Market Recovery Monitor - 30 April 2022

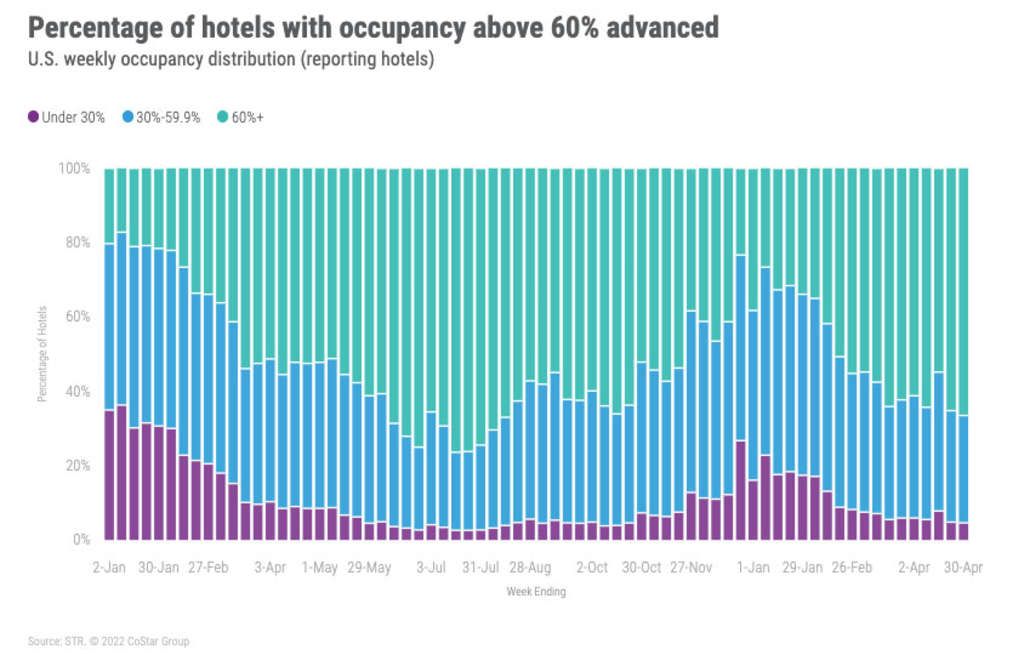

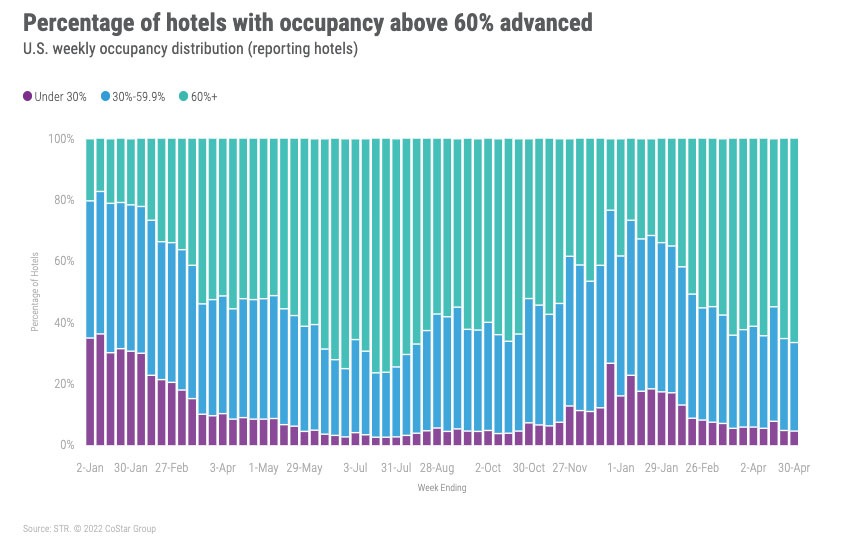

The U.S. hotel industry continued to gain steam with occupancy rising to 66.6% during the week of 24-30 April 2022. That absolute occupancy was the second highest of the year thus far, and it was the third time above 66% this year. For comparison, occupancy only surpassed 66% seven times last year, all of which came during the summer. Weekday (Monday-Wednesday) occupancy (64.8%) also reached the highest point of the year and the highest level since last summer. At a property-level, more than two-thirds of all hotels reported occupancy above 60%, which is also the most since summer 2021. Average daily rate (ADR) fell week over week to US$147, but that level was 10% higher than in the comparable week of 2019. Revenue per available room (RevPAR) was flat week over week with a 6% premium over 2019. RevPAR has been at a premium to 2019 in eight of the past 10 weeks.

