STR Weekly Insights: 22-28 October 2023

Countries included: China, El Salvador, Fiji, France, Serbia, United Arab Emirates, United Kingdom, and the United States.

U.S. Performance

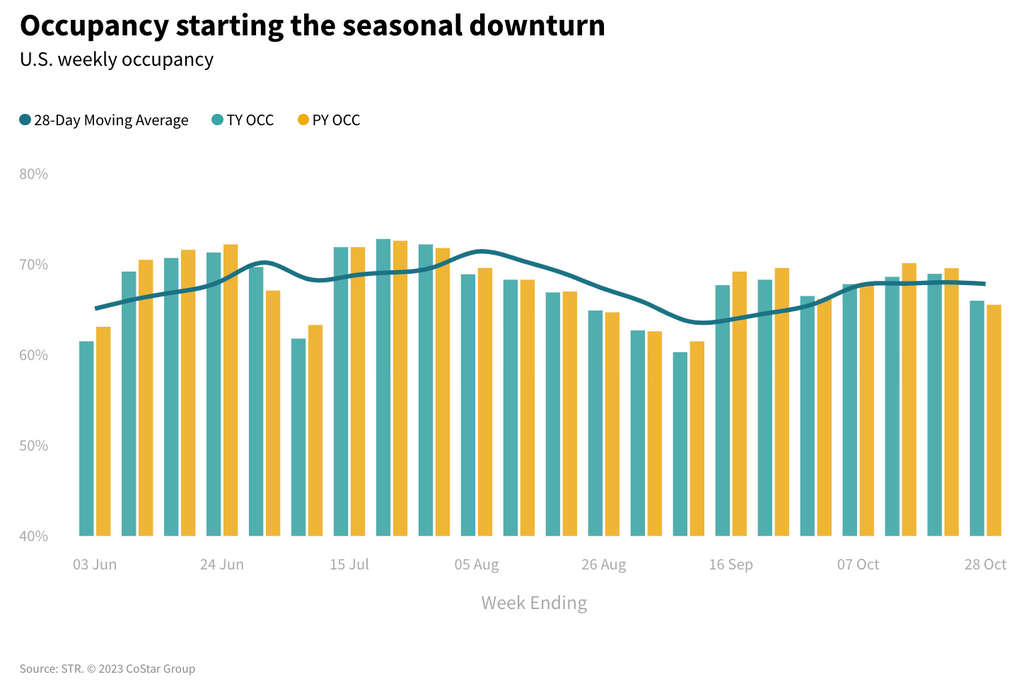

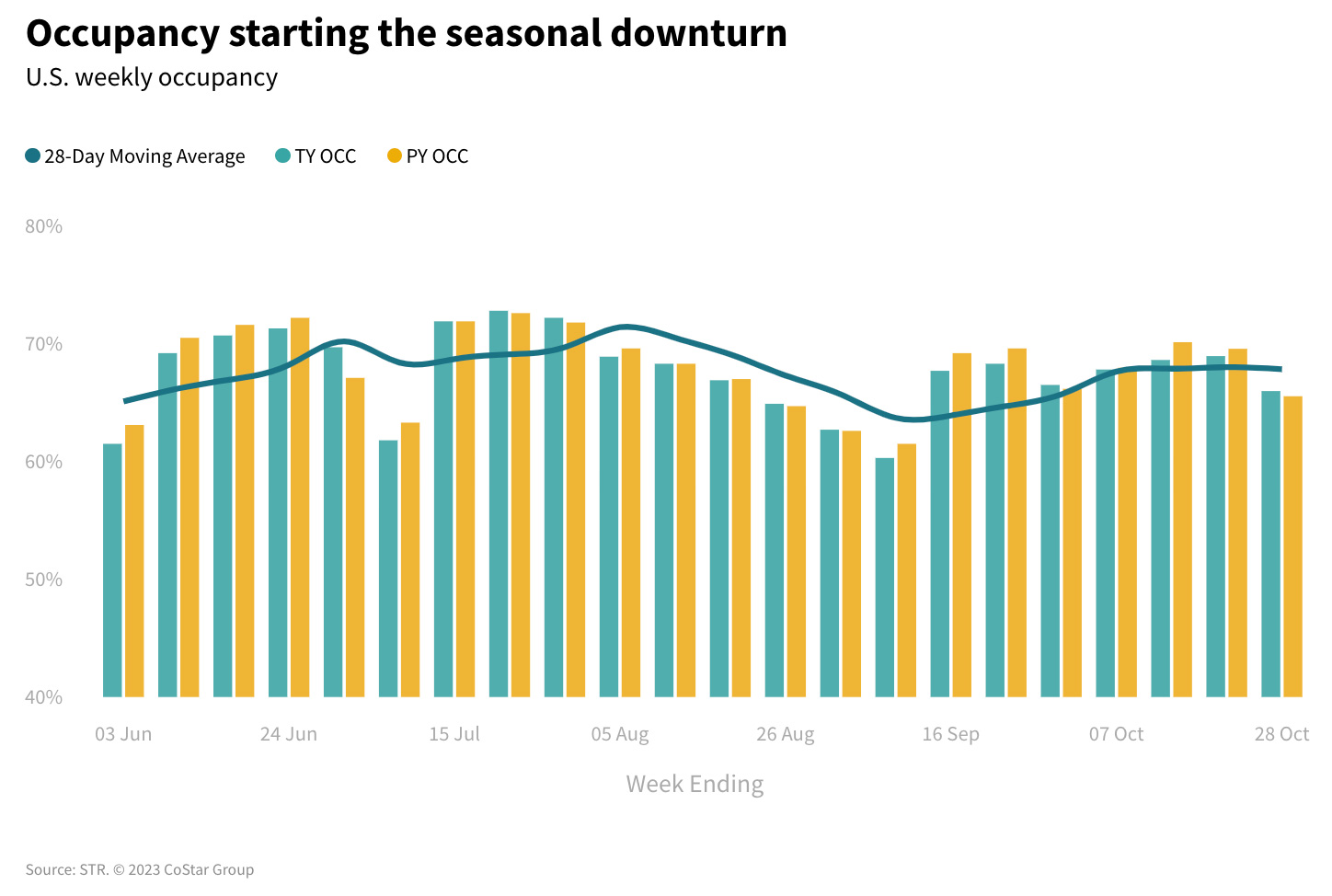

U.S. hotel industry occupancy increased 0.4 percentage points (ppts) compared to last year, reversing the course of year-over-year (YoY) declines of the previous three weeks. Weekends delivered the strongest gains (+1.0ppts) followed by weekdays (Monday – Wednesday: +0.6 ppts). The shoulder days (Sunday and Thursday) were down 0.4ppts. This strong weekend performance was possibly buoyed by early Halloween festivities given that the actual holiday fell in the following week on a “school night” (Tuesday). Average daily rate (ADR) increased 3.9%, the sixth consecutive week above 3%, with weekdays showing the greatest increase (+4.5%) followed by weekends (+3.9%) and shoulders (+2.8%).

