Show Me You Know How to Value a Hotel

... and Win a Copy of my Hotel Valuation Software

Take my hotel valuation quiz, and if you come within 5% plus or minus of the value, I will send you a free copy of my Hotel Market Analysis and Valuation Software—a $250 value—and recognize your achievement in my next Rushmore on Hotel Valuation newsletter. If you don’t come up with the correct value, I will give you a $200 off coupon so you can purchase the software for $50. So everyone is a winner!!

Below is a description of the hotel you will be valuing with all the information you need to estimate its Market Value. Either post your value as a Comment to this newsletter or send it to [email protected]

The Facts:

You are considering the purchase of a 250-unit hotel. This 9-year-old property is operated under a national franchise as a mid-rate lodging facility. Its occupancy has stabilized in the 73% range over the last several years; future trends indicate no significant changes in the supply and demand environment, and prospects for a continuation of a stable economy and occupancy levels are good.

The improvements consist of 250 guestrooms, a 180-seat restaurant, a 125-seat cocktail lounge, 8,000 square feet of meeting and banquet space, an outdoor swimming pool, and adequate parking. The facilities are well maintained and in good physical condition.

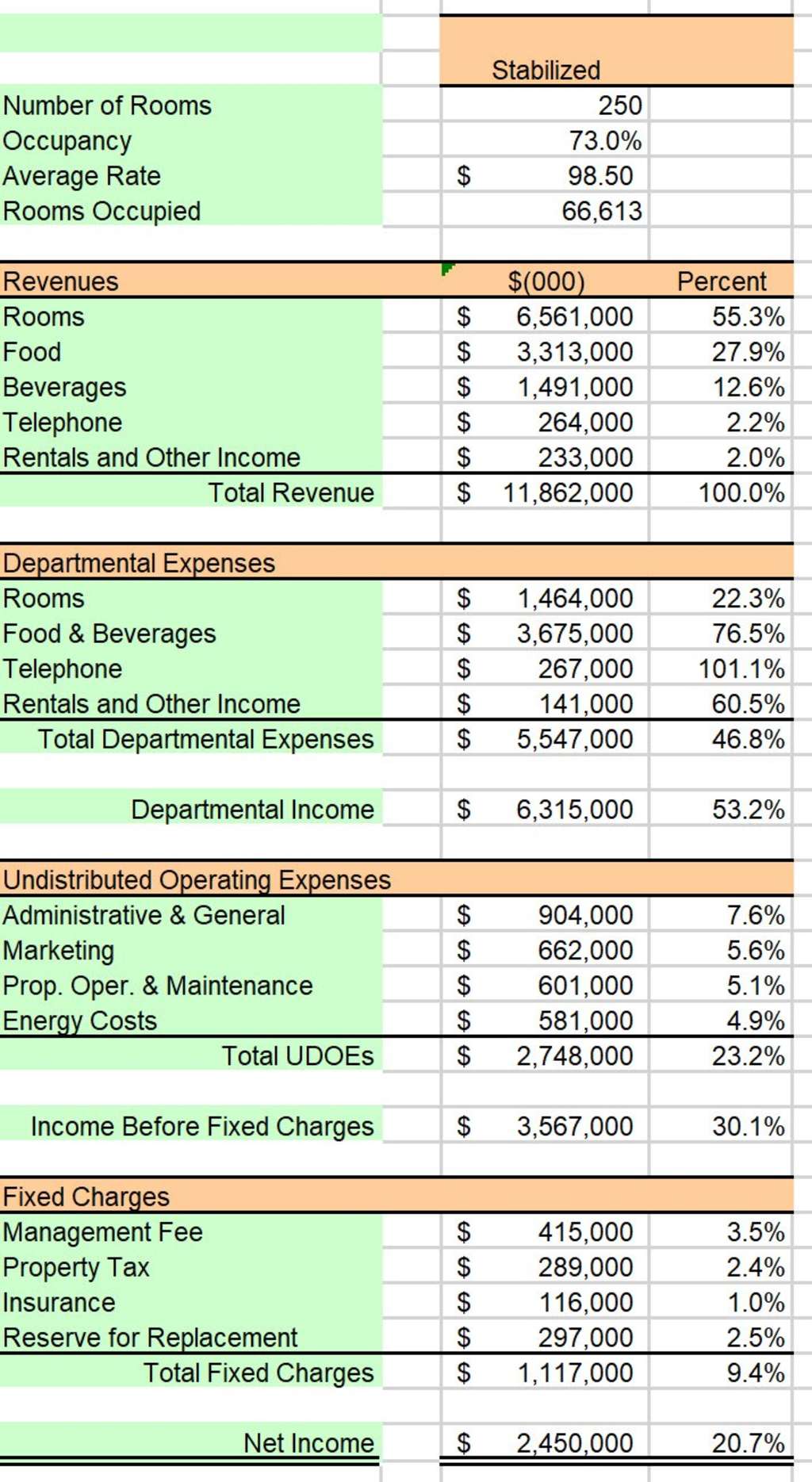

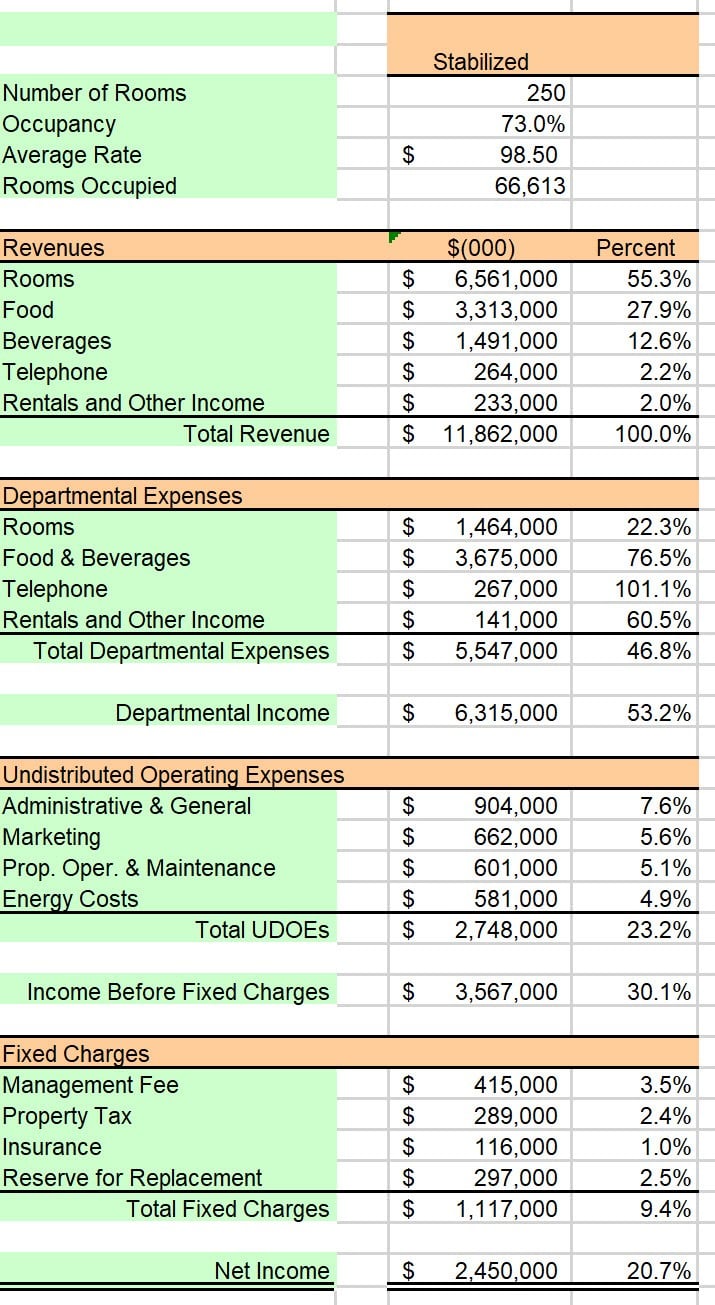

You have evaluated the operating history of the property and have collected the following information:

Statement of Income and Expense

The statement of income and expenses shows the subject property’s stabilized projection of income and expenses, representing your estimate of earnings over the foreseeable future.

