A Hotel Debt Quagmire - Borrowers with maturing loans have increasingly fewer options

Any optimism for a post-COVID resurgence of hotel lending activity has evaporated as the market stalls in the face of the highest interest rate environment in over a decade. The surging economic uncertainty is undoubtedly impacting the level of angst many hotel owners are feeling at the moment. The magnitude and unpredictability of changing loan underwriting assumptions in the past sixty to ninety days alone have meaningfully increased investment risk.

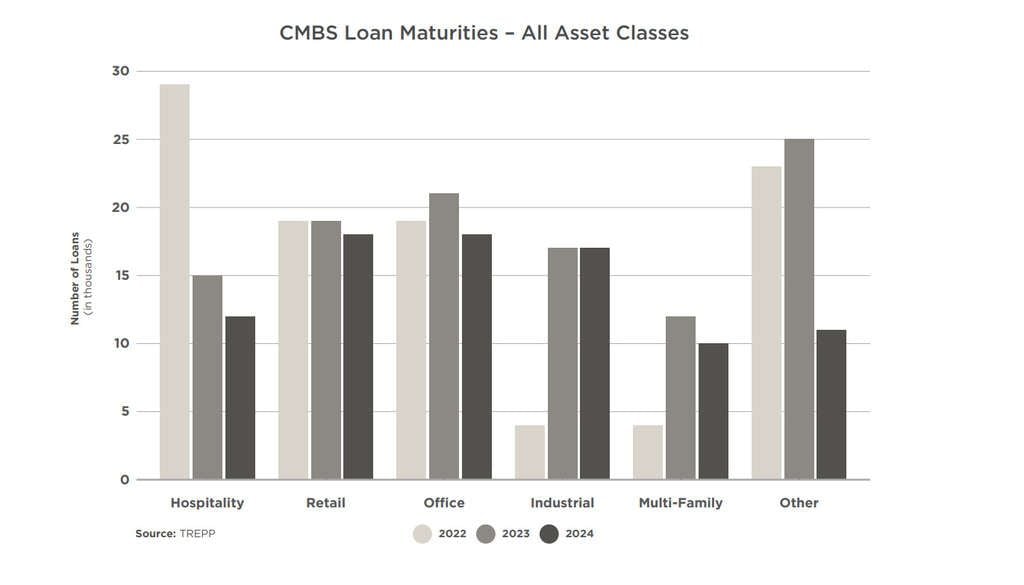

New debt for hotel acquisitions has all but vanished, but a bigger problem may be the wave of existing debt facilities of all types that are scheduled to mature this year and next. Beginning at the start of 2022 and through the end of 2023, nearly 45,000 CMBS hotel loans totaling about $30 billion in value were set to mature …

Click here to read the full article.

Greta Hart

Senior Vice President of Marketing & Partnerships

The Plasencia Group