The Continued Recovery of the New Orleans Lodging Market

New Orleans consistently ranks among the top leisure destinations in the United States due to its reputation for food, drink, and music; the preserved Vieux Carré (French Quarter); and its innate culture of hospitality. In 2020, New Orleans’s most popular event, Mardi Gras, was held on February 25, but the city shut down on March 20 as COVID-19 infection rates began to increase. Thus, Jazz Fest and other conventions, events, and festivals for the rest of that year were canceled. After stay-at-home orders were lifted, New Orleans was one of few cities on the Gulf Coast to impose capacity limits and enforce vaccination requirements. This cautionary approach made it difficult to promote concerts, sporting events, cruises, and casino visitation in Orleans Parish through early 2021.

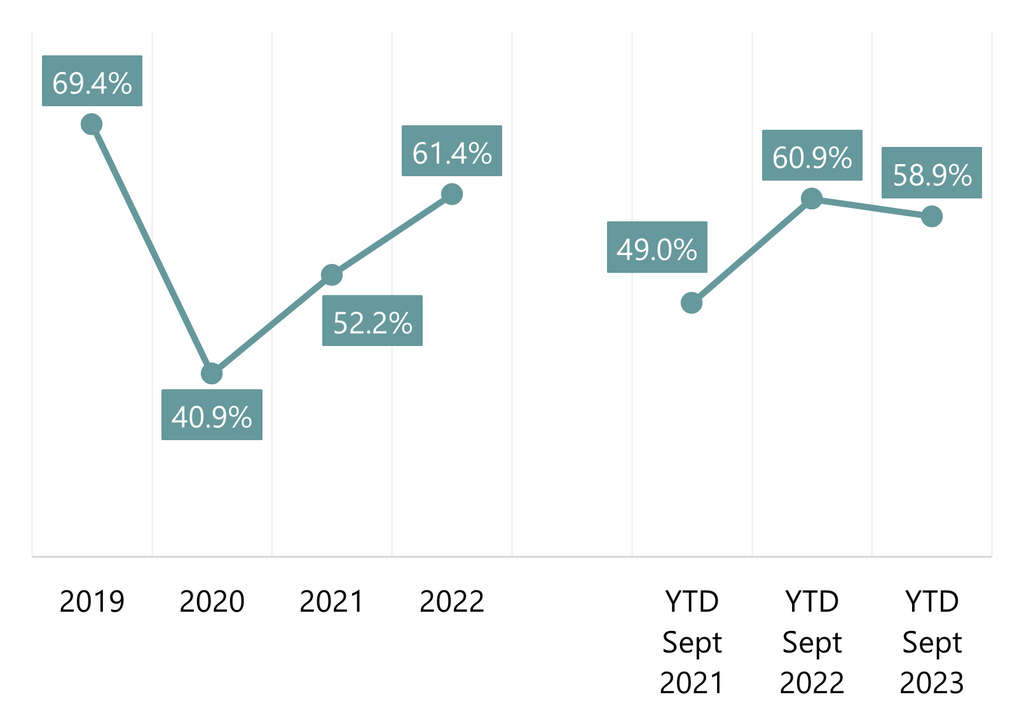

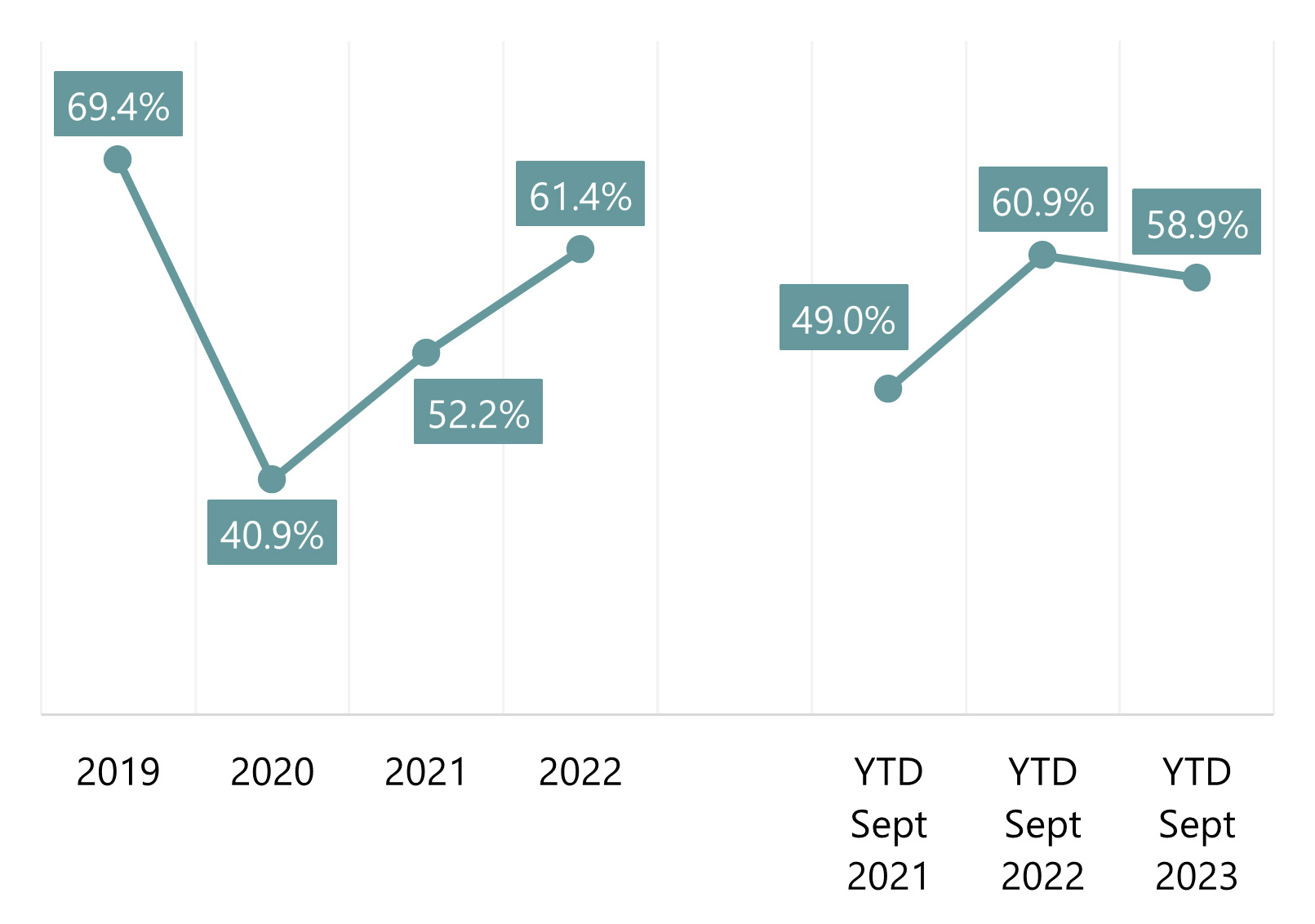

The following chart illustrates the occupancy levels recorded in the greater New Orleans market. This data includes Downtown New Orleans as well as submarkets outside the city center.

New Orleans Historical Occupancy

Decline, Normalization, or Cyclicality?

A well-publicized “leisure boom” was evident during the early recovery of nearby markets along the Gulf Coast and in Florida; however, weekly and monthly data for New Orleans periodically reported worrisome declines. One of the reasons for the disparities in demand is the dependence of the New Orleans market on convention bookings to fill the spring and fall periods and enhance weekday occupancy. According to market participants, 2022 and 2023 were not expected to be peak event years even prior to the onset of the pandemic, so last-minute bookings were unlikely to fill the gaps while business and group travel were still in recovery.

However, 2024 is pacing well to be more of a “normal” year, and hotel operators and New Orleans & Company have worked hard to fill in any soft spots in the calendar. Finally, 2025 is set to show real demand recovery, as the convention schedule for the year is strong, surpassing the three-year pacing of 2017–2019. The following years are pacing similarly.

