Hotel Performance Forecast 2020-2024

Author's Note

The increasing concern over the post COVID-19 implications on the travel and tourism sector coupled with a challenging economic outlook for the GCC region will have a major impact on the recovery of the hotel sector.

At the time of writing this publication and despite the uncertainties and unknowns that lie ahead, there are several confirmed realities that will have a long-lasting impact on the hospitality and tourism sector in 2020 and beyond;

- Most major airlines in the Middle East and from feeder markets have not resumed commercial operations and airports activity is limited to operating repatriation trips;

- Governments pandemic healthcare bill as well as the economic and financial support extended to support local businesses will have significant effect on the governments' budgets and future investment priorities;

- Economic growth across the Kingdom of Saudi Arabia and other GCC countries will contract as a result of lower oil prices and reduced production output;

- Large corporations have downsized, and spending budgets are drastically squeezed;

- Household disposable income and consumers purchasing power are reduced;

- Guest confidence is low, and it will take time for the industry to meet new guest's expectations;

- World Fair Dubai (Expo 2020) is rescheduled to October 2021; Formula One Grand Prix in Bahrain was scrapped, Umrah pilgrimage was suspended in February, and the annual hajj pilgrimage in July may be cancelled;

- Owners cash reserves and asset cashflows are running low or turning negative.

We take pride in our experience in the hospitality sector and our ability to forecast performance and undertake valuations that mirror quite accurately market dynamics and investor sentiment. Our work experience, access to actual operating data and comprehensive analysis of historical trends have allowed us, time and time again, to anticipate market changes, ascertain the uncertainty during market downturns, and develop a realistic outlook for recovery. Our 2019 Forecast versus 2019 Actual Performance of Hotels in select GCC cities is a testament to our experience in those markets and our ability to accurately project changes in market dynamics and the likely impact on EBITDA and hotel values.

Although COVID-19 has challenged our fundamental forecasting approach that typically relies on market trends, supply and demand dynamics and other useful metrics such as development pipeline, induced demand generators etc. we share with you our assumptions pertaining to what the recovery model may look like for select cities in the GCC region. For the purpose of future forecast, we have relied on publicly available information as on 4 May 2020 pertaining to travel and tourism national and international announcements and made a set of assumptions to help the reader interpret these forecasts.

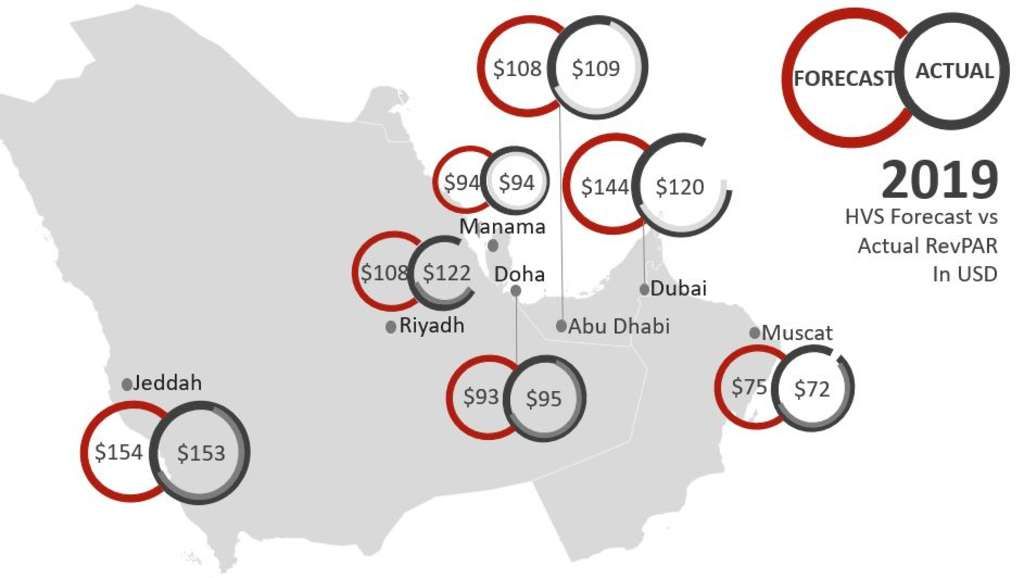

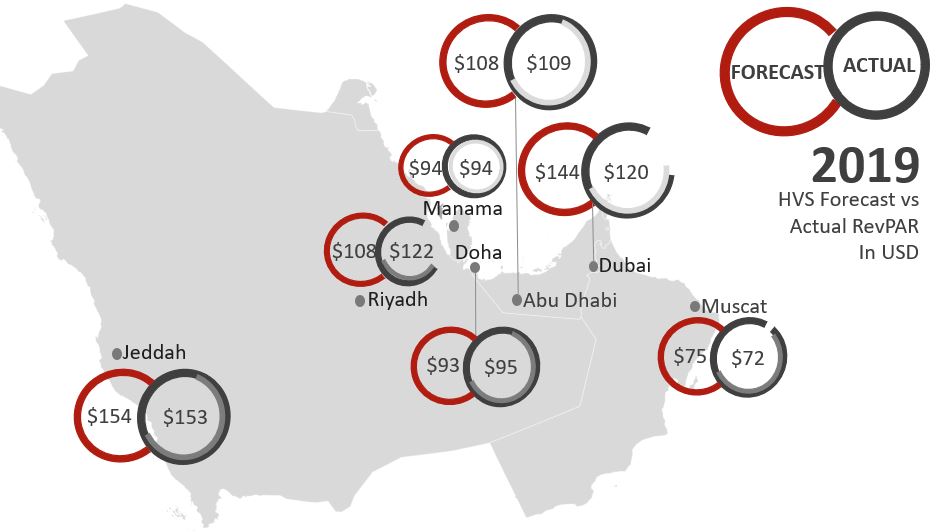

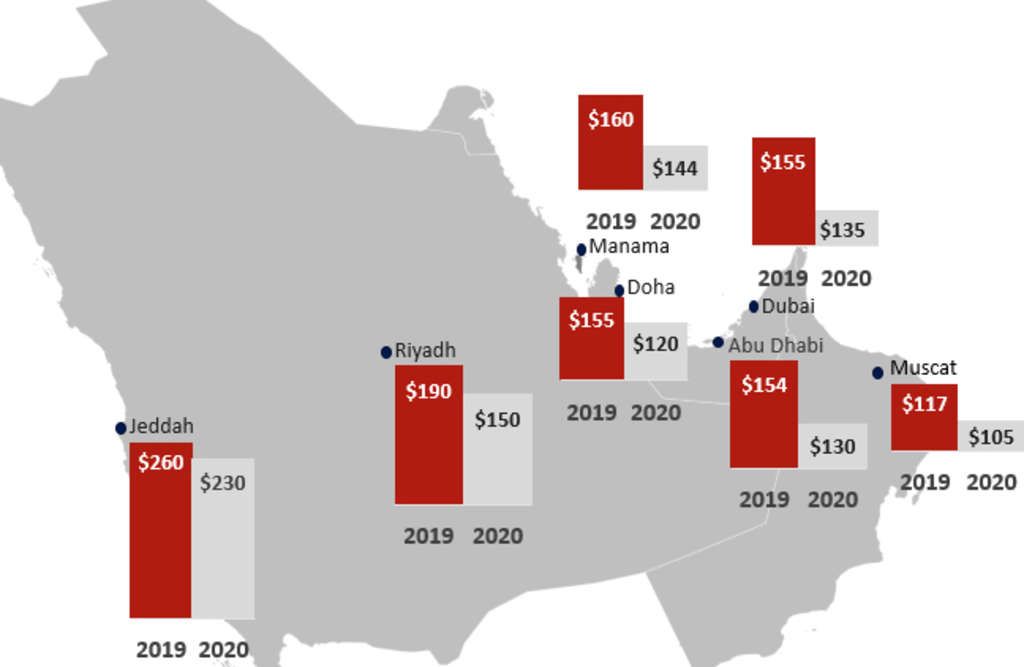

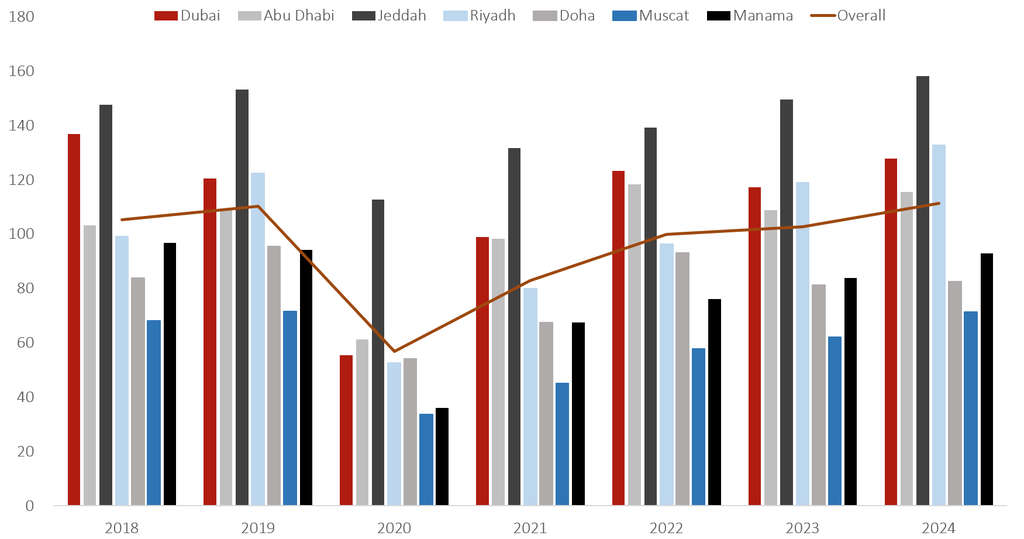

Figure 1: HVS Forecast vs Actual RevPAR 2019, in USD

As a result of increased supply, Revenue Per Available Room (RevPAR) in key GCC cities have declined over the last three years. Our forecast for 2019 was largely in line with the actual performance of hotels across the seven cities in the graph above. RevPAR decline was mainly triggered by a decrease in average rate although all cities experienced an increase in accommodated room night demand. In 2019, Jeddah was the market leader in average rate (USD260) while Dubai was the market leader in occupancy (78%).

Riyadh achieved higher RevPAR than forecasted on the back of the aggressive marketing and economic activities that took place in Riyadh in 2019 and induced additional room nights in the market. On the other hand, as a result of additional hotel competition, average rates in Dubai declined by 13% leading to a significant decline in market RevPAR.

