US Short-Term Rental Market Poised for Further Growth

Over the past decade, the short-term rental industry has taken the world by storm, affecting not just where people stay while traveling, but also how they vacation in general.

Before 2008, short-term rental websites existed, but Airbnb revolutionized the home-sharing concept and essentially created a new category of rental housing. Similar platforms emerged, and in a relatively short period, this alternative lodging market has evolved to become a widely accepted, mainstream industry valued at approximately $115 billion worldwide in 2019.

The short-term rental segment is comprised mainly of private accommodation bookings. This includes private holiday homes and houses as well as short-term rental of private rooms or flats via portals such as Airbnb, Vrbo, and Booking.com. In recent years there has been a convergence between traditional hospitality companies expanding into the short-term market, and short-term rental companies operating more like hotels.

Companies such as Sonder have expanded upon the short-term rental model by operating traditional apartment units like hotel rooms. Sonder was founded in Montreal in 2014 and today operates properties in more than 40 cities worldwide.

Sonder offers a more traditional hotel experience than individual short-term rental properties while enhancing the guest experience through technology. Everything from check-in to service requests to check-out can be handled on the app and the goal is to make the guest stay a seamless experience.

The increased competition in alternative lodging has also pushed traditional hotel companies to innovate, evidenced by Marriott International’s entry into this space with its alternative brand, Homes and Villas.

