Extended-Stay Hotels: One of the Fastest Growing Segments in the U.S.

While several new brands have emerged within the limited- and select-service segments over the past decade, the expansion of extended-stay brands was limited prior to 2021, and many of the hotels within this segment in the U.S. were dated. However, during the last two years, economy and midscale extended-stay brands have experienced a significant expansion.

One of the most prominent developments is Choice Hotels International, Inc.’s mid-year 2022 agreement with ServiceStar Capital Management to develop at least 21 new Everhome Suites hotels throughout Colorado, Arizona, Utah, Nevada, and Florida. This deal represents the largest investment by Choice into the Everhome Suites brand in its history. While the midscale, extended-stay brand was brought to market in 2019, only one Everhome Suites was open and operational as of December 31, 2022. In addition, it is reported that over 30 other Everhome Suites hotels are in the pipeline for development over the next few years.

In addition, Choice Hotels has begun a substantial repositioning of its WoodSpring Suites brand. As part of the transition, Blackstone Real Estate Partners and Starwood Capital Group, which purchased Extended Stay America for roughly $6 billion in 2021, acquired 111 WoodSpring Suites hotels across the U.S. from Brookfield Property Partners for a reported price of $1.5 billion in early 2022. The Blackstone and Starwood Capital partnership subsequently began to transition the properties into Extended Stay America’s newest brand, Extended Stay America Select Suites. Thereafter, Choice announced a partnership with Noble Investment Group in November 2022 to develop nine new WoodSpring Suites in Georgia and South Carolina, and the brand reportedly had over 200 additional hotels in its development pipeline across the U.S. as of year-end 2022. This represents a significant expansion of the brand, almost doubling the number of WoodSpring Suites hotels throughout the U.S.

Wyndham Hotels & Resorts has also been expanding within the extended-stay segment. In March 2022, the company announced the launch of the Echo Suites brand, known as “Project Echo.” The economy, extended-stay prototype features 124 guestrooms that average 300 square feet. The brand launch announcement also revealed that Wyndham has partnered with Sandpiper Hospitality and Gulf Coast Hotel Management to develop 50 Echo Suites hotels, with the first property slated for completion by year-end 2023 in Plano, Texas. As of March 2023, it was reported that Wyndham has over 200 Echo Suites in the development pipeline.

In April of this year, Hyatt Hotels Corporation announced the launch of its new upper-midscale, extended-stay brand, Hyatt Studios. The company has over 100 letters of interest signed by various developers, and the first hotel is expected to open in 2024. The new brand will offer a complimentary grab-and-go breakfast, as well as other typical amenities, such as a 24-hour market.