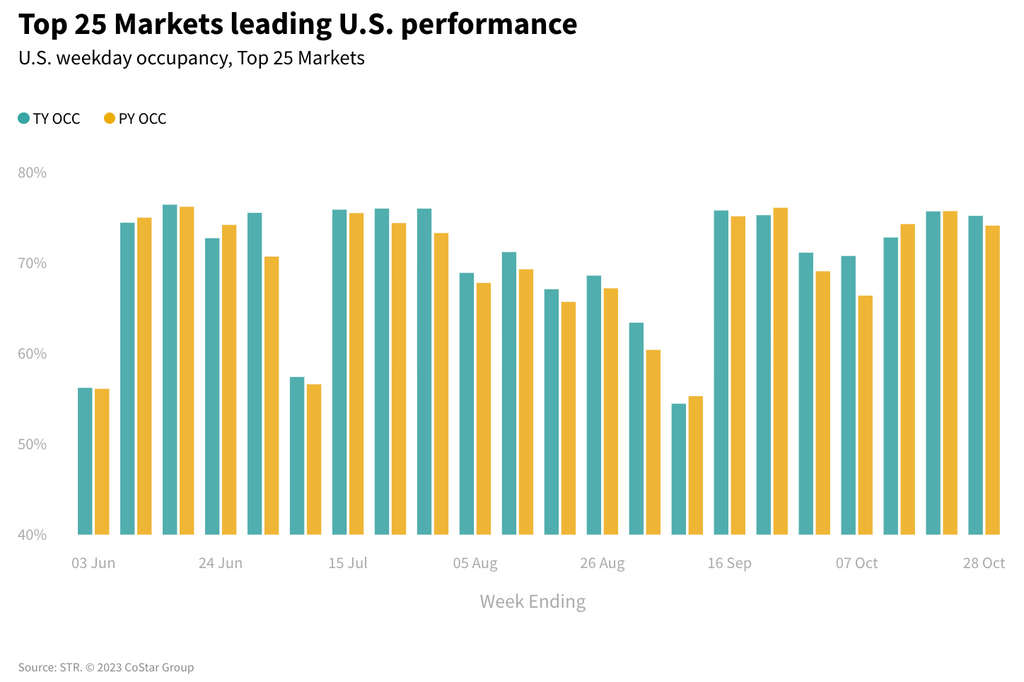

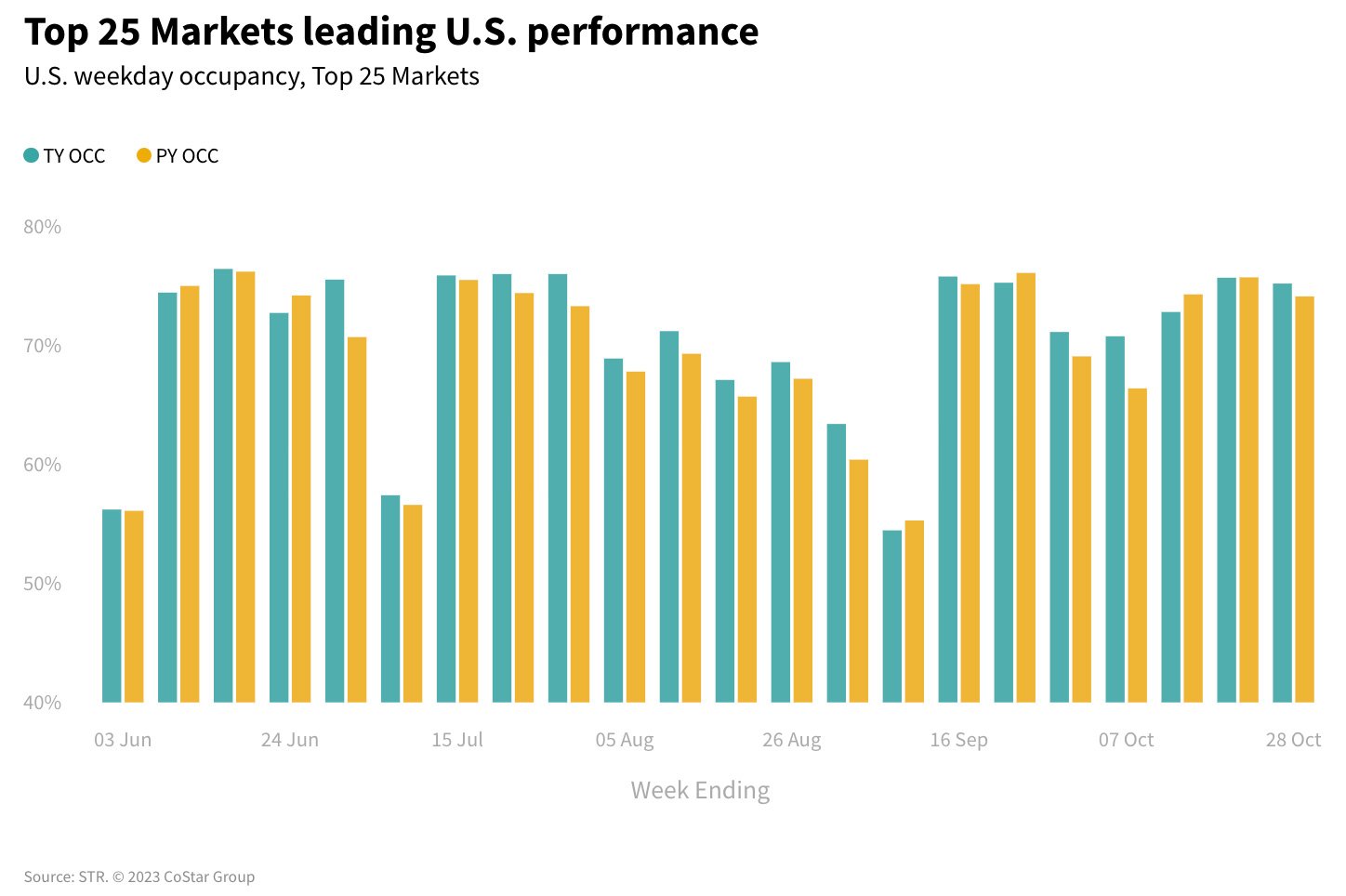

Revenue per available room (RevPAR) was up 4.6% versus a year ago, which was the highest growth rate of the past three weeks and among the highest of the past 25 weeks. Over the past six weeks, 60% of the industry’s revenue gain has come from weekdays with the Top 25 Markets contributing as much as the remaining 143 markets. This provides further evidence that business travel is recovering on the back of conferences and group meetings.

Weekdays and weekends were solid in the Top 25 Markets. Compared to last year, occupancy increased 1.3ppts and 1.1ppts for weekends and weekdays, respectively. Shoulders were softer, increasing only 0.4ppts. While occupancy was strongest on the weekend, ADR increased the most on weekdays (+5.4%), resulting in a weekday RevPAR gain of 6.9%. Weekend ADR grew 4.0% with RevPAR up 5.8%, shoulder day ADR increased 3.3% and netted a RevPAR increase of 3.9%.

In the remainder of the country, performance was subdued with occupancy increasing less than one percentage point over the weekend and weekdays while decreasing on shoulder days. ADR was a bit healthier: +3.7% weekend, +3.4% weekday, and +2% shoulder.

Three Top 25 Markets, New York City, Las Vegas, and Boston, continued to report strong performance with occupancy above 85% for a third consecutive week and double-digit ADR growth These three markets also posted the highest weekday and weekend occupancies of all Top 25 Markets. Other markets seeing strong weekday occupancy at or above 80% included San Francisco, Washinton D.C, and Nashville. ADR in these markets also showed strong growth. Austin led the non-Top 25 Markets as occupancy reached 82.4.