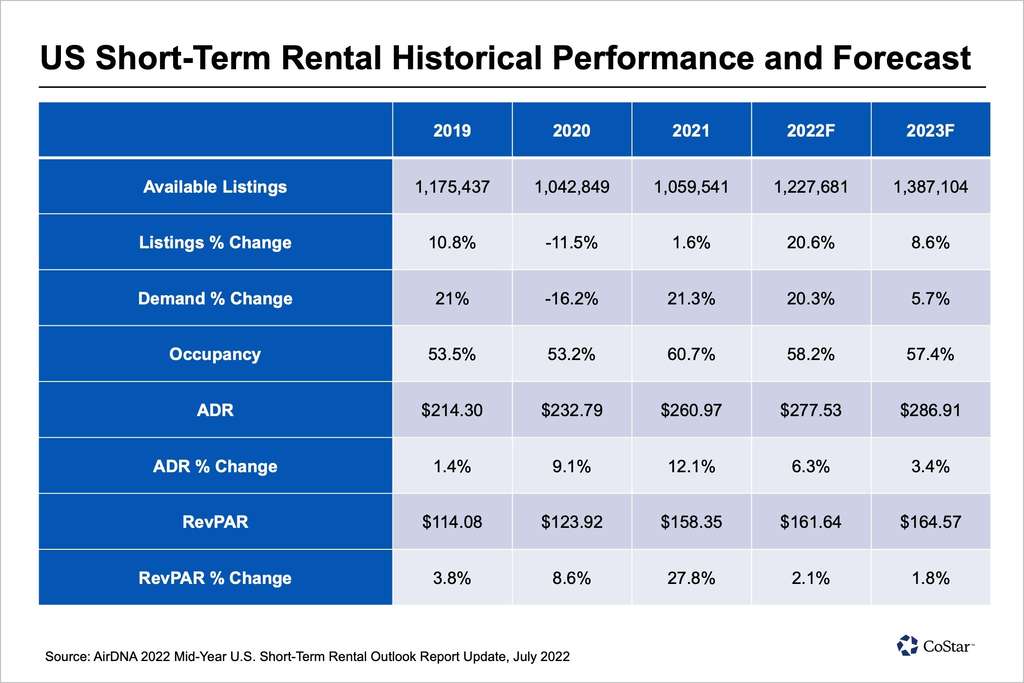

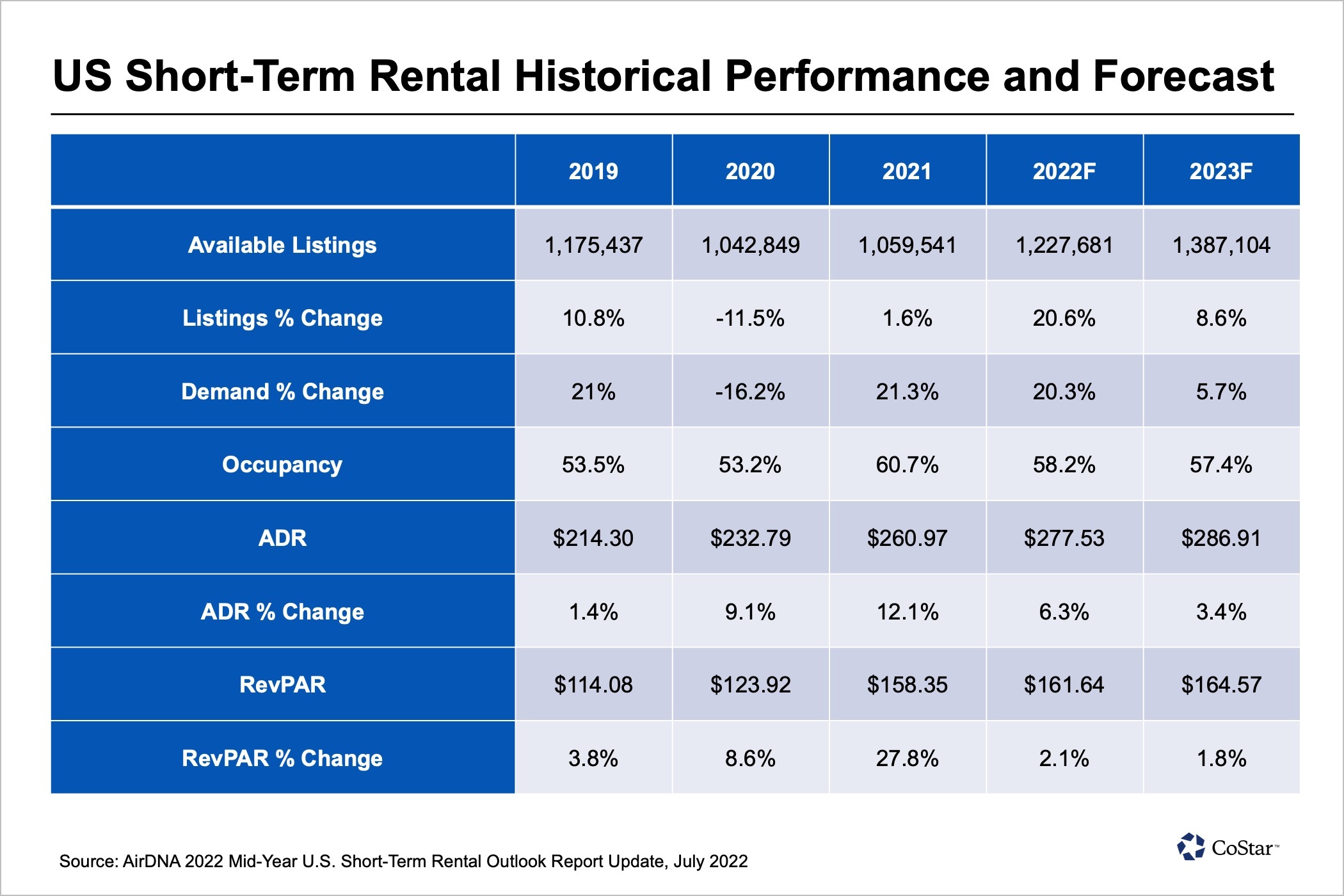

According to a July 2022 mid-year update on the U.S. short-term rental industry by AirDNA, there were 1,059,541 available units on various listing platforms in 2021, which was a slight increase from the number of listings in 2020 but still down 9.9% from the number of available listings in 2019. The following table provides short-term rental data from 2019 to 2021 along with forecasts for 2022 and 2023.

In 2020, the onset of the COVID-19 pandemic inundated many short-term rental hosts with cancellations. However, while listings declined by 11.5% and demand for short-term rentals dropped 16.2% overall for the year, some vacation rental locations saw a surge in new bookings.

As early as late March, those who wanted to travel but were looking for safety and seclusion began flocking to rural, drive-to getaways. During the pandemic, more travelers were choosing to stay at larger homes in destination markets, with higher average rates, leading to overall ADR growth in 2020 and 2021.

In May 2022, there were 88,000 new short-term rentals added to the overall supply, leading to an all-time high in total listings, per AirDNA. Although demand is projected to increase by more than 20% in 2022, occupancy is projected to decline due to the amount of new supply. In its initial forecast for 2022 prepared in December 2021, AirDNA forecasted a decline in ADR for 2022; however, due to inflation and strong demand during peak times, AirDNA now forecasts ADR to finish at $277.53 for 2022. Looking ahead to 2023, AirDNA forecasts continued growth in terms of the available listings, but occupancy is once again expected to decline due to supply outpacing demand growth.

