In Focus: Malaysia – A Rising Opportunity

Malaysia – Country Overview

Located in Southeast Asia, Malaysia comprises 13 states and three federal territories covering a total area of 329,847 square kilometres across Peninsula Malaysia and East Malaysia.

Malaysia's population is approximately 31.7 million (2016 government estimate) with 60% being of Malay heritage. The country's diversity is reflected in the share of different ethnic groups, such as Chinese, Indians and Indigenous, in its total population.

Kuala Lumpur, the administrative and commercial capital of Malaysia, is rapidly developing its service sector (banking and finance), IT and high-tech manufacturing industry to diversify from its historically strong oil and gas industry.

With significant efforts made to attract multinational companies to Kuala Lumpur resulting in newly generated job opportunities, Greater Kuala Lumpur's (or Klang Valley's) population is expected to grow from 7.2 million in 2016 to 10 million in 2020.

Economy Highlights

From 2012 to 2016, Malaysia recorded a Compound Annual Growth Rate (CAGR) of 5% in real Gross Domestic Product (GDP) growth.

The expansion of the service sector, construction and manufacturing have strongly contributed to Malaysia's GDP growth in 2014.

Since 2015, Malaysia's economy has suffered from the decline in gas prices, being one of the biggest producers of liquified gas worldwide.

2016 was overall a difficult year for the world, as well as for Malaysia, which was impacted by weaker exports of electronic and electrical goods. Real GDP growth declined to 4.2% from the 5.0% previously achieved in 2015.

Employment

Impacted by the stalling economic growth, unemployment rose from 2.9% in 2014 to 3.5% in 2016.

Malaysia's implementation of the new minimum wage (+11% for workers in Peninsula Malaysia and +15% in Sabah, Sarawak and Labuan) from July 2016 onwards has raised some profitability concerns among various businesses as it could trigger less employment creation in the future.

International Relations

Malaysia's international relations are expected to strengthen in 2017 to 2021.

With joint infrastructure projects between Malaysia and Singapore and 14 Memorandums of Understanding signed between China and Malaysia with investments worth MYR144 billion, Malaysia's construction, agriculture, education and finance sectors are expected to grow rapidly.

Outlook

Due to weak world trade growth and the country's dependence on exports to the USA and China, Malaysia's economy is expected to grow its real GDP by 4.4% in 2017, a minor improvement compared to 2016 supported by its agriculture and service sector.

Adaptive monetary and fiscal policies during the period from 2017 to 2021 could strengthen private consumption, which will be the key force for GDP growth.

Infrastructure

Upcoming Developments

Malaysia has extensive plans to improve its accessibility. The proposed infrastructure projects highlighted below will not only improve the country's accessibility but will also strengthen Malaysia's economy.

Tourism Market Overview

Today, Malaysia is the 12th most-visited country in the world and the third most-visited country in Asia after China and Thailand. The Malaysian government has made great efforts to ensure that tourism plays an important role in the country's economy. In 2016, travel and tourism directly contributed MYR58 billion to the country's GDP equaling 4.7% of total GDP, according to the World Travel and Tourism Council's economic forecast.

International Arrivals

Tourism Malaysia's extensively promoted campaign 'Visit Malaysia' positively contributed to the country's 2014 international arrival numbers, which touched a record at 21.7 million. Impacted by the repercussions of two Malaysia Airlines incidents as well as severe haze observed towards the end of 2014, a 6% decrease was recorded in international tourist arrivals in 2015.

In 2016, however, foreign arrivals recorded an upward trend and a healthy rebound for the overall Malaysian market was observed as figures for international arrivals closed at 26.7 million, a 4% increase from 2015.

Tourist Receipts

In line with a decrease in total tourist arrivals, tourist expenditure dropped by 4% in 2015 to reach MYR69 billion.

Despite the decrease in total tourist receipts in 2015, average per capita expenditure increased by 2.4% to reach MYR2,687.While the average length of stay decreased significantly by 16.7% from 6.6 nights (2014) to 5.5 nights (2015), average spent per diem increased by 26% to reach MYR489 in 2015.

For the future, Tourism Malaysia has ambitious plans with a target of MYR114 billion in tourist receipts for 2017 and MYR168 billion for 2020. A total growth in tourist receipts of 143% from 2015 to 2020 is being aimed for.