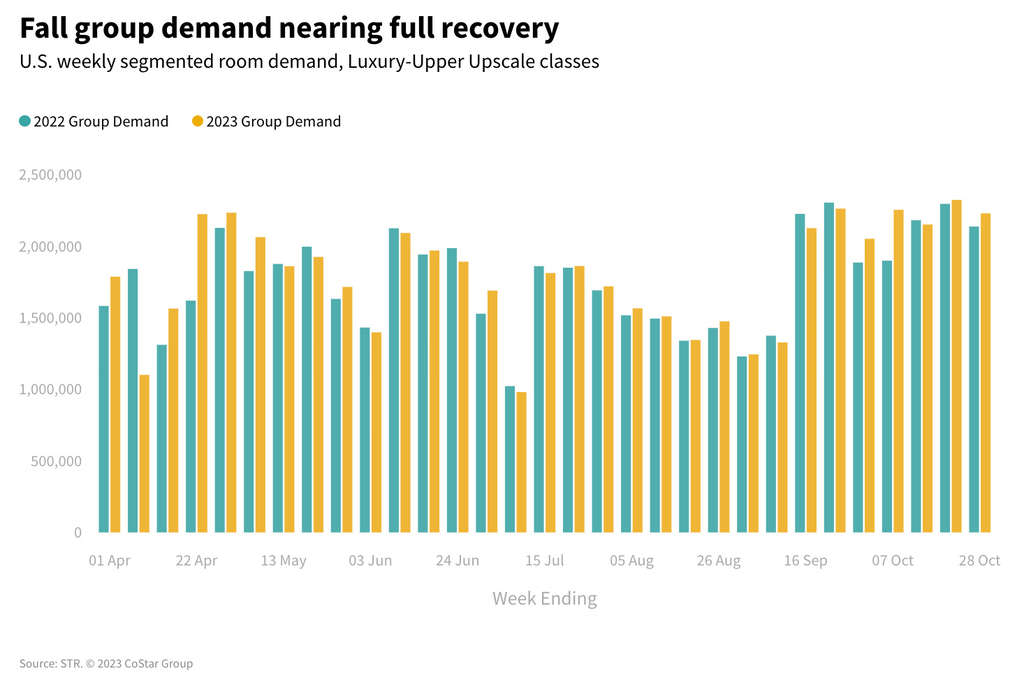

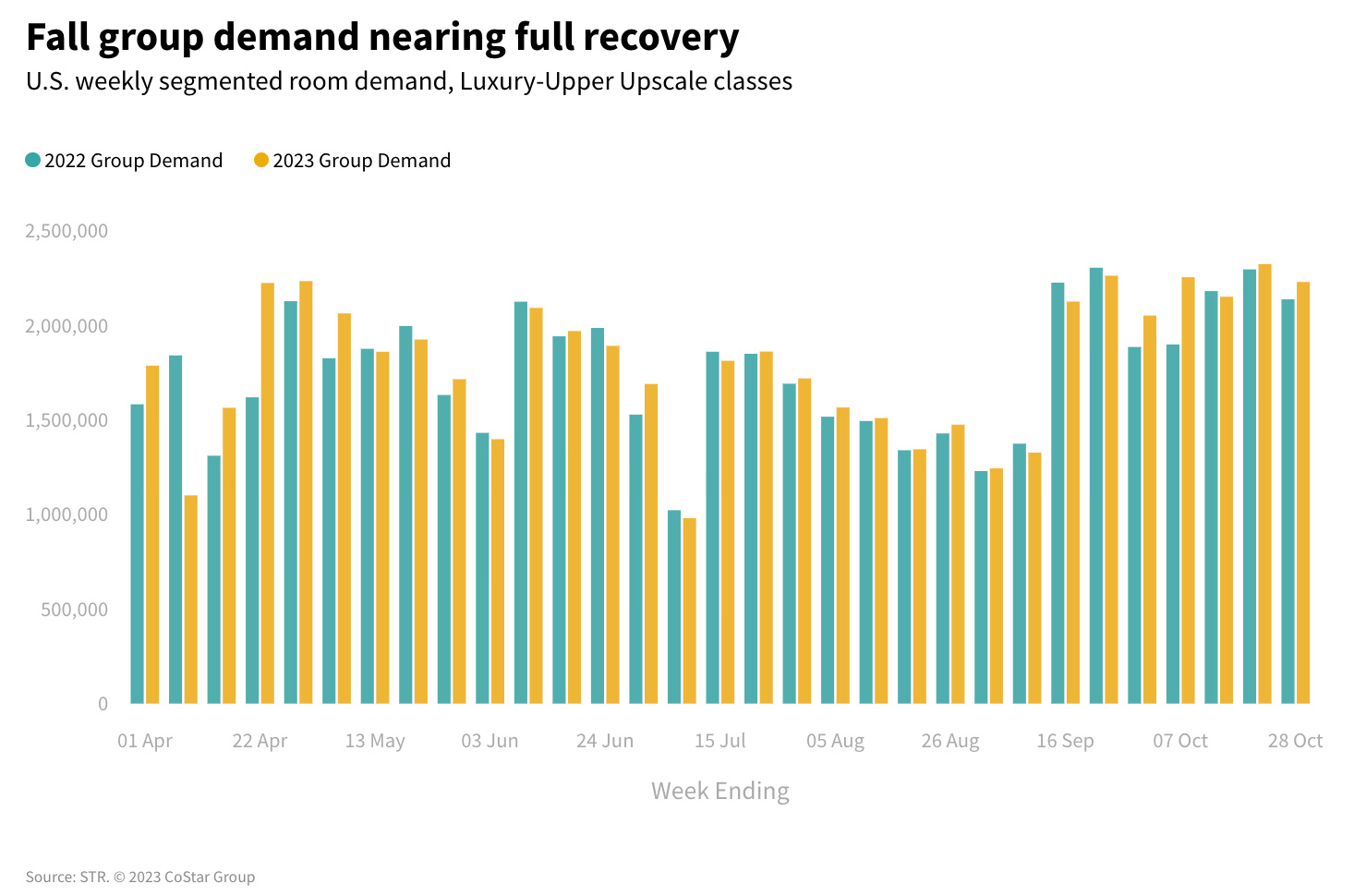

Group demand among Luxury and Upper Upscale hotels rose 4.3% YoY while dipping slightly from the prior week’s post-pandemic high. Since Labor Day, group demand has increased 3.1% YoY on average. When compared to the same post-Labor Day period in 2019, group demand is down 1.5% with occupancy down 1.9ppts. Group ADR for the most recent week was US$259, increasing 4.5% YoY. After adjusting for inflation, ADR was up 2% versus 2019. As the fall conference season winds down, group meetings and events are well on the road to recovery. Top 25 Markets seeing the largest gains in group of 5ppts or more included San Francisco, Atlanta, St. Louis, and Washington D.C. Among key markets, only Oahu surpassed 2019 group levels over the past seven weeks.