Major Events

Another thing to keep in mind about the city’s lodging industry is the importance of major events. The landfall of Hurricane Ida at the end of August 2021 benefited occupancy levels at the hotels that stayed open, as line workers traveled to the region to restore the power grid; however, ADR did not increase during this time. Shifting sports schedules have also caused anomalies in the city’s booking windows. While the Sugar Bowl is generally held January 1 or 2, it was held on New Year’s Eve in 2022; the next event returns to a normal schedule, planned for January 1, 2024. The NCAA Final Four boosted the market in April 2022, when record RevPAR was registered.

New Orleans was previously slated to host the Super Bowl in 2024, but changes to the NFL schedule created a conflict with Mardi Gras. The city will instead host Super Bowl LIX on February 9, 2025 (a month before Mardi Gras). For some events, record ADR levels are a temporary benefit; for instance, the record-high registered during the Final Four in 2022 dissipated the next year. However, New Orleans achieved a more lasting impact after the Super Bowl in 2013, as strong convention business and other events supported rate growth through the rest of that year and into the next. We expect a similar trend to occur in 2025 given a supportive convention season later that year and in 2026.

Renovations Support ADR Growth

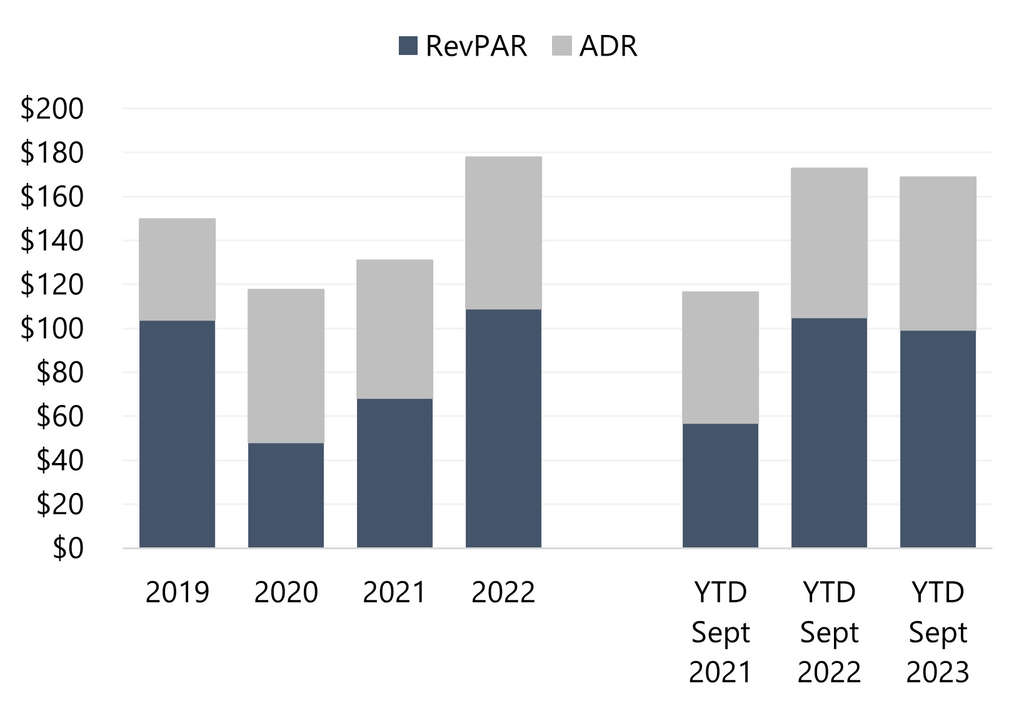

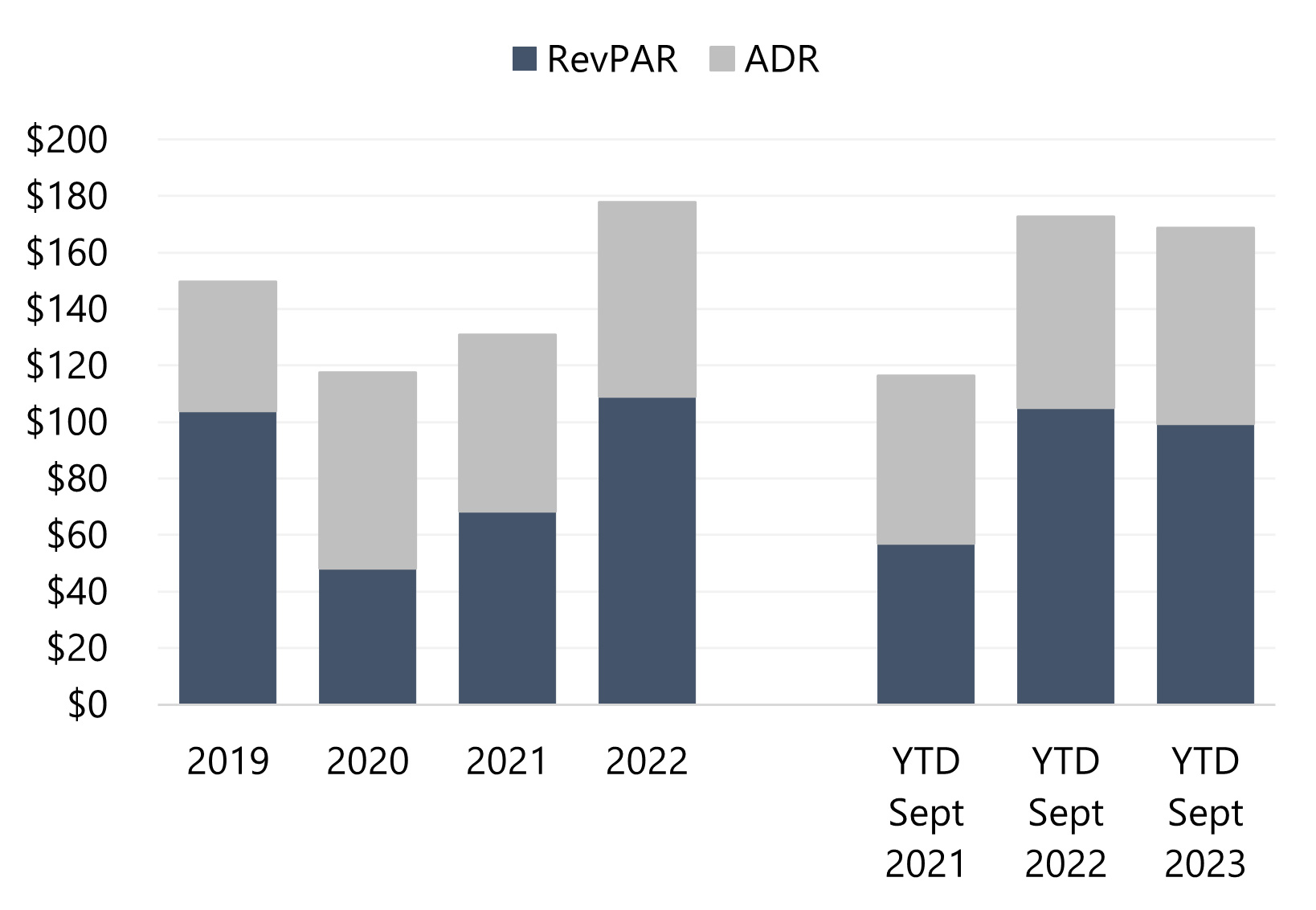

Improving hotel product has also been a driver of ADR gains in recent years. Existing hotels have been reaffiliating with more upscale brands, and almost all new supply has been upper-upscale or luxury-oriented. In past years, renovations and soft-brand affiliations have been common, but more recently, signature hotels like the Four Seasons and Virgin have opened. Operators at these properties plan to avoid discounting to get “heads in beds” and will maintain a high rate floor by curating high-end experiences during slower periods. Furthermore, many hotels are expected to undergo renovations before the Super Bowl in 2025. While the 2023 year-to-date ADR and RevPAR are slightly below those of 2022, as illustrated below, we anticipate stronger gains in 2024 and 2025.