Cost Data

Discussions with local real estate professionals indicate that the eight-acre parcel of land comprising the subject property has a current market value of $500,000 per acre. Construction costs for similar lodging facilities are an average of $80,000 per unit, and the property recently completed refurbishments at a cost of $14,000 per unit. The hotel is nine years old and suffers from no physical obsolescence.

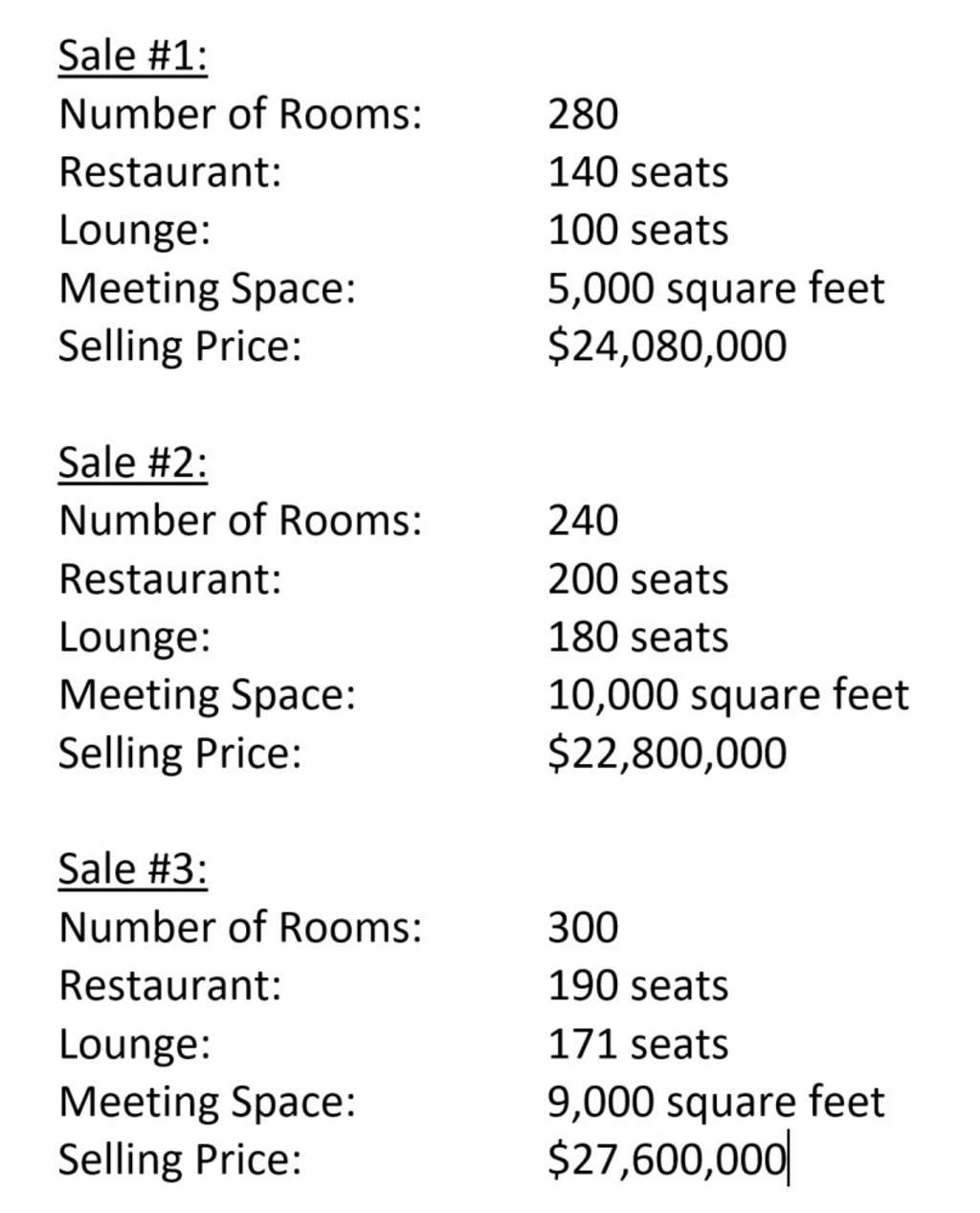

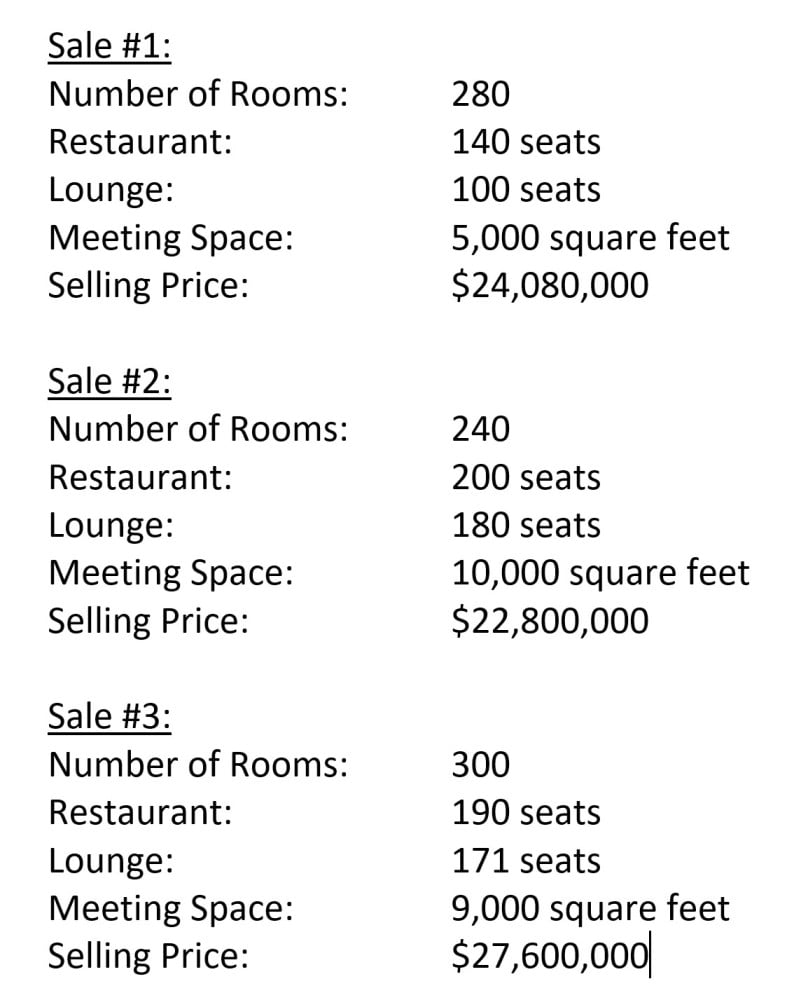

Sales of Comparable Hotels

A review of several hotel transactions shows that three similar hotel properties were recently sold. The data pertaining to these three sales is as follows.

Mortgage Data

Based on your relationship with a local bank, you are able to finance the purchase of this hotel at the following market terms:

- Mortgage Interest: 10.0%

- Mortgage Term: 30 years

- Mortgage Constant: 10.53%

- Loan-to-Value Ratio: 75%

- Equity Dividend: 12.0%

Valuation

Using this data, estimate the highest price that you would be willing to pay for this property.

Submit your value as a Comment to this newsletter or email it to me at [email protected]