Talent Disruption: Coming To A Hotel Near You

Introduction: LA Hotel Workers Mount the Largest Hotel Strike Ever

This July 4th weekend, thousands of employees at the most iconic hotels in Los Angeles joined what the union calls the largest ever strike in the history of U.S. hospitality. While the dispute revolves around wages and work rules, the conspicuous issue is widening income inequality plaguing the industry. Unless a new mindset is adopted, this dispute may just be the beginning, derailing the travel boom, and leading to substantial job losses across the country.

During the pandemic, hotels received $15 billion in federal bailouts and returned to profitability swiftly by cutting jobs and guest services. Fast forward to 2023, hotel profits in LA County have surpassed pre-pandemic levels and the city is collecting $225 million in transient occupancy taxes. Meanwhile, frontline workers, mostly women and minorities, struggle to afford a place to live in cities where they work and earn lower wages than UBER drivers.

What’s at Stake: The Magnitude of the Issue

65 full-service hotels, worth more than $5 billion and generating an estimated $500 million in operating profits combined, are at the heart of this conflict. The workers, including room attendants, cooks, dishwashers are demanding a 40% raise through an immediate $5 an hour increase with an additional $3 an hour in 2024 and 2025 plus 28% more benefits. The hotel coalition (which represents at least 42 of the hotels) offered a 30% raise with $2.50 an hour immediately and $6.25 over the next four years. A raise of $10 an hour equates to $1mm in additional labor costs or a decrease of 8-10% of net operating profits for these full-service hotels. This increase in fixed costs will reduce real estate values by an average of $15 million per hotel and render entire departments such as restaurants highly unprofitable with union labor costs as high as 80% of revenue. The outcome will be either layoffs and restaurant closures or leases to third parties willing to be subject to union work rules. Owners are rightly concerned about the significant impact on unit economics in the context of higher interest rates and minimal flexibility for refinancing.

Inequality and its Discontents: The Post-Pandemic Labor Problem

The underlying issue goes beyond this hotel strike and is spreading across the country. It is a symptom of the growing income inequality within a highly profitable industry that has a Gini coefficient of 0.73, worse than South Africa (the country with the worst inequality according to the World Bank). The sector is grappling with a shrinking talent pool, losing 20% of its labor market share to the gig economy and other industries. Workers have lost their dignity and cite concerns such as increased workloads, affordable housing, and long commute times. The consequences are flowing through the service profit chain: customer satisfaction scores are at record lows and price increases have outpaced inflation by three times since 2021.

Putting Things in Perspective: A Framework for Talent Disruption

Harvard Business School Professor Christensen’s research on innovation focused on technologies that address unmet customer needs through either low cost or new market disruptions. But there is another type of disruption that may radically alter performance in any industry: talent disruption. Talent disruption is the process by which traditional labor ends and talent shifts from legacy full-time employment to higher paying, more flexible work, facilitated by innovative technologies that empower individuals to build a personal brand. As disruption grows, talent ruthlessly migrates to the highest paying and most flexible sources of work and entrepreneurship, leapfrogging inefficiencies in hierarchies of legacy industries.

