Transition-related Climate Risk and its Impact on Commercial Real Estate

Working toward net zero is not elective. Climate change will prove disruptive for property owners and occupiers.

Executive Summary

Climate risk is important for everyone. As professionals in an industry responsible for approximately 30%1 of the world’s greenhouse gas emissions, the commercial real estate industry is beginning to come together globally to address the challenges.

CBRE Econometric Advisors (CBRE EA) recently hosted its Client Forum on “Preparing for a Changing Investment Climate.” Two panels of experts shared insights on climate risk, net zero and physical and transition risks related to commercial real estate. In this Viewpoint CBRE EA will share some of our views on transition risk.

Transition risk is business-related risk that follows societal and economic shifts toward a low-carbon and more climate-friendly future. Examples include policy, regulation, technology, or reputation.

Stranding Asset Risk And The Journey To Net Zero

There is a limit to the amount of carbon that can be emitted globally before 2050 to ensure that global temperature increases do not exceed 1.5 degrees Celsius (or 2.7 degrees Fahrenheit).

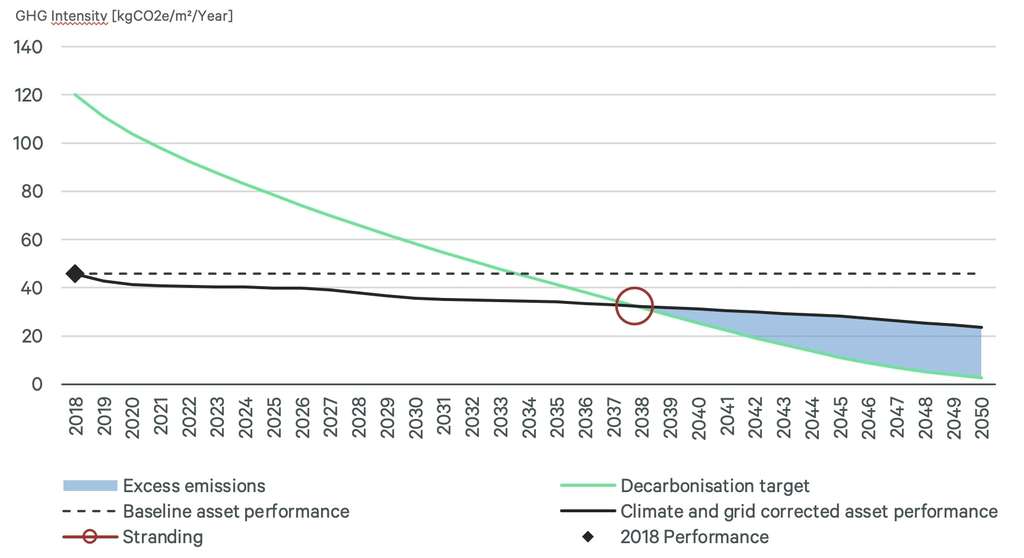

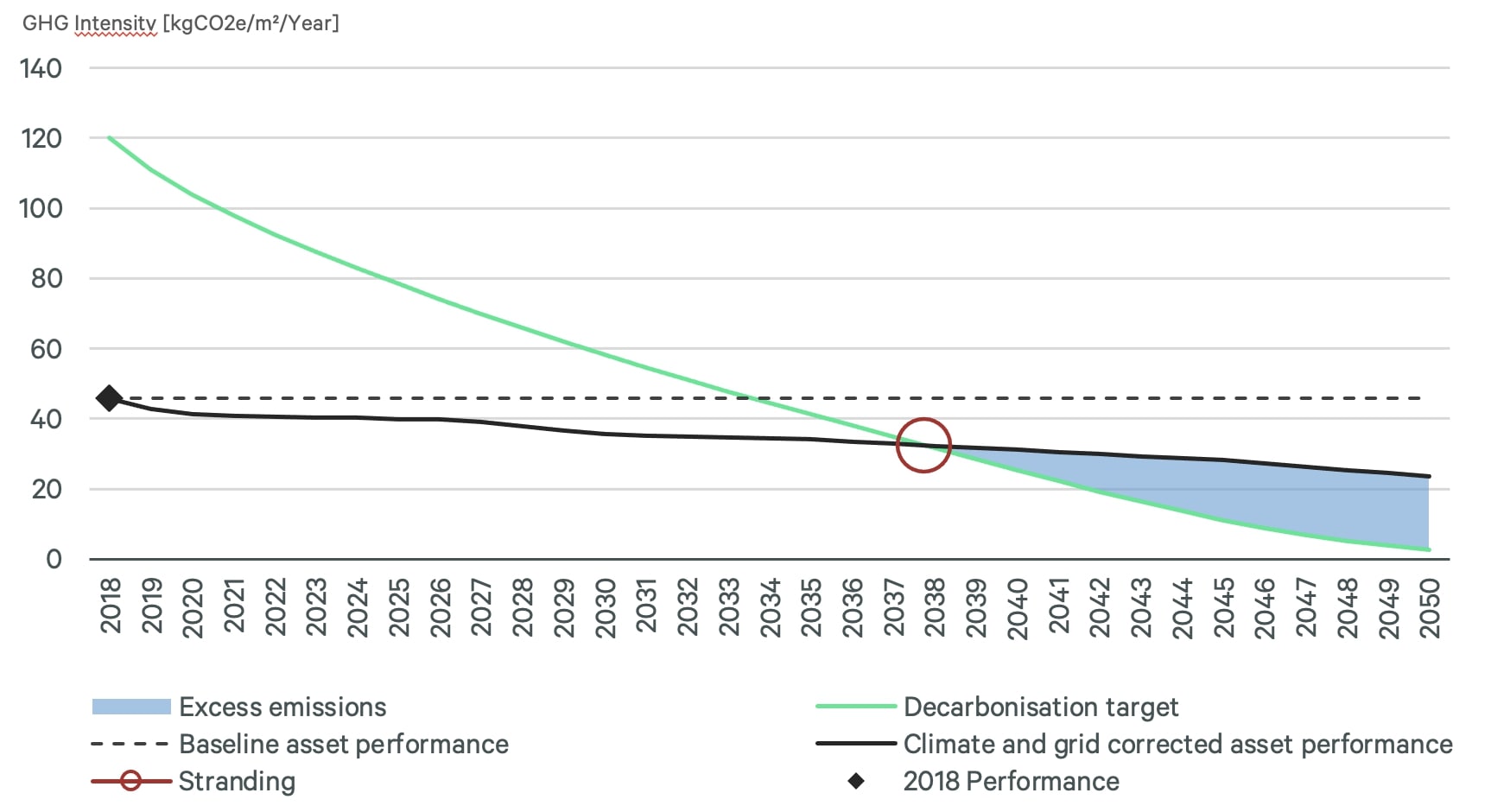

To measure carbon risk, real estate professionals have started using the Carbon Risk Real Estate Monitor (CRREM) tool, which originated in Europe and has become more widely adopted worldwide. The tool analyzes greenhouse gas intensity on a per-square-meter basis (convertible to per sq. ft.) annually. The green line in Figure 1 shows a decarbonization pathway that one would need to meet to be aligned with the Paris Agreement2. The pathway varies significantly among property types and countries.

Figure 1: A Theoretical Framework for Transition Risk & Stranded Assets

The dotted line in Figure 1 shows a typical property’s current carbon emissions. With the expectation of future improvements, we include a climate and grid correct asset performance, represented by the black line. When the asset performance is above the decarbonization pathway, a property will theoretically be “stranded” and prone to a “brown discount,” or decline in value. In the above figure, by 2038 there will be an asset that no longer meets the carbon reduction intensity pathway and therefore becomes stranded.