Forecast of Occupancy and Rate - Select GCC cities

We have made several assumptions which govern our projections of occupancy and average rate from 2020 and up to 2024:

- Oil and gas prices will recover over the next 12 months;

- Governments will continue to support and facilitate regional and local events;

- Governments will continue to monitor and contain the spread of COVID-19;

- COVID-19 vaccine and/or approved treatment will be available within the next 12 months;

- Regional and international travel ban to and from key source markets will be fully lifted by October 2020;

- Traveler and guest confidence improves;

- 65% of closed hotels will have re-opened and those converted to quarantine facilities will resume normal operations by end of 2020;

- Dubai Expo will take place between October 2021 and March 2022;

- World Cup 2022 in Qatar will take place as scheduled;

- Travel to and from Qatar will resume to other GCC cities by end of 2020;

- Domestic tourism will generate the largest portion of demand in Saudi Arabia followed by religious tourism;

- Hotels under construction will be delayed and only 25% of new hotel inventory will come into the respective markets between 2021 and 2023;

- It will take four years for a full recovery with the exception of increased demand around major events such as Expo Dubai and World Cup Qatar;

- Brand and Hotel Managers will be successful in implementing new health and safety regulations and owners will meet funding requirements;

- Brand and Hotel Managers will not apply heavy discounts as lower rates is unlikely to be the key driver for decision making as evidenced in HVS Traveler and Guest Sentiment Survey.

- These assumptions exclude any future abnormal events, including but not limited to currency fluctuations, political conflicts, social unrest, hard-hit recession, and new viruses.