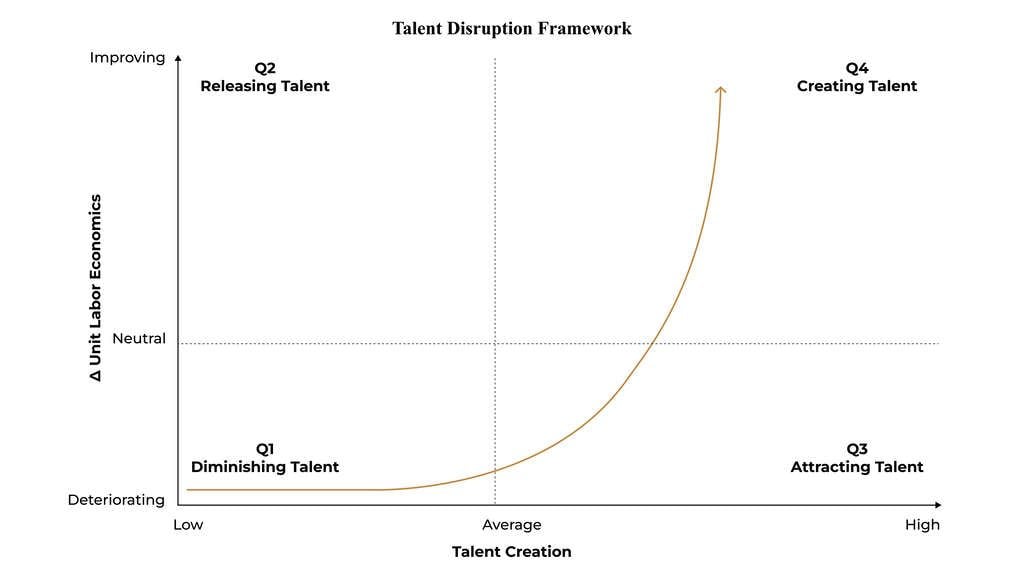

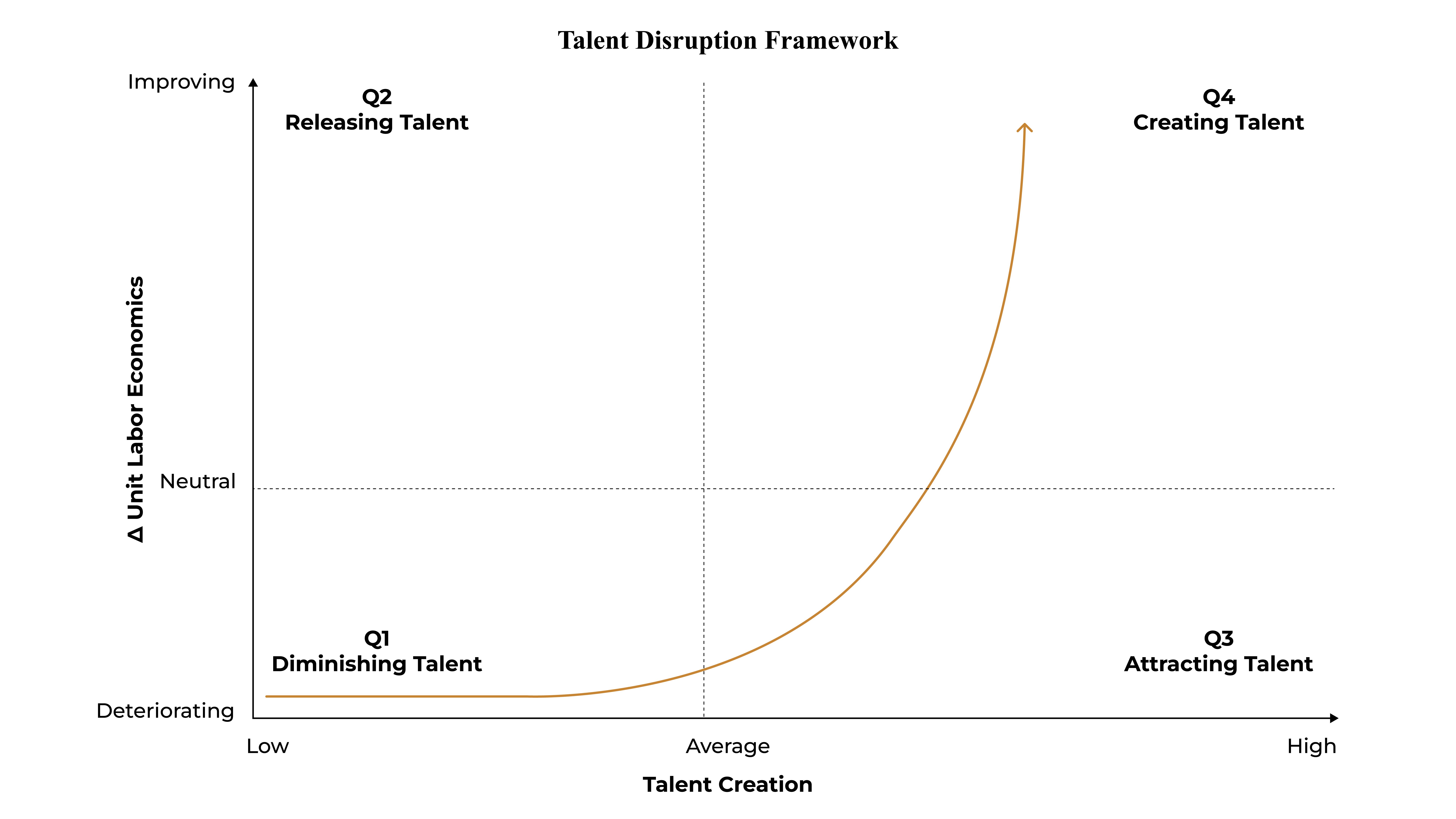

In our journey to develop an AI-driven talent marketplace for hospitality, our team developed a theory that predicts when talent disruption occurs and what incumbents can do to either mitigate or accelerate each type of disruption. The Talent Disruption framework has two dimensions: talent creation, or the ability of an organization to capture or lose share of elite talent and unit labor economics, or the total direct and indirect costs of talent divided by the unit of product or service. The slope of the disruption curve reflects the rate at which a sector progresses on both dimensions simultaneously. Those industries or organizations alongside or to the right of the curve address unmet customer needs through an operating model that creates a talent disruption resulting in a long-term shift in the labor markets.

Talent Disruption Framework

On x-axis, one can measure an organization’s net talent creation in a geographic hub. This is a measure of its employer brand equity that reflects its share of the industry’s talent pool, less turnover and attrition. KPIs measure whether organizations, and specifically, which functions and departments are gaining market share of elite talent (top 10% versus competitors). Second, talent creation measures the velocity of upwards mobility for these diverse elite talents as they rise the front line to managerial positions such as hotel GM, chief nurse, or store manager.

At the low end of the talent creation continuum, rigid talent management practices are used to recruit full time permanent employees that have strict job definitions, multiple reporting layers, an established hierarchy or pecking order supported by many standardized processes. At the extreme, they are unionized, with job-based pay scales and tenure-based criteria for advancement.