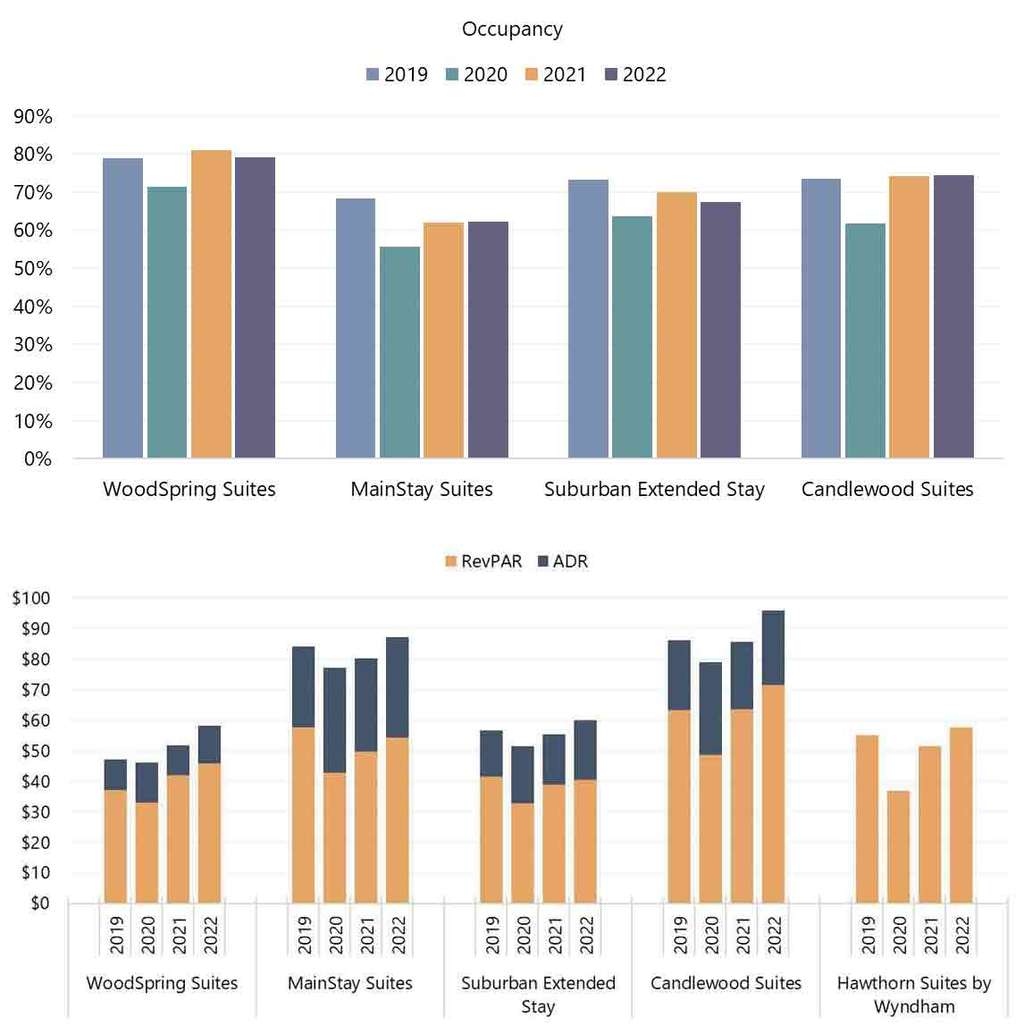

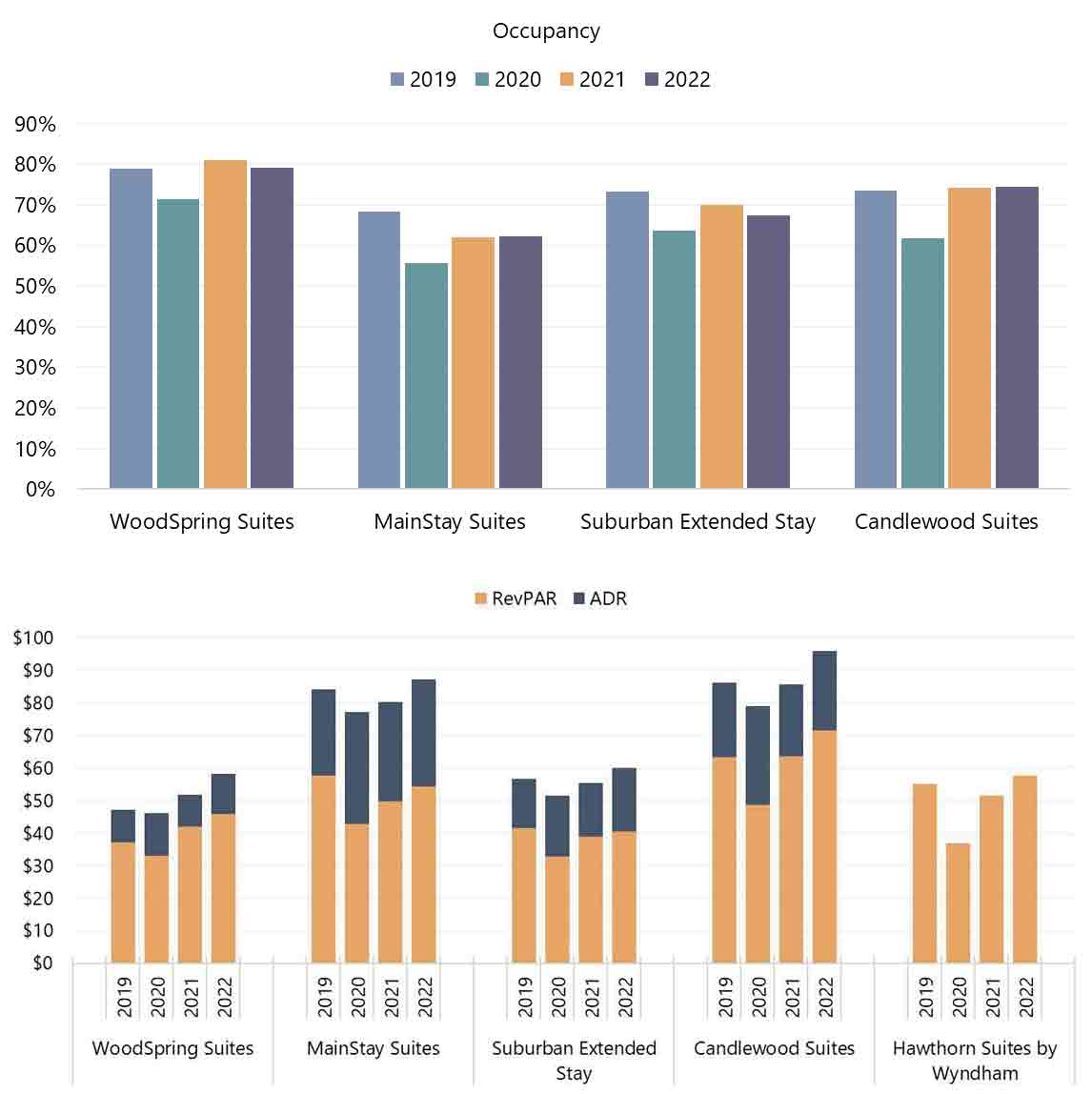

The following charts illustrate the occupancy, ADR, and RevPAR levels for various midscale and economy extended-stay brands. These data demonstrate the strength of the segment, even during the significant pandemic-related downturn that occurred in 2020 and early 2021.

Historical Metrics for Select Extended-Stay Brands

The ongoing expansions of existing brands and the announcements of new extended-stay brands reflect the strong performance and stability of the extended-stay segment over the past few years, particularly during the pandemic. These brands can provide hotel developers with a low-cost option when compared to other, higher-tier brands, while typically operating at higher margins as a percentage of revenue given the extended-stay nature of the operation.

To learn more about how HVS can help with your hotel development venture in this sector, please contact Ryan Mark at (303) 881-4762 or [email protected]. He is a specialist in this sector and consults on projects nationwide.

Follow us on LinkedIn for the latest market and industry insights.