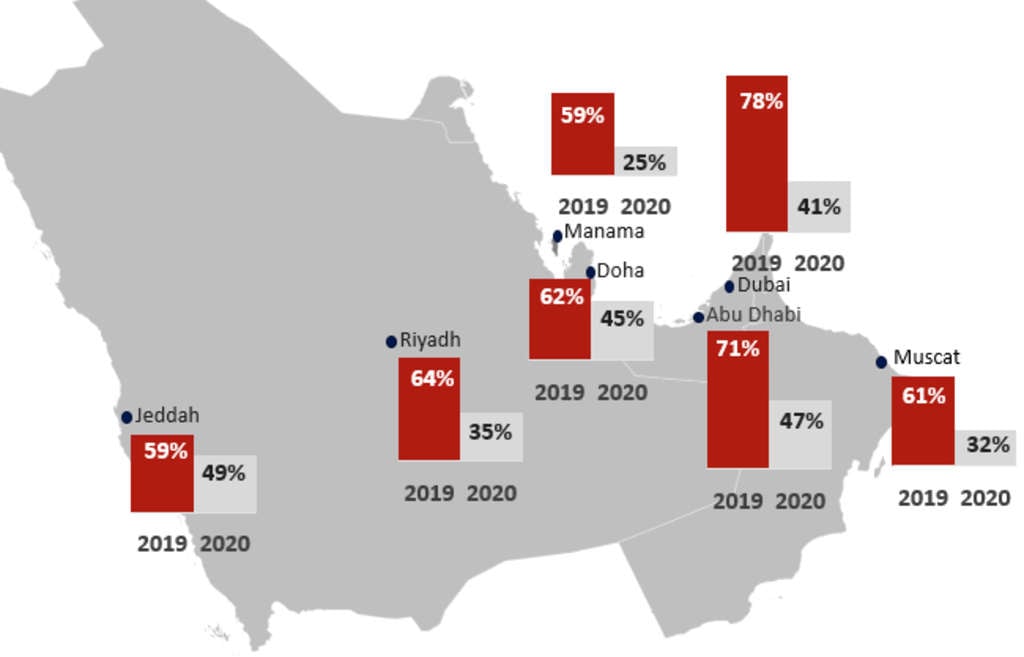

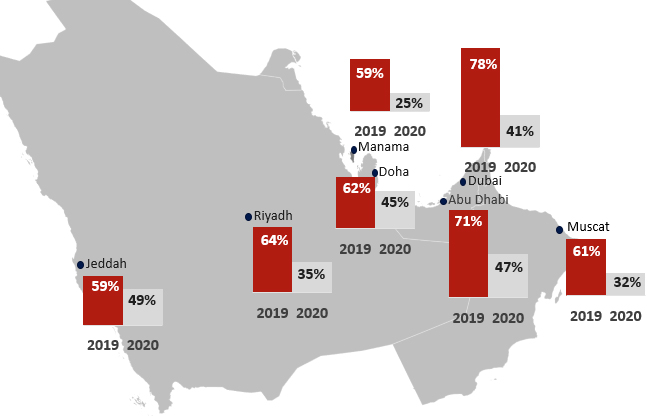

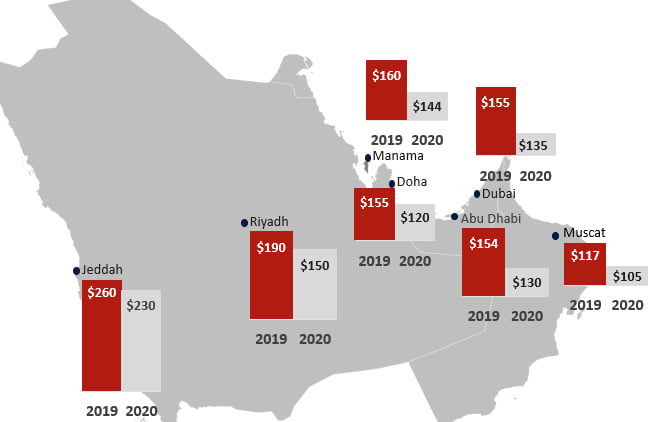

Figure 2: 2019 - 2020F Occupancy

Figure 3: 2019 - 2020F ADR

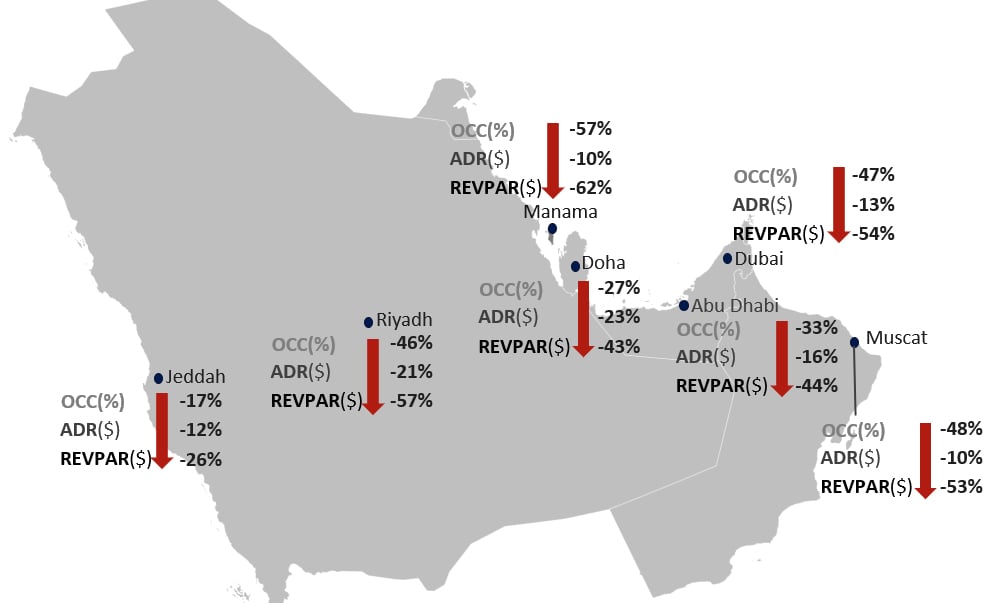

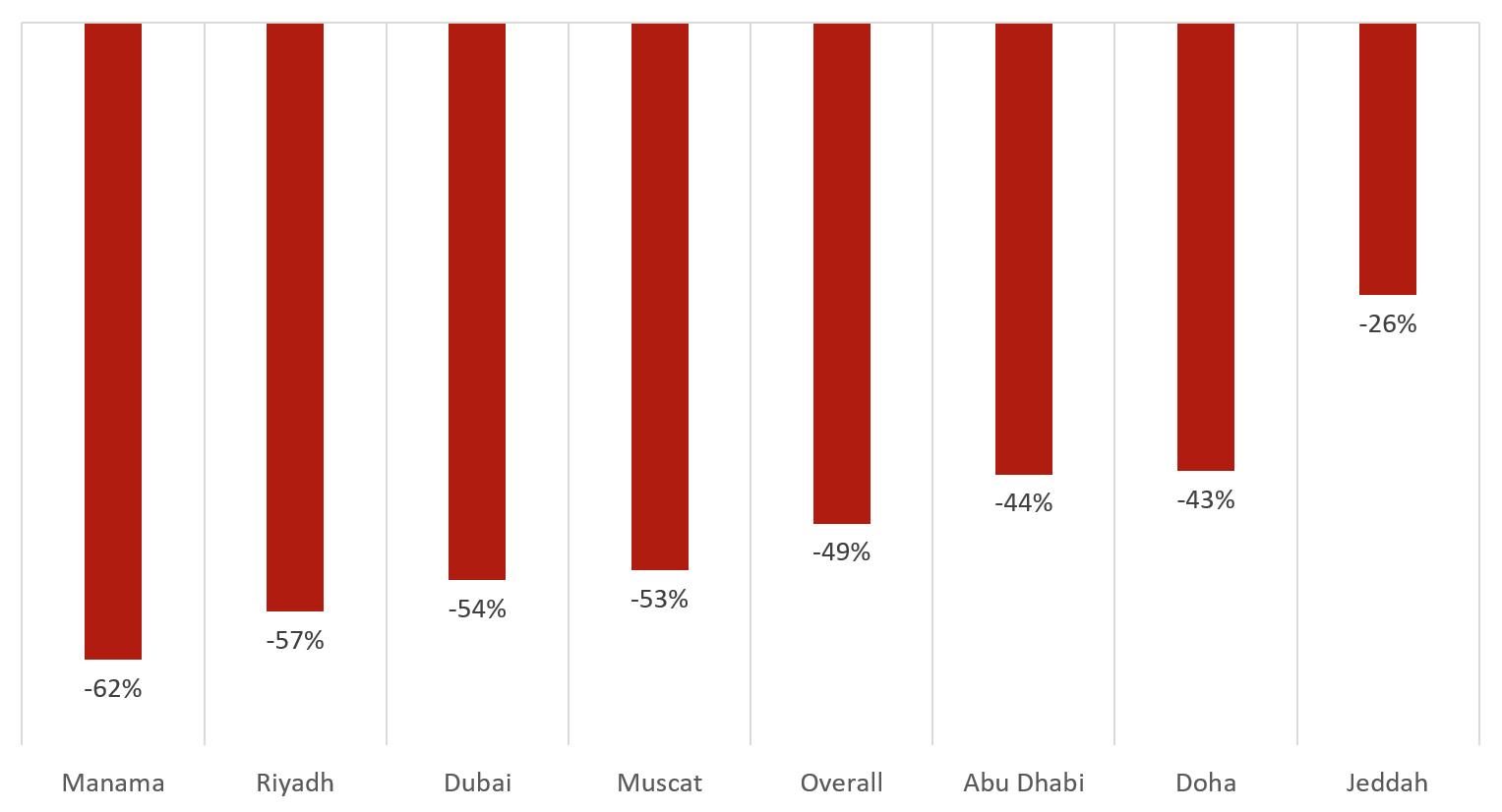

Figure 4: 2019 - 2020 Year on Year Variance

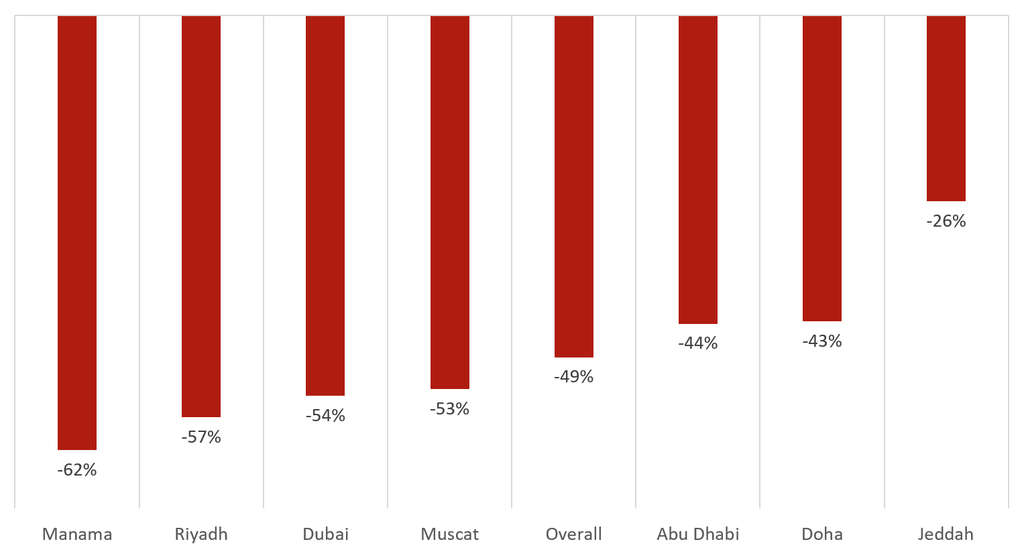

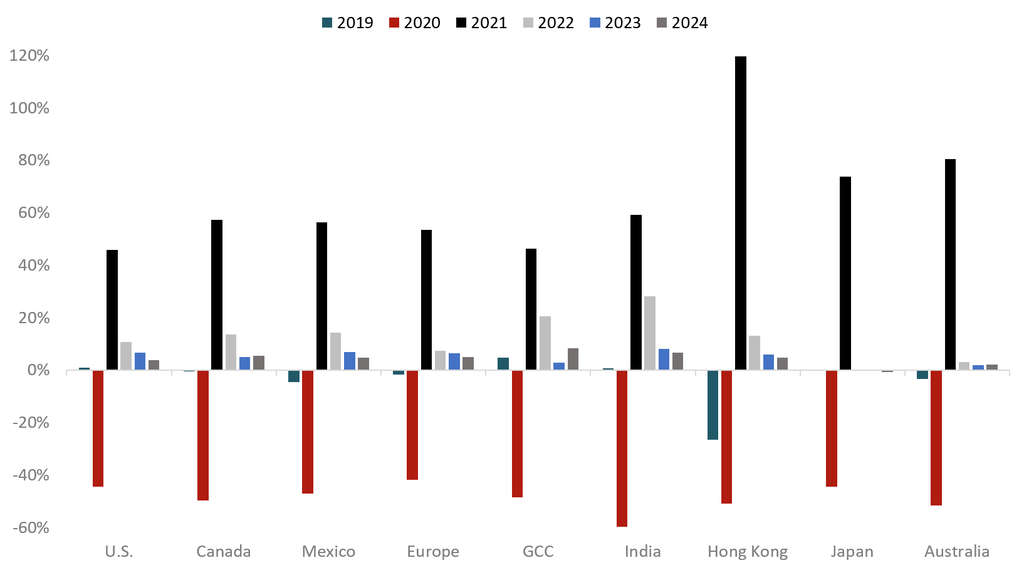

Figure 5: Regional RevPAR % Change 2019 - 2020F

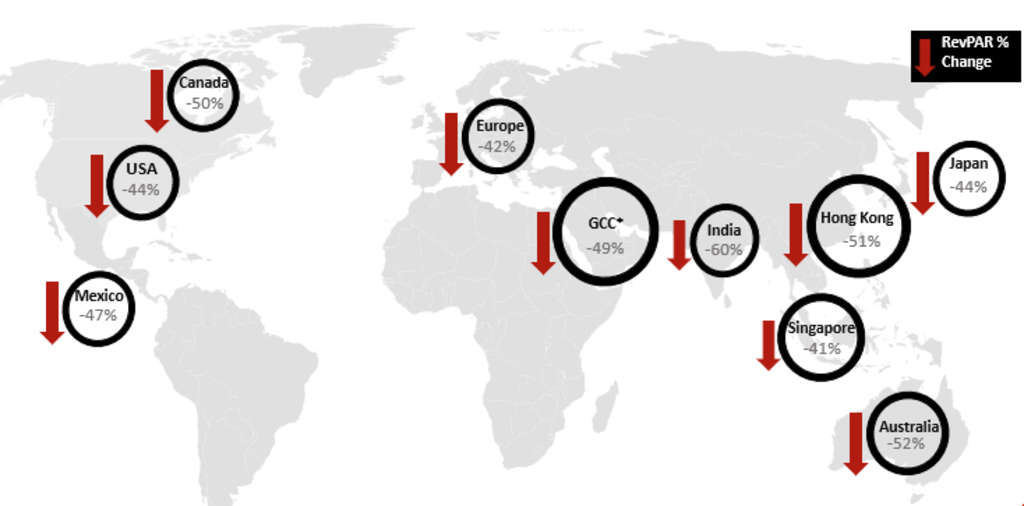

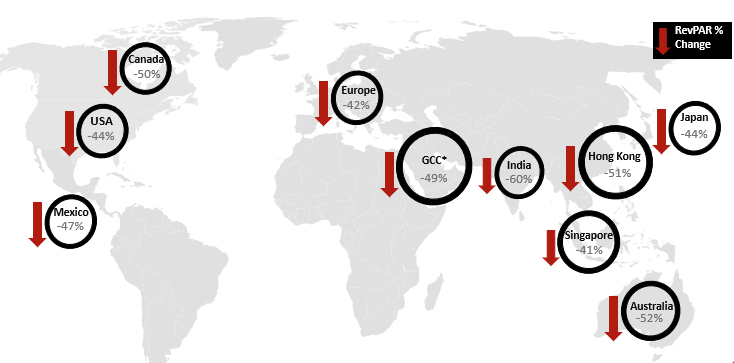

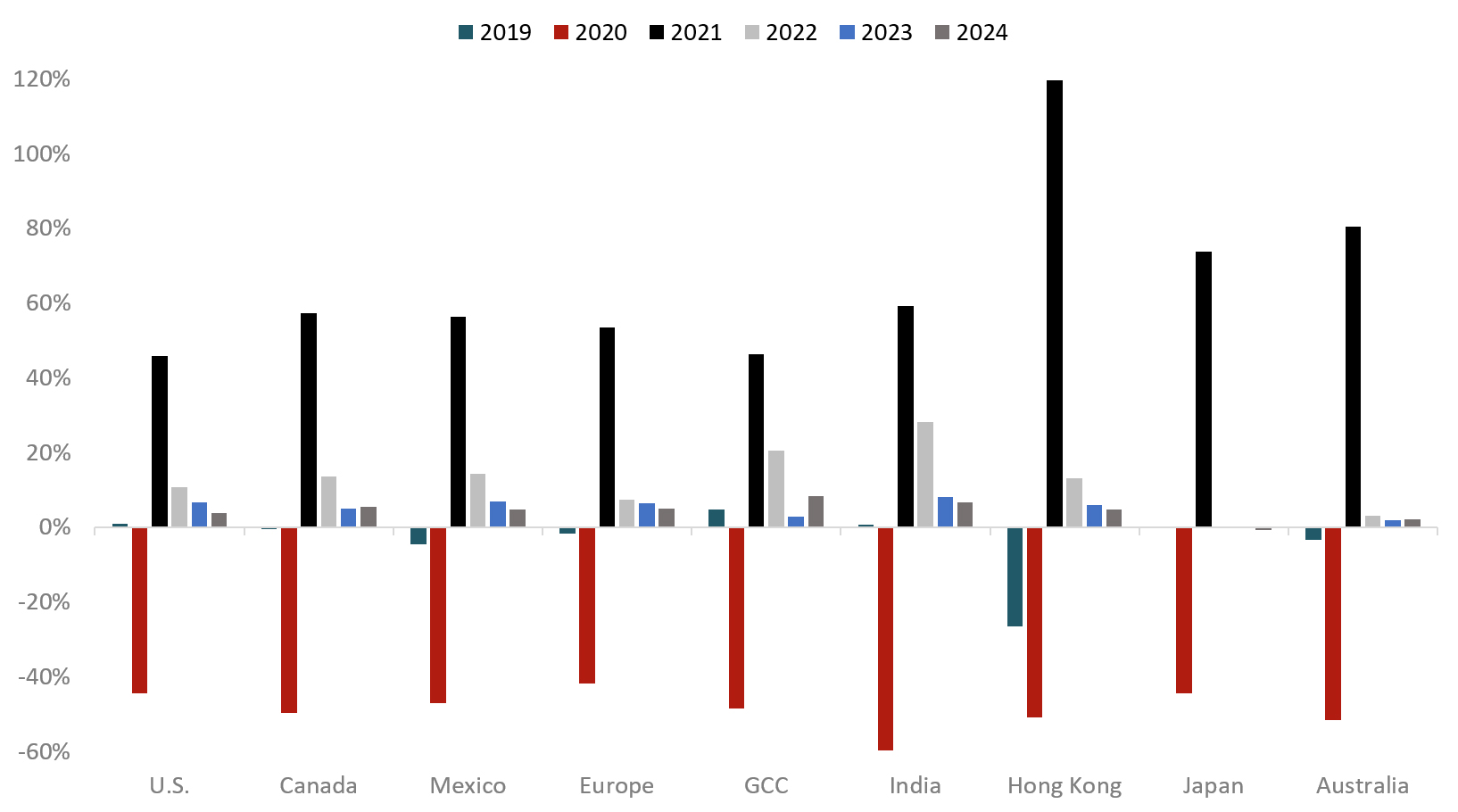

Figure 6: Global RevPAR % Change 2019 - 2020F

Seasonality, Source Market and Type of Visitation

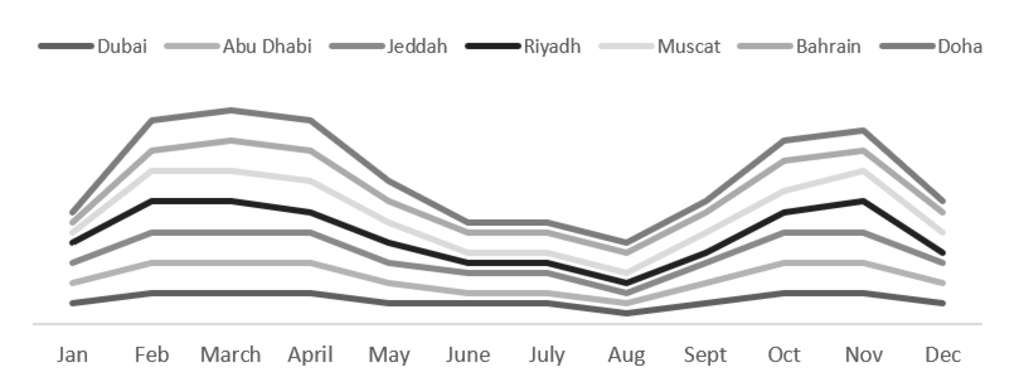

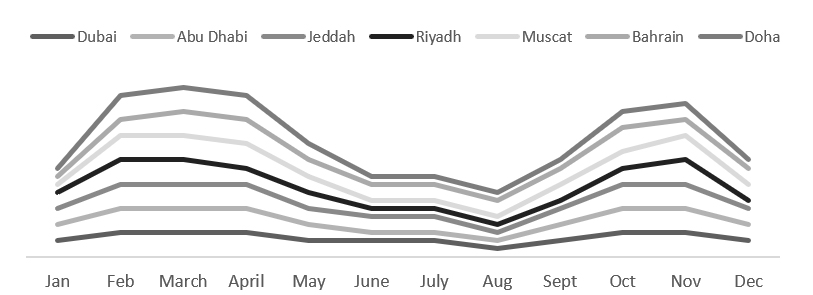

Typical segmentation for each hotel market in 2019, which is also reflected in the seasonality trends below, was as follows:

- Riyadh: 85% Commercial-15% Leisure

- Jeddah: 40% Commercial -60% Leisure

- Dubai-:45% commercial:-55% Leisure

- Abu Dhabi: 65% commercial:-35% Leisure

- Muscat: 60% commercial: 40% Leisure

- Manama- 50% Commercial:50% leisure

- Doha- 80% Commercial: 20% leisure

Amongst all seven cities, Dubai has the least pronounced seasonality as it caters to both commercial and leisure segments equally. Dubai has been successful in diversifying its offering over the last five years and flattening the seasonality curve. In particular, Doha and Riyadh attract mostly the commercial segment and therefore experience sharper seasonality inline with corporate activity.

For the purpose of this publication, the segments are defined as:

-

Commercial: Corporate/Airline/MICE/Government

- Leisure: Group, Individual, FIT, Tour Operators/Wholesale

Figure 7: Seasonality Trend 2019

In 2019, key source markets to Jeddah and Riyadh were domestic guests, 63% and 65% respectively. This was followed by visitation from the GCC which accounted to 20%.

