Hotel Market Spotlight - Barcelona YTD Apr 2024

City Centre Full-Service Hotels

Hotel Market Overview

In the first four months of 2024, full-service branded hotels in Barcelona recorded a healthy performance increase, underpinned by growing tourism demand and the regulation constraining hotel development.

Revenue per available room (RevPAR) expanded by 12% compared to last year. This was driven by an 11% increase in ADR, reaching €245 YTD April 2024

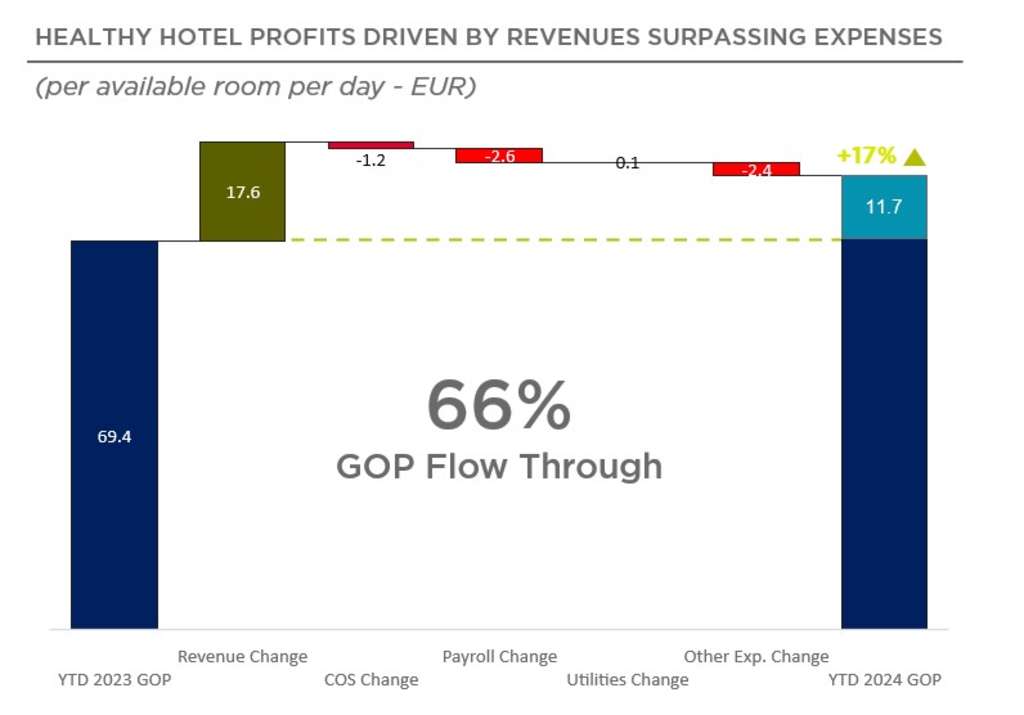

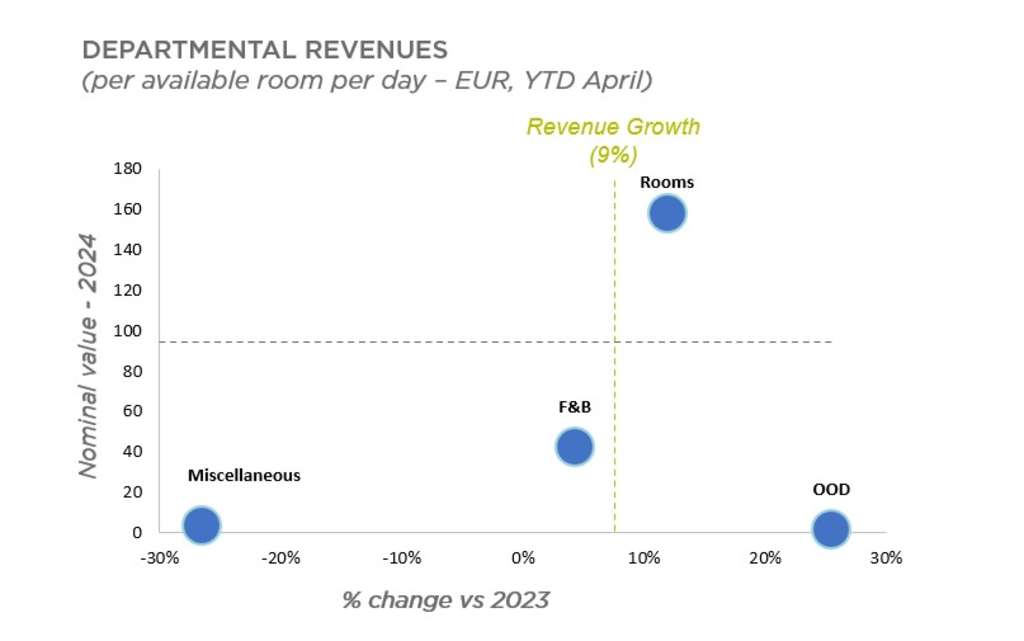

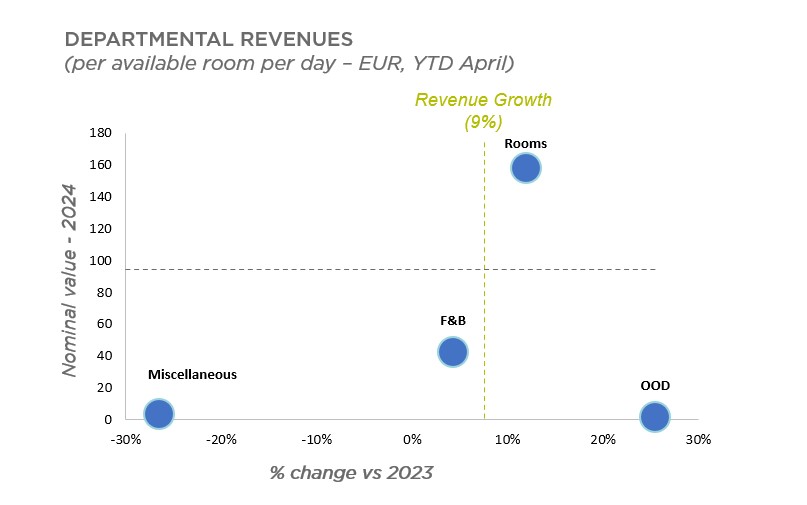

During the same period, overall revenues grew by 9%, surpassing a 5% growth in expenses. As a result, GOP per available room grew by 17% to €81 per room per day. This increased the profit margins by 3 percentage points to 39% YTD Apr (43% GOP on a 12-month basis YE Apr 2024).