Luxury, Upper Upscale and Upscale class hotels all experienced strong weekend performance with YoY occupancy increases of 3ppts or more. Weekend ADR growth was healthy for Upscale class hotels (+4.3%) and more moderate for Upper Upscale (+2.3%) and Luxury (+1.1%) class hotels. Upscale and Upper Upscale hotels posted strong weekday occupancy gains of +3.7% and +3.1%, respectively, with all three upper-tier hotel classes recording weekday ADR increases of +3%. Upper Midscale class hotels generally matched the overall industry increase in occupancy and ADR for both weekends and weekdays. Midscale class hotels were essentially flat, and Economy hotels saw falling occupancy across all days of the week with only slight ADR improvement.

Global Performance

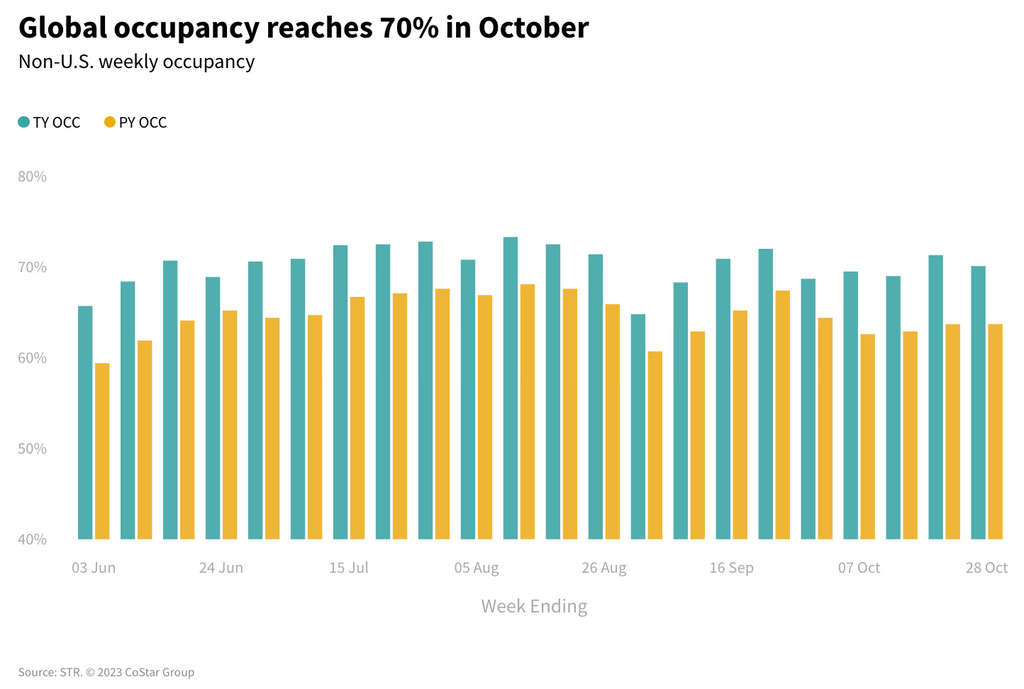

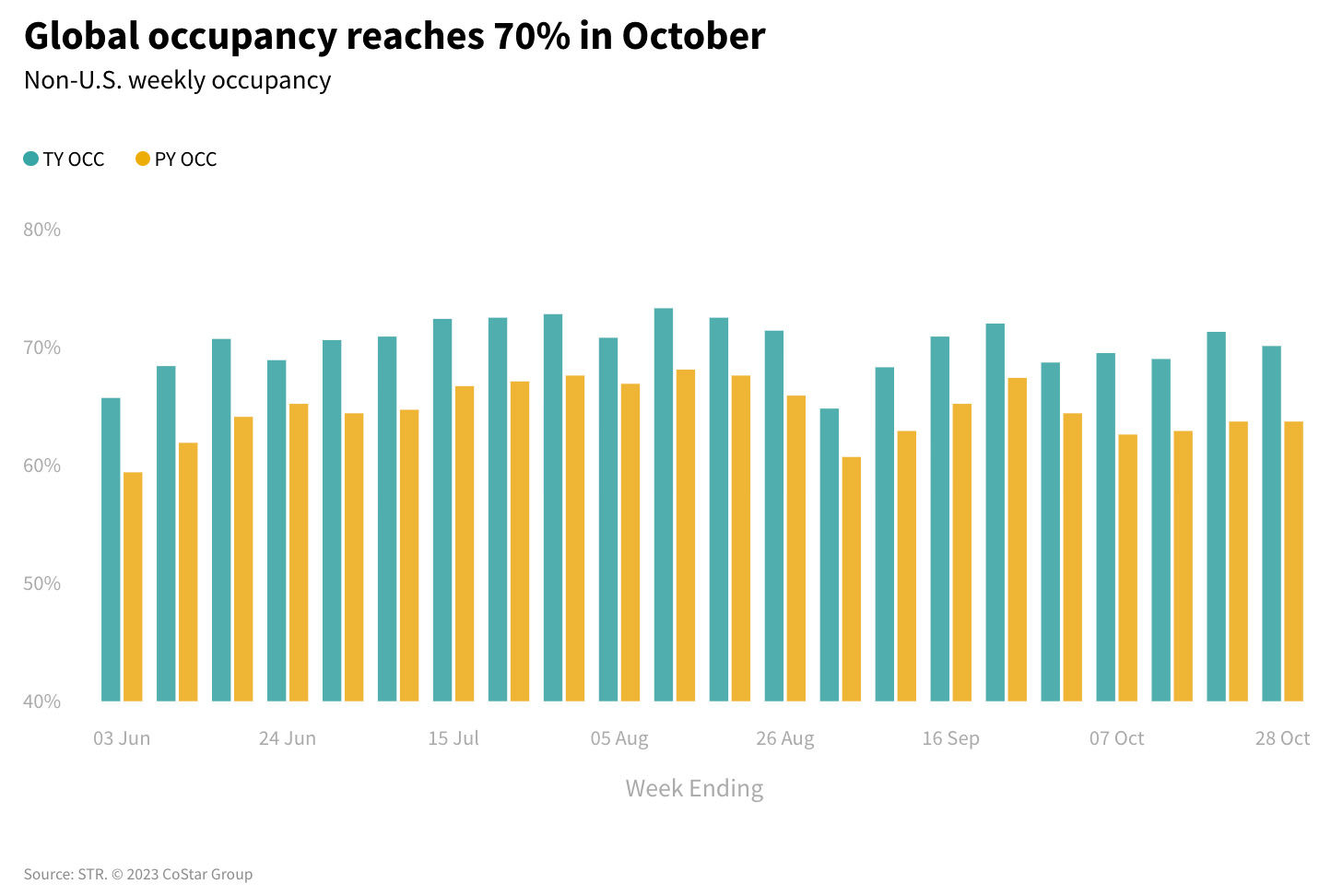

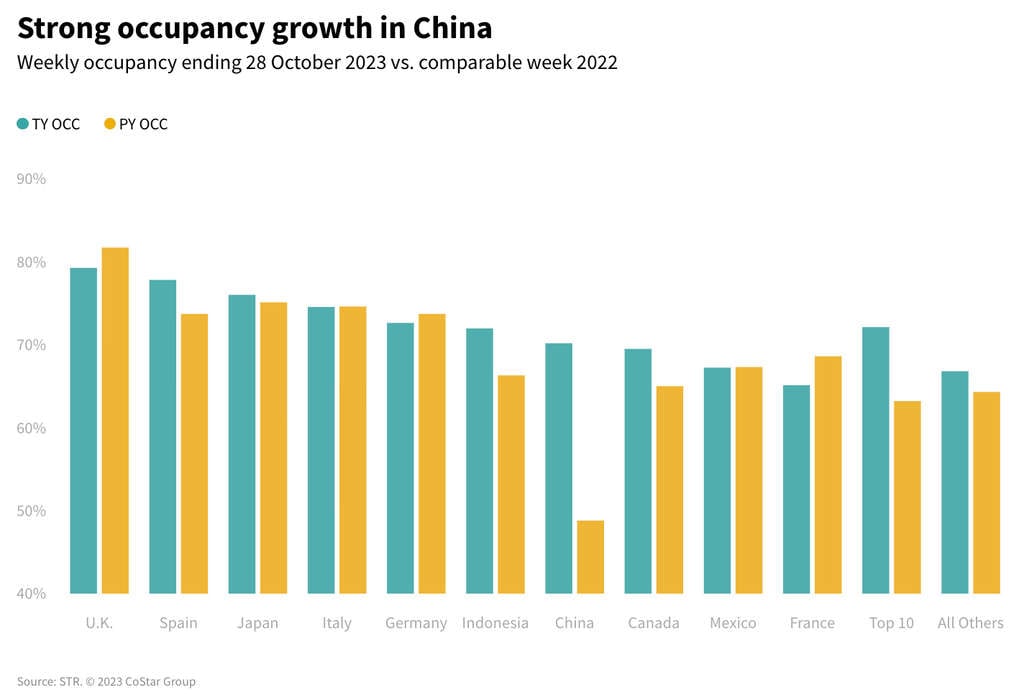

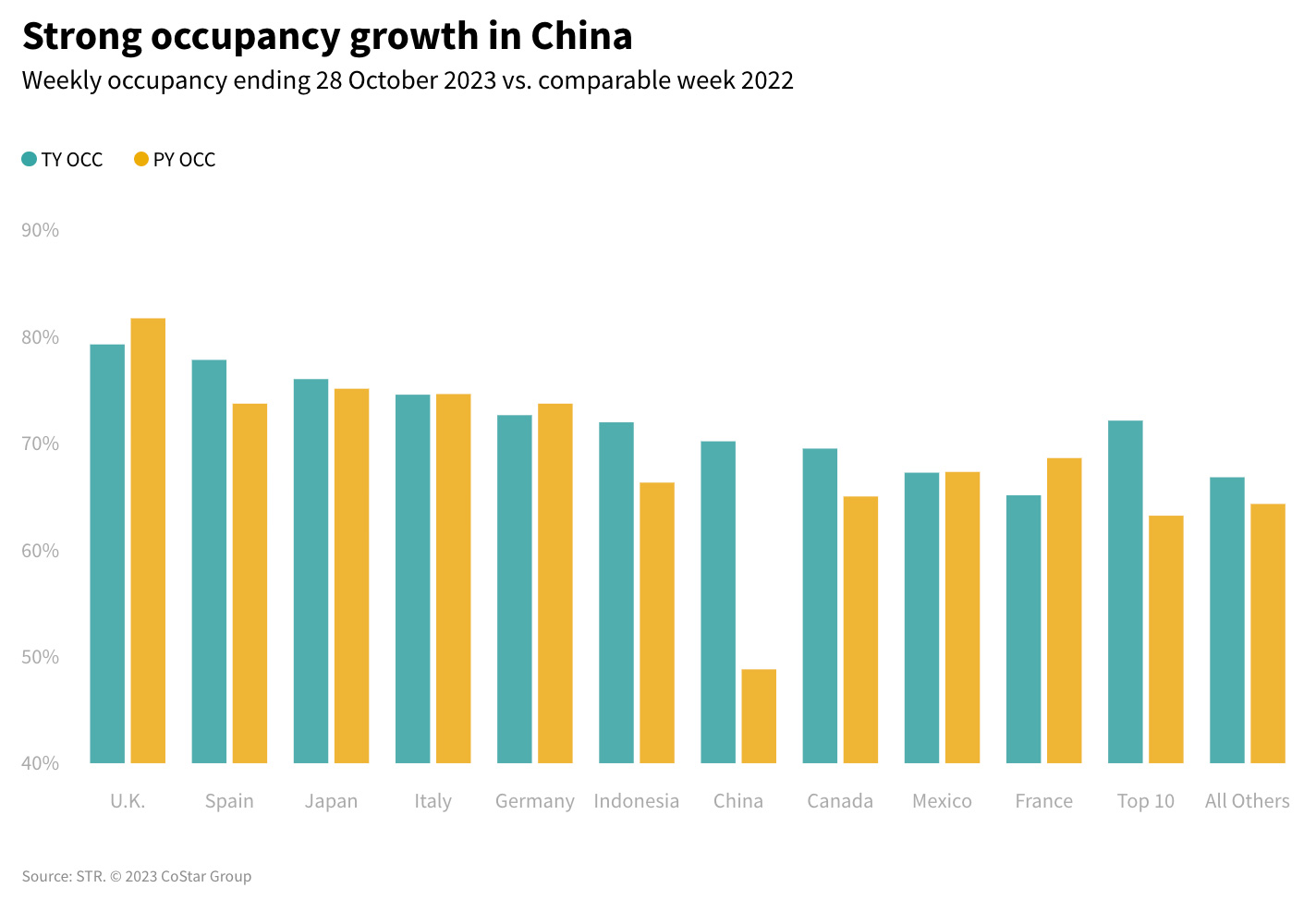