Conversely, at the high end of the talent creation continuum are team-based organizations where the workforce performs multiple, flexible jobs and a network of vetted part time or gig workers may even be key contributors. These organizations possess “bench strength,” with deep talent pipelines, that can withstand changes in demand by orchestrating faster or slower career mobility for its employees. The scope of employees’ duties may vary radically by project, and they work in organizations that are flat, with minimal bureaucracy and documented rules of engagement.

The Y-axis measures change in unit labor economics, or the change in total compensation divided by a single unit or production or customers served. For example, in hospitals unit labor economics can be calculated by dividing total compensation for full time equivalents (including contracted labor such as Nurses and technicians) by the number of patients discharged. In hotels or vacation rentals, occupied room nights and restaurant covers per seat are examples of the denominator used to measure unit economics. The extent to which an organization’s unit labor economics improves or declines, for any reason (such as an economic correction, process, or technology innovations) is charted over time, with a steeper positive slope of the curve implying positive gains.

The change in unit labor economics can also reflect different degrees of automation, starting with operational processes such as back-office and support functions, all the way to core customer-facing activities. Examples include U.S. hospitals that experienced a 180 percent increase in costs per unit of service from 2019 to 2022 primarily due to a 258 percent increase in contract labor for nurses, technicians, and other roles over this three-year period. Consequently, their unit labor economics are deteriorating, and they lack the processes and technology tools to grow the talent pool other than through traditional methods which occur in low frequency.