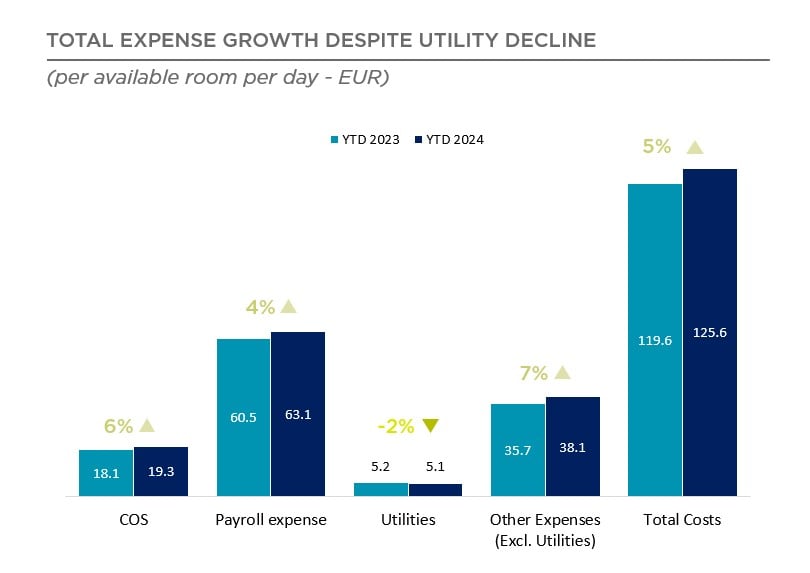

Utilities Costs

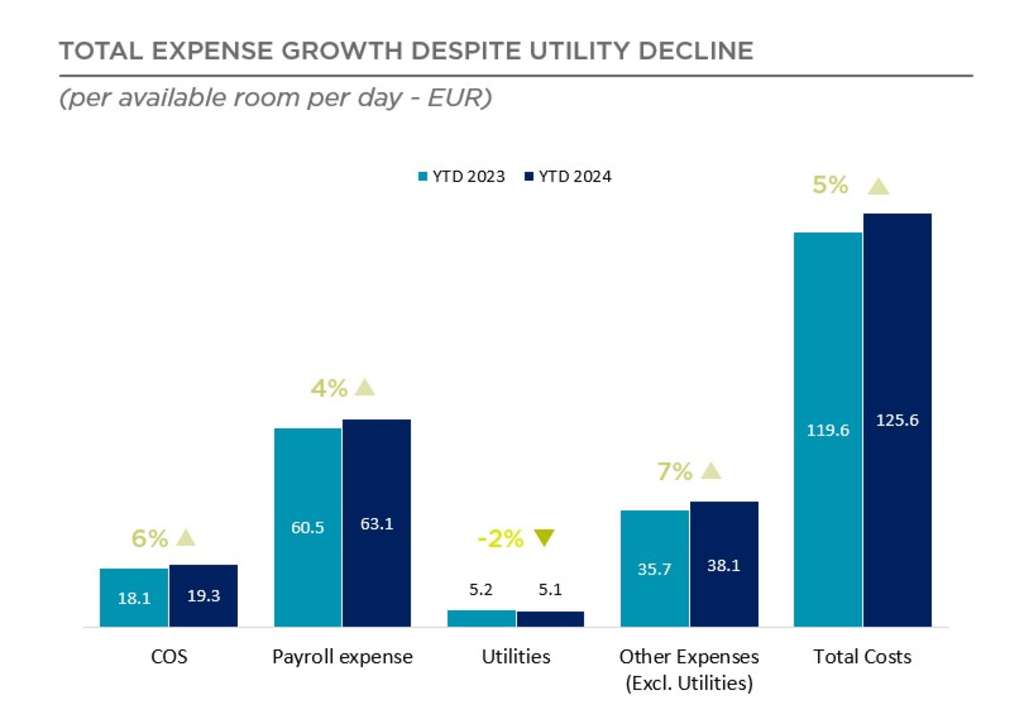

Despite geopolitical conflicts impacting utility expenses, the costs have decreased by 2% compared to the same period in 2023. This utility reduction was driven by a 7% decrease in electricity costs.

Payroll Costs

Total payroll increased by approximately 4%, with part of this attributed to the rise in minimum wage, which has increased by 5% since January 2024.

