Hotel Market Beat 2023 Q1 - Europe

Robust Investment In European Hotels in Q1 2023 Sets the Scene For An Active Second Half Of The Year

- €4.1 billion transacted over 154 properties, comprising 16,817 rooms

- Continuedstrong appetite for resort hotels, accounting for 22% of transactions

- Robust performance recovery and constrained supply growth driving the positive investor sentiment

- Vendor and buyer expectations set to converge in the coming months, raising the prospect of an active H2 2023

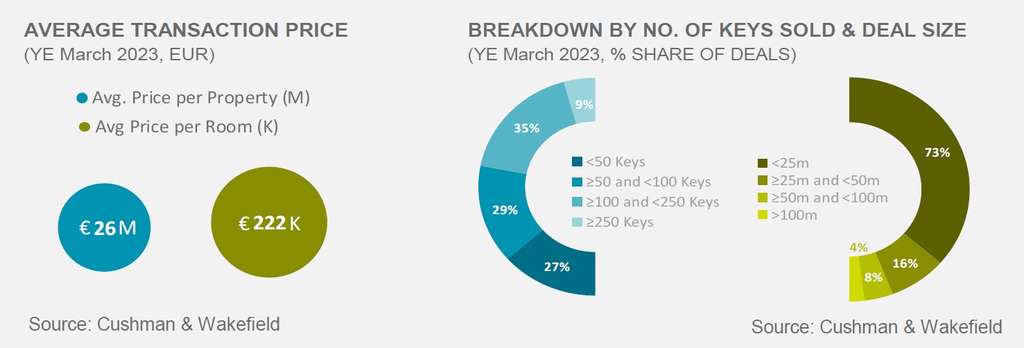

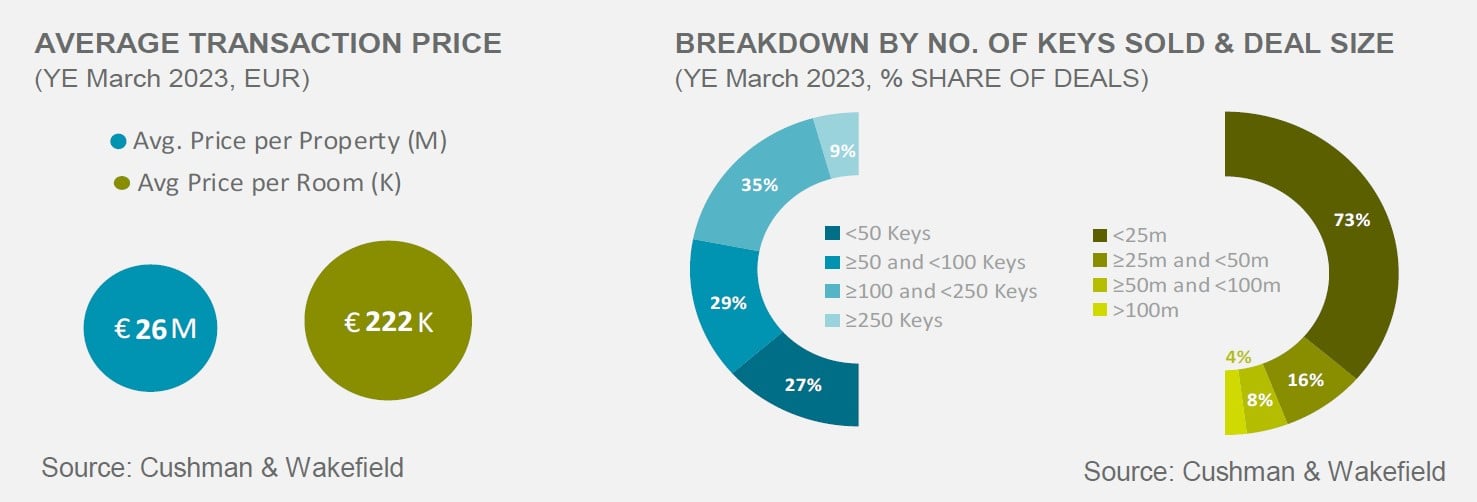

London, June 16, 2023 – Europe experienced healthy hotel investment activity with €4.1 billion transacted in Q1 2023, according to global real estate services firm Cushman & Wakefield. This represents an 18% increase on Q1 2022 despite high financing costs and economic and geopolitical concerns.