Property Types

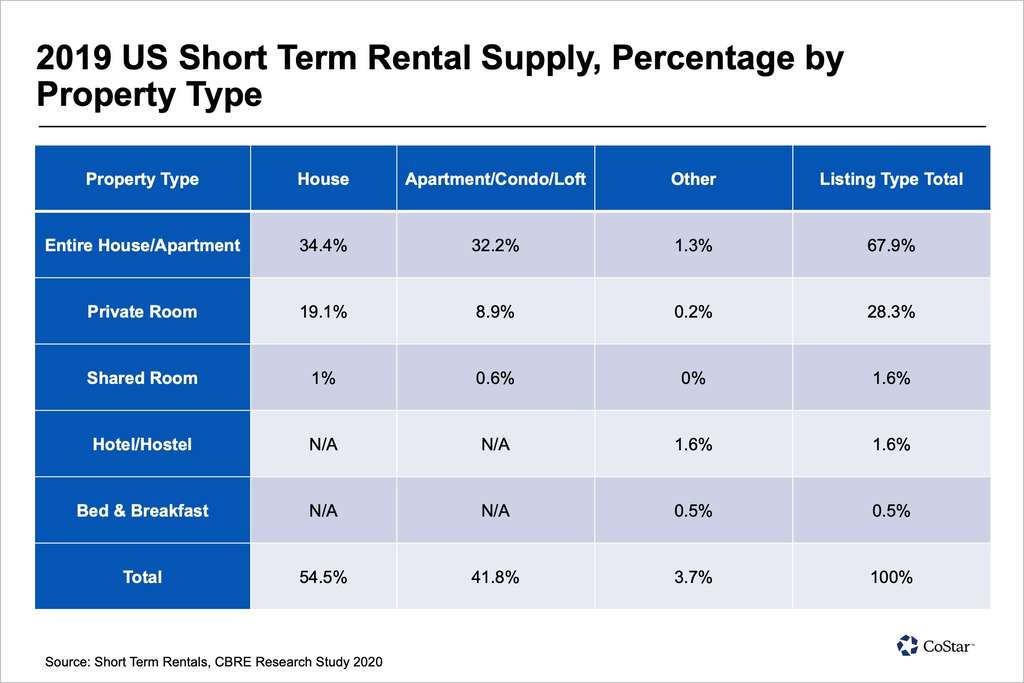

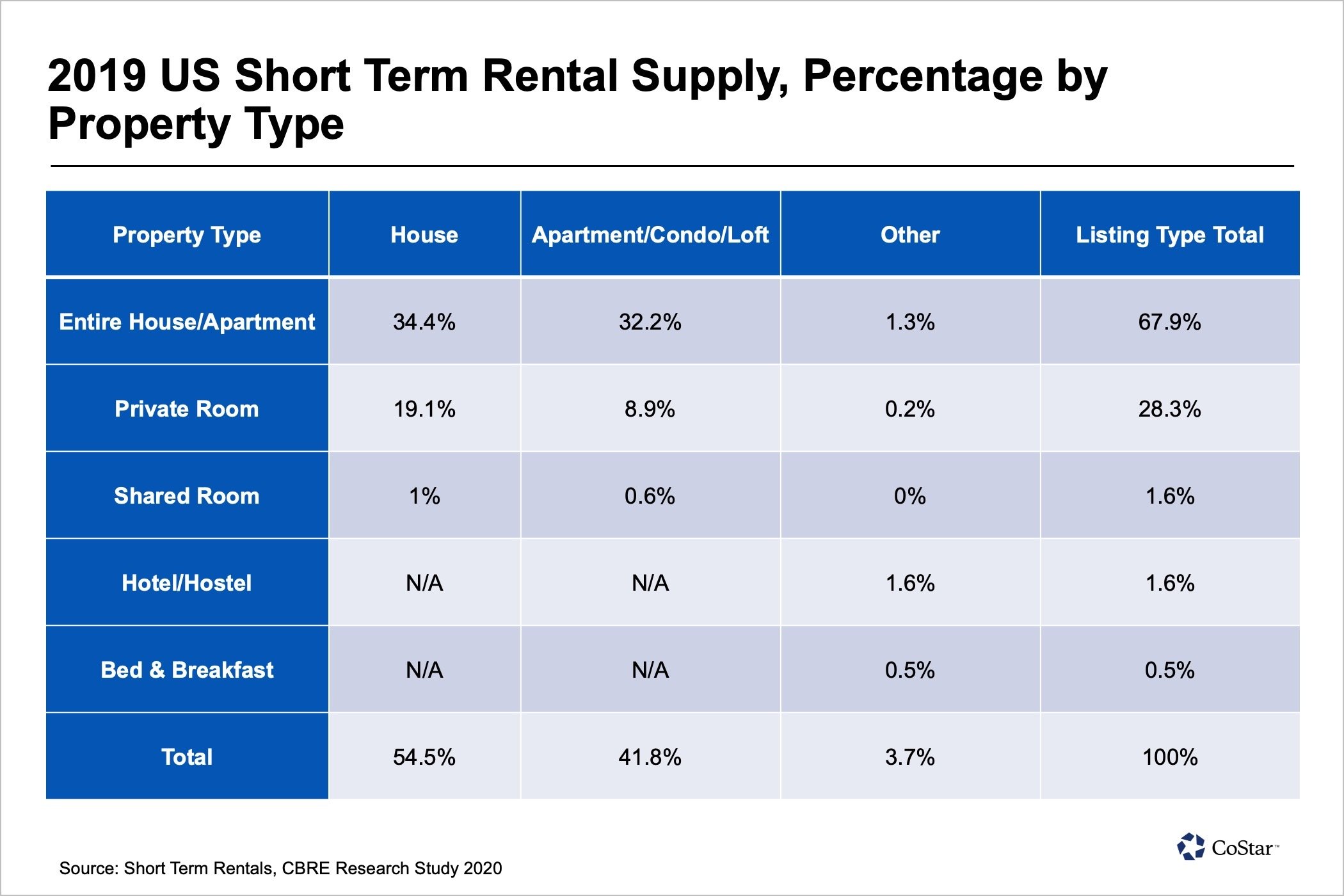

According to a 2020 CBRE Research study, houses and apartment/condo/loft units make up about 96% of all the properties available for rent in the U.S. on short-term rental distribution channels. The other 4% includes unique units — such as lighthouses, boats, and tents — bed and breakfasts, hotels, and hostels.

The following table shows the short-term rental supply for the entire U.S. by property type and listing type in 2019.

By 2019, house rentals had grown at a significantly higher rate than apartment/condo/loft units and accounted for 54.5% of the total U.S. supply. Shared spaces, hotel/hostel units, and bed and breakfasts represented only 3.7% of the total supply.