In 2018 and 2019, Muscat benefited from transient demand on the way to and from Qatar which generated additional room nights in the market. Key source of visitation to Muscat in 2019 was 58% from the Middle East, followed by 20% from Asia Pacific. Approximately 20% of hotel demand is generated domestically.

Qatar's hotel market is largely dependent on commercial demand and international visitation. Approximately 80% of hotel demand in 2019 originated from Europe, South and South East Asia and America. Local demand generated less than 10% of room nights. A large portion of hotel demand in Doha is extended stay (more than 1 month).

Regional tourism constituted a large portion of demand in Dubai in 2019. GCC and Other MENA countries accounted for roughly 28% of the total number of hotel guests in Dubai. Asia also generated 28% of international visitors and was followed by Western Europe and Americas, 20% and 7% respectively.

While 30% of hotel stays in Abu Dhabi in 2019 were generated from the domestic market, 42% of international visitors were from Europe. Additional key source markets to Abu Dhabi were from Asian subcontinent and MENA, 17% and 13% respectively.

In 2019, the main feeder market to Bahrain was the GCC, accounting for approximately 70% of total number of arrivals, of which 58% came from Saudi Arabia. This was followed by Asia, Europe and Americas, accounting for approximately 25% of the number of inbound visitors.

Dubai

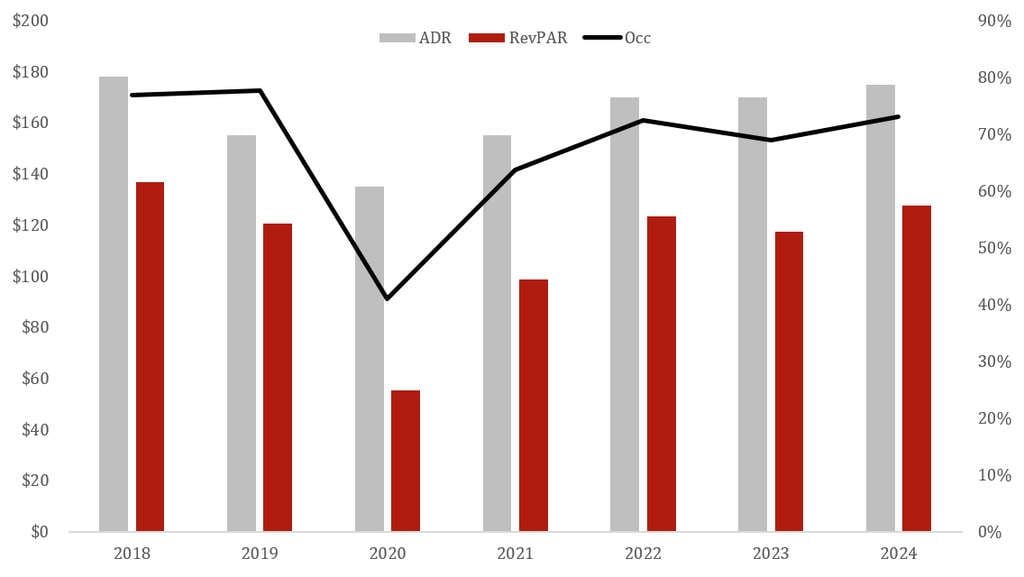

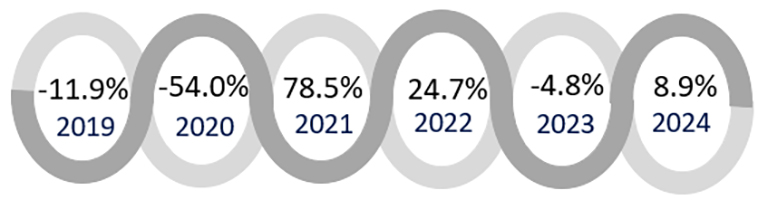

Hotel market recovery in Dubai is likely to commence in September 2020 and will be driven mainly by local demand emanating from UAE residents followed by commercial demand from neighboring GCC countries.

Dubai will see a faster recovery than other GCC markets on the back of the anticipated demand in the lead up to and during Expo Dubai which will take place in October 2021 and ending in March 2020.

A correction in market-wide occupancy is expected in 2023 and the hotel market is forecasted to stabilize and recover by 2024, albeit at lower levels than 2019.

