Waterpark Resort Development: Successes and Pitfalls

The waterpark industry continues to flourish in the United States and Canada. While the pandemic slowed demand and growth in 2020 and 2021, 2022 has largely been a return to normal for operators but also for developers and investors looking for new opportunities to leverage the growing popularity of waterpark resorts along with increasing consumer demand for fun, family-oriented vacation options.

In 2022, the industry has enjoyed strong average daily rate (ADR) growth and higher day pass ticket prices, allowing for increased revenue. However, construction costs have increased, and developers continue to face financing challenges. Despite the industry’s many successes, there have also been some failures, showing that when planning a waterpark resort, there is no substitute for due diligence, proper planning, and a long-term vision.

Current waterpark supply

As of July 2022, the United States and Canada had a total of 1,188 waterparks, the majority of which are outdoor waterparks. Hotel & Leisure Advisors has identified nearly 20 new facilities with the potential to open by year-end.

The U.S. and Canada waterpark properties achieved total revenues of over $8.5 billion in 2021. The waterpark resort segment, which includes indoor waterpark resorts and resorts with outdoor waterparks, represents 19% of waterpark supply in the United States and Canada, but the waterpark resort revenue was 74% of the total revenue for all waterpark properties. Resorts include attached hotels that typically have additional amenities such as restaurants, conference space, retail, spas, and other attractions. The resort figure includes all revenue from the waterpark resorts during the time when the waterparks are open (excluding the cold weather months when resorts with outdoor waterparks close their waterpark). This article focuses on the waterpark resort segment.

Indoor waterpark resorts

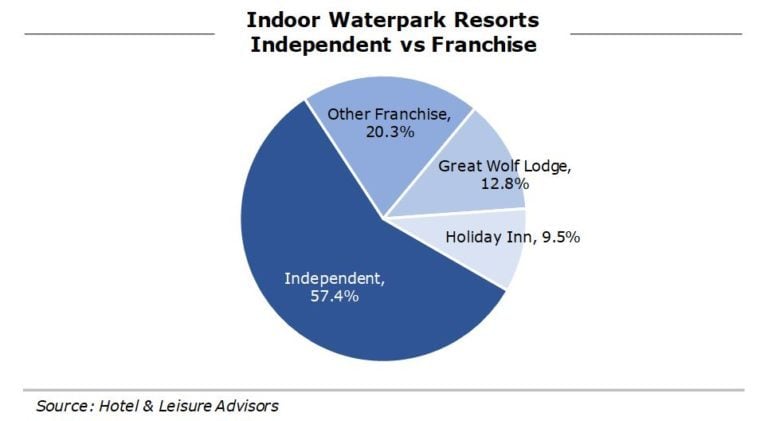

Indoor waterpark resorts represent 12% of the total market and the total number (148) has been relatively stable over the past seven years. More than half (57%) of these properties are independent, while 43% are affiliated with a franchise. More than half of the franchise properties are affiliated with one of two chains: Great Wolf Resorts and Holiday Inn.

By 2026, 18 new indoor waterpark resorts are expected to open, with 10 being independent and eight being franchise affiliated. However, some of these have yet to obtain financing. Great Wolf Lodge will open five properties, bringing the company’s market share to 14.5% of indoor waterpark resort properties. More than $4 billion in projected construction of indoor waterpark resorts will occur in the next few years.

Great Wolf Resorts has broken ground on their upcoming Perryville, Maryland, and Naples, Florida, properties, which are slated to open in 2023 and 2024, respectively.

- Perryville is the largest of their upcoming properties, with 700 guest rooms and a 126,000-square-foot indoor waterpark

- Naples will offer 500 rooms and a 100,000-square-foot indoor waterpark

Three Great Wolf Resorts are currently in the development stages with debuts planned for 2024.

- Jackson, Tennessee, will have 400 guest rooms and an 80,000-square-foot indoor waterpark

- Webster, Texas, will have 400 guest rooms and an 80,000-square-foot indoor waterpark

- Foxwoods Casino in Mashantucket, Connecticut, will feature 550 guest rooms and a 90,000-square-foot indoor waterpark

Outdoor waterpark resorts

Outdoor waterpark resorts are the smallest segment with properties representing 7% of the total waterpark market. This is the fastest-growing segment of the four waterpark segments with an increase in supply of 37% between 2014 and 2021. These properties are approximately evenly split between independent operators and franchises. Hyatt is the largest individual brand in this segment followed by Margaritaville and Holiday Inn.

A number of existing hotels and resorts are adding outdoor waterpark features in the United States. We are tracking six new resorts with outdoor waterparks that are planned to open in the next three years.

Preparing for success

With the success of many waterpark resorts in North America, it’s easy to lose focus on what makes a waterpark resort successful. The “if you build it, they will come” mentality is a not viable strategy. There are several key factors that developers, investors, and operators need to keep in mind when considering new builds or significant renovations.

- Demographics: The strength of the population base, household incomes, regional employment levels, and tourism are key demographic trends that are important to analyze. Properties developed with stronger population bases or in markets with heavy tourism will have a significant advantage in attracting overnight guests and day visitors. As waterpark resorts become more widespread, consumers have multiple options in many markets, creating increased competition.

