Ancillary Revenue In 2020: Resorts Benefit the Most

By controlling costs, U.S. hotels have been able to achieve a 16.7 percent gross operating profit (GOP) margin through August 2020.

Last month CBRE Hotels Research analyzed the cost control measures U.S. hotel operators have implemented to mitigate the impact of the severe declines in revenue inflicting the lodging industry in 2020. In short, the mostly controllable expenses within the operated departments were cut by 26.8 percent on a per-occupied-room (POR) basis in July 2020 compared to July 2019. This trend continued into August 2020 when we observed operated department expenses decline by 30.6 percent compared to the same month of the prior year at the 1,800 properties in CBRE's sample.

By controlling costs, U.S. hotels have been able to achieve a 16.7 percent gross operating profit (GOP) margin through August 2020. While this is less than the 34.3 percent margin achieved during the same period in 2019, it does reflect the ability of U.S. hotels to earn enough revenue to cover their departmental and undistributed costs. In fact, through August 2020, all property types analyzed by CBRE are achieving a positive GOP margin.

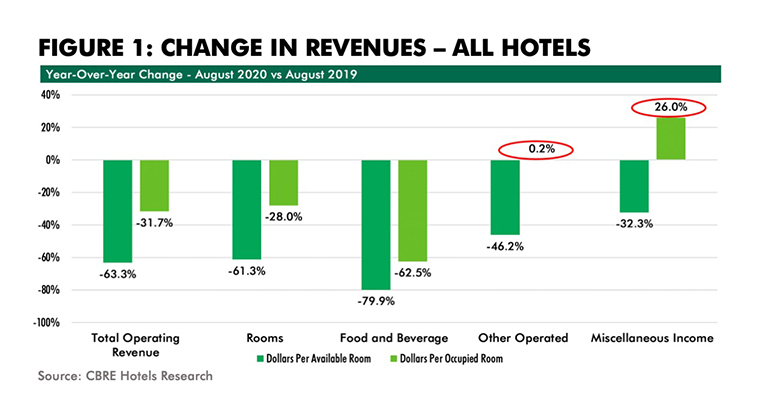

While cost controls have been the primary contributor to the operating efficiencies, we also observed some "good news" on the revenue side during August. During the month, total operating revenues were down 63.3 percent on a per-available-room (PAR) basis compared to the prior year. However, measured on a per-occupied-room basis, the revenue decline was just 31.7 percent.

Buoying revenue POR were increases in the other operated departments and miscellaneous income. This implies that hotels successfully earned ancillary income from guests once they made their reservation, or checked in. During August 2020, other operated revenues increased by 0.2 percent POR over August 2019, while miscellaneous income increased by 26.0 percent.

Across all property types, miscellaneous income was able to grow on a POR basis. This revenue category includes income from cancellation and attrition fees which have grown due to the lack of meetings during the year. The experience with other operated department revenue was less uniform. Three of the five property categories saw their other operated department revenues POR decline. However, given the relative lack of other operated departments within limited-service and extended-stay hotels, the drop at these hotels is not alarming.

Resort hotels benefited the most from increases in both other operated revenue and miscellaneous income POR during August 2020. At the resorts in the CBRE sample, other operated revenues grew by 35.4 percent POR. The surge in golf during 2020 has had an influence in this category. Concurrently, miscellaneous income increased by 116 percent POR. Resort hotels not only benefitted from cancellation and attrition income, but rising resort fees as well.

Compounding the benefit to resort hotels, other operated revenue and miscellaneous income comprise 18 percent of total operating revenue at this property type. The strong growth in ancillary revenue POR, plus a 5.6 percent increase in ADR, resulted in a 7.3 percent gain in total operating revenue POR for resort hotels during August. Resorts were the only property type to achieve a gain in total operating revenue POR during the month.

The increase in other operating and miscellaneous income on a per-occupied-room basis demonstrates the resourcefulness of managers not only as stern operators, but creative marketers as well.

Robert Mandelbaum

Director of Research Information Services

CBRE Hotels