Employee Benefits Reporting on Your P&L

When it comes to payroll we are not just paying the cash wages. We have additional dollars that are substantial in the form of supplemental costs and employee benefits.

So, what we want to have are three areas we can see and analyze in our financial statements:

- Cash wages

- Auxiliary wage costs - "supplemental"

- Employee benefits

Before I get into how to set these up and record them let's define what needs to go into each bucket.

Cash Wages

They are by far the most straight-forward. They include wages paid because of work being performed to all hourly and salaried positions. I wrote two separate detailed articles on how to classify the hourly and management positions; you can find both on my blog at https://hotelfinancialcoach.com/blog/.

When recording, be sure to only include real wages paid in this group and overtime wages, any contracted labor, modified work and training. We always want the cash wages section to reflect the total productive wages paid and not any other form of payroll. Keeping this "cash wages" section clean and recording the hours worked will allow us to measure productivity on our financial statements. This is golden.

Auxiliary wage costs - aka Supplemental

They are second in importance in payroll and are the trickiest to wrap your head around but once you do you will see why they need to have their own bucket on your statement.

Auxiliary wages are payroll costs that come directly because of the productive wages, "cash wages," paid. In most cases, you have no or very little discretion to pay them. The simplest form is payroll taxes.

Whatever jurisdiction you operate in, you are paying the government your employer share of some form of payroll tax and you have no control over its cost as it is a direct function of wages paid. This bucket also includes: severance costs, vacation, holiday, stat holiday, sick time, jury duty and any other form of employee compensation that you pay that is nonproductive payroll. You do not ever want to mix this up with the "cash wages," the productive payroll bucket.

Benefits

The third and final part we want to capture separately is benefits. Unlike auxiliary, benefits are costs that management and ownership have the discretion to pay or not, at some level. Items to include here are pensions, medical plans, employee meals, staff quarters, employee events, and any other benefit that is given to employees that are not required by local, provincial, state or federal governments.

Some items like health care are mandatory in some jurisdictions and not in others; put yours where they belong based on your local requirement.

The "what & why" idea of the three buckets is…

- to see the productive wages that are under management control (scheduling)

- to see the auxiliary costs that management cannot control beyond the values of No. 1

- to see the benefit costs that management has some discretion over

Now that we have the overall concept of how to slice and dice the payroll costs we need to lay out how to report them.

The first area, cash wages, is fairly straightforward

We set up and utilize general ledger accounts in each department for hourly and management payroll positions.

We record each pay period as a journal and monthly we must accrue and reverse the stub period for the wages based on the payroll calendar. The only other wrinkle is the F&B department and the allocations that are required to move the kitchen, stewarding and management wages to the outlets. I have written a separate detailed article on F&B payroll allocations and you can find the blog post on my website. Format your statements so you are capturing direct payroll for the cash wages section in each department, set up F&B to capture both direct wages (outlets) and allocated wages (kitchens, etc.). https://hotelfinancialcoach.com/hospitality-financial-leadership-how-to-set-up-and-report-food-beverage-in-your-hotel-financials/

The second area to record is auxiliary payroll costs

This will need to be accomplished using both the direct and allocated method. Each department on your general ledger needs to have all the accounts listed above, separately. In addition to each department having these accounts, you are going to need an allocated department with the same accounts (a quasi-balance sheet account).

Post each month directly to the departments the costs that you can identify as direct. Direct items include any of the expenses in the Auxiliary Wages Costs area that you know belong to a specific department. Common items that go direct are any item that comes from the payroll journal as they are almost always reported back to you by department. Items that need to go to the allocated department may include state taxes that get calculated on a percentage of payroll or an experience factor.

One by one, review your aux details and determine what can go directly and what needs to be allocated. Once the entire payroll is posted, and all the aux items are posted, including the allocated aux costs, it is time to run your allocation to clean out these accounts.

With allocations, establish a consistent and reasonable method and stick with it. I favor a percentage of total cash wages to use as my allocation basis for auxiliary payroll costs. Total by department these costs and allocate the aux costs back to the detailed lines in each department, effectively zeroing out your auxiliary department each month. Use the aux department as a holding place for items until you are ready to close and then allocate.

If you are still with me, the mumbo jumbo is almost done and the results of our work are going to produce a financial statement that is going to really help the efforts to see, understand and manage what is going on in the business.

