C&W Market Beat 2023 – Hotel Investment In Europe

Final Quarter Flurry Boosts European Hotel Deal Volumes

- New data reveals that European hotel transactions totalled nearly €17 Bn in 2023

- Strong final quarter significantly boosted overall numbers

- London is the hottest destination for investors, followed by Paris and Madrid

Across the year, 787 properties were sold comprising 106,000 rooms and totalling €16.9 Bn in value. This remains significantly below 2019 levels but is only 4% short of the 2022 total. In the last quarter, volumes reached €5.4 Bn, a 13% increase relative to Q4 2022 (€4.8 Bn).*

Several major individual deals drove these volumes, including the sale of the Westin Paris Vendome, the Center Parcs Allgäu in Germany, the Six Senses Hotel Rome, the Mandarin Oriental and Hotel Sofia in Barcelona, and Haymarket House in London (office to hotel conversion).

According to the research, portfolio transactions represented one third of the 2023 total volume (vs. 28% in 2022 and 45% in 2019). Most of these portfolio transactions were completed in the last quarter of 2023, representing more than half of the volumes transacted (56% in Q4 2023, vs 31% in 2022 and 35% in 2019).

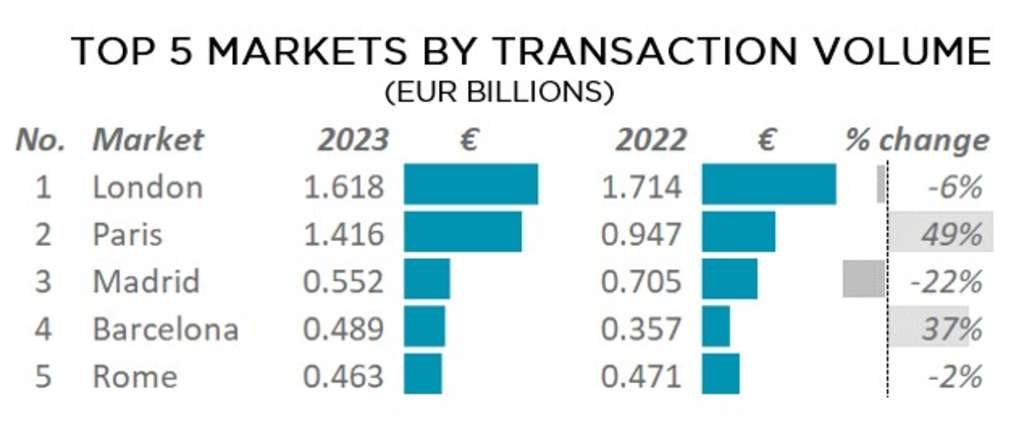

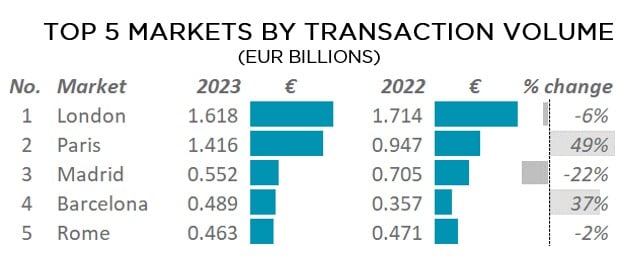

Spain, France, and the UK were the most active markets, accounting for 59% of European volumes in 2023 with a total of €10 Bn (+7% vs 2022). Among the top-10 markets, Spain, France, and Greece witnessed the largest growth relative to 2022, with an increase of 44%, 26% and 23%, respectively. In terms of the key urban markets, London, Paris, and Madrid continue to be on the top of the list for investors followed by Barcelona and Rome.

Frederic Le Fichoux, Head of Hotel Transactions, EMEA, at Cushman & Wakefield, said “A strong final quarter saw hotel transaction volumes boosted but they are still somewhat short of the numbers seen in 2019 and very slightly down on last year. This is primarily due to increased cost of debt, putting pressure on asset values. Like last year, the premium and luxury segments of the market remain the most sought after, and we also continue to see a strong interest in acquiring properties in resort destinations or urban markets with strong leisure demand”.

“Early data for January 2024 indicate over 50% increase of the activity compared to 2023. This positive trend is likely to accelerate once the central banks start to reduce interest rates which is expected in the second half of this year”.

Jonathan Hubbard, Head of Hospitality, EMEA at Cushman & Wakefield, said “Hotel investment in Europe was not immune to the unprecedented increase in financing cost, economic and geopolitical uncertainties in 2023. However, the decrease in activity has been less pronounced compared to the broader real estate sector which recorded a nearly 50% decline in transaction volumes.

“This resilience can be attributed to various factors, with the key driver being the ongoing trend of investors shifting towards alternative asset classes, benefiting from structural changes in the economy and society. This has been reinforced by the exceptional hotel performance recovery across most markets. On average, the revenue per available room (RevPAR) in European hotels surpassed pre-pandemic levels (2019) by nearly 22% in 2023. This positive performance growth is expected to continue in 2024, albeit at more moderate level, due to a slowing economy and the impact of inflation on real disposable income”.

*The transaction volumes include the partial sale of HIP (35% - ES, IT, GR, PT) and Beatriz (51% - ES) portfolios.

**A contingency of 5% is assumed for transactions in the last 12 months, as some deals are revealed with delays.

Borivoj Vokrinek

Strategic Advisory & Head of Hospitality Research EMEA

Cushman & Wakefield