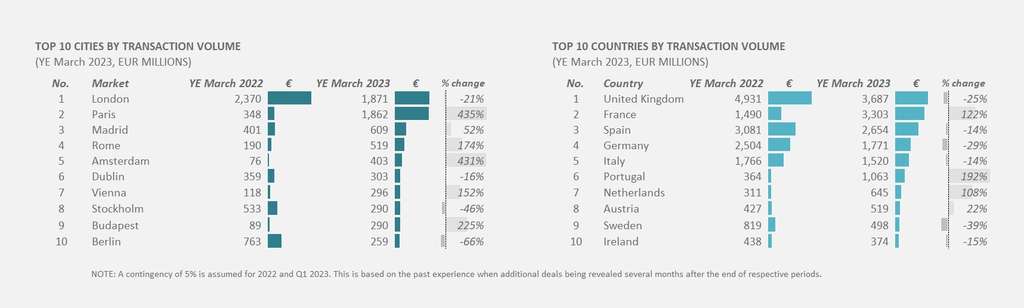

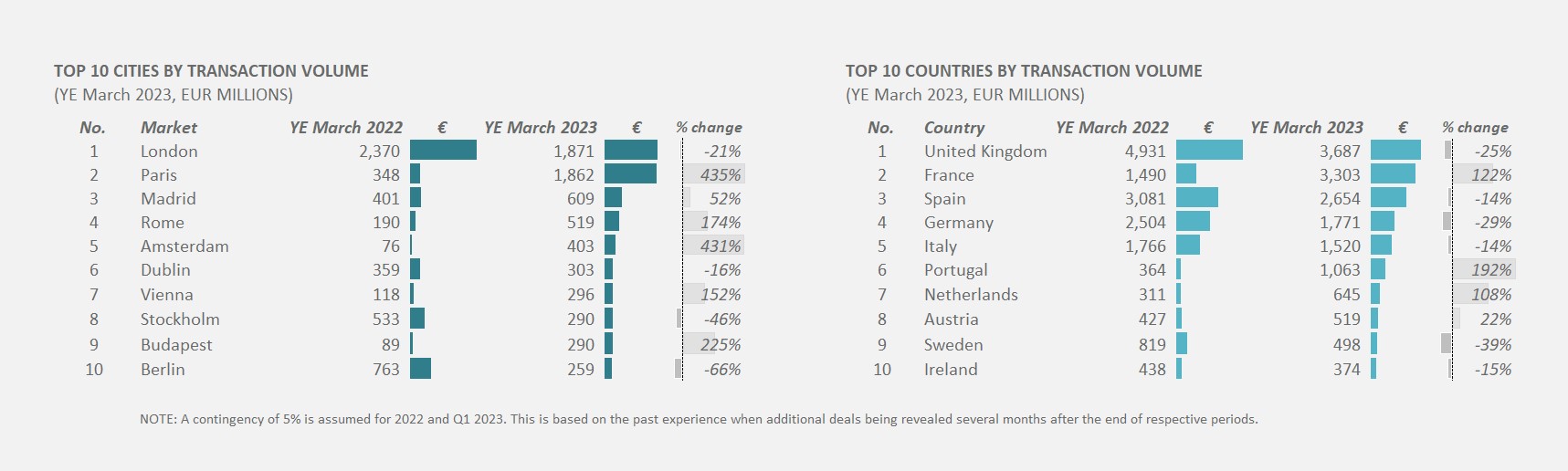

Several major deals drove this strong growth, including the sale of Westin in Paris, Mandarin Oriental in Bodrum and Le Richemond in Geneva. Nevertheless, investment activity on a 12-months basis – which smooths the impact of unusually large deals – shows hotel transaction volumes in Europe grew by about 3% for the running 12 months ending Q1 2023, compared with the running 12 months ending Q1 2022. The UK, France and Spain were the most attractive markets, accounting for 52% of transactions. In terms of the key urban markets, London continues to be on the top of the list for investors followed by Paris and Madrid. Most funds came from European buyers (76%) while the Middle East was the fastest growing source of capital (up by 142%). Upscale and Upper Upscale hotels accounted for half of Q1 2023 transaction volumes, with resorts continuing to be in high demand from investors.