- Asian countries account for 92% of international arrivals

- Strongest CAGR from 2009-2016: China with 10%, reaching 2 million arrivals in 2016

- Changes to Top 10 international arrivals:

- Highest 2016 Y-o-Y increase: Thailand with 26.4%

- Highest 2016 Y-o-Y decrease: Philippines with 18.6%, decrease for the second consecutive year

- UK is the strongest European country with 415,000 arrivals

- Saudi Arabia is the strongest Middle Eastern country with 0.5% share and 22.8% increase from 2015 to 2016

2020 Tourism Target

- Welcoming 36 million international passengers (expected 35% increase from 2016)

- Increasing arrivals from China to 8 million, a 300% increase from 2016, with support from Alibaba's Fliggy OTA, which has recently integrated Malaysian travel and tourism products to its e-commerce platform

Domestic Arrivals and Tourism Promotion

Domestic tourism dominates Malaysia's hotel market with 63.2% of total arrivals to hotels in Malaysia in 2015.

Five new domestic tourist information offices will replace the 14 recently closed Tourism Malaysia offices to better promote Malaysia amongst domestic tourists as well as to avoid job replication with state owned agencies.

Also, following the discontinuation of Malaysian Airline flights to Perth, New York, Stockholm and Johannesburg, Tourism Malaysia will shut-down these offices in 2017. However, plans to open new offices in stronger source markets such as China, India and European key cities are under review.

Hotel Performance

From 2011 to 2013, demand for Malaysian hotels remained stable despite the continued increase in tourism accommodation*. In 2014, however, the additional supply (+978 hotels) with 52,500 rooms (25% growth) could not be absorbed by the rising number of incoming tourists leading to a simultaneous drop in hotel occupancy and average rate.

The repercussions of the significant addition to supply combined with the Malaysian Airlines incidents impacted Malaysia's hotel performances even further in 2015 leading to a RevPAR decrease of 6%. While rate continued to decrease for the third consecutive year in 2016, occupancy gained 2 percentage points.

Malaysia's hotel performances had a solid start into the new year. With occupancy increasing by 2 points and ADR recording 4.8% increase, RevPAR in Malaysia was up 7% as of March 2017.

Hotel Supply

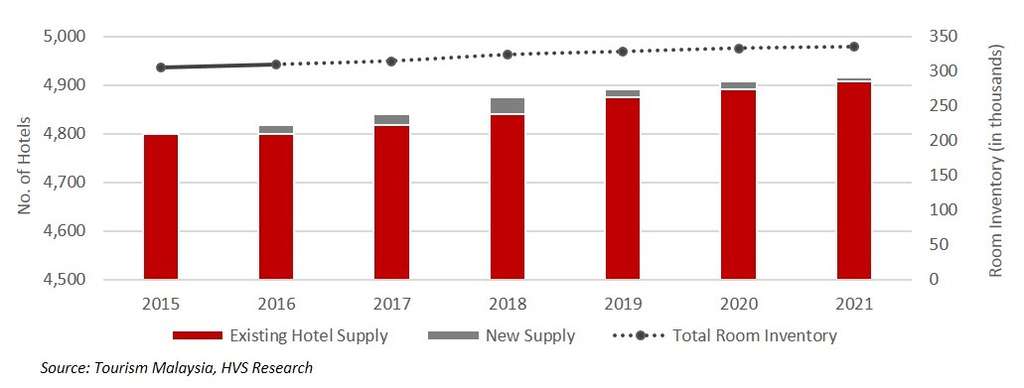

From 2015 to 2016, hotel supply in Malaysia increased by 18 classified hotels to reach 4,817 hotels and 309,369 rooms.

To accommodate the estimated growth in tourist demand projected for the upcoming years (as highlighted in Figure 3), a significant number of hotel projects is expected to enter the market.

As of April 2017, an addition of 98 hotels, with 25,537 classified rooms have been publicly announced for the period of 2017-2021.