New Orleans Historical ADR and RevPAR

In addition to hotel renovations, major demand generators in the city are being upgraded in anticipation of high visitation levels in the next few years. The National WWII Museum’s $400-million expansion will be complete by November 2023 with the opening of the Liberation Pavilion. The Caesars Superdome is in the midst of a $500-million renovation, and a $557-million capital improvement project at the convention center began in 2018. The updates to these major demand generators are expected to attract new tourists and support better experiences for repeat visitors.

Outlook

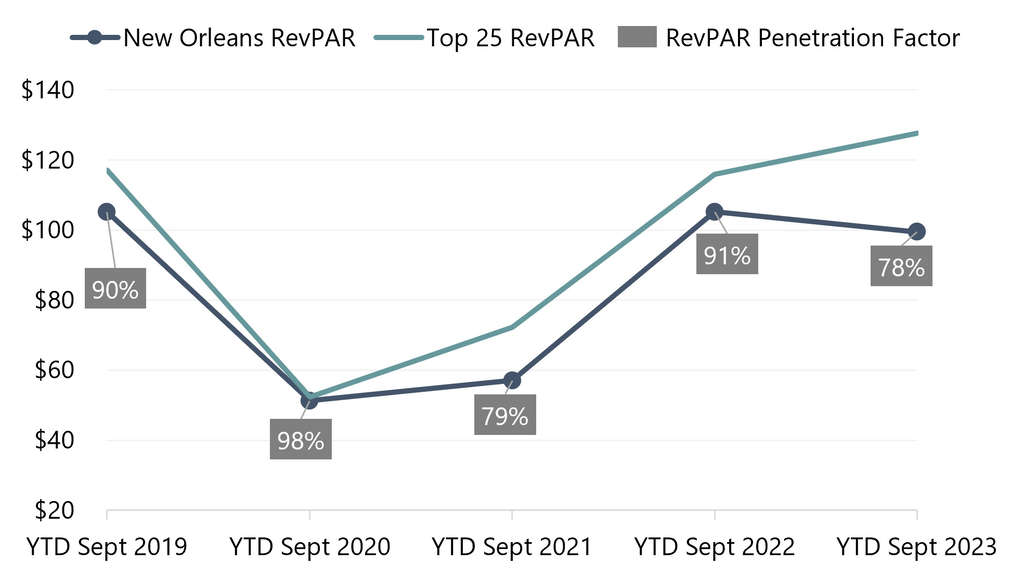

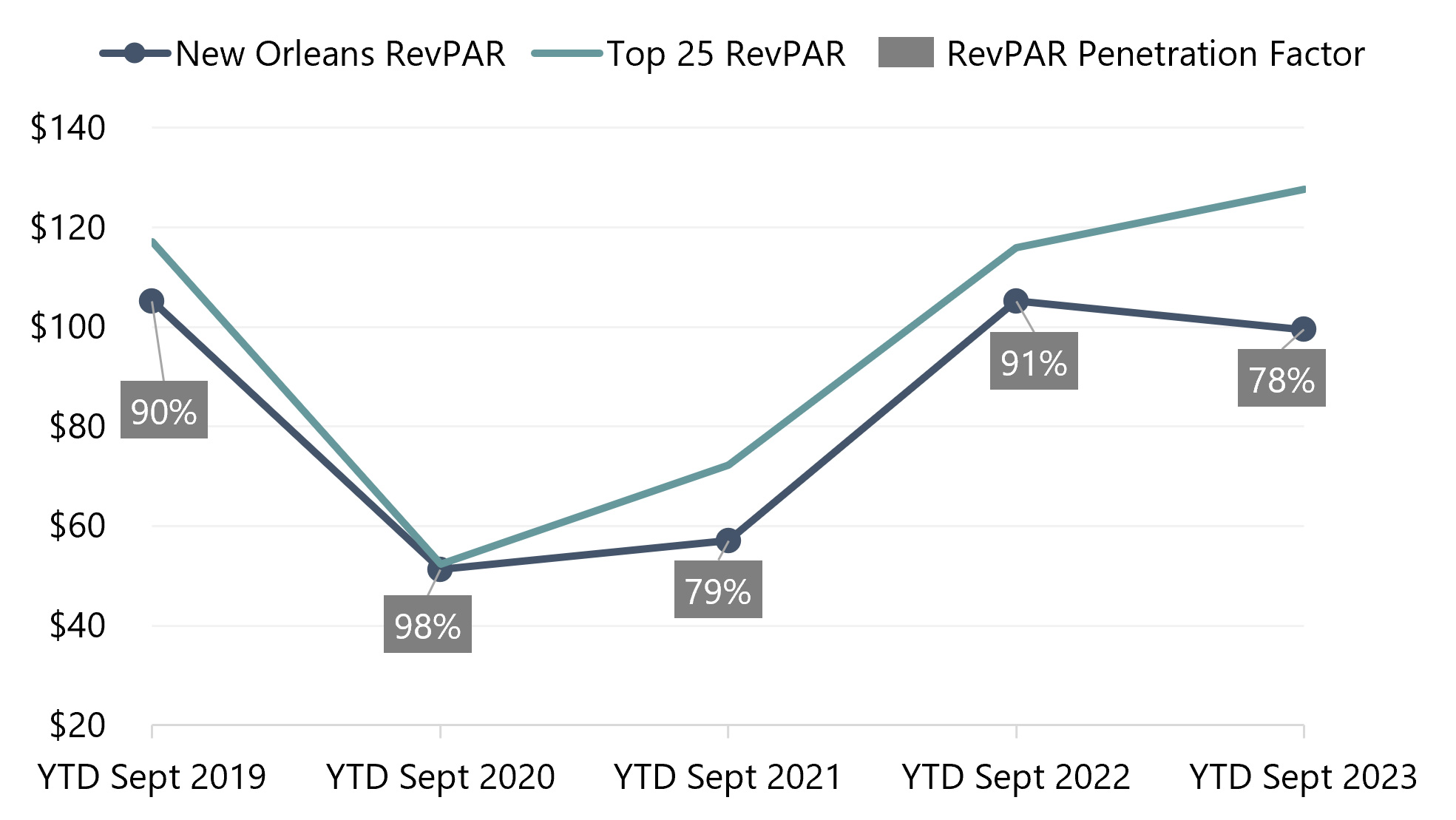

The chart below illustrates the difficulty that prolonged regulations had on New Orleans’ recovery as compared to STR’s Top 25 lodging markets. Without the benefit of Mardi Gras and Jazz Fest, the first half of 2021 was still ostensibly under pandemic limitations.

New Orleans Hotel RevPAR vs. Top 25 Markets

While 2022 brought New Orleans’ RevPAR back to the 90th percentile when compared to the Top 25 markets, as was typical between 2017 and 2019, the lack of large conventions thus far in 2023 was exacerbated by one of the slowest summers on record. Going forward, major events with over 10,000 room nights will be held during the off-season in 2024, including the Evangelical Lutheran Church in America and the American Society of Health-System Pharmacists events. These events will help fill group hotels and provide overflow to the rest of the market. As a bonus, market participants are optimistic about the three Taylor Swift concerts scheduled for October that year.

Early 2025 will remain busy, as the National Automobile Dealers Association event will be held in late January before the Super Bowl paves the way for Mardi Gras. Further out, the American Diabetes Association convention will help fill hotels in New Orleans at the start of the off-season in June 2026, and convention bookings through 2027 are ahead of the three-year average pace. Although the recovery has been slow and the market may lag 2019 levels in 2023, the cyclicality of the convention schedule should bring the city back to pre-pandemic occupancy levels by 2025, with further ADR growth expected in 2026.

Lauren Hock, HVS Director, has been based in New Orleans since 2014 and primarily works in Louisiana, Mississippi, and Alabama, with additional market expertise in Florida and South Carolina. For more information on the Gulf Coast or to inquire about a specific hotel project, please contact Lauren directly.