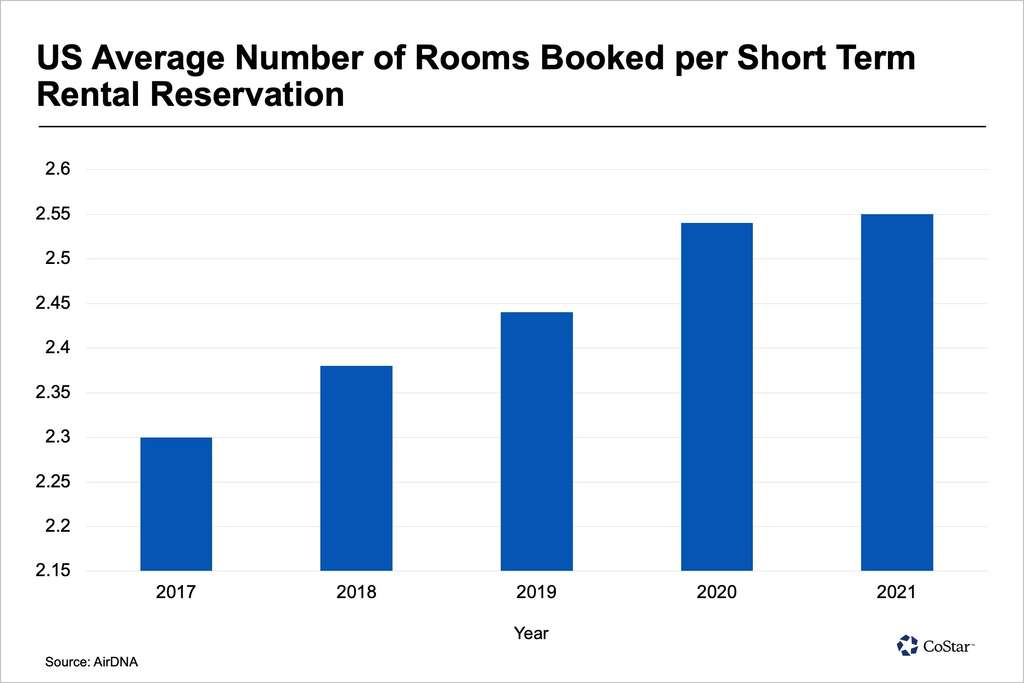

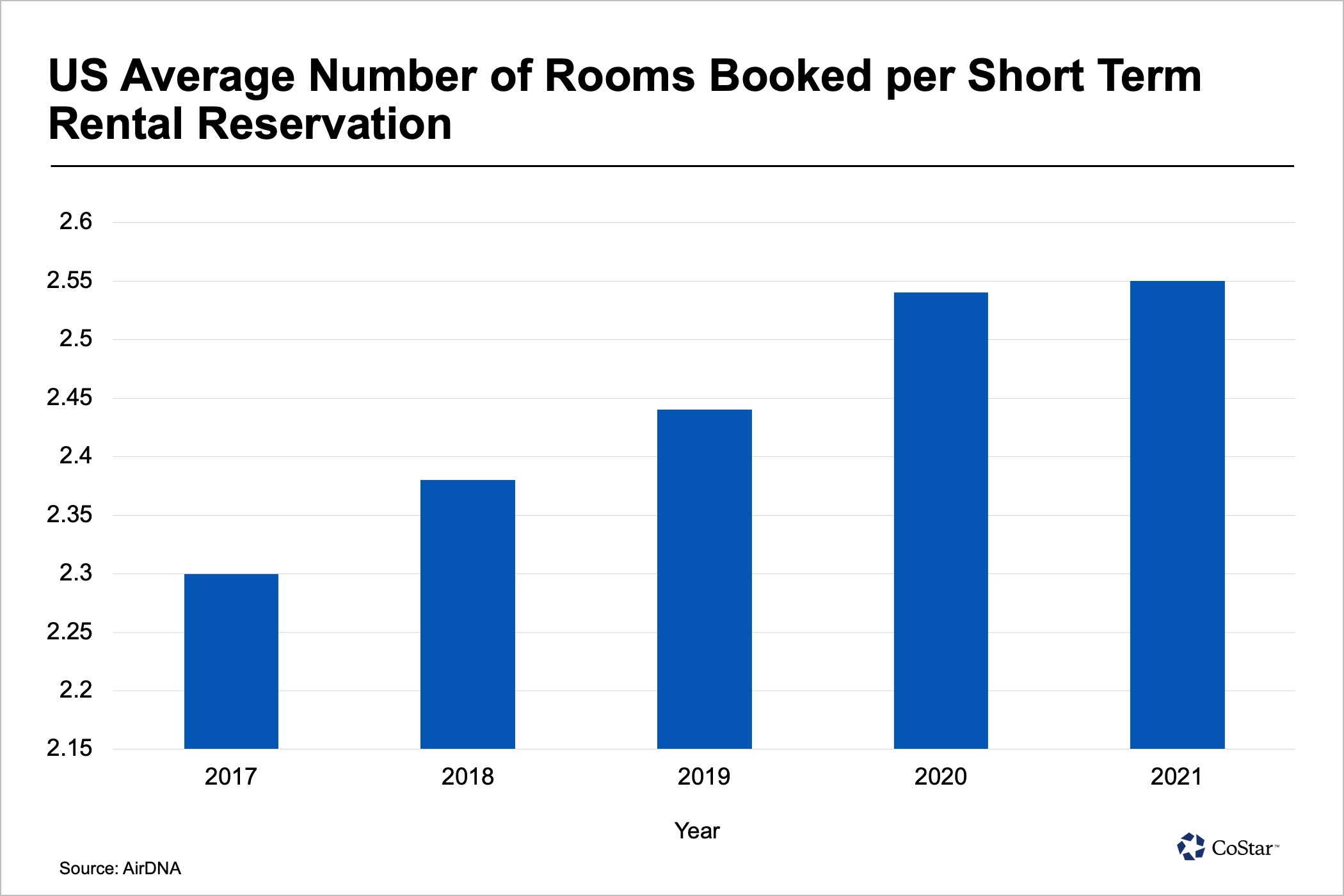

Research data from AirDNA has shown that short-term renters are looking for larger rentals that can accommodate groups and families. As demonstrated in the following chart, the average number of rooms for booked properties has grown consistently over the last five years and jumped considerably in 2020 as guests avoided smaller urban properties in favor of larger homes in destination locations.