The last part of the exercise is to post the benefit items

As with the Aux methodology, record costs using the detailed accounts in each department and the allocated department. Items that you can identify as belonging to a specific department—like pension or medical —go direct. Items that benefit every department that we cannot book directly, like an employee event, go to the allocated department. Wait until all direct benefits, cash payroll, and auxiliary items are posted and then run your benefit allocations.

Now that the bookkeeping is done we need to review how we want our financial statements formatted. This is different from how our GL looks. In all departments, in the P&L we want to see a total for all cash wages, auxiliary costs, and benefits and finally total payroll.

We want to see direct wages in all departments on two lines: management and hourly.

In F&B we also want to see allocated payroll both management and hourly.

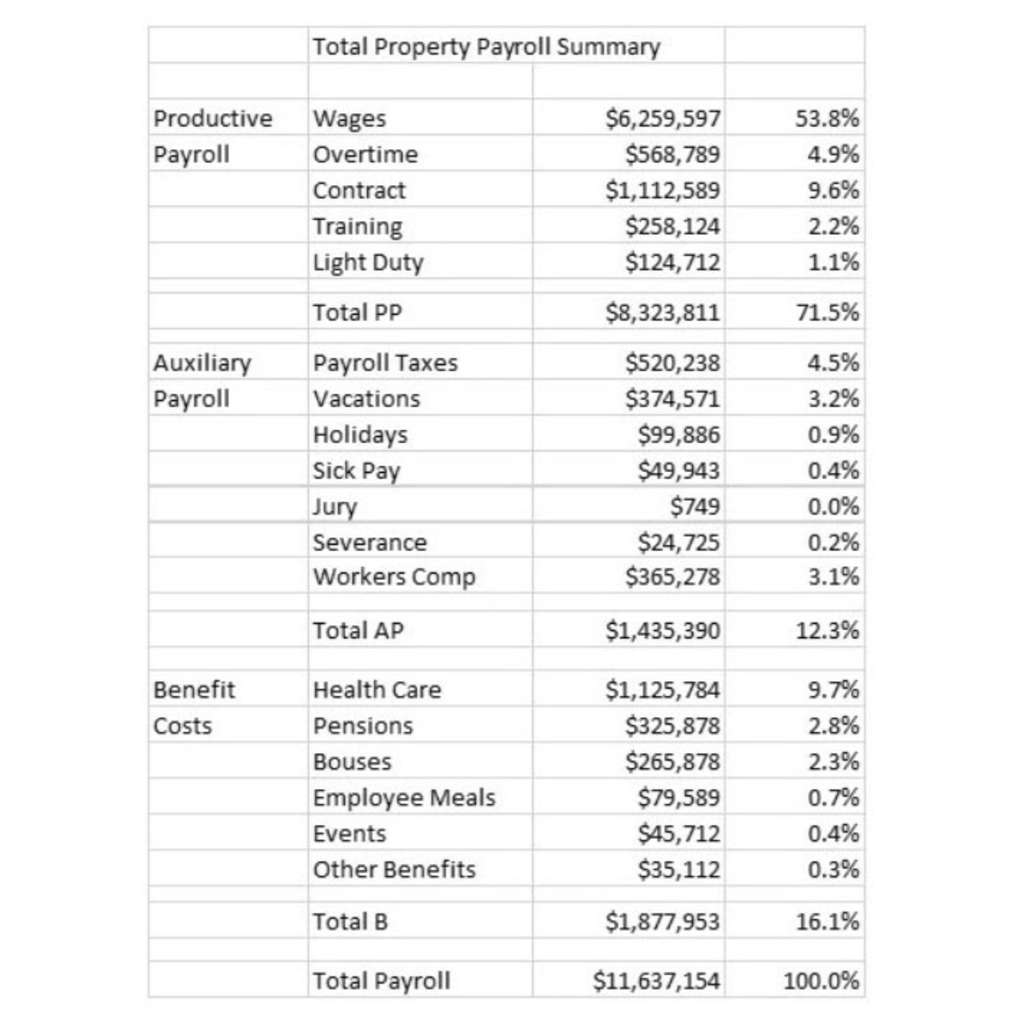

Beyond the departmental summary, we want to create schedules that show the overall property cost for all the items in the three different buckets.

With detailed information and an understanding of what is direct vs. allocated, we have a powerful reporting tool.

David Lund

The Hotel Financial Coach

+1 415 696 9593

David Lund