Myth busting: CSRD and, Small and Medium Enterprises (SMEs)

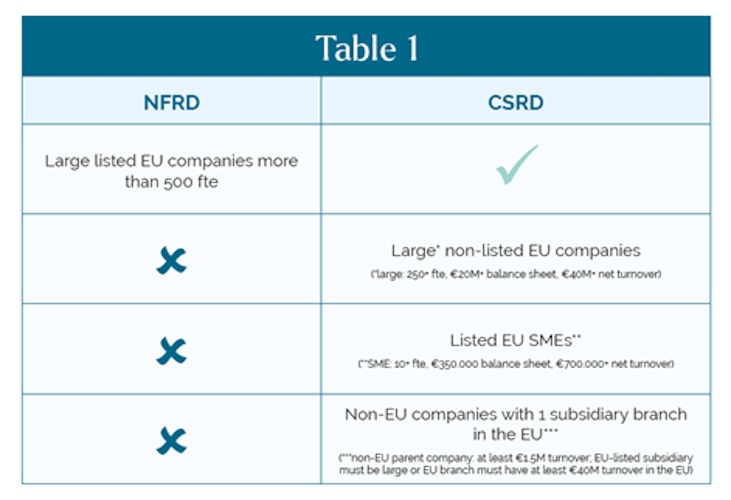

There's a prevalent misconception that SMEs must comply with the Corporate Social Responsibility Directive (CSRD); in other words, they must prepare long and “complicated” standardised ESG and/or sustainability reports. However, this is far from the truth (Table 1). So, what is the actual scope of the CSRD?

- Large listed EU companies with more than 500 fte

- Large non-listed EU companies with certain characteristics (Table 1)

- SMEs listed on EU-regulated market

- Non-EU companies generating over €150M in the EU.

It's crucial to note that the CSRD applies to a specific subset of SMEs, namely the LISTED ones (LSMEs). What does 'listed' mean? It means that these companies sell their securities/stocks on a stock exchange, which refers to the public availability of their shares for trading. The new rules were designed to ensure that investors and other stakeholders have access to the information they need to assess the impact of companies on people and the environment and for investors to evaluate financial risks and opportunities arising from climate change and other ESG/sustainability issues.

There are approximately 1.4 million micro, small, and medium-sized enterprises (SMEs) in The Netherlands alone [1]. Unless listed on a stock exchange, these SMEs are not required to be CSRD compliant (except if national regulation makes it an obligation under a different concept). In comparison, “only” around 50.000 enterprises are obliged to report under CSRD in the EU.

Does this mean an everyday SME does not need to be responsible for environmental, social, and governance (ESG) aspects? Of course not. The company's size does not determine the importance of ethical and responsible behaviour. Every company, regardless of its size, should strive to behave ethically and responsibly. Can non-listed SMEs be affected by the new EU reporting standardisation process? Yes, there are various ways to be affected:

- Indirectly, because you are the leading supplier to someone CSRD compliant, scope 3 emissions under the CSRD cover a broad range of indirect emissions. Scope 3 emissions refer to all indirect emissions that occur in the value chain of the reporting company, including both upstream and downstream activities. These are emissions not directly produced by the reporting company but by those linked to its operations. These suppliers and providers are SMEs for most of the time.

- Because of financial and investment-related regulations and access to refinancing and loans. (Stay tuned for another article coming about this subject.)

I believe the above-mentioned new rules will be more favourable for non-listed EU SMEs. They present an opportunity for these companies to demonstrate their commitment to sustainability and responsible business practices, potentially enhancing their competitiveness and market appeal. To take an easy example, consider CO2 emissions. Who has more favourable CO2 emissions, the one who produces and sells from the EU market to the EU market or who first needs to ship the product from a third country?

Anyhow, the new rules are here to stay, and it's better to get familiar with them and create a more transparent and ethical entrepreneurial environment. It is always a good idea for companies to follow voluntary reporting standards for non-listed SMEs. This can be a complex process, but resources and support are available to help you navigate it. The current multiple ESG data requests are expected to be standardised by reducing the number of uncoordinated requests you might have received until now. The new voluntary reporting standard is expected to support SMEs with better access to lenders, investors, and clients, mitigating risks better and helping to understand their business and its impacts in depth. If you want to participate in projects with us, please email [email protected]

References

[1] Statista (2024). Available: Netherlands SMEs 2023, by size | Statista (openathens.net) [accessed 29 May 2024]

About Melinda

Dr. Melinda Ratkai, originally from Hungary, earned her PhD in SME Management and Economics from the University of Huelva, Spain, in 2014. She is currently a lector at Hotelschool The Hague, focusing on corporate governance and non-financial disclosure. With over a decade of experience in management economics and digital accounting/finance, Dr. Ratkai specialises in corporate sustainability reporting frameworks. Her work supports the hospitality industry in adapting to new reporting requirements, promoting ethical and ESG-conscious business practices, and attracting sustainability-minded stakeholders.