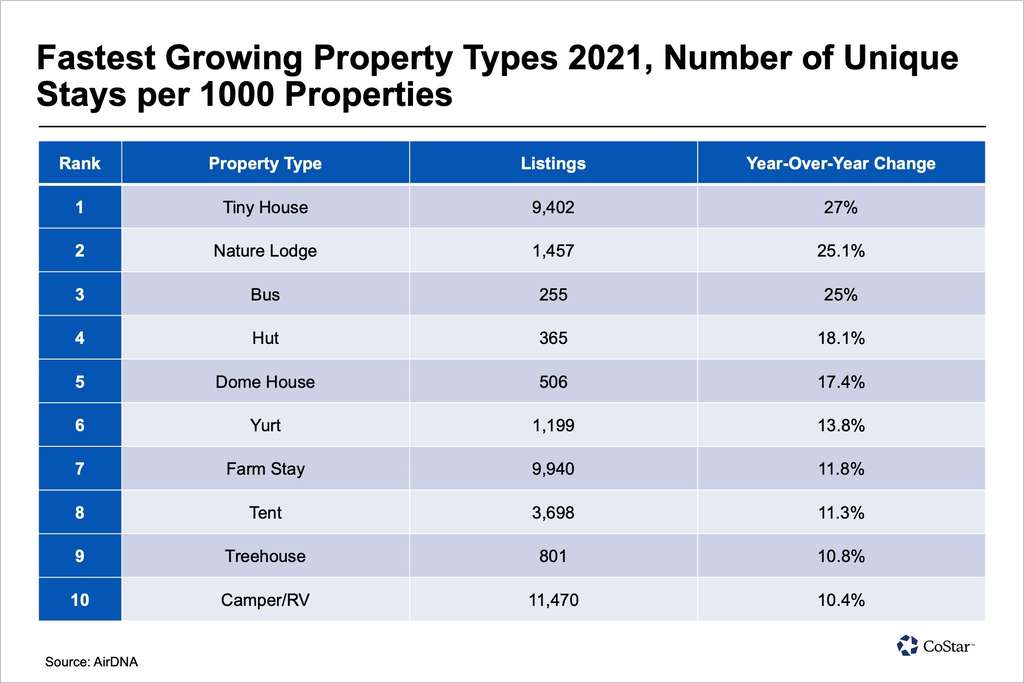

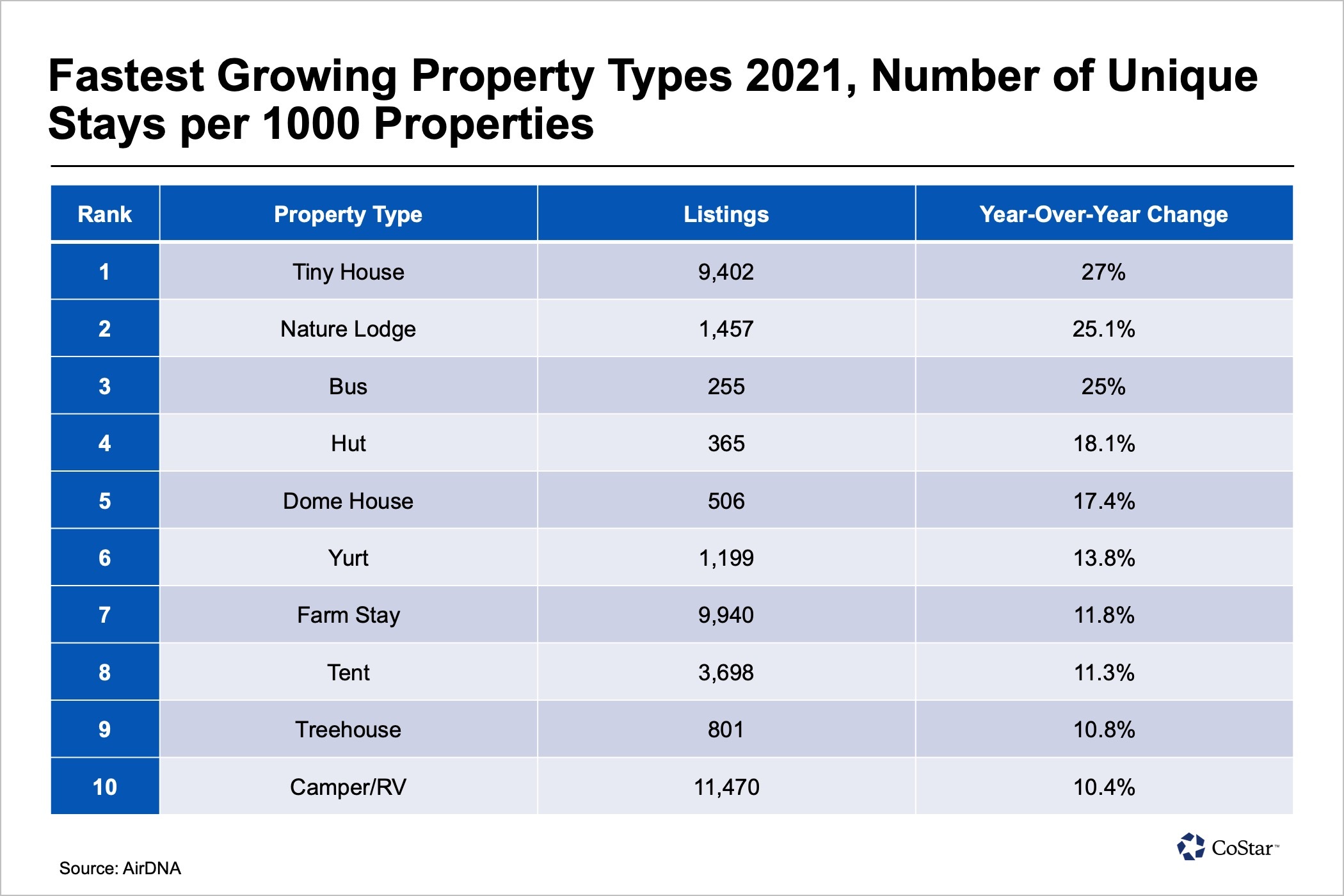

Although the size of the rental is an important factor, guests are also interested in unique experiences, no matter the size. As the following table shows, tiny houses were the fastest-growing short-term rental property type, growing 27% in 2021 to 9,402 listings.

Hosts

In recent years, there has been a growing trend of people utilizing short-term rentals to help pay their mortgage and other living expenses as most short-term rentals found on booking platforms such as Airbnb are individual owners.

According to the 2022 Airbnb annual survey of hosts and guests, approximately 45% of hosts reported that income from renting their property helped them continue to afford their homes’ expenses, while more than 20% of hosts stated their rental income kept them from having their property foreclosed or being evicted. The average host reported earning approximately $13,800 in 2021, which was an 85% increase from 2019.

Some homeowners are now specifically looking for properties with rental potential when searching for homes to purchase to help cover some of their living expenses. This could include purchasing a duplex, a home with an outbuilding, a finished basement or attic space, and other options. While some of these owners are looking for long-term rental potential, others prefer the short-term model as it provides them with more flexibility.

Price and Location