Talent Disruption in the Service Industry

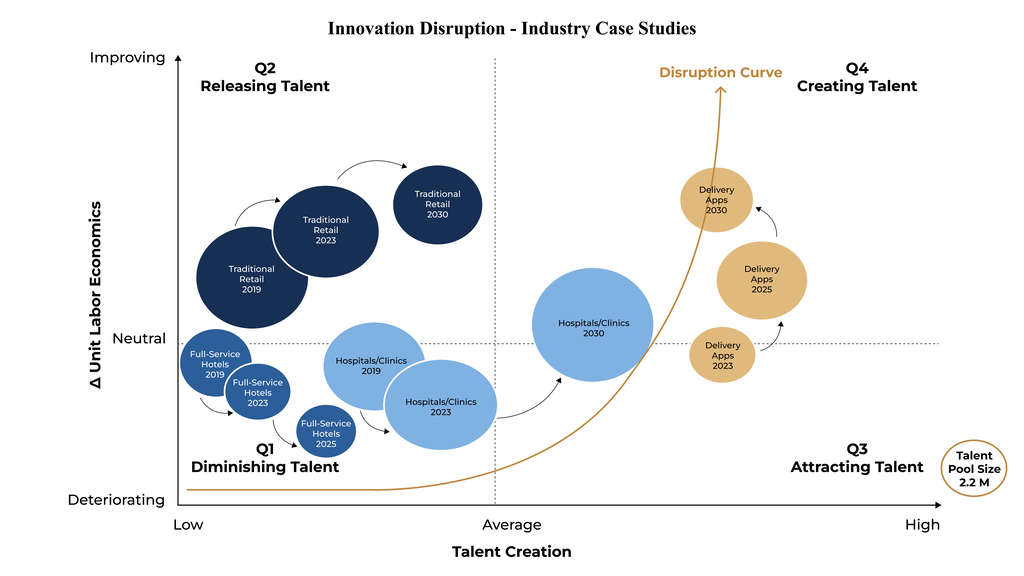

The immediate pre and post Covid-19 pandemic period, from 2019 to 2023 provides a window into the performance of service industries, especially hospitality, retail, and healthcare. We used AI and machine learning to analyze and chart the human capital performance of over 1000 internally managed properties at over 100 publicly traded companies in the hotel, hospital, retail, and delivery sectors.

We classified industries and organizations into one of four buckets to chart their historical performance and determine whether they are either facing a talent disruption or likely to confront one soon. It's also useful to chart the relative progress or decline of an organization’s operational processes over time, including whether they are sustaining their model by relocating production to arbitrage differential currency, labor cost and regulatory gains in a global supply chain.

Accelerating and Combating the Talent Disruption in Service Industries 2019-2023

A case in point is the healthcare industry is facing significant challenges, including rising costs, a labor shortage, and declining operating margins. The U.S. is projected to face a shortage of more than 200,000 registered nurses and more than 50,000 physicians in the next three years. In 2023, healthcare leaders expect a drop in operating margins of between 25 and 75 percent, which could place even more workload for an already stressed workforce and necessitate hospital closures and layoffs. Furthermore, the industry is seeking improvements in diversity, equity, and inclusion. For example, while 28 percent of physicians are immigrants, only 6 percent of Hispanics and 5 percent of Black people identify as physicians; 75 percent of general practice doctors are men.

However, innovative models are being adopted that shift the industry from hospital-based care to lower acuity sites and home-based care, enabled by innovative technologies. $1 trillion of productivity improvements are being ushered in by telehealth, virtual testing, and remote patient monitoring. Furthermore, the industry is responding to improve transparency and data sharing, including price transparency and data interoperability. The integration of price and quality-rating information across healthcare providers will help consumers make better decisions about where to go for care. Furthermore, the regional expansion of academic medical centers through mergers and acquisitions into distribution networks such as UCLA Health, including doctors’ offices and clinics are resulting in burgeoning talent pools for nurses, technicians, and residents. R&D has grown to over $200 billion, or 6 percent of revenue, including over $20 billion invested in building AI-driven “hospitals of the future,” and the industry has attracted over $50 billion of capital since 2021 focused on creating workflow efficiencies and using data for clinical decision support.

Therefore, as healthcare becomes less expensive and automated, less invasive, and more precise and customers have access to their data, unit labor costs for hospitals and most healthcare providers will decline sharply. This will result in reductions in admission costs per patient. Public-private partnerships in healthcare are investing in technologies such as remote monitored robotic surgeries that are also changing the nature of work. Further investments in for-profit hospitals from private equity will create more cost efficiencies that mitigate the labor shortage.

The retail industry, which is expected to close 50,000 stores in 2022 alone and continue investing in e-commerce automation. Given the restructuring of commercial real estate across the country, retail may permanently shrink as an employer. However, new roles in fulfillment, logistics and AI are being created, and retailers will increasingly compete for talent with traditional manufacturing, logistics, and technology businesses.

