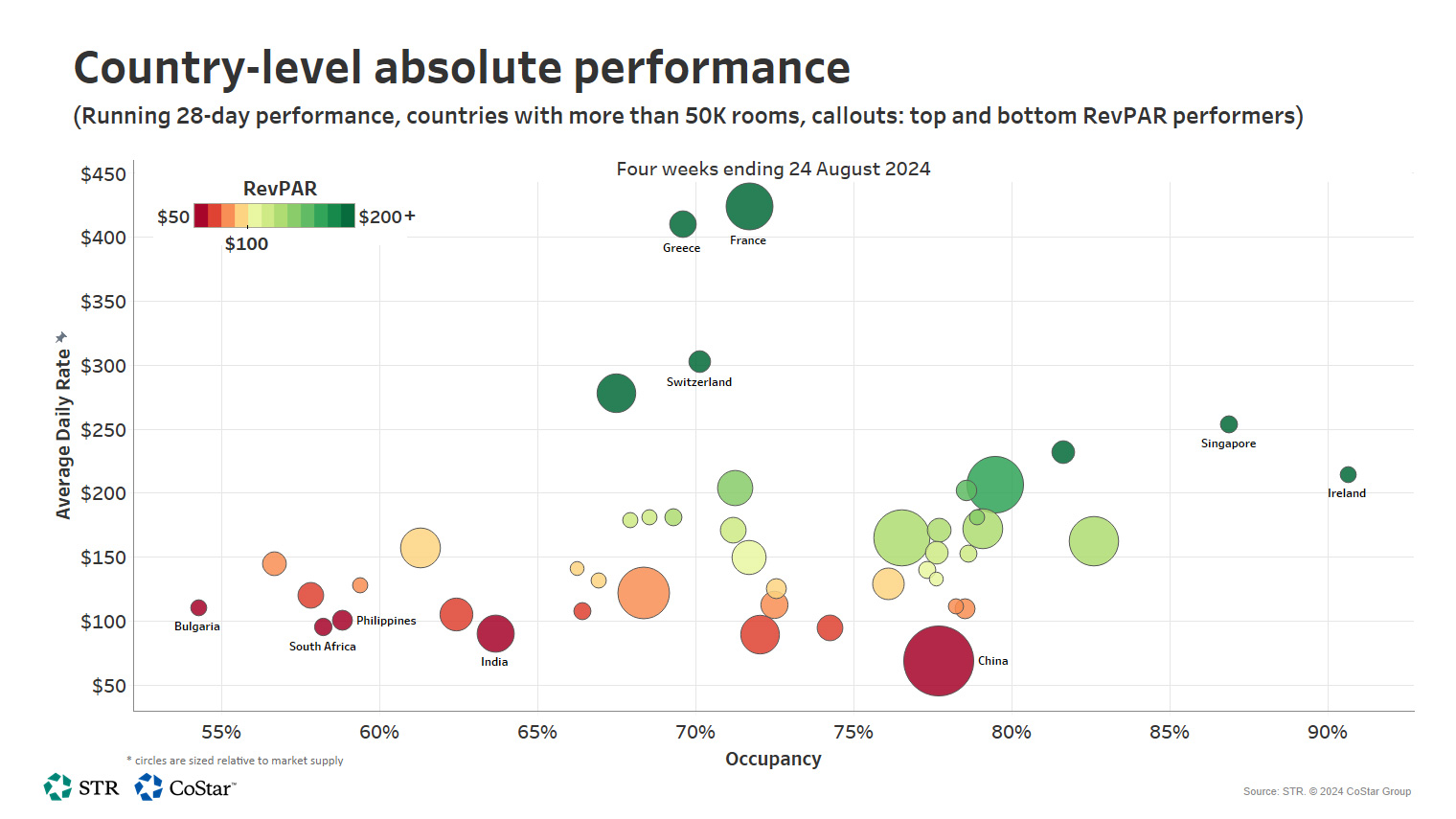

Among countries with 50,000 rooms and adequate hotel reporting levels, France, Greece, Singapore, Switzerland and Ireland — mostly the same as last month’s set of higher-priced countries with exception of Ireland in place of Italy—posted the highest RevPAR on an actualized basis. France, buoyed by the 2024 Olympics, which closed on 11 August, posted the highest four-week average RevPAR ($304), followed by Greece ($285) and Singapore ($220) for the period.

In terms of year-over-year RevPAR percentage change, France recorded 54% growth for the four-week period that largely include the Olympics. As anticipated, a majority of France’s boost fell on the back of ADR gains (+46%) far more than occupancy (+5.6%). You may recall in STR’s global update last month that France had been had underperforming in the weeks leading into the Games—it is not unusual that a special event on this one-of-a-kind scale could be detrimental to the surrounding shoulder weeks as pre-/post- preparations may impede normal work/vacation demand with non-event travelers avoiding local disruptions.

The remaining leaders in year-over-year RevPAR growth were Egypt, Austria, Malaysia and Bulgaria. Excluding countries with more turbulent socioeconomic conditions, only eight nations (of 45 reported) experienced negative RevPAR comparisons compared to 2023.

Excluding provincial areas and country markets, the top market-level RevPAR gains occurred in three French markets (Paris, Hauts-d-France & Ile-de-France), Munich and the Red Sea Resorts. The top gaining market was Île-de-France (+133% RevPAR), which lies just beyond the centralized boundaries of the inner city of Paris market (+99%). While both these markets experienced similar ADR lift (+88% for Île and +89% for Paris), the Île benefited through more distinct YOY gains in occupancy (+13% from 2023) compared to +5% for Paris. Still, Paris led the French trifecta in actualized occupancy (72.2%) compared to Île (66.5) and Hauts de France (64.1%).

The Olympic Games were not the only special global event contributing to top markets’ performance for the period as Munich also had notable premiums for the period stemming largely from concerts. Multiple concert dates with performances from Adele and Coldplay contributed to that market’s 69% RevPAR gain against last year. The Red Sea Resorts rounded out the top five RevPAR gaining markets with a 44% RevPAR increase based solely on ADR gains.

*Analysis by M. Brian Riley.

Note: All financial figures presented in US$.

About STR

About STR

STR is the global leader in hospitality data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a robust global presence with regional offices strategically located in Nashville, London, and Singapore. In October 2019, STR was acquired by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.