Dallas Hotel Development: A Success Story Amid the Pandemic Recovery

Dallas Hotel Metrics

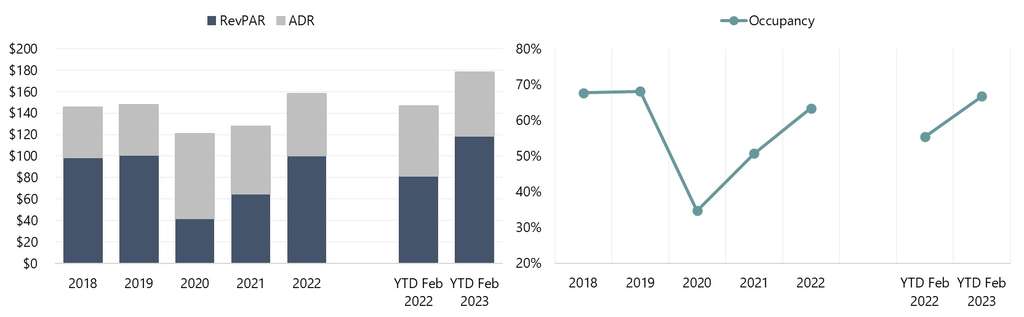

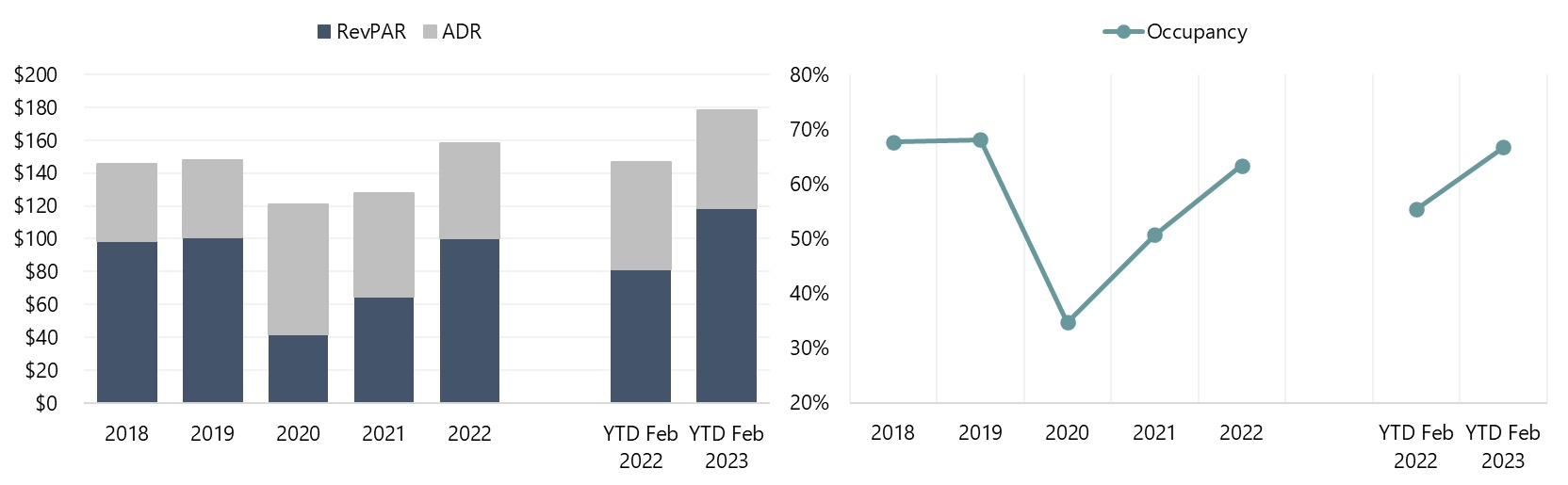

Within the hotel and lodging sector, Dallas’s popularity with visitors and its ability to attract new businesses have contributed to an unhesitating redemption. In the wake of the COVID-19 pandemic, revenue per available room (RevPAR) in the greater Downtown Dallas area for 2022 rebounded to levels similar to 2019; however, the year-to-date period ending February 2023 shows RevPAR exceeding prior peak levels, as illustrated in the Kalibri Labs data below.