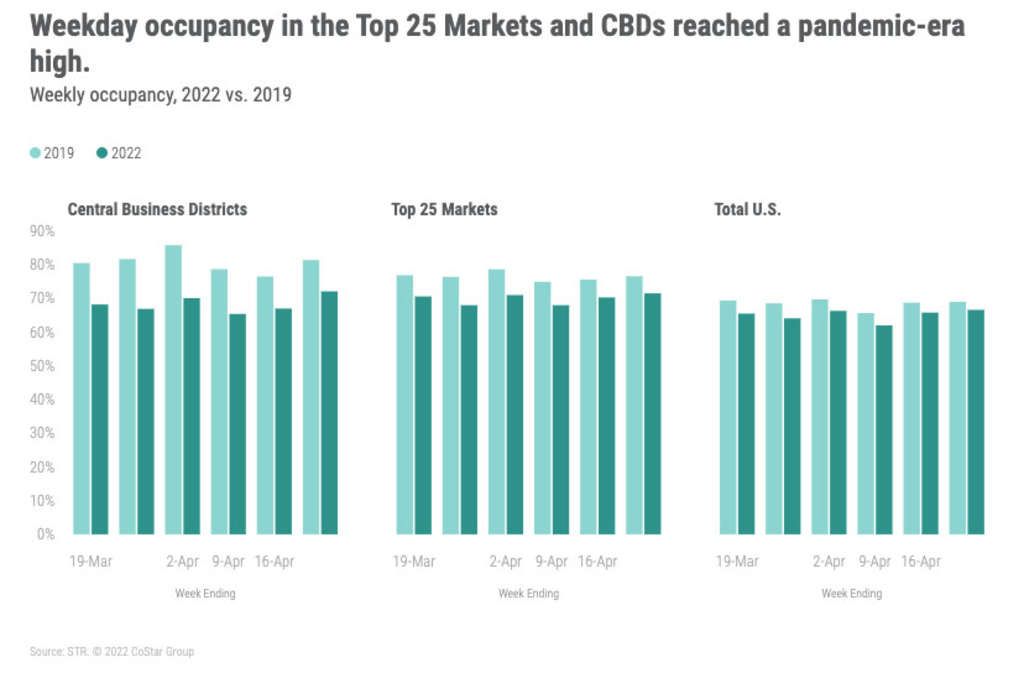

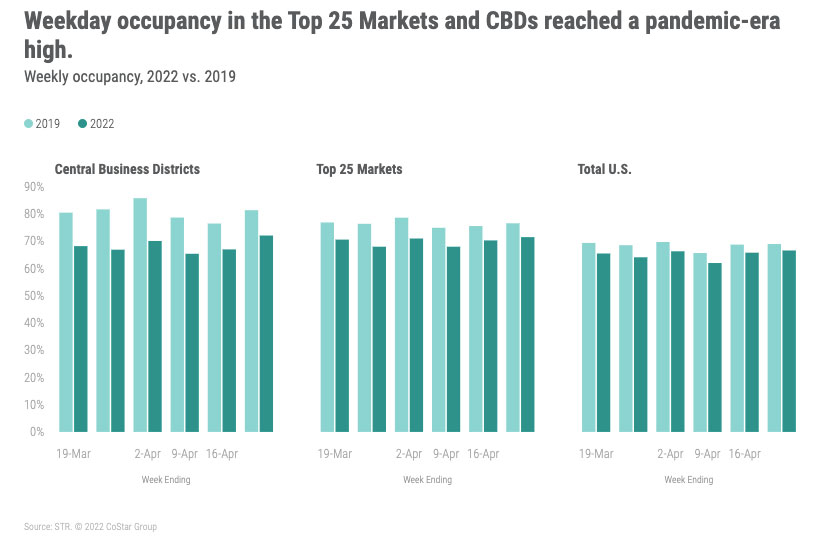

Savannah had the nation’s highest market occupancy this week (81.6%) and has been in the top five for five consecutive weeks. Among submarkets, the Savannah Historic District was the best with weekly occupancy of 88.3%. Occupancy in the Top 25 Markets was at its second highest level (71.5%) since the start of the pandemic. Weekday Top 25 Market occupancy (70.2%), however, was the best of the pandemic-era. Among the Top 25, Dallas (75.7%), San Francisco (75.8%), Seattle (71.5%), and Washington, D.C. (70.3%) posted their highest weekly occupancy since March 2020. With the exception Seattle, all those markets also reported their highest weekday occupancy of the pandemic era. For Seattle, it was its second best. Occupancy in San Francisco has been above 60% in six of the past seven weeks. Weekday occupancy has been at 69% or higher in the past three weeks. By day of week, Top 25 occupancy on Tuesday (71.4%) was the best for that day since before the pandemic. Wednesday’s Top 25 occupancy (72.6%) was the second highest for that day and the third highest of the week behind Friday and Saturday. As indexed to 2019, total weekly demand in the Top 25 was 96% of what it was in the comparable week, and it has been above 90% in each of the past seven weeks.

Occupancy in New York City has been above 70% for the past seven weeks, its longest streak at that level since early 2020. Additionally, occupancy in the city has been above 75% over the past four weeks with the most recent week’s level (77.2%) being the fifth highest since the start of the pandemic. NYC’s pandemic-era high was 81.9% at Christmas time.

Weekly occupancy in the central business districts (CBDs) reached a pandemic-era high (72.1%) as did weekday occupancy (72.0%). Five of the 20 CBDs tracked for this analysis reported weekday occupancy above 80%, including Austin CBD, Dallas CBD, Nashville CBD, New Orleans CBD, and New York Financial District. Dallas CBD had the highest weekday occupancy (92.3%) in that group. On the other end of the spectrum, Minneapolis CBD had the lowest weekday occupancy (37.8%) and has been the bottom dweller for most of the year. Besides setting pandemic-era occupancy records, CBDs also reported their highest RevPAR level of the pandemic-era.