Global occupancy, excluding the U.S., remained just above 70% but was down from a week ago. As compared to a year ago, occupancy continued to reflect healthy growth (+6.4ppts). ADR and RevPAR also showed strong year-over-year gains (+8.9% and +19.9%, respectively).

Occupancy for the top 10 countries, based on total supply, was 72.1%, up 8.9ppts YoY. The gain in the top 10 was due almost entirely to China, where occupancy increased 21ppts YoY. Without China, occupancy would have been just slightly up. As has been the case for weeks, top 10 ADR (+9.3%) and RevPAR (+24.7%) showed strong growth year over year.

France saw the largest occupancy decrease among the top 10, down 3.5ppts YoY to 65.1%. The country held both finals of the Rugby World Cup at the Stade de France. While Paris saw mostly flat occupancy on the match nights (+0.5ppts & +0.2ppts), the days leading to those nights showed an average of -10.8ppts. Lyon and Marseille having hosted some of the earlier matches also in the finals week saw overall occupancy fall (-4.6ppts and -1.8ppts, respectively). Despite lower occupancy, ADR in Paris soared to US$581 over the weekend, up 47.2% YoY. Overall, ADR in France was up 13% YoY.

Outside of the top 10 the countries, occupancy was led by:

- Americas: El Salvador, 78.2% (+19.0ppts YoY)

- Asia Pacific: Fiji, 83.7% (+4.7ppts YoY). Fiji also had the highest occupancy of any country.

- Europe: Serbia, 79.3% (-5.2ppts YoY)

- Middle East & Africa: United Arab Emirates, 82.3% (+2.1ppts YoY)

Final thoughts

The U.S. hotel industry performed as expected driven by solid weekday growth, which was likely driven by conventions and group meetings ahead of the Halloween week along with increased business travel. The weekend growth was somewhat of a surprise and better than what it was a year ago, which we attribute to football games and other events. Also surprising this week was the year-over-year fall in year occupancy among key European countries like the U.K. Germany, France and Italy.