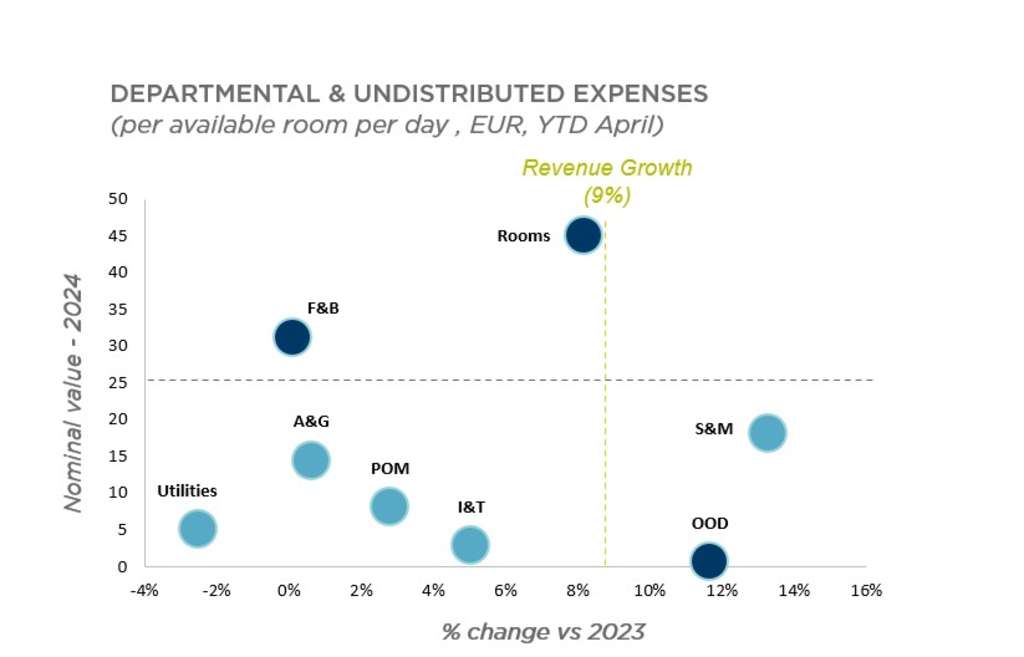

Among all departments, labor costs in Sales & Marketing experienced the most significant change (+9%), followed by Rooms department (+8%)

Other Expenses

Other Expenses in Barcelona hotels increased by 7%, two times faster than the CPI in Spain (3.4% in April 2024). In nominal terms, the Other Expenses grew by €2.4 PAR, driven by Rooms and Sales & Marketing.