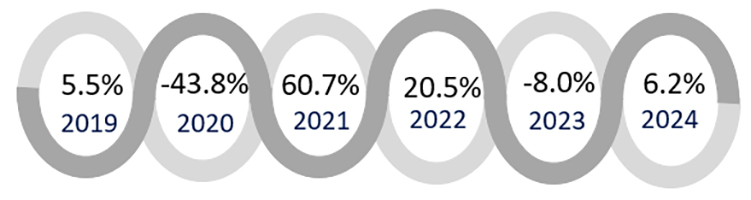

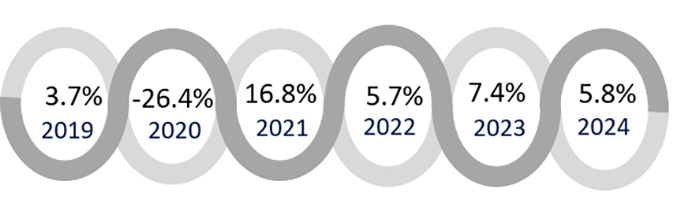

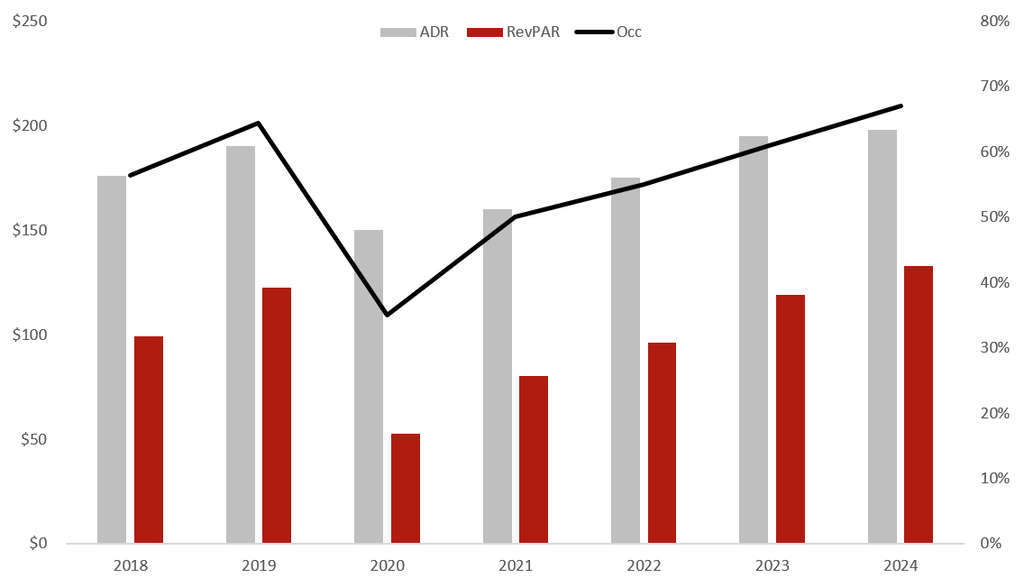

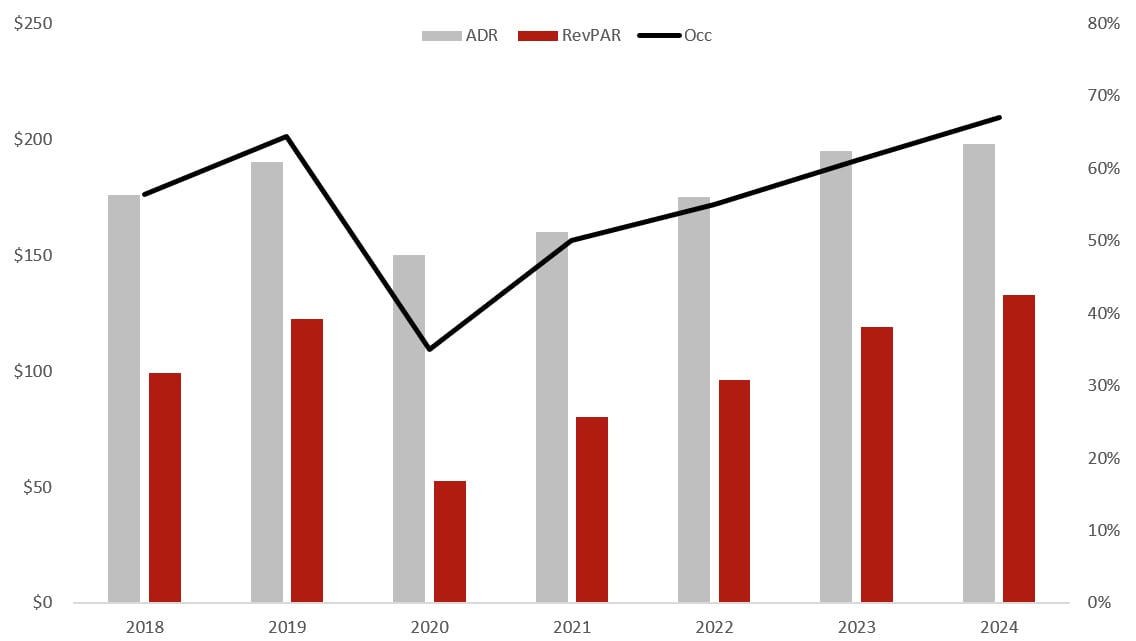

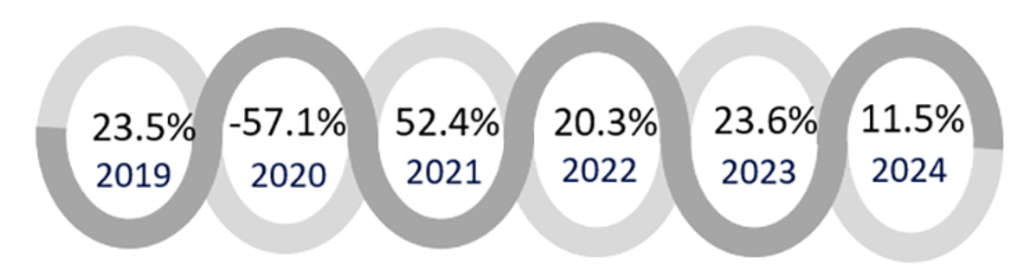

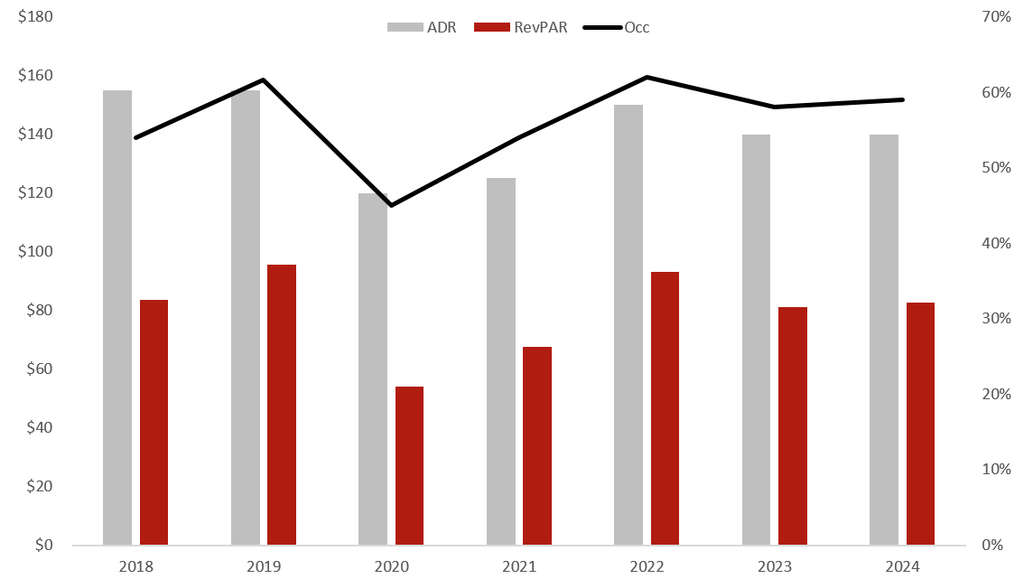

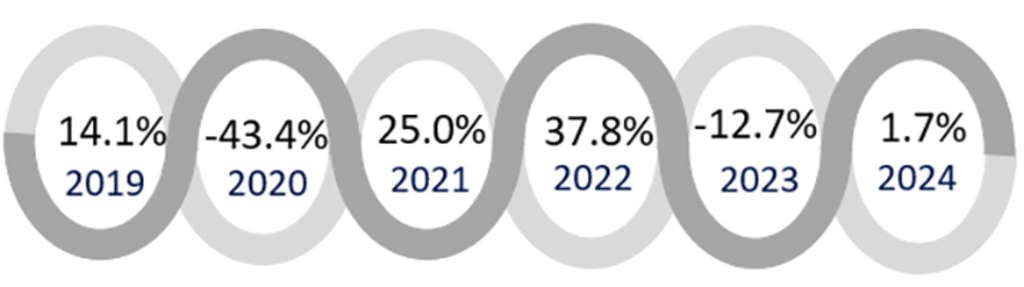

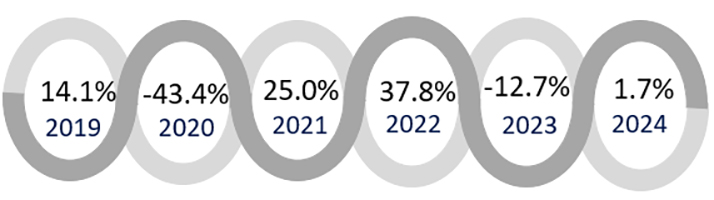

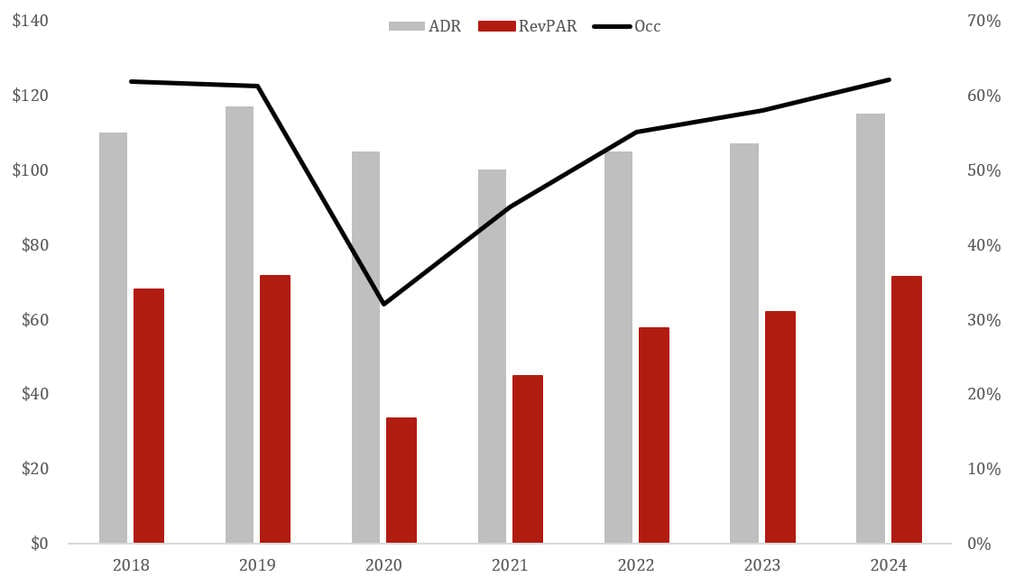

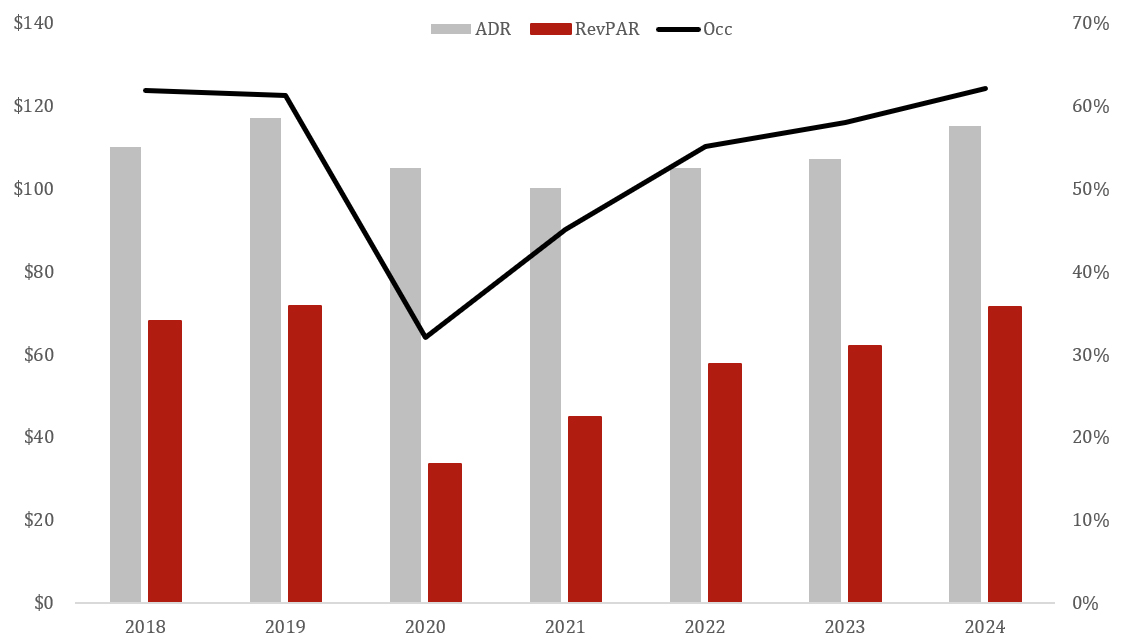

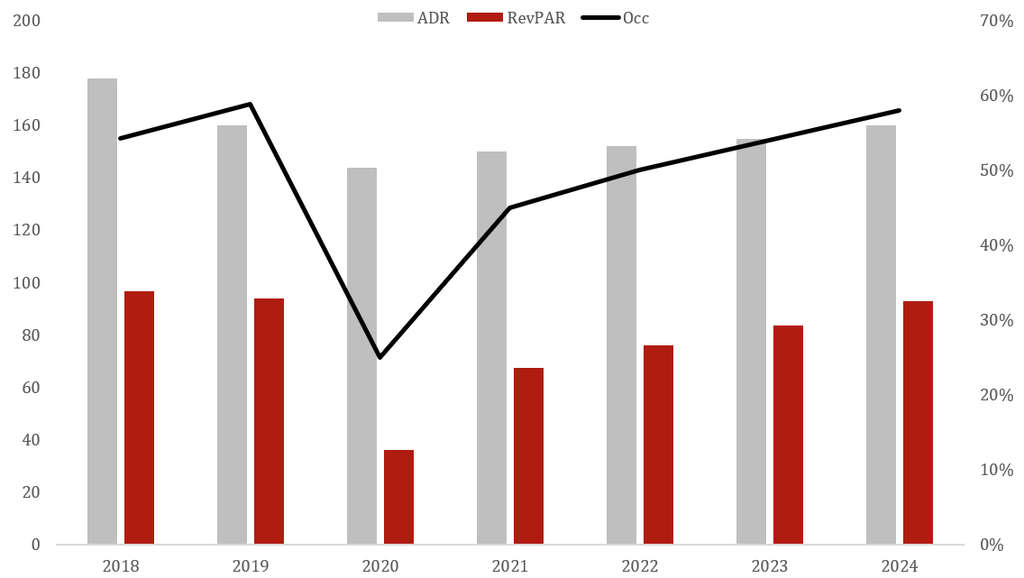

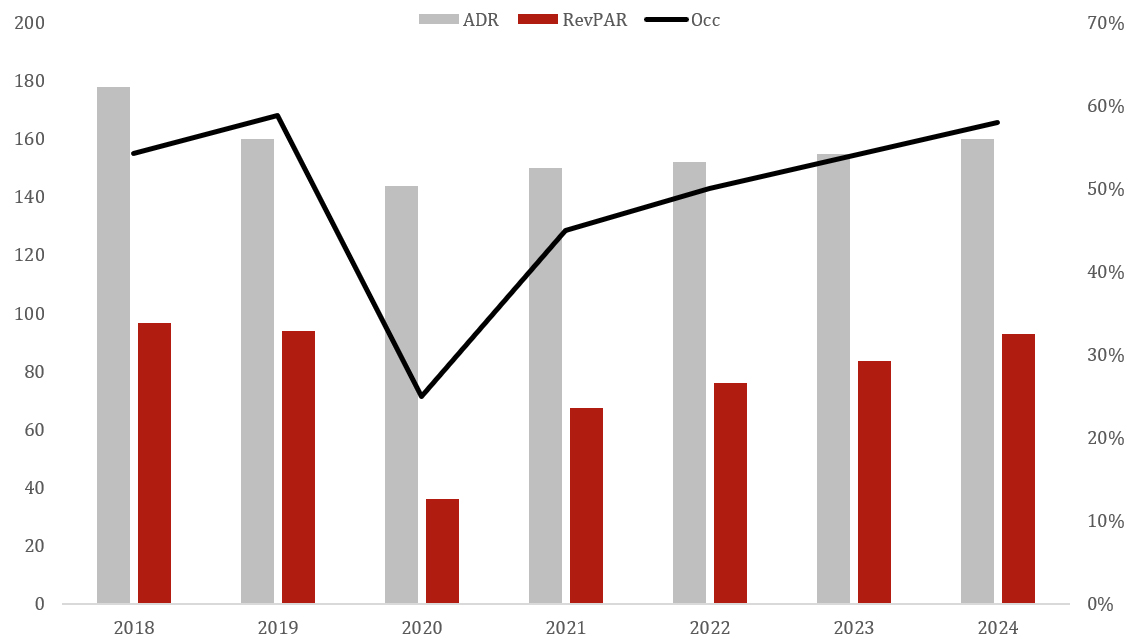

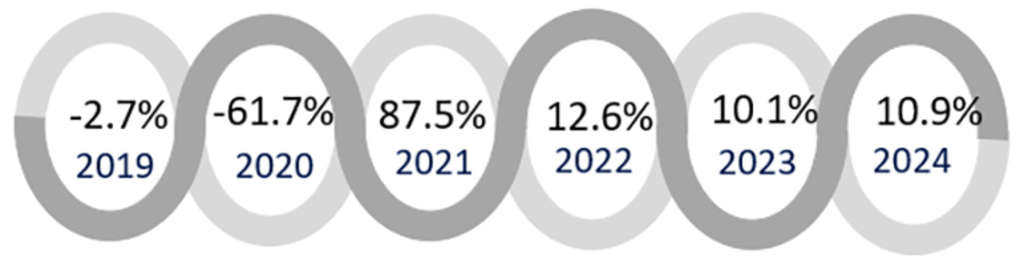

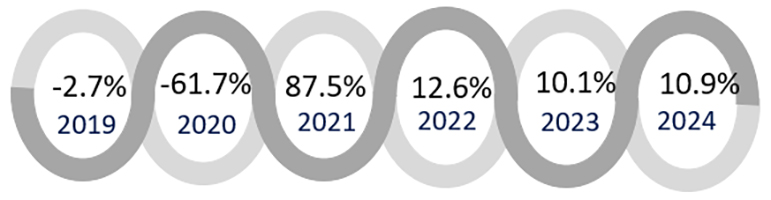

