Current State of the Pima County Hospitality Industry

Factors contributing to Tucson’s strong and consistent demand levels during the majority of the last decade have included increased business activity, growth in the healthcare and education sectors, increased airlift to Tucson International Airport, and the continued popularity of the region as a tourist destination. Following the COVID-19 pandemic and the significant decline in market performance, Pima County’s hotel demand levels fully recovered in 2022 and the year-to-date 2023 period. The local inventory of older, economy-oriented properties has been reduced through conversions, and the market has absorbed other new supply relatively well over the last few years.

Recent Tucson and Pima County Market Statistics

Current State of the Pima County Hospitality Industry

Factors contributing to Tucson’s strong and consistent demand levels during the majority of the last decade have included increased business activity, growth in the healthcare and education sectors, increased airlift to

Despite accelerating recessionary concerns, the Tucson lodging industry sustained strong growth in the first quarter of 2023, similar to nationwide trends. Per the Statewide Lodging Performance Report for the first quarter of 2023, Metro Tucson experienced a 2.8% increase in demand and an approximately 10.0% increase in ADR over the same quarter in 2022 and reaching levels well above those attained in 2019. We note that Pima County’s growth levels have outpaced those of the other counties in the state, aside from Maricopa County.

Hoteliers reported a slight decline in leisure demand in the second half of 2022 and the first half of 2023. However, there were significant gains in group and commercial demand throughout the market. During the last year, the number of scheduled events throughout the area spiked, drawing thousands of travelers to the area. The 2022 Gem Show had about 75% of its typical pre-pandemic attendance and economic impact, and the 2023 Gem Show operated at roughly 95% of pre-pandemic levels. Officials at Visit Tucson are optimistic that the show will be fully recovered by 2024.

Furthermore, the Jehovah’s Witnesses convention has historically been a strong demand driver to the market. The event was held virtually in 2022, but the group returned in-person in the summer of 2023. The conference has approximately 7,000 attendees in a normal year, while it had roughly 4,000 attendees in its first year back since the pandemic began. Visit Tucson reports that the Tucson Convention Center has increased other types of bookings in the center and does not rely as heavily on this group to fill demand. Additionally, the market experienced strong demand levels in the first half of 2023 when the Korean Baseball Organization’s NC Dinos and KT Wiz teams visited.

Going forward, we anticipate occupancy to remain relatively stable in the high 60s and ADR to continue softening as ongoing inflationary concerns tighten consumer purse strings and demand levels moderate, resulting in fewer peak/compression nights. ADR is forecast to grow below expected inflation levels in the second half of 2023 given a shift in segmentation, the modest normalization of leisure demand, and the recessionary headwinds.

For a look farther into the past, you can reference our previous Tucson article.

Investors Looking to an Evolving Tucson

Tucson’s hotel supply and investment interest have evolved in the past few years. The leading investment trend in Tucson (and throughout the state) has been in the economy and midscale sectors for conversions to other uses, including multi-family and affordable housing, as well as shelters and transitional housing. Additionally, developers are replacing Tucson’s older supply with new, higher-end hotels, such as The Eddy Hotel, a Tapestry Collection by Hilton; The Leo Kent, a Tribute Portfolio Hotel; and the SpringHill Suites by Marriott at the Bridges. Several hotels are in the pipeline for Pima County, including Hotel Arizona’s restoration to a Hyatt. Despite high debt and construction costs that have slowed development of some projects throughout the city, state, and nation, hotels remain a popular investment asset class in the prevailing inflationary environment nationwide.

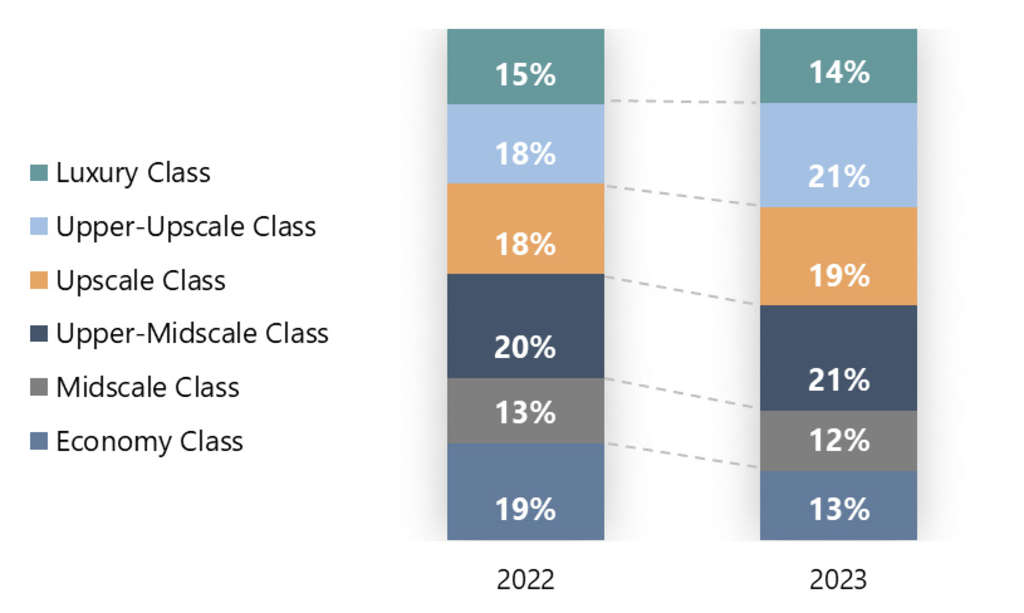

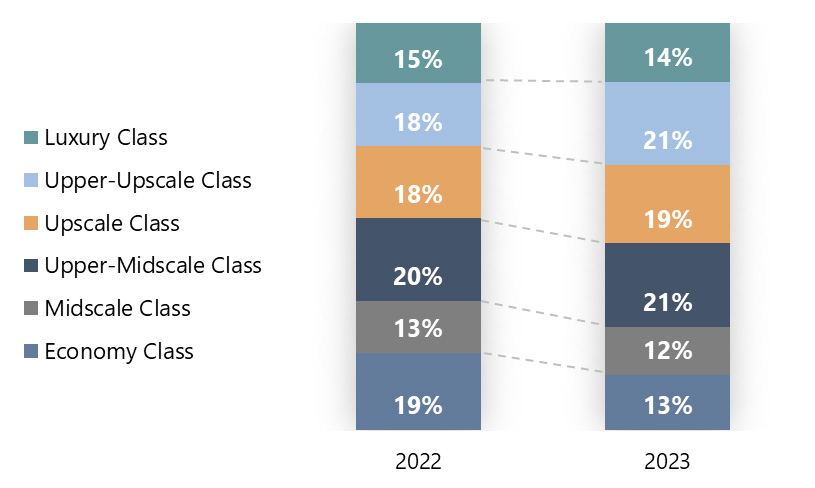

The following chart illustrates the mix of hotel classes in Pima County by percentage of market share for 2023, compared to 2022.

Pima County Existing Hotel Supply by Chain Scale

A notable recent transaction in the market was Southwest Value Partners’ acquisition of the JW Starr Pass Resort & Spa for $110 million. The company plans to carry out a property-wide renovation for a total reported price of $62.2 million, or $108,000 per room. Furthermore, several of the Tucson resorts, such as Omni Tucson National Resort and Loews Ventana Canyon, completed renovations in 2022 and 2023. The resort market in Arizona has always been led by Scottsdale; however, Tucson resorts continue to tighten the ADR gap.

For more information on the Tucson lodging market, please contact Zabada Abouelhana with the HVS Phoenix office.

This article was originally published in Trend Report, August 2023.