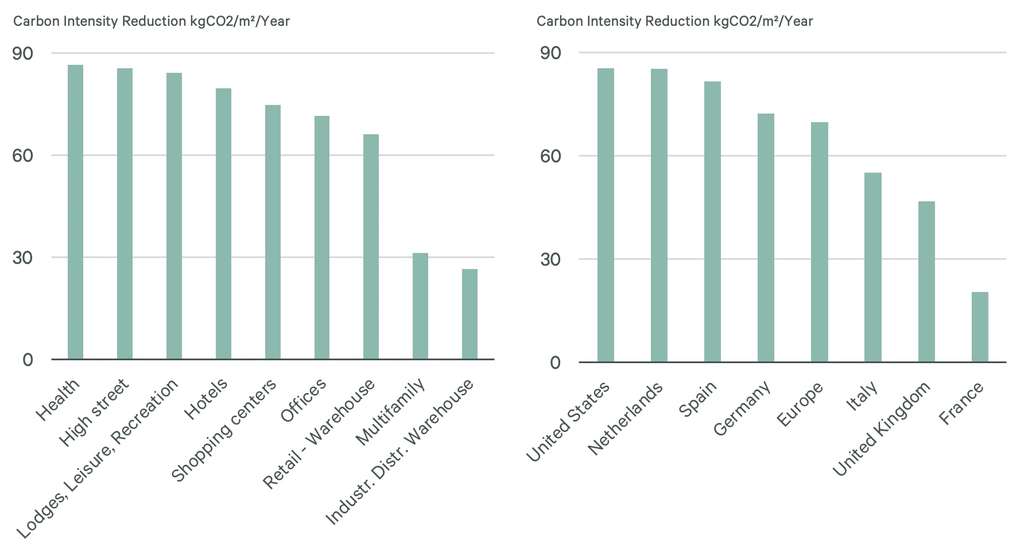

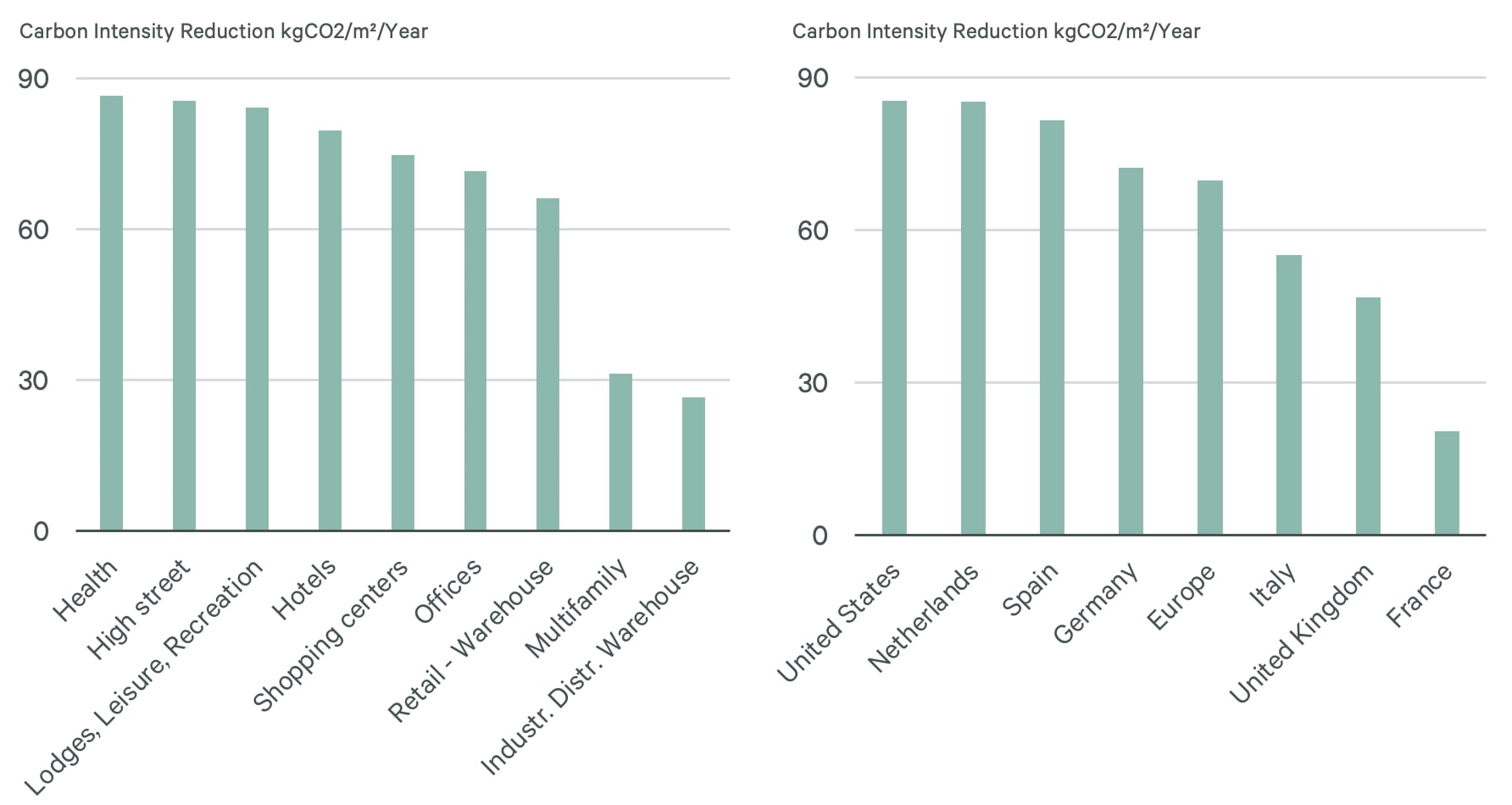

Figure 2 shows the reduction in greenhouse gas and carbon intensity that needs to be achieved before 2050 to comply with the Paris Agreement, on which the CRREM tool is based (note: these are equally weighted averages across property types and countries). There are some significant differences among sectors and countries. For example, healthcare and high street are more carbon-intensive than multifamily or industrial warehouses. In France, where the energy grid is powered more heavily by nuclear energy, the required future carbon reduction is much less than in the Netherlands or the United States.

Figure 2: GHG Reduction Pathways by Sector & Country

Quantifying Transition Risk

There are two principal elements influencing how we quantify transition risk, namely retrofit costs to reduce energy consumption and greenhouse gas emissions, and technological advances. The costs to reduce greenhouse gas emissions are nonlinear. The more energy reduction you want to achieve, the higher the marginal cost will be.