Figure 8: 2019-2024(F), Dubai Occupancy, ADR & RevPAR, In USD

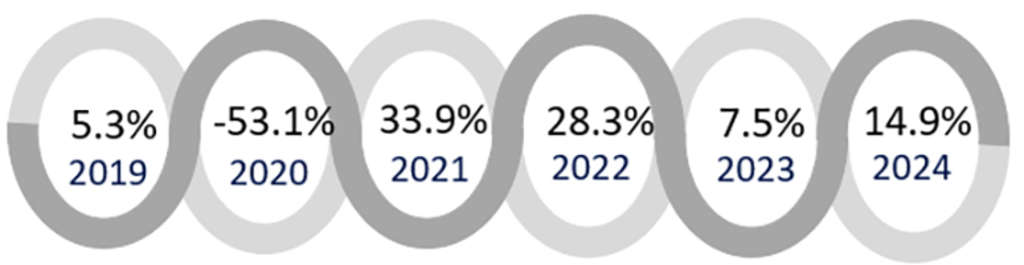

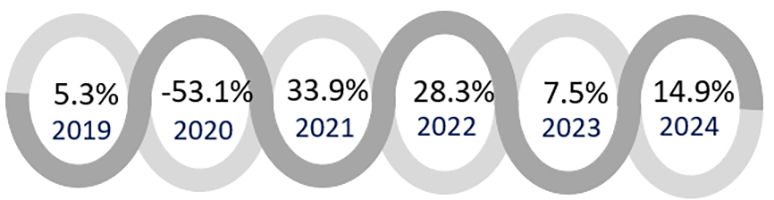

2019-2024(F), RevPAR, YoY %Change, In USD

Abu Dhabi

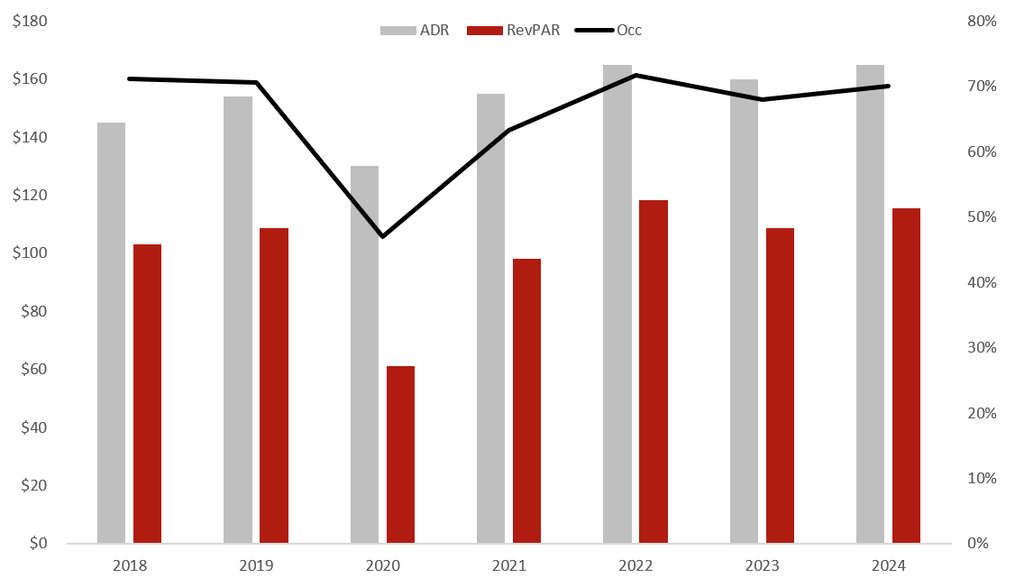

Hotel market recovery in Abu Dhabi is likely to commence in September 2020 and will be driven mainly by government related initiatives and meetings followed by local demand emanating from UAE residents.

Abu Dhabi hotel market will benefit from demand in the lead up to and during Expo Dubai which will take place in October 2021 and ending in March 2020.