Local interaction, home-like amenities, more space, and/or unusual experiences are some of the factors that motivate consumers to choose short-term rental accommodations. Price and location, however, remain the primary motivators. Short-term rentals can provide affordable options to tourists visiting cities in which hotels have disproportionately high prices, plus the typical home or apartment unit offers cost-saving benefits, such as kitchen and laundry facilities. According to CBRE, short-term rentals offered a discount of about 5% across the top 30 markets, and in the more urban U.S. cities the discount was as high as 20% to 30%.

After price, location is generally the most likely reason travelers choose to book a short-term rental. A CBRE analysis of hotel and short-term rental unit location data shows that more than 35% of short-term rental properties are located more than a mile from the closest hotel. That increases to 57% for rural locations. Recent growth of short-term rentals has primarily occurred in suburban and rural areas. Though the supply of units in urban locations grew by 17% in 2019, these locations dropped to 21% of total short-term rental supply, down from 46% in 2014. As of 2019, 57% of units were located outside of large cities.

According to CBRE’s 2020 study, most of the change in share resulted from large increases in resort and rural locations that primarily serve destination-vacation travel. Units for rent along the beach, at lakes, and at ski/mountain resorts accounted for 42% of units outside of urban areas. ADR growth for short-term rentals has seen the sharpest increase for properties in smaller to midsized markets.