As occupancy levels remained below pre-pandemic levels owing to a sluggish business travel recovery, the RevPAR increase was largely driven by a significant upswing in average daily rate (ADR), fueled by greater levels of high-rated leisure demand and an increase in upper-upscale and luxury full-service inventory in the greater Dallas market.

Tourism and Convention Demand Segment Factors

According to Craig Davis, CEO of VisitDallas, the tourism/hospitality industry is the tenth-largest industry in Dallas, and total visitor volume and spending are expected to fully recover to their pre-pandemic levels by the end of 2023. A significant number of attendees at citywide conventions and other special events contribute to the total visitor volume. Dallas has long been a popular convention destination, and the post-pandemic rebound in Dallas has been swift and strong.

Shaping the future of the convention market in Dallas, a plan to build a new, expanded, almost $3-billion convention center was approved by voters in November 2022. The existing Kay Bailey Hutchison Convention Center is aging and does not offer all of the facilities and amenities that meeting planners prefer. Construction of the new 2.5-million-square-foot center is projected to occur from 2024 to 2028.

Per preliminary plans of the new facility, the amount of exhibit space will increase modestly from the existing center, but meeting space will double and ballroom space will triple—resulting in the new facility being about 500,000 square feet larger than the existing center. The project will also include rotating the center’s orientation clockwise approximately 90 degrees, creating a deck park over Interstate 30, improving connectivity, and increasing development potential among Downtown Dallas, the Cedars neighborhood, and South Dallas.

Commercial Demand Segment Factors

Along with being a popular convention destination, Dallas is home to two major airports and boasts a diverse, business-friendly environment. The city is one of the world’s leading choices for corporate headquarters. Furthermore, airport traffic at both Dallas Love Field Airport and Dallas/Fort Worth International Airport registered at more than 95% of 2019 levels for year-end 2022. Rising inflation costs and efforts to control expenses remain threats to business travel, and while the office market has been slow to recover, work-from-home practices are increasingly migrating to hybrid models that require some office attendance. As such, business travel is rebounding, although the pace is somewhat irregular.

Hotel Development and Renovations

As ADR growth buoyed the RevPAR recovery, it is important to recognize several recent and planned high-end hotel projects, as well as major renovations, that are expected to spur additional rate growth and elevate the greater downtown area’s lodging supply.

Downtown

- The 268-room Virgin Hotel Dallas opened in August 2019 within the Design District, steps from dining, art galleries, design studios, and showrooms.

- In December 2019, the 183-room HALL Arts Hotel Dallas, Curio Collection by Hilton opened in the heart of the Dallas Arts District.

- In August 2020, the 165-room Kimpton The Pittman Hotel opened on the fringe of Deep Ellum.

- In November 2020, the 219-room Thompson Dallas opened in the heart of downtown within The National, an urban adaptive-reuse project.

- The 255-room Marriott Uptown Dallas opened in March 2021; the hotel is within walking distance of Katy Trail.

- Following their acquisition of the property in September 2022, the new owners of the Rosewood Mansion on Turtle Creek (HN Capital Partners) are planning additional upgrades, following the significant renovations completed in 2020, to preserve the history and appeal of this landmark property.

- The 267-room JW Marriott Dallas Arts District Hotel is expected to open in the spring of 2023; the hotel will be the first JW Marriott-branded hotel in the Metroplex.

- The 134-room Hôtel Swexan is set to open in the summer of 2023 within the 19-block Harwood District.

- The Ritz-Carlton Dallas is currently undergoing a $22-million renovation, while the W Dallas Victory is undergoing a $21-million renovation.

- The 325-room Magnolia Hotel is expected to be converted to a luxury Hilton brand following a $65-million renovation and expansion project; the room count is expected to be reduced to 270 with the conversion.

- A new-build, 240-room Four Seasons is planned to open along Turtle Creek; the project is anticipated to include residential condos.

- A 260-room dual-brand AC Hotel by Marriott/Moxy is planned for Uptown; the project includes a rooftop bar.

- An InterContinental Hotel is under development within the existing Cityplace Tower.

- The Lumen will transition into the Graduate Dallas; the brand is a collection of properties located in college towns across the U.S.

- The planned Knox Street and Newpark Dallas large-scale, mixed-use developments are both anticipated to include hotel components.