A correction in market-wide occupancy is expected in 2023 and the market is forecasted to stabilize in 2024 to levels similar to those registered in 2019.

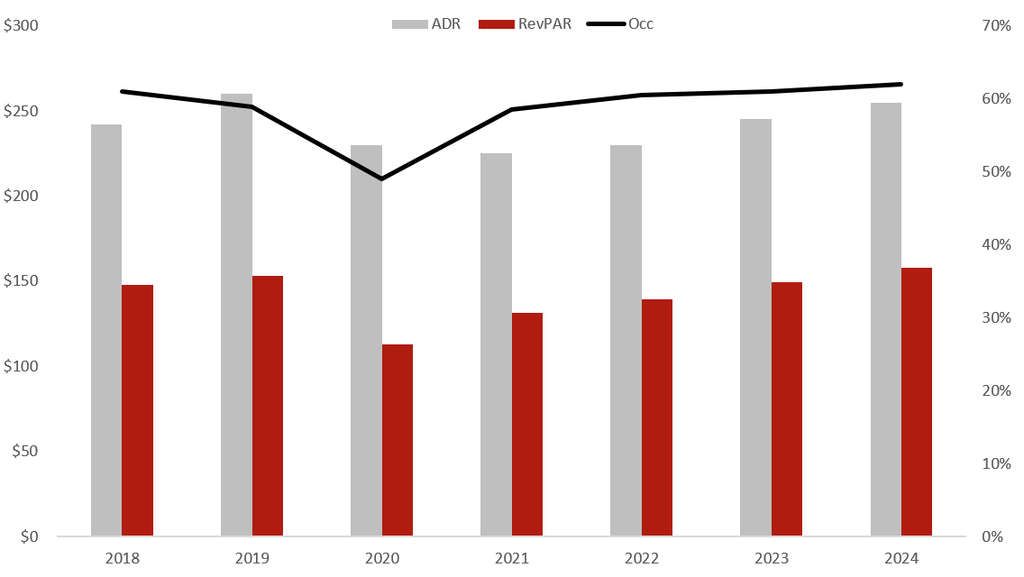

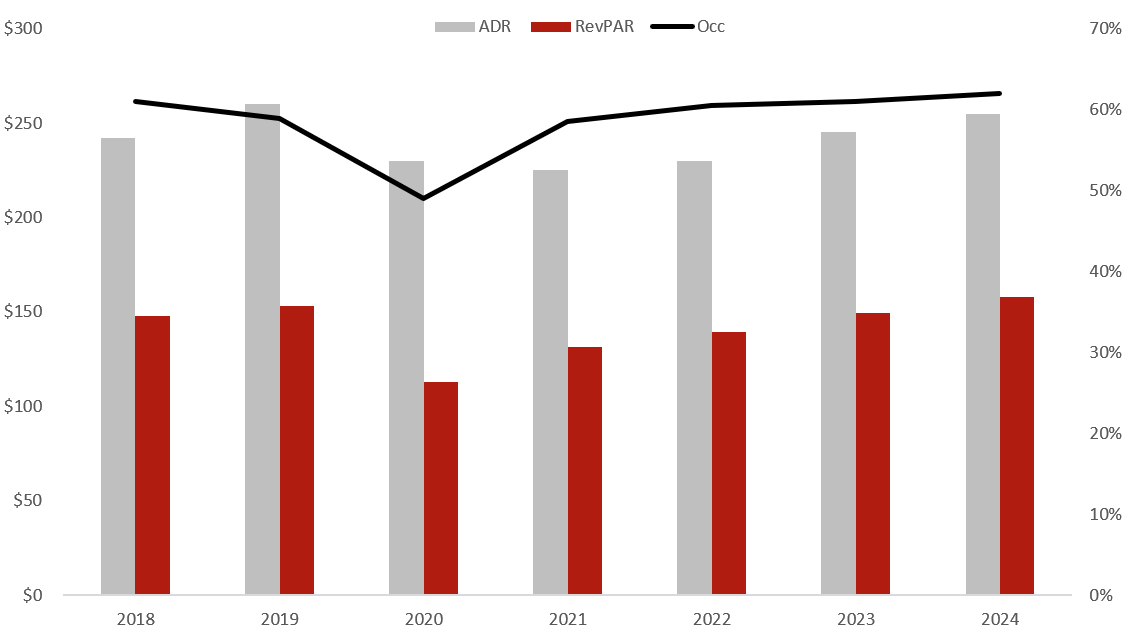

Figure 9: 2019-2024(F), Abu Dhabi Occupancy, ADR & RevPAR, In USD

2019-2024(F), RevPAR, YoY %Change, In USD

Jeddah

We forecast recovery in the Jeddah hotel market will be primarily driven by local tourism in Q4 of 2020 and well into 2021.

Over the next 18-24 months, Jeddah is likely to benefit primarily from domestic leisure demand and potentially transient guests to and from Makkah to perform religious duties.

On the basis that the Saudi government remains committed to Vision 2030 investment and development plans, Jeddah's hotel market is forecasted to stabilize in 2024 at slightly higher levels than those achieved in 2019.

Figure 10: 2019-2024(F), Jeddah Occupancy, ADR & RevPAR, In USD

2019-2024(F), RevPAR, YoY %Change, In USD

Riyadh

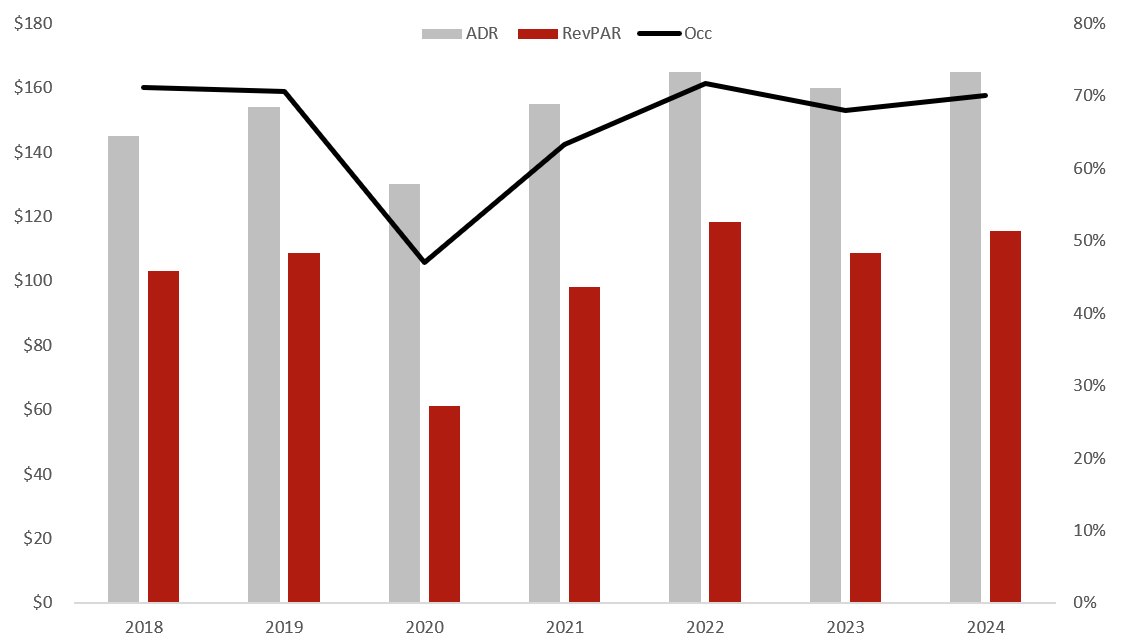

We forecast recovery in the Riyadh hotel market to be slow in Q4 2020 and hotel demand during that period will be primarily driven by domestic commercial demand.

We forecast that market-wide occupancy will grow substantially in 2021 driven largely by regional and domestic corporate demand.

On the basis that the Saudi government remains committed to Vision 2030 investment and development plans, Riyadh's hotel market is forecasted to see reasonable growth in 2022 and thereafter to stabilize in 2024; at slightly higher levels than 2019.

We expect a change in guest segmentation in the stabilized year, with a noticeable increase in leisure travelers.

Figure 11: 2019-2024(F), Riyadh Occupancy, ADR & RevPAR, In USD

2019-2024(F), RevPAR, YoY %Change, In USD

Doha

Hotel recovery in Doha will remain slow over the next 12 months, considering Doha's heavy dependence on international visitation. More than 80% of hotel guests emanate from Europe, US and Asia.

Doha will see strong growth in 2022 on the back of the anticipated demand in the lead up to and during the World Cup which will take place in November 2022.

A correction in market-wide occupancy is expected in 2023 and the hotel market is forecasted to stabilize and recover by 2024, albeit at lower levels than 2019.

It is yet to be seen whether Doha will be able to diversify its recreational offerings to attract the leisure traveler and reduce its reliance on the commercial segment.

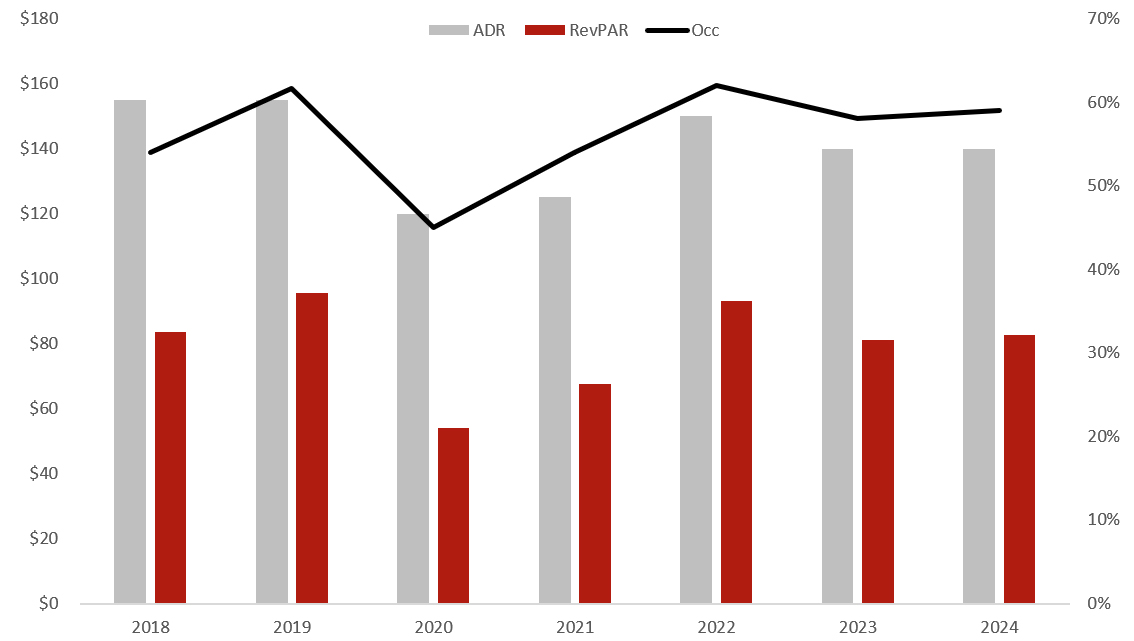

Figure 12: 2019-2024(F), Doha Occupancy, ADR & RevPAR, In USD

2019-2024(F), RevPAR, YoY %Change, In USD

Muscat

We forecast recovery in the Muscat hotel market will remain slow in Q4 2020 and hotel stays during that period will be primarily driven by domestic demand.