In a recent article, CoStar highlighted the top 10 markets for demand change from year-to-date June 2022 versus June 2019. The data showed that of these 10 markets, the biggest ADR growth for short-term rentals was in the smaller markets of Gatlinburg/Pigeon Forge, Tennessee; Panama City Beach, Florida; and the Wisconsin Area. In each of these markets, the ADR growth for short-term rentals has been noticeably higher than the ADR growth for hotels. One notable large market is Houston, Texas, where short-term rentals have experienced a 36% increase in ADR during this period, while hotels have only seen a 3% increase.

Impact on Traditional Hotels

While short-term rental platforms have seen much greater demand in recent years, one question that has remained is how many travelers are leaving traditional hotels behind in favor of short-term rentals.

A 2021 survey conducted by ValuePenguin found that 72% of all survey participants preferred to stay at a hotel or resort compared to a vacation rental. This does not hold true among all demographics, however, as another survey conducted by YPulse found that 24% of millennials would prefer to stay at either an Airbnb or rental house compared to 12% who preferred an all-inclusive resort and 12% who preferred a national hotel chain.

Per iPropertyManagement, 51% of all Airbnb bookings are generated from travelers between the ages of 18 and 34. In contrast, the fastest-growing demographic for new hosts on the Airbnb platform are seniors, who total more than 400,000 worldwide.

While there are many factors that influence a traveler’s decision, the survey conducted by ValuePenguin found that some of the biggest factors for preferring a hotel stay included more amenities, a more simplified booking experience, higher staffing levels and dining options at the property. Travelers who are combining business and leisure trips, known colloquially as bleisure travelers, are more concerned with having strong internet performance, which gives traditional hotels a slight advantage as internet service varies widely between vacation rentals.

Another factor for guests preferring hotels was the rewards program. Guests who can earn travel rewards points can use these points to earn a discount on their room or pay for it entirely. Travelers who prefer short-term rentals have historically missed out on earning rewards points.

This is poised to change for at least one company, as Expedia Group, which owns Vrbo, announced a new rewards program known as One Key that will allow guests to earn points by booking through any of their brands including Vrbo. It remains to be seen how much this will impact the hotel segment; however, for at least one platform, it eliminates one of the weaknesses that short-term rentals have faced when compared to hotels.

Impact of COVID-19 on Short-Term Rental Industry

According to a joint report from STR and AirDNA, short-term rentals weathered the pandemic better than hotels in 27 markets through June 2020. While hotel occupancy fell 77.3% at the end of March compared with the previous year, short-term rental occupancy declined 45.1% for studio and one-bedroom rentals, and 46.2% for two- or more bedroom rentals. By August 2020, the short-term rental industry was already in recovery mode. Data from AllTheRooms Analytics showed that short-term rental bookings made on platforms such as Airbnb and Vrbo were at 81% of their 2019 levels.

Overall, short-term rentals have benefited from a shift in travel preferences to more rural and remote areas, the option for longer and cheaper stays, and safety considerations. According to Expedia Group, a full 95% of Vrbo bookings made between May and October 2020 were in non-urban locations, and most vacationers chose properties within a three-hour drive time.

Although hotels implemented enhanced cleaning measures, more travelers continued to opt for private, short-term rentals — especially those that offer no-contact check-ins — because the probability of close contact with people was reduced. As travelers have become more comfortable traveling again and resuming their pre-pandemic activities, it is likely that their motivations will be driven more by other factors such as location and amenities rather than enhanced cleaning and distancing protocols.

Outlook

With demand exceeding pre-pandemic levels in 2021 (2.6% higher than 2019) and the forecasted growth in demand over the next couple of years, the short-term rental market is poised to continue to change the way people travel. Whether occupancy for these properties increases remains to be seen as there has been a heavy influx of new supply in the past two years, offsetting much of the demand growth.

One question that lingers is what impact a potential recession could have on the short-term rental industry. Between 2007 and 2009 occupancy for the U.S. hotel market declined from 63.2% to 55.1%.

The potential downturn in the economy is not enough to cause concern so far for Airbnb executives. A recent article published in Hotel News Now summarized a recent earnings conference call where Airbnb CFO Dave Stephenson said he believes with the number of travelers eager to get back to traveling, even in tough economic times demand could remain resilient. Although they project growth in demand, Airbnb executives are emphasizing a strategy of supply growth and bringing new hosts onto the platform.

Even if economic conditions do impact performance growth for short-term rentals in the near future, the data from the past several years has shown this industry is no longer a niche industry and has the ability to achieve positive results for property owners, both individual and institutional.