Greater DFW Area

Outside the Downtown Dallas core, the northern suburban area remains a hotspot for new construction, particularly in Frisco and Plano. Most notably, PGA of America recently completed construction of its headquarters in a 600-acre, mixed-use development in Frisco's North Platinum Corridor. After the area welcomed the Omni Frisco Hotel and the Renaissance Dallas at Plano Legacy West in 2017, a 303-room Hyatt Regency opened in 2020 at the Stonebriar Centre shopping mall. Multiple mixed-use developments are planned or under construction near the PGA site or near the State Highway 121/Dallas North Tollway interchange, including within Plano and The Colony. Many of these developments are planned to include upper-upscale or luxury hotels. Recently announced projects include a Ritz-Carlton and Autograph Collection by Marriott at Fields West, a Dream Hotel at Firefly, and HALL Park’s Autograph Collection Hotel. Furthermore, a sampling of notable full-service hotel projects in the greater DFW area is listed below.

Grapevine

- The 120-room Hotel Vin, Autograph Collection affiliate opened within Grapevine Main in 2020; a 120-unit expansion is already planned.

Southlake

- The Delta Hotels by Marriott Dallas Southlake, located east of White Chapel Boulevard along State Highway 114, opened with 240 rooms in 2020.

- The Westin Southlake opened with 261 rooms in 2021, along the north side of State Highway 114, east of Carroll Avenue.

Fort Worth

- In 2020, The Sinclair, a Marriott Autograph Collection affiliate, opened with 164 rooms; the restored boutique hotel features advanced technology for a customized guest experience and energy conservation.

- The Hotel Drover, Autograph Collection affiliate offers 200 rustic-luxe rooms and suites and is an integral part of Fort Worth’s Mule Alley redevelopment in the Stockyards; the hotel opened 2021.

- The Kimpton Harper Hotel, an adaptive reuse from an office building, debuted Downtown in 2021 with 226 rooms.

- In 2022, the 245-room Sandman Signature opened in Downtown’s historic Waggoner Building; this hotel is the second Sandman Signature property in DFW and nationwide.

- Within the Cultural District, a 200-room luxury hotel is under construction as part of the Crescent mixed-use development; the hotel is set to open mid-year 2023.

- The under-construction Bowie House Hotel, managed by Auberge Resorts Collection and set to open in 2023, will feature 106 rooms within the Museum District.

- The 189-room Le Méridien Fort Worth is a redevelopment of the 13-story historic building formerly known as the Hotel Texas Annex; the opening is planned for late 2023.

- A 400-room expansion is planned for the 618-unit Omni Fort Worth Hotel; completion is expected by 2026.

- An additional convention hotel with around 1,000 rooms has been proposed with the redevelopment and expansion of the Fort Worth Convention Center.

Roanoke

- A 266-room Peabody Hotel and Convention Center is planned for a site next to Roanoke's city hall.

Rowlett

- Sapphire Bay, a unique waterfront destination development underway on the shores of Lake Ray Hubbard, is planned to offer multiple hotels, including a 500-room resort and a Compass Hotels by Margaritaville.

Las Colinas/Irving

- Set to open in late 2023, a 168-unit Embassy Suites by Hilton is under construction adjacent to Las Colinas Village, near Walnut Hill Lane and State Highway 114.

- A 150-room Hotel Indigo is under construction on the western edge of Las Colinas Urban Center, between State Highway 114 and the Mandalay Canal.

- The Las Colinas Resort (former Four Seasons Las Colinas) is expected to undergo a $50-million renovation as part of its rebranding to a Ritz-Carlton.

Arlington

- In 2019, the 300-room Live! by Loews opened as part of the Texas Live! dining, entertainment, and hospitality district between the Texas Rangers’ Globe Life Field and the Dallas Cowboys' AT&T Stadium. An adjacent 888-room Loews Arlington Hotel and Convention Center is under construction and is set to open in 2024.

Looking Forward

The outlook for the greater Dallas area is optimistic as the region continues to offer an inviting business climate that encourages growth in all sectors. Although occupancy levels remain below 2019 levels, average rates in the Metroplex have increased significantly since the low point in 2020, with market ADR reaching a new all-time peak. Commercial and group demand increases are expected to accelerate throughout 2023. Overall, the Dallas lodging market is well positioned for long-term growth.

For more information, contact Kathleen Donahue of the HVS Dallas office.