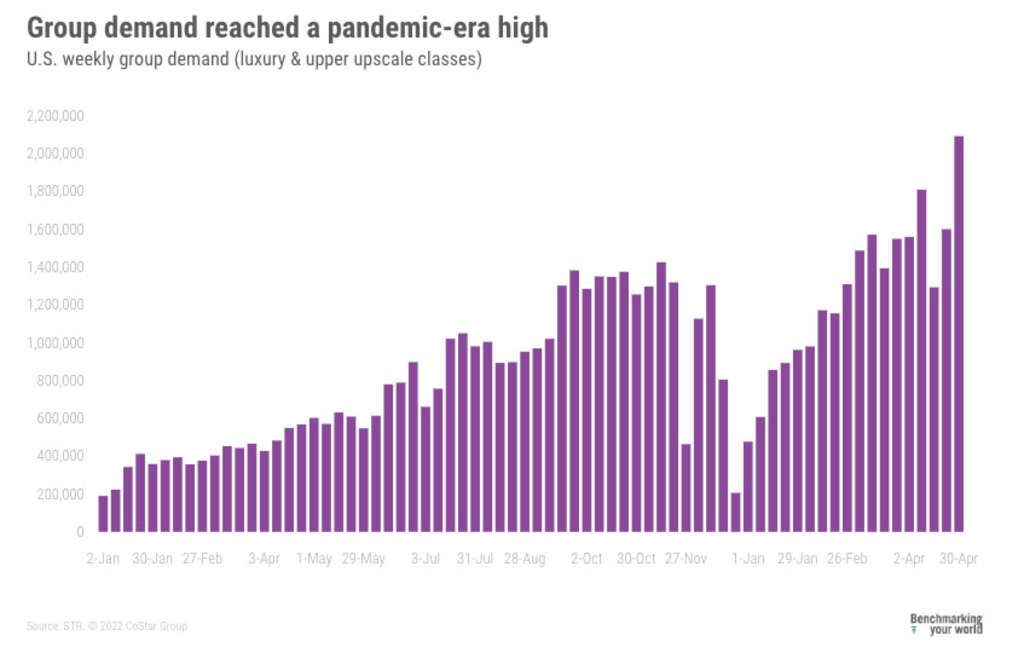

Driving some of the gains in the Top 25 Markets and CBDs was group demand, which reached its highest level since late 2019 as more than two million rooms were sold in luxury and upper upscale classes. Weekday group demand was also at its highest level of the pandemic era and comparable to what was seen in early 2020. Of note, 12 of the Top 25 Markets saw their highest weekday group demand since the start of the pandemic, including Atlanta, Boston, Chicago, Dallas, Miami, Nashville, San Diego, and San Francisco. Five other markets, including Orlando and Washington D.C., reported their second highest weekday group demand.

ADR remained above 2019 for a 12th consecutive week while weekend ADR has been above 2019 levels since early summer 2020. The strength of ADR was initially driven by non-Top 25 Markets, where the level has been above 2019 since early last summer as well. The Top 25 Markets, however, are now seeing a similar result with 2022 ADR surpassing the 2019 comparable in 10 of the past 11 weeks. Moreover, Dallas, San Francisco, Seattle, and Washington D.C. reported their highest ADR since the start of the pandemic. Overall, 88% of all STR-defined U.S. markets saw weekly ADR that was above the 2019 comparable. Considering inflation, real ADR was 2.5% less than the matching week in 2019, and only 46% of markets had an ADR higher than what was reported pre-pandemic.