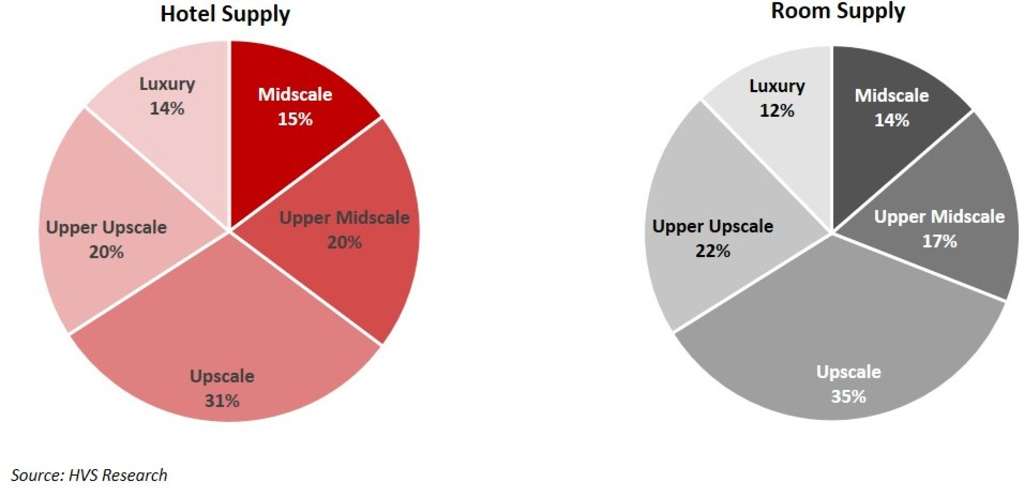

Classified Hotel Supply by Segment

Malaysia's upcoming hotel supply will re-shape the country's tourism accommodation.

Upscale and Upper Upscale hotels entering from 2017-2021 will account for 46% of total room supply, while this segment will dominate the new room supply with 53%.

While luxury supply shows an equal distribution amongst total hotels and rooms entering, we noted that the classified budget and economy segments are basically non-existent in Malaysia's hotel pipeline from 2017 to 2021.

Setting the focus on hotel openings by location, Malaysia's key business and leisure cities, as highlighted below, account for 55% of total future hotel supply and 54% of new room supply.

Lifestyle hotels and the need to adapt to the Millennial's travel behavior

The young hotel guest wants to enjoy local culture, design and stay connected – with high expectations on service quality.

The millennial generation's travel behavior and how hotel chains need to adapt to the new trends has been discussed at every major hotel conference.

The population of Millennials is surpassing that of the Baby Boomers. It has been estimated that by 2020 Millennials will comprise half of the global work force.

When it comes to choosing hotels, an underlying difference between the age groups is their spending power. While Baby Boomers allocate a higher share of their travel budget to the hotel, Millennials tend to spend less and look for accommodation offering great value for money.

With Millennials' increasing curiosity and enthusiasm for overseas travel despite their limited spending power, hotels face a new task to attract young travellers.

Millennials are greatly drawn to the idea of a unique and distinctive experience. For this young generation, travel implies the possibility to engage with local culture, learn about the history of a place and sample local food and drink.

Convenience and the ease of booking is a top priority for this segment of travellers. The rising number of mobile applications available to manage hotel reservations or to proceed with online check-in has changed the hospitality tech-world in the past three years. Applications centralising hotel bookings and transportation have especially gained in popularity.

Adapting to Millennials' expectations and today's world

Over the past 20 years, lifestyle brands such as W, Edition, Autograph and Indigo were created to cater to the rapid-changing travel behavior and guest demands.

These hotel brands have seen great success and solid growth rates across the globe. Their success, together with the need to adapt to a changing consumer economy, travellers' behavior and the trend towards personalised as well as sustainable travel, led to the launch of several new lifestyle brands in 2016.

Important trends when developing hotels in Malaysia

Adjustment to country: To cater to both domestic and international markets, international chains adapt hotel facilities to the local culture of the country to generate better results.

Choice of hotel brand:

With Malaysia's dense existing supply and upcoming projects, the affiliation, the classification and the design of the hotel need to be carefully selected to cater to the right customer.

Value for Money: Limited spending power does not necessarily mean lower expectations. Millennials in particular look for good quality hotels at a low cost.

Lifestyle brands: International operators feel that lifestyle-branded products will perform better in locations such as Kuala Lumpur, Penang and Malacca.