Borivoj Vokrinek, Strategic Advisory & Head of Hospitality Research EMEA at Cushman & Wakefield, said: “Resorts continued popularity among investors is underpinned by the strong recovery of leisure demand, long-term growth potential and constrained supply growth. Overall, resorts accounted for 22% of total transaction volumes in Q1 2023, and 28% when looking at data on 12-months running to March 2023. This is notably more than before Covid-19, when this type of hotel accounted only for about 13% of total hotel transaction volumes in 2019.”

The positive investment sentiment towards hotels is supported by a strong recovery performance, with Revenue Per Available Room (RevPAR) for the whole of Q1 2023 already overpassing 2019 levels by nearly 13%. This was driven by a robust increase of hotel room prices across Europe, with Average Daily Rate (ADR) rising 19% above 2019 levels.

The greatest RevPAR increases were recorded in Lithuania, Turkey, Ireland, Croatia and France, with Paris, Belgrade, Istanbul and Vilnius being the key urban markets in Europe experiencing the strongest RevPAR growth in Q1 2023 relative to Q1 2019.

Frederic Le Fichoux, Head of Hotel Transactions, Continental Europe at Cushman & Wakefield, said: “The hotel sector stands out as the only property segment experiencing growth in transaction volumes in Europe. While many other real estate sectors are facing structural challenges and softening occupational demand, hotels continue to outperform the expectation across most markets. Indeed, the sector’s rapid rebound after the pandemic and strong performance registered over the past year combined with the strong long-term demand fundamentals underpinning the potential of healthy investment-returns, is increasingly attracting new investors to the sector that are reassessing their fund allocations and long-term investment strategies. The ‘hotelisation’ of the overall real estate industry is helping these non-traditional hotel investors to better understand hotel investments and future upsides generated by this asset class. This coupled with the return of traditional hotel investors from Middle East and Asia is rising prospects for increased transaction activity in coming months.”

Investors also appreciate the relatively low supply growth within the hotel sector, that was below 2% in 2022. Going forward the development pipeline is expected to remain hampered by rising construction costs and a high interest rate causing delays and cancellations. While more openings are expected in 2023 (such as The OWO, Raffles in London, Six Senses in Rome and One & Only Aesthesis in Athens), the overall hotel pipeline in Europe is relatively moderate, with sector growth expected to remain below 2.5%.

While single asset transactions have been the focus of investors over the past months, we see a resurgence of portfolio deals. Several are already on the market such as Centre Parcs portfolio in the UK, Tryp portfolio in Spain, Landsec portfolio comprising 21 hotels in the UK and most recently Travelodge chain with 595 hotels across the UK, Ireland, and Spain.

Looking ahead, the recovery of transactional activity is expected to be bolstered by the stabilization of inflation rates, offering a clearer outlook and the prospect of a moderation in interest rates. Furthermore, there is mounting pressure on some owners to sell due to challenging refinancing terms or high capital expenditures, with some funds also facing redemptions and needing to dispose assets. On the buyer side, the key drivers are the improving performance, the weight of dry powder and decompressing yields (on average up by about 70bps in Q1 2023). These factors should contribute to a narrower bid-ask spread and facilitate the successful completion of transactions.

Jonathan Hubbard, Head of Hospitality EMEA at Cushman & Wakefield, said: “Whilst the headline figures indicate a positive hotel investment market, activity is undoubtedly being held back across Europe by increased debt costs and inflationary cost pressures. This has resulted in a degree of investor caution. Nonetheless, investment activity is expected to gain momentum in the second half of the year, supported by continued performance recovery compensating for decompressing yields, the need among many investors to deploy capital and pressure on some owners to deleverage or address fund redemptions. Hotels remain an effective hedge against inflation which, combined with the return of international capital and pricing consensus, should support activity within the sector”

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 52,000 employees in over 400 offices and approximately 60 countries. In 2022, the firm had revenue of $10.1 billion across core services of property, facilities and project management, leasing, capital markets, and valuation and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.