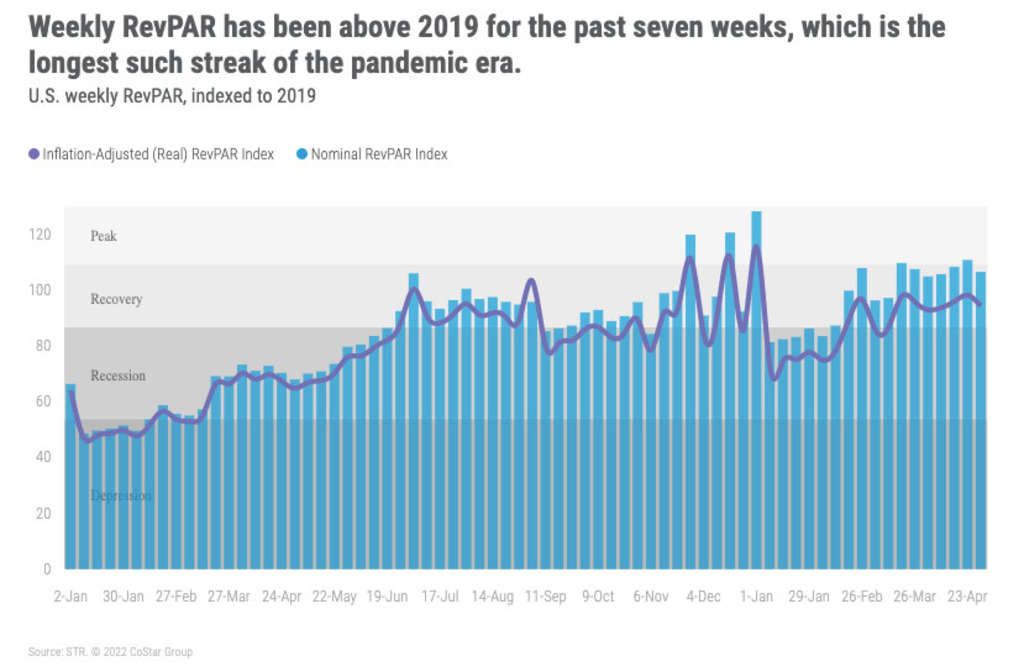

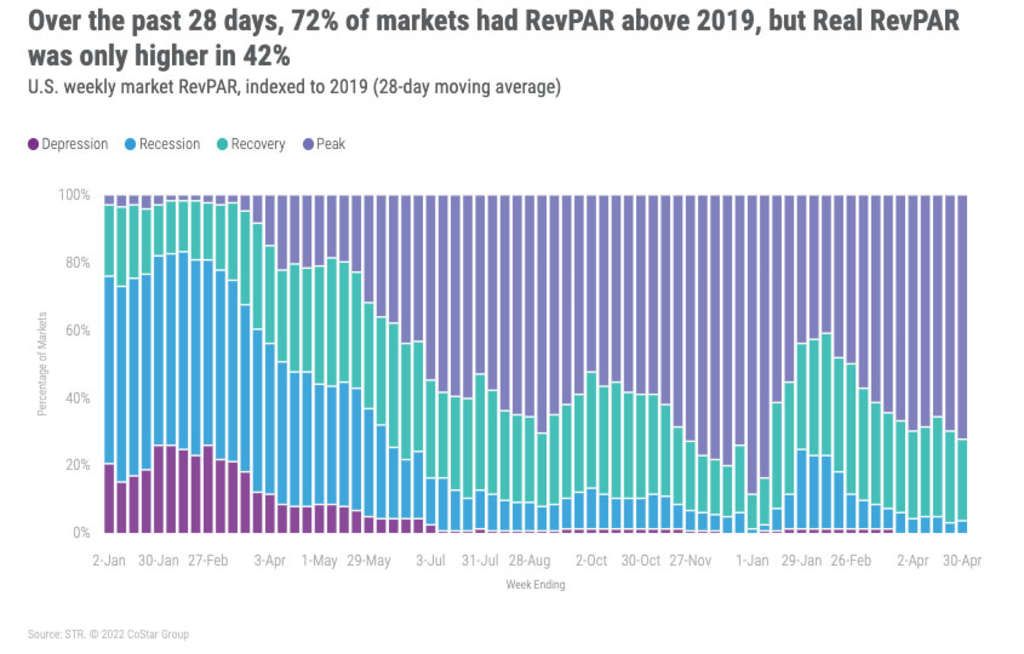

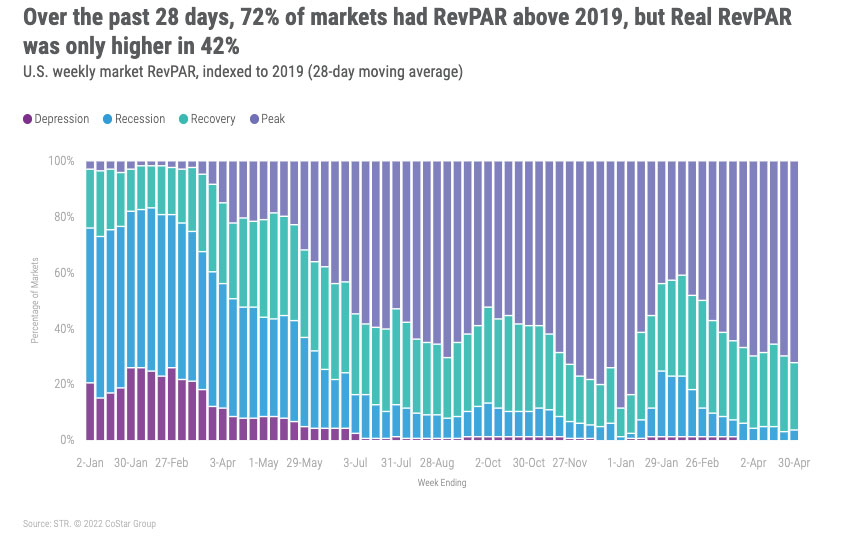

Weekly RevPAR has been above 2019 for the past seven weeks, which is the longest such streak of the pandemic-era. Like ADR, and since summer 2020, RevPAR in non-Top Markets 25 has seen a majority of weeks above 2019 levels. Top 25 Markets are just beginning to see similar results. This past week, RevPAR in the Top 25 Markets was just below the 2019 comp. Across all markets, 73% showed higher RevPAR than in 2019. Real ADR, however, was higher in only 46% markets. Over the past 28 days, 72% of markets had RevPAR above 2019, but Real RevPAR was only higher in 42% of them. Seventeen markets were still in “recession” (real RevPAR indexed to 2019 between 50 and 80), including Boston, Minneapolis, New York, and San Francisco.

Around the Globe

Outside of the U.S., occupancy increased week over week by 2.1 percentage points to 57.5%. ADR remained relatively flat at US$127, resulting in a 3.9% RevPAR increase. Forty-two of the countries tracked on a weekly basis saw a week-over-week drop in occupancy – an improvement compared with the week prior.