Looking ahead

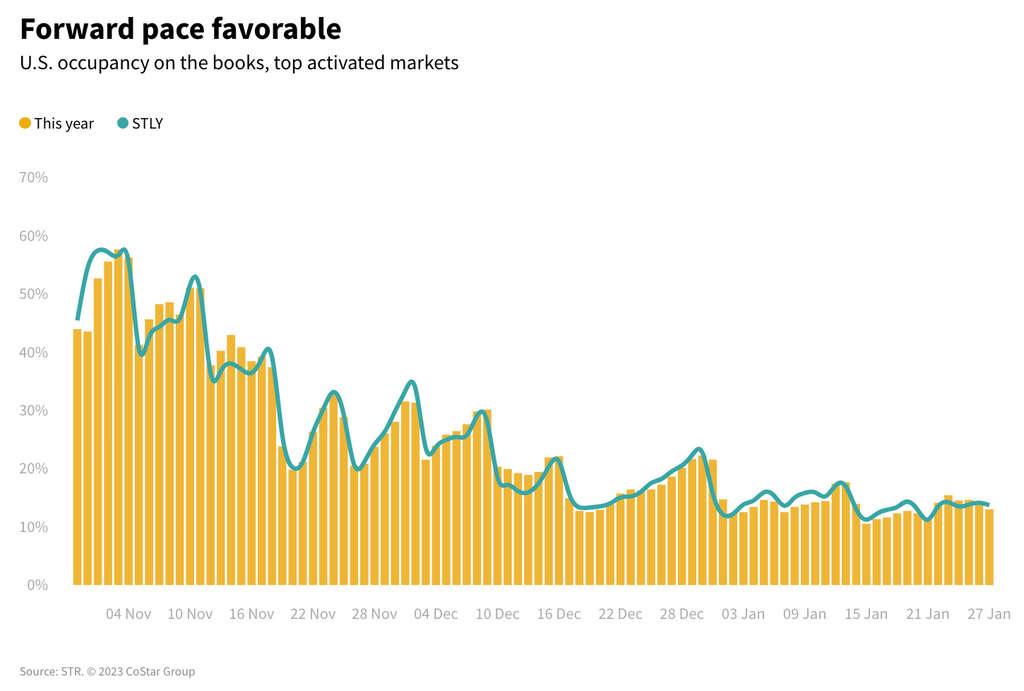

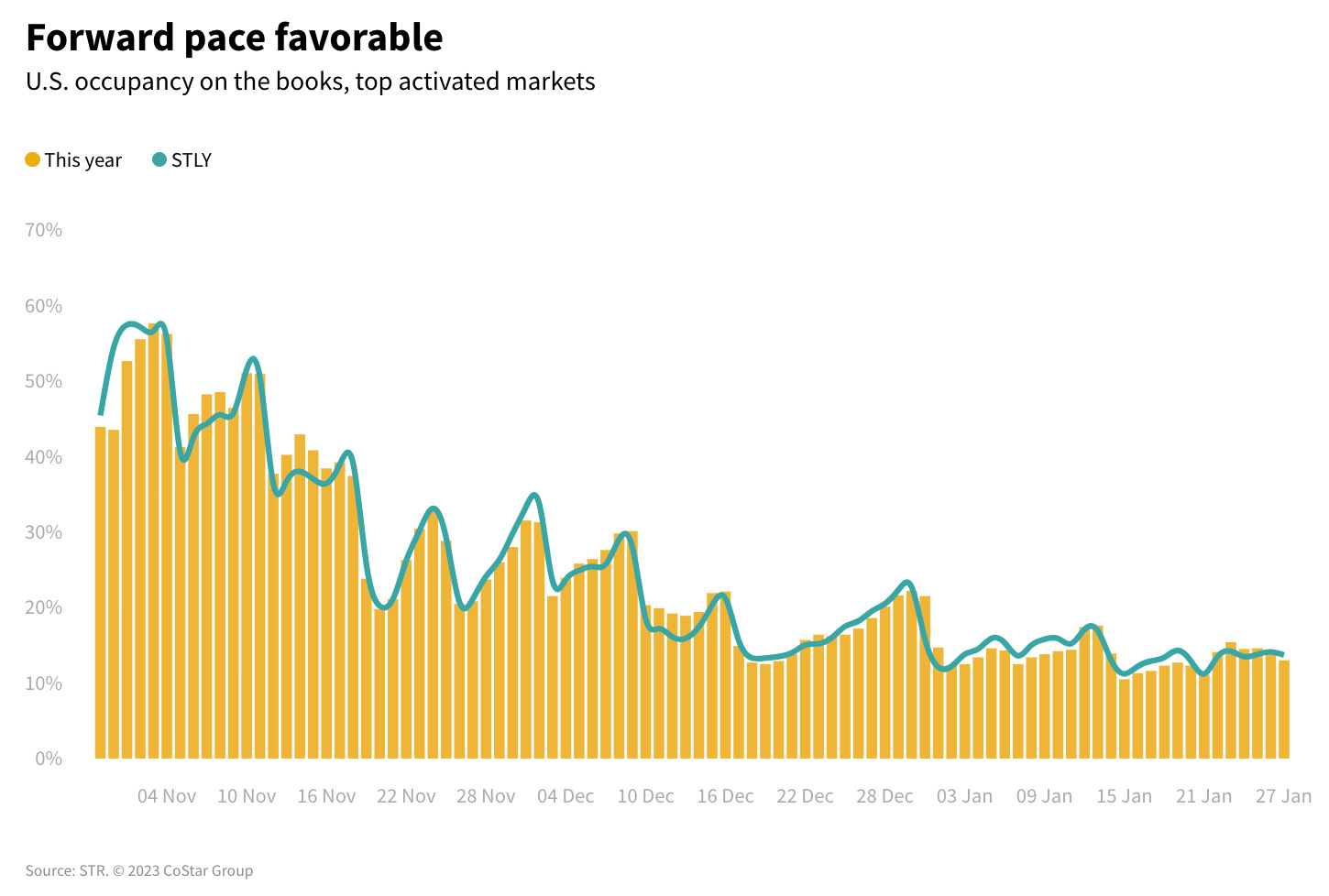

As we have been writing for the past two weeks, U.S. performance for the week ending 4 November will be weak due to the impact of Halloween, which fell on a Tuesday this year. We expect occupancy to be down ~8ppts year over year. The week following Halloween will see a recovery but it will be short-lived as Thanksgiving and the Christmas holiday season nears. Globally, performance will stay strong, but it too will begin to slow.

*Analysis by Isaac Collazo, Chris Klauda, Will Anns

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.