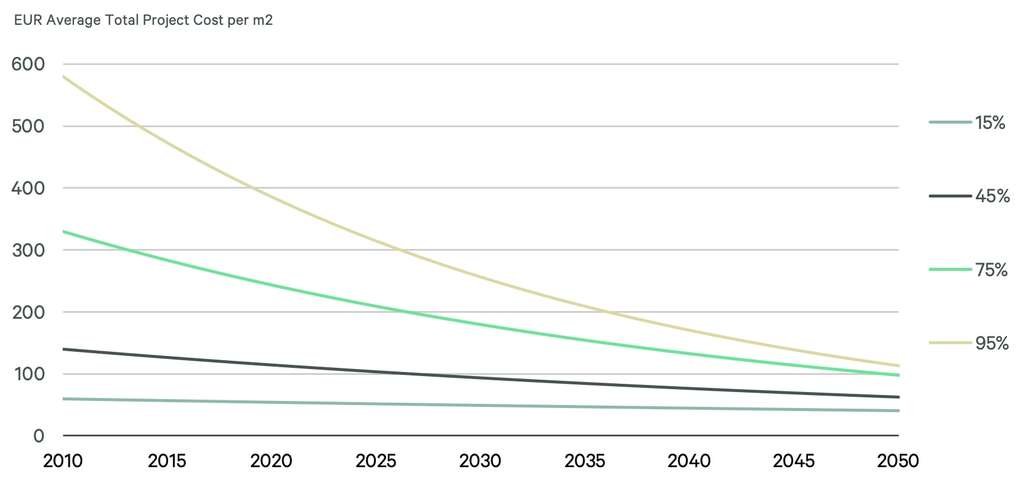

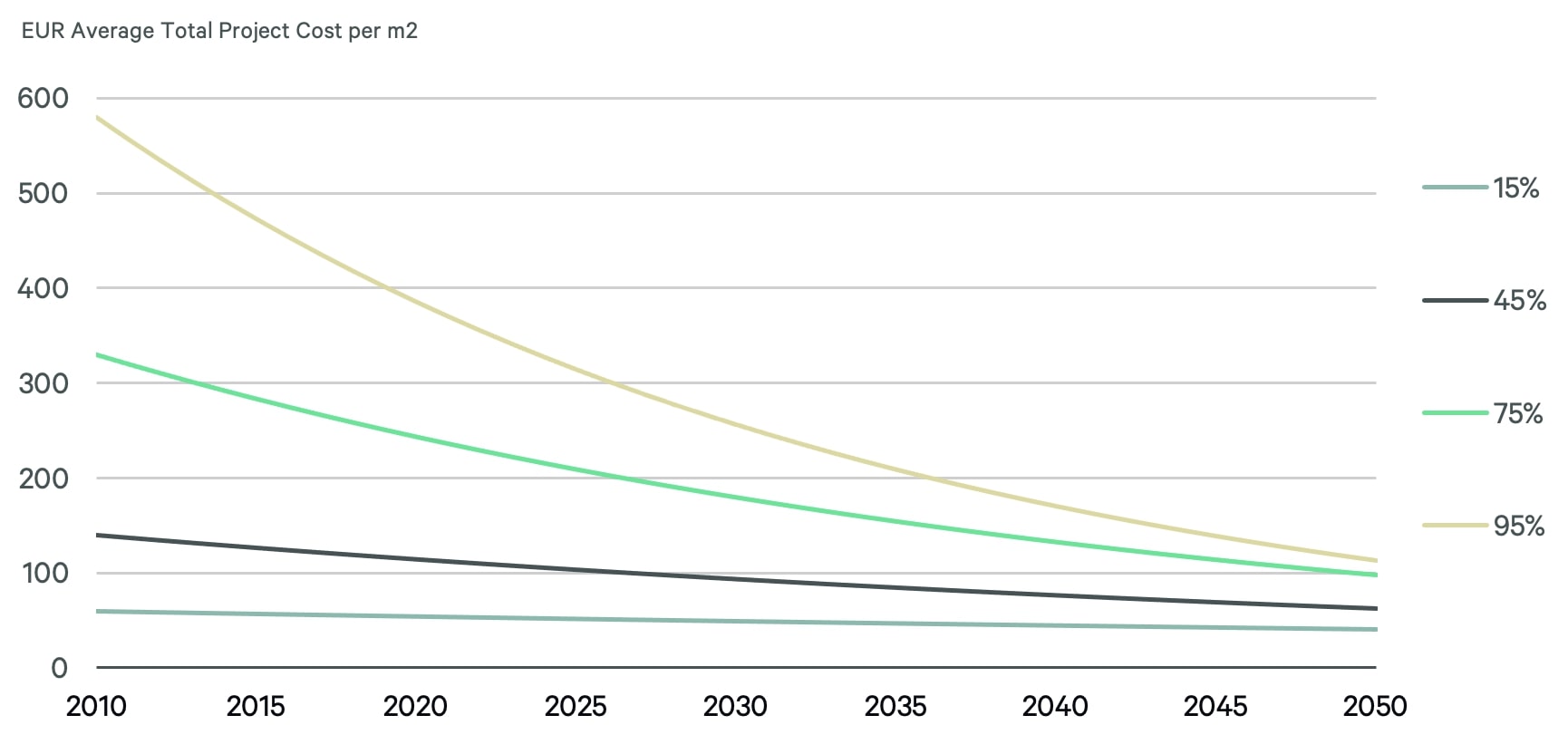

Luckily, technological advances will decrease the high costs over time. Figure 3 shows the intervals at which costs might decline over the next 30 years, and a plotted time curve of costs for energy reductions ranging from 15% to 95%. In the coming years, expect further refinement as more data becomes available with larger usage adoption.