Quality of service: While high-tech lobbies and automated check-in counters are decorating hotel entrances, the presence of staff overseeing the check-in process and assisting when needed is still highly appreciated.

Experience: It is not only about a good night's sleep. Millennials are looking for a memorable experience influenced by decoration, architecture and photogenic views or objects.

Moreover, other generations, too, are placing increasing value on distinct experiences and actively seek them when travelling.

Investment

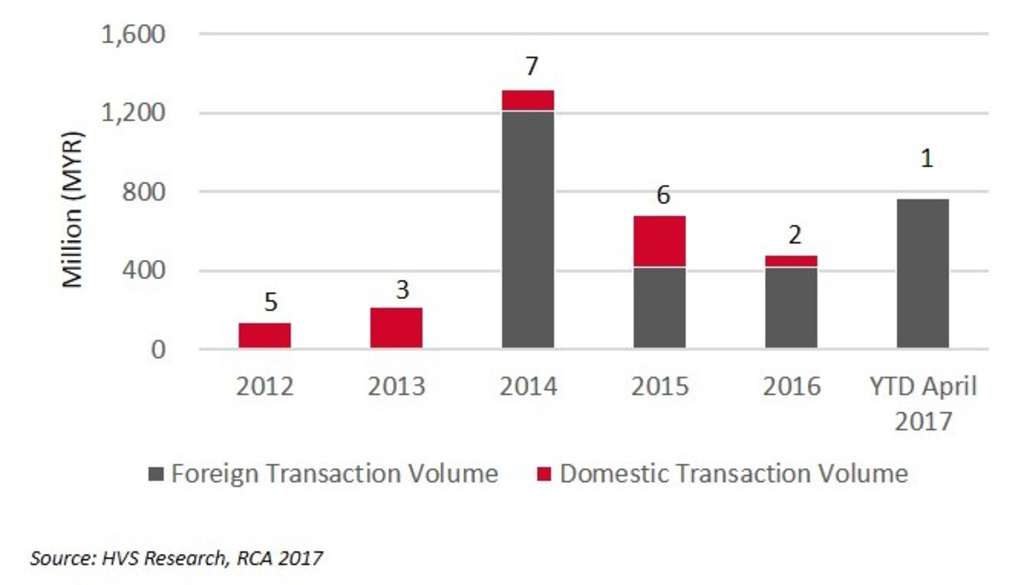

Between the period of 2012 and 2016, hotel investment in Malaysia (publicly available) peaked in 2014 recording a transaction volume of more than MYR1,300 million. Over the analysed period, the majority of hotel investments was transacted by foreign buyers, with the majority of sales occurring in the capital Kuala Lumpur.

The most recent noteworthy transaction:

The Renaissance Kuala Lumpur

- Transaction price of MYR765 million

- MYR840,660 per key

- Sold to Canali Logistics Pte Ltd.

Aloft Kuala Lumpur Sentral

- Transaction price of MYR419 million

- MYR868,670 per key

- Sold to Sino Prosper Group Holdings

Outlook

Malaysia's tourism target for 2020 is ambitious with the goal of welcoming 36 million international arrivals and generating MYR168 billion in tourist receipts, considering a recorded CAGR of 1.6% of international tourist arrivals from 2012 to 2016.

With the younger generation seeking cultural happenings and unique adventures, Malaysia can offer a unique experience from eco-tourism in rainforest reserves to heritage sites and upcoming theme parks such as the 20th Century Fox Park in Genting or the Ubisoft in Kuala Lumpur.

While Kuala Lumpur and its surrounding Klang Valley, Kota Kinabalu, Penang and Malacca are expected to mature with numerous hotels currently in the pipeline, Ipoh should not be overlooked.

Despite low rates and sporadic hotel development to date, Ipoh shows potential for Millennials travelling from Penang to Kuala Lumpur. With its revamped shophouses, new cafes and heritage buildings, Ipoh seems to be a city that millennial travellers are looking for: a cultural experience, unique architecture and good value for money.

Going forth, we expect the tourism industry in Malaysia to grow albeit at a slower pace. Existing hotels will feel the pressure from incoming supply in the next three years; however, we believe Malaysia has great potential to further develop its tourism industry, especially amongst millennials looking for new, more affordable lifestyle concepts.