European Court of Justice to clarify competition law questions for online travel agencies

Do online travel platforms constitute a market of their own? That's the question for the courts to tackle and it has the potential to become a landmark competition law ruling on digital platforms

Online travel platforms increase choice and transparency for consumers and make it easier for hotels to reach a worldwide audience. Parity clauses, which address the risk of hotels free-riding on a platform, have been a hot topic in competition law and the travel sector for years. Now the Court of Justice of the European Union will have the opportunity to clarify important questions of law and guide courts and competition authorities in deciding whether online travel platforms constitute a market of their own. Recent research by the European Commission shows that hotels use a wide variety of distribution channels and online platforms and hotels’ own distribution channels are substitutes. If confirmed after guidance from the highest European Court, this would establish that there is indeed no dominant platform in hotel distribution. It would also strongly indicate that there is no gatekeeper platform since hotels have sufficient alternatives.

Online travel platforms and the risk of free-riding

Online travel platforms, such as Booking.com, have a simple business model. We offer hotels and other accommodations the opportunity to market and sell their rooms to consumers near and far. To be successful, Booking.com invests heavily in the latest technology, global marketing, and customer service in 40+ languages.

Using Booking.com is risk-free for hotels. Only when a consumer makes a booking via our platform, do we charge a small commission fee to the accommodation. This so-called agency model aligns incentives: we are only successful when the accommodations on our platform are successful.

The agency model requires a minimum degree of trust and fairness. Because platforms are only remunerated for bookings made via the platform, there is always a risk free-riding on the platform’s services. Free-riding is simple. All hotels have to do is to inflate the price on a platform. If consumers are sufficiently aware of this price inflation, they will use platforms to find their preferred option, but then book it directly with the hotel.

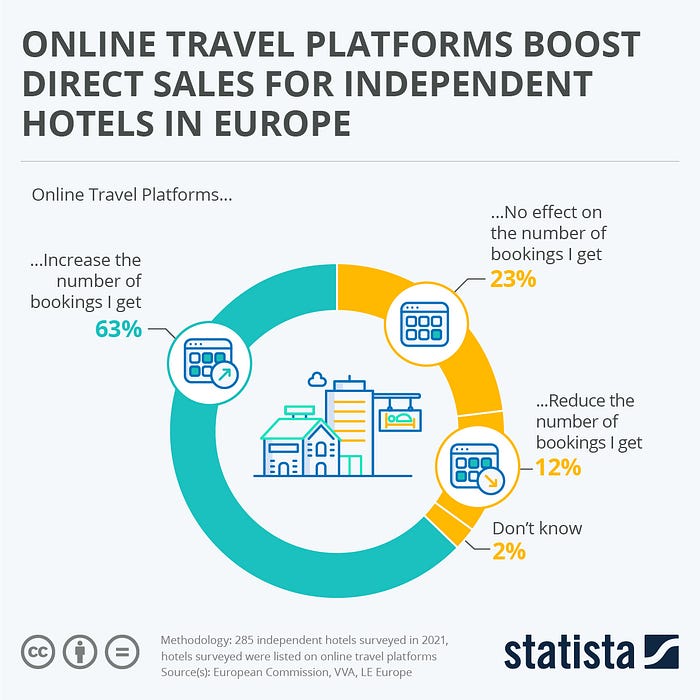

Statista: Online travel platforms boost direct sales for independent hotels in Europe

For this reason, online travel platforms have long been using so called parity clauses. In essence, these clauses require hotels to offer consumers on online travel platforms a price that is at least as good as the one offered on its own website. Parity clauses guarantee a fair and balanced relationship between hotels and platforms. Hotels can generate additional business without any upfront investment and commercial risk. Platforms can ensure that they will be paid for the services provided to hotels.

With parity clauses, hotels are still free to offer lower prices on rival platforms, people calling or emailing the hotel, or those walking in. It is just the hotel’s own website that serves as the benchmark for offering fair and competitive prices on a platform.

The overall impact of online travel platforms on hotel prices is unambiguous. Because platforms increase choice and transparency, competition intensifies on and off the platform, resulting in lower prices for consumers, saving consumers billions of Euros every year.

Statista: Online travel platforms make all hotels cheaper

A European standard for parity clauses and Germany’s diverging approach

In recent years, parity clauses have come under scrutiny from competition authorities and policy makers. Often, this has been the result of pressure from hotel associations, who actively promote free-riding on platforms. In 2015, Booking.com and Expedia entered into an agreement with the French, Italian and Swedish competition authorities, that established the current standard of permitting platforms to ask hotels not to inflate their prices vis-a-vis their own website. Other European authorities tacitly accepted this agreement as well.

That is with one exception: the German competition authority had always wanted to ban parity clauses for online platforms and issued a corresponding order in 2016. Booking.com successfully appealed this order in 2019. The Dusseldorf appellate court held that: “Parity clauses are necessary to ensure a fair and balanced exchange of services between the parties and it does not go beyond what is necessary to achieve the objective in terms of time, geography, or content.” This ruling, in turn, was successfully appealed by the German competition authority to the Federal Court of Justice (FCJ).

At the heart of the dispute are two questions: Are parity clauses restricting competition, or are they merely ancillary to an otherwise neutral or pro-competitive agreement? What is the relevant market for online travel platforms? The Amsterdam district court — dealing with preemptive follow-on litigation, initiated by Booking.com, from the German FCJ decision — has now decided to refer these two questions to the Court of Justice of the European Union (CJEU) for a preliminary ruling. Finally, these questions will likely be settled by the highest European court.