Figure 3: Projected Annual Reduction Rate from the Average Total Project Costs Over Time per Reduction Target (%)

Both property owners and occupiers have power to influence carbon reductions, though property owners have more direct capabilities. Depending on the property’s age and layout, sometimes retrofitting a building is more expensive than tearing it down and starting over, but sometimes simple changes can make a substantial difference. Another consideration is that the process of tearing down an existing building itself releases carbon into the environment.

For reference, to achieve a carbon reduction of 75%, a property owner can expect to pay, on average, approximately $500 per sq. meter, or $46 per sq. ft. However, more environmentally conscious property owners – or those with larger budgets – may choose to retrofit, despite this being more expensive than tearing down a building in most cases.

Another opportunity is to incorporate green leases – a movement in which occupiers agree to share some of the energy use responsibilities and work with property owners to achieve energy reductions. This is a movement that occupiers can help drive. If occupiers are demanding more environmentally conscious spaces and efforts, complying is in property owners’ interests. According to CBRE’s most recent Occupier Sentiment Survey, more than 70% of respondents indicated that reducing greenhouse gas emissions is their top priority.

Who Is Leading The Change Around The World

Europe is ahead in some respects but not others, and the U.S. is close behind Europe. Europe has more regulations like the European Union green taxonomy. In January 2020, the U.S. federal government launched the Buildings Coalition for Better Performance, which permits states and cities to avoid financial penalties by committing to achieving certain performance benchmarks. Many U.S. cities, such as Seattle, Denver, Boston, New York City, Los Angeles, Sacramento and others have since made commitments.

The Securities and Exchange Commission (SEC) also proposed in March 2022 rule changes that would require registrants to include certain climate-related disclosures in their registration statements and periodic reports, including information about climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition, and certain climate-related financial statement metrics in a note to their audited financial statements. The required information about climate-related risks also would include disclosure of a registrant’s greenhouse gas emissions, which have become a commonly used metric to assess a registrant’s exposure to such risks.

Many large U.S. companies are using innovative technology to address climate risk. Between these resources and the relative new vintage of its overall building stock, which are more energy efficient, the U.S. is in a good position to make major progress in the next 30 years.

Canada has committed to achieving net zero by 2050 and has a leaderboard to track its efforts. Canada has been transparent about its efforts, but like others, is struggling with the governance of what net zero means.

A Business Opportunity

When looking to acquire a building or portfolio, many investors are making sure there is a business plan to meet short- and long-term carbon-emission targets that account for both legal and social requirements. Climate conscious investors will typically move forward with an investment if the plan includes capital expenditures (CapEX) for improvements. Investors are driving ESG compliance right now, and this type of unified global drive is expected to triple the amount of global assets with ESG mandates over the next decade. These are real, measurable mitigation measures working toward addressing climate change and represent a huge business opportunity for the industry.

Conclusion

The first step in achieving greenhouse gas reduction is more collaboration among investors, regulators, insurers, occupiers and others within commercial real estate. More data availability and transparency will lead to better informed decisions. Working toward net zero is not elective; climate change will prove disruptive for property owners and occupiers. Those with a plan to mitigate the challenge of rising temperatures will maximize the value of their assets.

- 1 Sustainable Real Estate Investment – United Nations Environment – Finance Initiative (unepfi.org)

- 2 The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties at COP 21 in Paris, on 12 December 2015 and entered into force on 4 November 2016. Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.