In contrast, absent significant innovation, the labor productivity in U.S. hotels will continue to diminish. Even taking into consideration an economic recession, changes in U.S. immigration policies and departures from legacy brand standards resulting in reduced service levels and further investment in employer branding, the industry will have 2.4 million job openings annually. Hotels will continue suffering from “diminishing talent,” losing market share of future GMs to other industries and experience growing labor costs buttressed by the expansionist agenda of organized labor, and the intensifying talent shift to the gig economy.

The Root Causes of the Hotel Industry’s Talent Disruption

Despite a labor shortage of 1.6 million workers (and a demand for 2.4 million workers annually including turnover), the main hurdle in the hotel industry is the lack of leadership. Various parties extract billions of dollars in fees from hotels for branding, asset and hotel management, taxes, and union dues yet accountability is murky. The industry's governance structure is becoming unmanageable, with brands, owners, third-party operators, cities, and municipalities pointing fingers at each other. Hotel chains focused on franchising avoid accountability while enjoying the benefits of revenues from the topline and owner funded marketing budgets. Meanwhile, cities and municipalities extract $46 billion in taxes but prioritize advertising over labor related investments.

Unions are growing and workers have few alternatives but to join them to have a voice. Unlike airlines, frontline employees have no ownership stake in hotel properties. Hotel owners, driven by short-term profit goals, perpetuate turnover by hiring third-party managers to cut costs and exiting properties an average of every 5.5 years. Hotel operators have also been inefficient in recruiting talent, relying on legacy technologies that filter out millions of semi-qualified hidden workers. It’s imperative that industry CEOs advance alternative, market-based solutions, such as pay for performance, that demonstrate a renewed sense of purpose in building human capital.

Strategic Choices for Hotel CEOs and Boards of Directors

There are three, non-exclusive strategic alternatives for the industry that change the game and revitalize the industry.

- Accelerate Automation through AI: Hotels could reduce labor costs through automation and robotics, eliminating many front-line positions and eventually entire departments such as the front office or housekeeping. They can also further reduce brand standards, service levels, and amenities. Such experiments are taking place in China and other East Asian markets, and feedback from tech savvy customers has been overall positive. However, this approach risks a confrontation with unions, work stoppages, cannibalizing brands and prolonging the recovery of individual and group business travel in the context of a potential recession. Given the potential job losses, it will also invite government intervention which could lead to unintended consequences, at the local and state levels.

- Empower Employees through Ownership: The industry could adopt AI-driven HR technologies and build transparent talent marketplaces that reward high performers and facilitate meritocracy. AI can be used to establish market-based approaches such as profit sharing, ownership and other variable pay including bonuses and tips. In addition, hotel owners should make front-line employee’s partial owners, teaching them financial literacy and giving them a voice in property level governance. As employee ownership generates new wealth and expands hospitality’s middle class, it will help spawn a new generation of future hotel owners, including those being targeted in DEI related initiatives. This approach requires partnering with technology start-ups and additional legal and data related costs but could drive productivity, drive fixed costs down and attract talent into the industry.

- Reinvent the Franchising Model: Hotels should adjust the use of proceeds in their franchising fee model and partner with cities to redirect funds, such as program fees and tax revenues, to support workforce-related initiatives including housing allowances tied to employee retention. Asset managers could reallocate capital reserves (2-4%) of revenues to performance-based bonuses, and housing allowances for hourly workers. Although this shift in resource allocation from marketing to human capital is not what unions are seeking, it represents a market-based approach toward addressing the industry’s talent disruption.

Conclusion: Hospitality’s Moment of Truth Has Arrived

Failure to act strategically will only accelerate the talent disruption but increase the likelihood of automation, which will permanently shrink employment in hospitality, an industry has a rich history of self-made entrepreneurship that includes people of all backgrounds and social classes. It’s time for stakeholders to step up with innovative solutions that prioritize worker well-being, address income inequality, and elongate the travel boom. By investing in human capital and adapting the franchising business model, CEOs in the hotel industry can create new wealth alongside a more equitable and prosperous future for all stakeholders.

Alexander Mirza is the CEO of Mogul Hospitality. He was CEO of Cachet Hotels and a senior executive at Hilton, Starwood, and Caesars. His book, Talent Disruption: People Are The Brands, is being published this year.

Alexander Mirza

Founder & Chief Executive Officer