Week over week, Monaco saw a significant 30.4-percentage-point increase in occupancy to 75.0%, thanks to the Monte Carlo Film Festival and Monaco e-Prix taking place in the final week of April. The occupancy result was also 10 percentage points ahead of the comparable week in 2019, while ADR increased 36.8% week over week. The United Kingdom saw a robust week-over-week uptick in occupancy, up 7.3 percentage points to 76.6%, sitting just 1.3 percentage points behind 2019 levels. The largest week-over-week growth came on Monday (+27.2 pp) and Tuesday (+16.5 pp), indicating growth in corporate business for the country.

Ireland achieved the highest weekly occupancy in the world at 80.7% with Dublin seeing 86.8%. The market is consistently reporting high occupancy levels, particularly during the weekend, and last week benefited from hosting “Pain in Europe”, a biennial medical conference. Northern Europe again saw the highest occupancy (76.0%) of any subcontinent, up 6.9 percentage points, with Northern Africa the lowest (37.3%).

From a market perspective, Cologne occupancy saw a 12.3 percentage point increase last week, while ADR rose 48.9%, due to Anuga Foodtech taking place 26-29 April. Beijing has seen lockdowns come into place across some parts of the city, but occupancy fell by just 1.9 percentage points week over week.

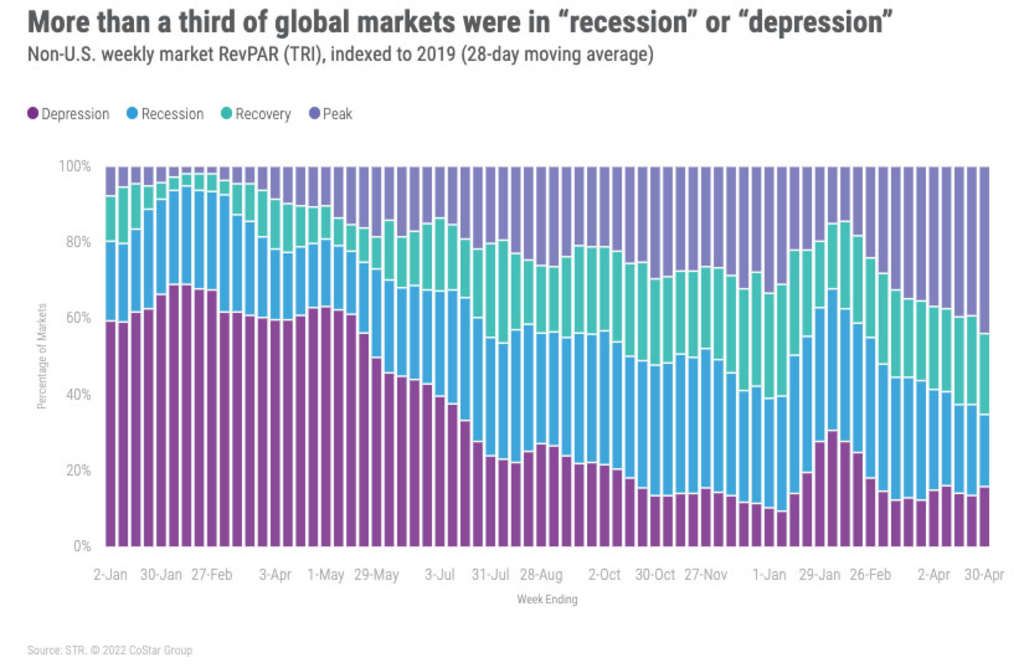

Over the past 28 days, 19% of non-U.S. markets remained in “Recession” (RevPAR indexed to 2019 between 50 and 80) with another 16% in “Depression” (RevPAR indexed to 2019 under 50). This is a slight regression compared with the previous week

Big Picture

Business and group travel is returning as evidenced by the strengthening of weekday demand in the U.S. Top 25 Markets and CBDs as well as in the U.K. While the geographic groups in the U.S. are not at the levels that they were prior to the pandemic, they are not too far off from that mark, and it is conceivable that they could see a full recovery sooner than we anticipated. The slack in business travel can be seen in TSA security screenings, which have averaged 90% of 2019 volumes over the past 30 days. But as competitive pressures build, we believe business travel will also increase as the realization that relationships indeed drive growth.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.