What Is Commercial Real Estate Lending?

Commercial Real Estate Lending

Commercial real estate lending is provided to finance income-producing property that is to be built, to refinance and restructure existing real estate financing, and to acquire distressed or non-performing loans (NPLs). The majority of real estate lending in Europe is used to finance new investment/acquisition of real estate or to refinance existing facilities, with lending for property development and unsecured real estate lending making up most of the rest.

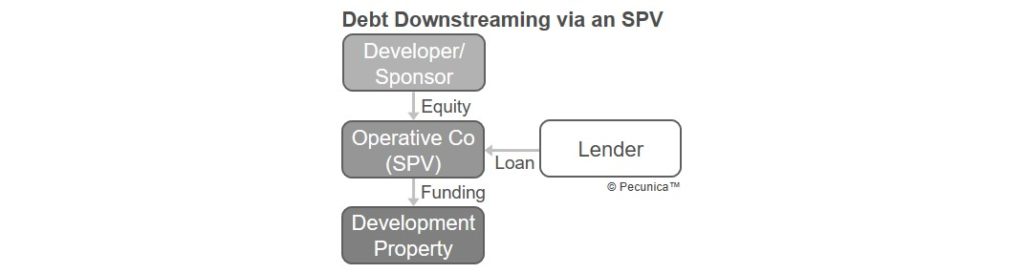

The structure of a real estate financing transaction generally depends on its purpose, the location of the borrower/sponsor, the lender's loan portfolio, the security package, and tax considerations. Typically, a special purpose vehicle (SPV) is established in a suitable tax-efficient jurisdiction with clear and tested security and enforcement rules solely for the financing transaction.

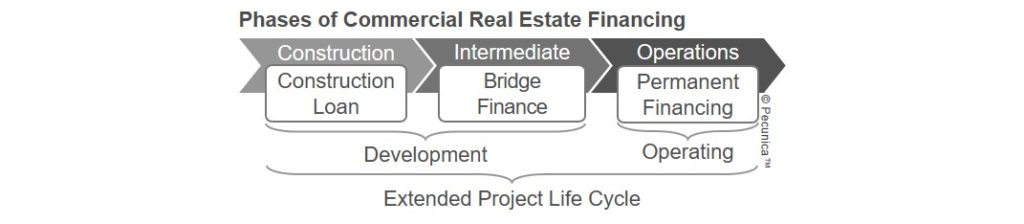

Commercial real estate lending can be grouped by size and lender participation as either bilateral or multilateral and by type as acquisition, development and construction (ADC) financing, bridge, or permanent financing. Each type of financing is utilized for different purposes during the different phases in the life cycle of commercial real estate.

Lending/investment parameters depend on the investment criteria and the degree of desired exposure to a client or sector. They include asset location, transaction size, the degree of leverage (senior, junior or mezzanine), asset type, and the lender's investment horizon. Stricter capital requirements in recent years have had a significant impact on the lending capacity and risk appetite of banks as traditional commercial real estate lenders.

Multisector transactions, in which security is spread across different types of assets, tend to be the most common of all commercial real estate lending, followed by transactions secured by offices. Many lenders provide finance for any CRE sector - offices, shopping centers, mixed-use, retail, industrial, residential, and hotels, while some do not take exposure to certain sectors or asset classes (e.g., operational assets or development projects).

Phases of Commercial Real Estate Financing

An acquisition, development and construction loan (ADC) is financing for the development of commercial real estate that is made available during a project's construction phase. It allows a property developer to buy land, install the infrastructure, and build improvements.

ADC financing is commonly progress payment financing, where payments are made to the developer of property to cover the cost of materials and the asset's construction while it is being developed. The principal amount is advanced in involves progress payments and generally applied to the asset's permanent financing.

Bridge financing is short-term financing with a bullet maturity that allows newly constructed or acquired commercial properties to reach stabilization and to pay off the construction loans until permanent financing can be obtained. Bridge financing is frequently provided by private equity investors for the acquisition of property and is subordinated to permanent financing, which is the source of its repayment.

Permanent financing is long-term commercial real estate financing that is used to finance acquisition of stabilized properties, refinance construction, bridge loans or other financing, commonly with a maturity of 30 years and longer. Permanent financing is provided by the construction lender and other types of lenders, including life insurance companies, pension funds, private debt funds, private equity debt funds, and conduits that issue securitize commercial mortgages.

A construction lender often requires a take-out commitment from a permanent lender. The permanent lender contractually commits to provide permanent financing to complement or replace the construction financing when a certain event occurs, generally upon stabilization and completion of the project.

Stabilization is when a development project or acquisition achieves a certain level of completion, lease-up and/or net income to enable either its sale or qualification for permanent financing. A take-out assures lenders that permanent financing will be available to repay the construction loan when the project is completed and other conditions are met.

Commercial Real Estate Mortgages

Real property is permanent, nonmovable property, such as buildings, land and permanent improvements to land, including the interests, benefits and rights inherent in the ownership of real estate. Title to real estate is transferred by property deed, which is the document evidencing ownership of property.

A mortgage is a lien on property to secure a borrower's performance under the terms and conditions of the mortgage loan agreement. A mortgage provides the mortgage holder a legal mechanism to foreclose on the financing if the mortgage borrower defaults on the loan.

The provider of a mortgage loan is the mortgagee, to whom a lien on real property is assigned as security for the loan. The borrower of a mortgage loan is the mortgagor, who assigns to the mortgage lender a property lien on real estate owned by the borrower as security for the loan. A real estate mortgage involves a mortgage note and a mortgage deed.

A mortgage note is a promissory note secured by a real estate mortgage evidencing the obligation of the mortgagor to repay to the mortgage holder the mortgage loan plus interest at a specified rate and over a specified period. The document that imposes the lien on the title to real property as security for a loan is a mortgage deed.

A mortgage is perfected by recording the mortgage deed in the local public land records. This allows the secured party to foreclose on the financing if the mortgagor fails to repay the loan or otherwise perform as contractually required in the mortgage loan agreement.

Mortgages are conventionally used to finance the real estate that serves as the collateral to secure the loan (i.e., real estate mortgages). Chattel mortgages are used to secure the financing of tangible personal property (chattel), such as equipment, fixtures, and the renovation of property.

Copyright © 2020 Pecunica LLC. All rights reserved.