Three key developments in the U.S. OTA market

OTAs showed welcome recovery in 2021, buoyed by continued strength in domestic travel. After ending 2020 down 58%, U.S. OTA bookings nearly doubled despite the ups and downs of another pandemic year. According to Phocuswright’s latest travel research report on the segment U.S. Online Travel Agency Market Report 2021-2025, OTAs delivered $65.2 billion in gross bookings in 2021, reaching 82% of pre-pandemic levels (2019).

Three key developments in the U.S. OTA market:

Full-service stands alone no more

Expedia has long offered a near-full spectrum of travel products via its flagship Expedia.com site, allowing customers to book multiple products for a trip, while its U.S. competitors have heavily skewed toward one product line.

Booking.com and HotelTonight have been rooted in accommodations, Hopper and CheapOair in flights. However, Booking.com and Hopper both made great strides in expanding into full-service OTAs, putting new pressure on Expedia.

Money talks: sales, acquisitions and investments

2021 was a year for OTAs to examine portfolios and either slim down or supplement their offerings. For Expedia Group, the focus was simplifying business to operate more efficiently as a family of brands, and investing in businesses where they are best positioned to win.

Conversely, Booking Holdings opened its wallet wide, spending more than $3 billion on acquisitions and investments in 2021.

Hopper, which plays on a much smaller scale compared to Expedia and Booking but has big ambitions, also joined in the acquisition game, while raising $345 million in 2021 between its March Series F and August Series G rounds.

Tours, activities & attractions: the remix

Not long ago, the tours, activities and attractions segment was dubbed the next big source of growthin the travel industry. The category flourished in 2018, and OTA giants, including Booking and Expedia, were vying to position themselves as leaders.

Since then, both OTAs have changed their approach to offering activities. Rather than sourcing all supply directly, Expedia and Booking have largely turned to partnerships with activities-focused travel companies. While changes had already been in play pre-pandemic, the OTAs have further enforced the partnership approach in 2021.

Hopper, in contrast, entered into the space with its PlacePass acquisition. PlacePass was most notable as the supply source of Marriott's tours and activities booking platform, which Hopper will now power.

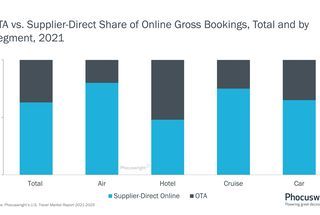

OTAs continue to regain share of the total online market during travel's recovery in 2021. However, it’s important for travel companies to know that supplier websites maintained their majority stake in the U.S. online travel market with a 63% share of online gross bookings. This report helps companies understand how suppliers and OTAs compete, differentiate themselves and offer new value for travelers. Phocuswright’s U.S. Online Travel Agency Market Report 2021-2025 provides a comprehensive view of the U.S. OTA landscape, including detailed market sizing and projections, distribution trends, key developments and more.

For further intelligence for you and your entire company, subscribe to Phocuswright Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. See the benefits here.

ABOUT PHOCUSWRIGHT INC.

Phocuswright is the travel industry research authority on how travelers, suppliers and intermediaries connect. Independent, rigorous and unbiased, Phocuswright fosters smart strategic planning, tactical decision-making and organizational effectiveness.

Phocuswright delivers qualitative and quantitative research on the evolving dynamics that influence travel, tourism and hospitality distribution. Our marketplace intelligence is the industry standard for segmentation, sizing, forecasting, trends, analysis and consumer travel planning behavior. Every day around the world, senior executives, marketers, strategists and research professionals from all segments of the industry value chain use Phocuswright research for competitive advantage.

To complement its primary research in North and Latin America, Europe and Asia, Phocuswright produces several high-profile conferences in the United States and Europe, and partners with conferences in China, Singapore and the United Arab Emirates. Industry leaders and company analysts bring this intelligence to life by debating issues, sharing ideas and defining the ever-evolving reality of travel commerce.

The company is headquartered in the United States with Asia Pacific operations based in India and local analysts on five continents.

Phocuswright is a wholly-owned subsidiary of Northstar Travel Media, LLC. (116 32nd Street, 14th Floor, New York, NY 10001 United States). www.phocuswright.com

ABOUT NORTHSTAR TRAVEL GROUP

Northstar Travel Group is the leading provider of business-to-business news, information, data, transactions and custom content solutions for the travel, meetings and hospitality industries. Brands under the Northstar umbrella include Travel Weekly, Travel Weekly China, Travel Weekly Asia, TravelAge West, Business Travel News, Phocuswright, Meetings & Conventions, M&C China, Web in Travel and Inntopia. Northstar is the industry leader in marketing solutions, custom content communications, content licensing and database management serving the travel and meetings industries. The company produces more than 52 face-to-face events, taking place in North and South America, Europe, Asia and the Middle East. Northstar is based in Secaucus, NJ, and is a portfolio company of EagleTree Capital. www.northstartravelgroup.com