Statista: Most overnight stays in Europe are booked directly with the hotel

Online travel: a world of choice for consumers and hotels

In particular, the question of market definition is an important one. For years, hotel associations have pushed the narrative that Booking.com is so big that hotels have become dependent on it. This is despite the fact that the hotel association’s own surveys show that online platforms account for not even a third of all bookings. While Booking.com is certainly a successful company, no hotel is forced to use it. At most, 14 percent of all hotel bookings in Europe are facilitated by our platform.

Statista: When independent hotels decide to use online travel platform, they rarely settle for just one

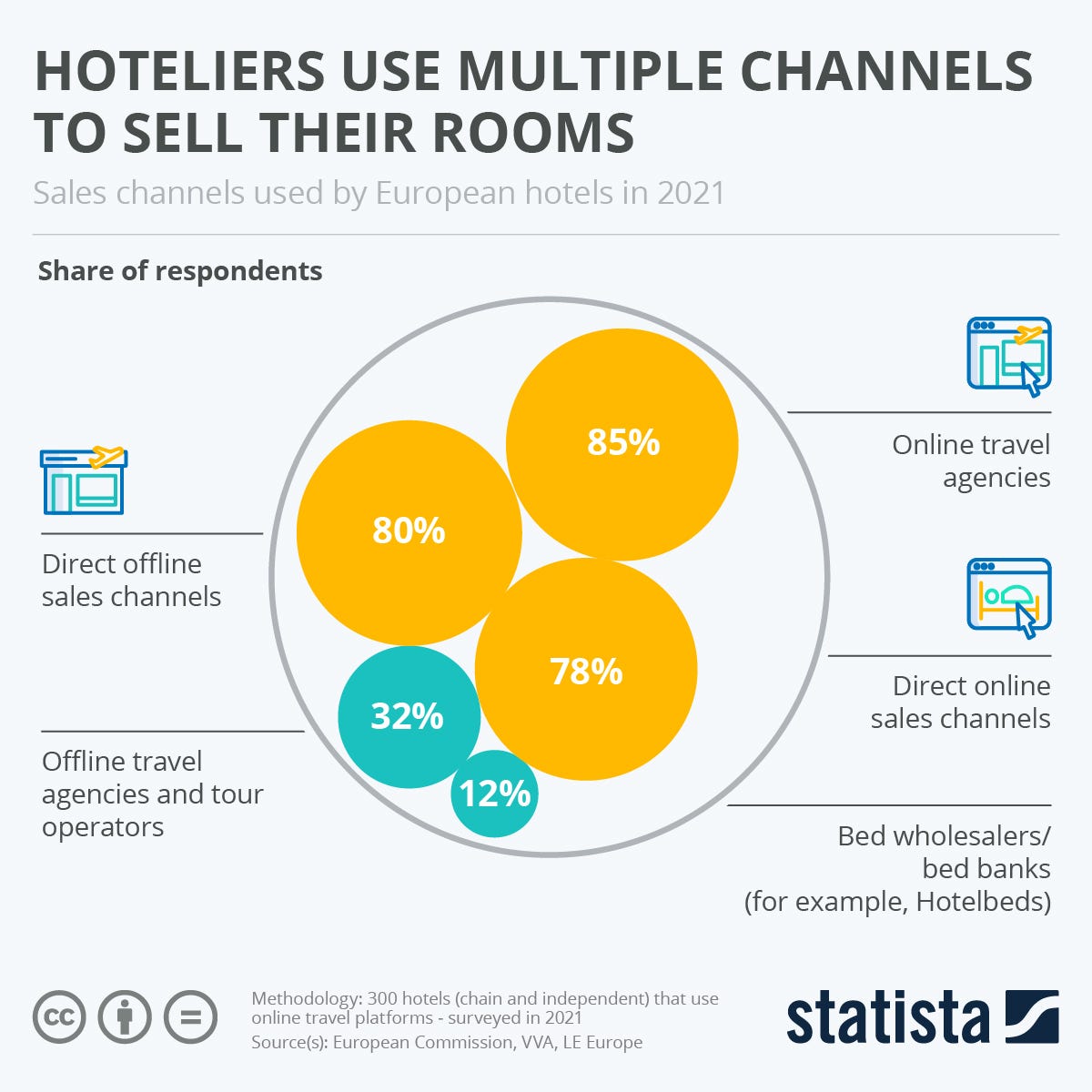

Moreover, as a recent study by the European Commission reports, the vast majority of hotels use more than one travel platform in parallel, and generally make use of a variety of distribution channels. Platforms and a hotel’s own website are substitutes for one another as can be seen from the fact that listing on an online platform also increases a hotel’s direct bookings. It also indicates that there is no competitive bottleneck or gatekeeper in hotel distribution. Hotels and consumers alike have a wide variety of choices to transact with one another.

Statista: Hoteliers use multiple channels to sell their rooms

The Amsterdam Court has now called into question the faulty logic that online travel platforms constitute a market of their own. The Court points out that market definition for multi-sided platforms requires careful consideration of the interaction between different user groups and the hotel’s own arguments point towards the direct distribution channel being part of the same market. If confirmed by guidance from the CJEU, this would clearly establish that there is no dominant platform in travel distribution. Given the low market shares for any individual platform and multi-homing behavior of consumers and hotels, it would also make it all but impossible to claim hotels are dependent on a particular platform.

Market definition for multi-sided platforms raises important legal questions beyond the present case and we hope the CJEU will use this opportunity to clarify fundamental principles of market definition for the digital economy.