- Complementary Tourism Attractions: While many waterpark resorts bill themselves as destination resorts, smaller properties must rely on nearby attractions to help boost tourism, and thereby park attendance. These family-oriented attractions prove indispensable when trying to leverage a property’s appeal to out-of-town visitors.

- Area ADRs:The strength of the ADRs of area hotels surrounding the potential location is a key factor in estimating potential revenue for a waterpark resort. Properties in the Poconos are achieving the highest ADRs of waterpark resorts in the United States while Midwestern locations tend to achieve lower ADRs. All parts of the country have seen strong growth in 2021 and 2022 due to the increased demand for the combination of business and leisure (“bleisure”) long weekends and family time.

- Waterpark Size: Though not all markets are suited for larger destination waterparks, there is no doubt that larger properties with more attractions and features attract more visitors than their smaller counterparts. Customers are willing to travel greater distances to go to a larger destination property, resulting in a larger population base from which to draw.

- Competent Management: There is no substitute for a competent and highly qualified management company to operate the property. Waterparks require a unique set of skills in marketing, revenue management, and day-to-day operations to run an efficient operation that meets customer expectations while remaining profitable.

- Focus of Property: There are two types of waterpark resorts: those that focus exclusively on families and those where the waterpark is an additional amenity among many. For example, Great Wolf Lodge properties are very focused on families, in particular with younger children, and attract no business/commercial demand and limited group demand. In contrast, Kalahari Resorts (four locations) and Gaylord Hotels (four locations with waterparks), attract strong group and convention demand in addition to strong leisure demand. Most waterpark resorts attract little commercial demand.

- Financing: Finding financing is one of the most challenging aspects of waterpark resort development. Savvy investors will require a solid plan with financial projections that show the potential for sustained performance. Competent developers begin the project with a well-written feasibility study that will analyze the market and help determine if the waterpark resort will be successful in a particular location.

- Branding vs. Independent: More waterpark resorts are independent but rely on strong theming to make their properties unique and marketable. Others, like Great Wolf Lodge or Holiday Inn hotels with waterparks, are branded or franchised properties. Great Wolf Lodge offers brand standards and theming across its portfolio, which means that guests know what to expect at any property. This kind of consistency increases brand loyalty and customer satisfaction. However, independent properties can also create loyalty and “branding” by maintaining consistent standards and offering guests a unique, highly themed experience like what is offered at Camelback Resort in Tannersville, Pennsylvania or Wilderness Resort in Wisconsin Dells, Wisconsin.

- Theming: Successful waterpark resort properties generally have unique and immersive theming. As the industry becomes more diverse in terms of offerings, and consumers demand more immersive attractions, properties need to project a strong theme that resonates with guests, tells a story, and provides additional marketing opportunities. Waterpark resorts with strong theming include Splash Lagoon in Erie, Pennsylvania; Kartrite Resort in Monticello, New York; and Kalahari Resorts in Ohio, Pennsylvania, Texas, and Wisconsin.

Mitigating failures

While the industry has many successful ventures to its credit, it’s important to remember that not all properties have achieved financial success over the years. The following highlights some recent closures of waterpark resorts:

- The 11,000-square-foot Wasserbahn Waterpark Resort in Williamsburg, Iowa, permanently closed in 2022 after years of operational challenges. Since its opening in 2004, the property changed ownership and branding multiple times.

- The 340-room Caribbean Cove Waterpark Resort in Indianapolis, Indiana, closed in 2017. The property was originally a Holiday Inn that added a 35,000-square-foot indoor waterpark, but subsequently changed franchise affiliations to other brands. Drury Inns purchased the property for $4.7 million in January 2018 and demolished the buildings to develop a new hotel.

- In Newark, Ohio, the 200-room Cherry Valley Lodge and 26,000-square-foot CoCo Key Water Resort sold after a long period of poor performance. In response to low attendance, the waterpark closed in November 2017.

- The 26,000-square-foot CoCo Key Water Resort in Waterbury, Connecticut, closed in 2016 after eight years of operation. The 282-room property sold at auction for $5.2 million, and the buyers demolished the structure with plans to redevelop the site.

These failures highlight the importance of proper management, sizing of waterpark, area for expansion, continued programs of innovation and improvement, and a long-term strategy for success. Prior to development, a feasibility study can assist in looking at these long-term issues to help ensure success assuming the client reviews and implements the recommendations of the feasibility study.

Looking to the future

The pandemic forced the industry to adapt, but its fundamentals remain strong. We expect to see continued growth in indoor and outdoor waterparks at hotels and resorts. Owners, operators, and developers can take the lessons learned and challenges faced into the recovery with renewed hope and perspective for the future. The challenges facing developers lie in pursuing projects with strong fundamentals and a reasonable chance of financing. As waterpark resorts become more popular in many markets, those fundamentals will become even more important, with only the well-considered and expertly evaluated projects being seen as viable by investors and stakeholders.

This article was created for and first published by InPark Magazine, and is shared with permission. Visit www.inparkmagazine.com.