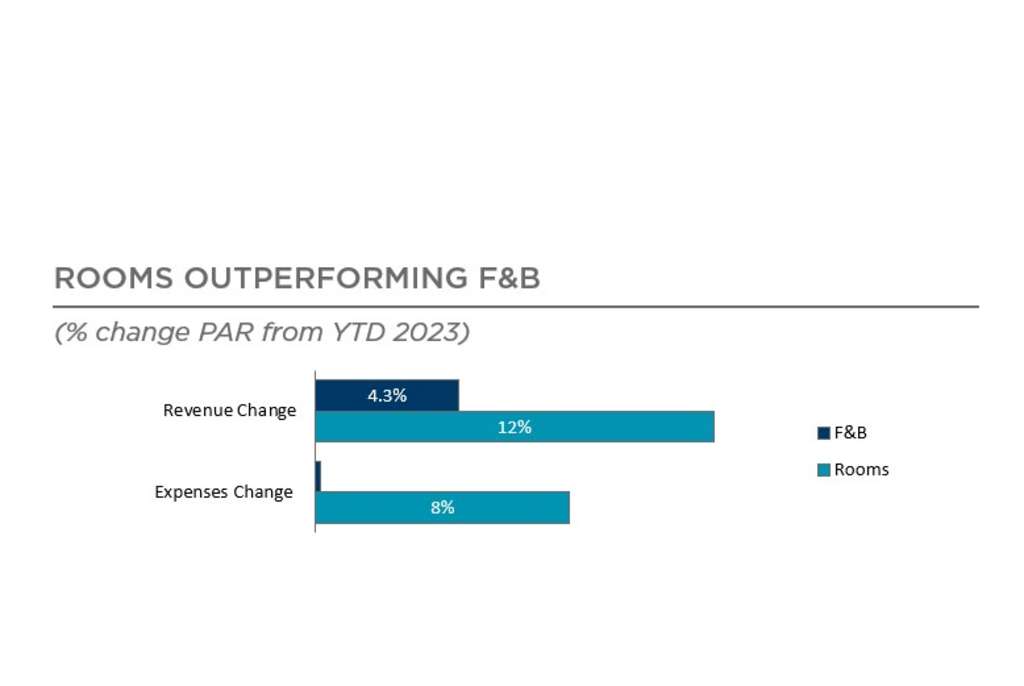

Departmental Revenues

The rooms department was the key driver of revenue growth (+€17 PAR), accounting for 95% of the total revenue increase (+€18 PAR).

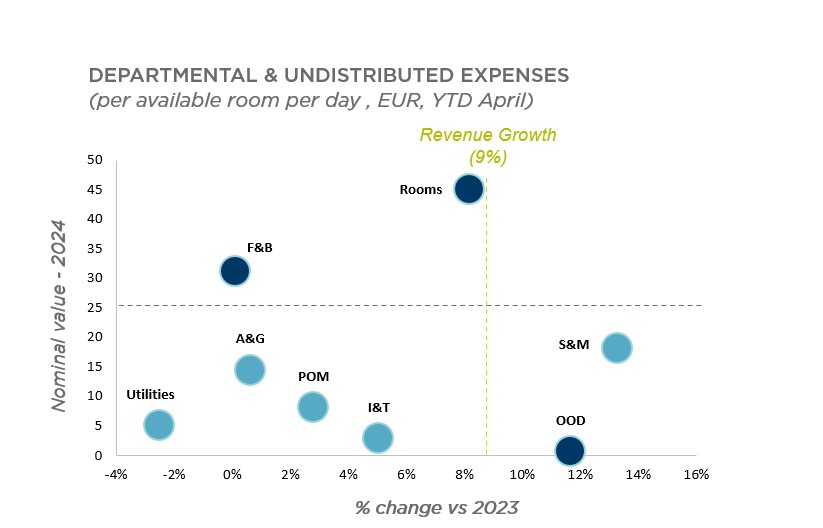

Departmental & undistributed Expenses

Most hotel expenses remained under control, increasing at a slower pace than the total revenue, except the S&M expense (+13%) and Other Operating Department (OOD) expense.