Gradual recovery is forecasted from 2021 to 2023 and the hotel market is forecasted to stabilize in 2024, albeit at lower levels than those registered in 2019.

Over the last two years, the hotel market in Muscat benefitted from unexpected demand from travelers on the way to and from Doha as a result of the Qatar diplomatic crisis which brought about travel restrictions between Doha and several other countries in the region.

Figure 13: 2019-2024(F), Muscat Occupancy, ADR & RevPAR, In USD

2019-2024(F), RevPAR, YoY %Change, In USD

Manama

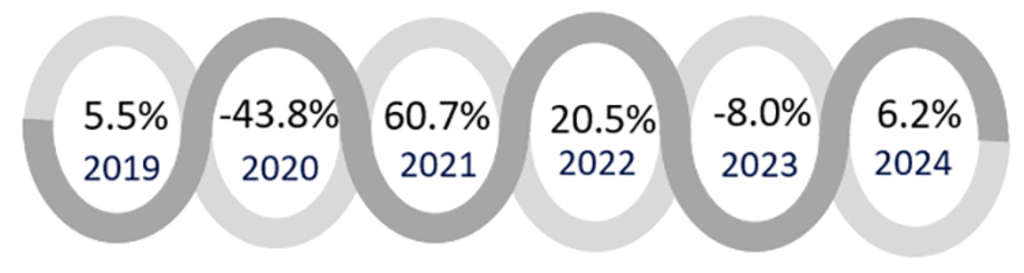

Hotel market recovery in Manama is likely to commence in the last quarter of 2020 and will be driven mainly by local demand emanating from Bahrain residents as well as demand from Saudi Arabia.

From an international perspective, demand is predominantly attributable to corporate visitation and the Bahrain Grand Prix, which is the largest inbound demand generator in Bahrain.

We forecast that the hotel market will recover gradually and stabilize in 2024 to similar levels as those registered in 2019.

Figure 14: 2019-2024(F), Manama Occupancy, ADR & RevPAR, In USD

2019-2024(F), RevPAR, YoY %Change, In USD

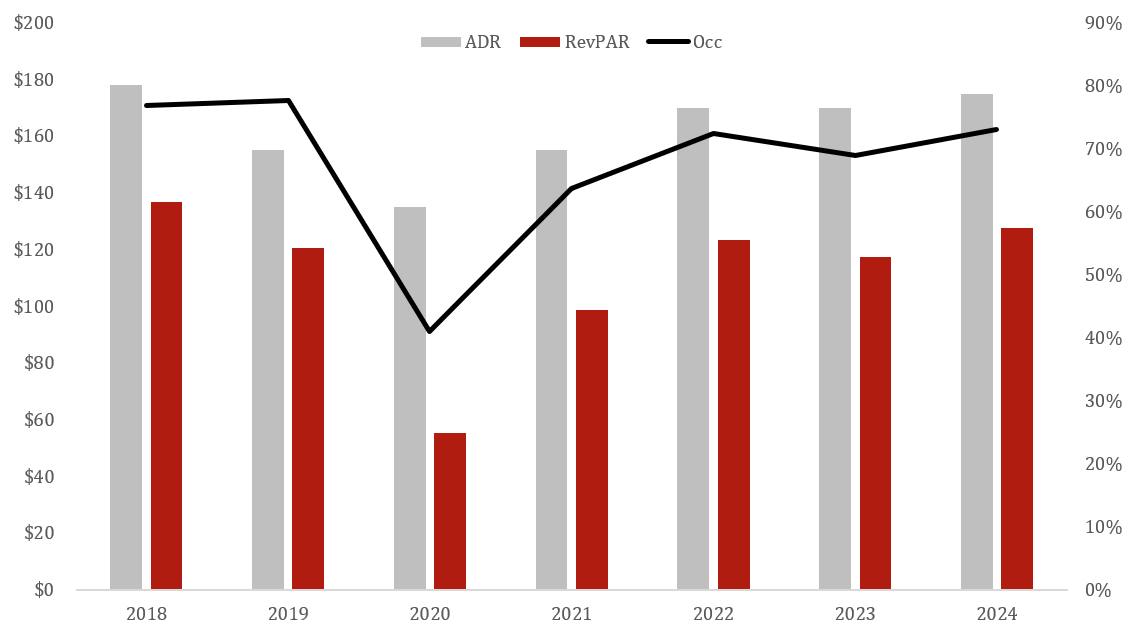

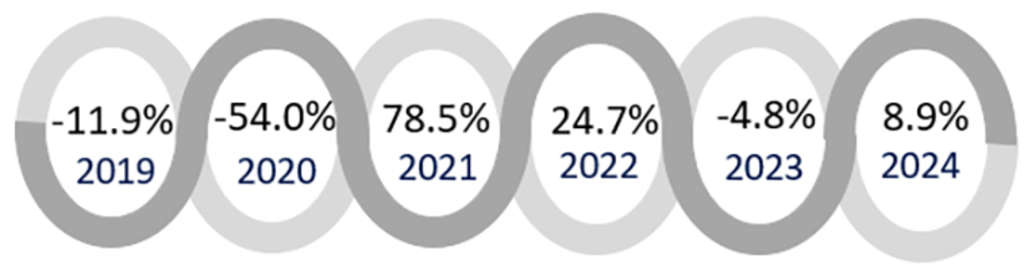

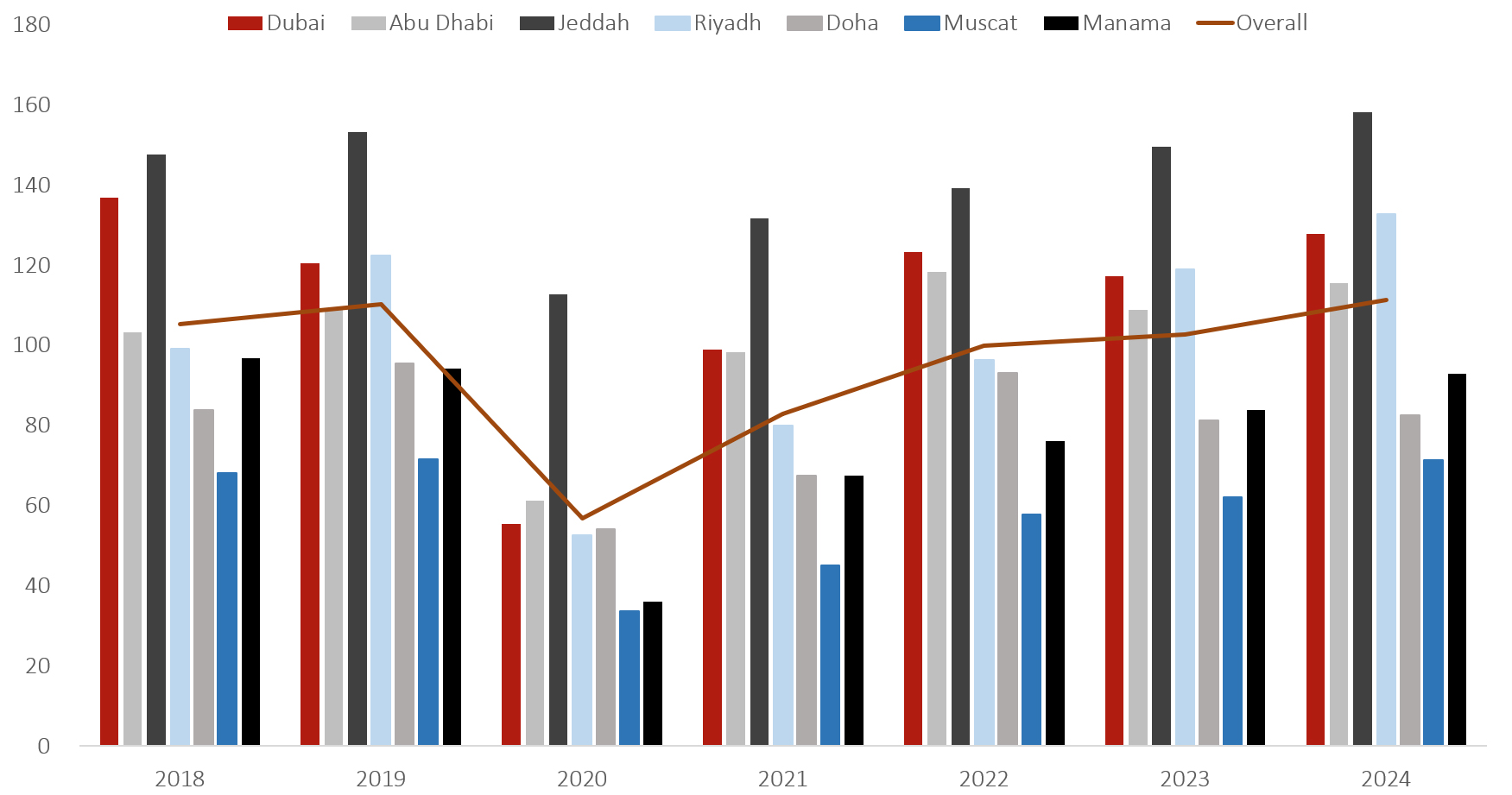

Figure 15: Regional RevPAR Outlook 2018-2024, In USD

Figure 16: Global RevPAR % Change 2018-2024, In USD

Disclaimer

Disclaimer: HVS forecast of occupancy and rate is based on a set of assumptions and information available to us at the time of forecast. HVS forecast should be viewed as indicative only and not relied upon for future course of action. These forecast may be subject to change and therefore HVS has no obligation to update these forecasts and makes no representation or warranty and expressly disclaims any liability with respect thereto.

Hala Matar Choufany

President for HVS Middle East, Africa & South Asia and Managing Partner of HVS Dubai

HVS