Singapore vs Hong Kong - Hotel Market Comparison

This report delves into the intense rivalry between Singapore and Hong Kong, two of Asia’s most influential hotel markets, each vying for dominance in the post-pandemic era. Singapore, now leading the region with occupancy rates surpassing 83% in early 2024, is capitalising on its ability to attract major international events.

Meanwhile, Hong Kong grapples with a sluggish luxury sector and shifting visitor demographics. With average daily rates in Singapore soaring to US$314 and Hong Kong’s new stadium set to open in 2025, these markets are poised for a showdown.

This article unpacks the key metrics, challenges, and opportunities defining the future of hospitality in these pivotal destinations.

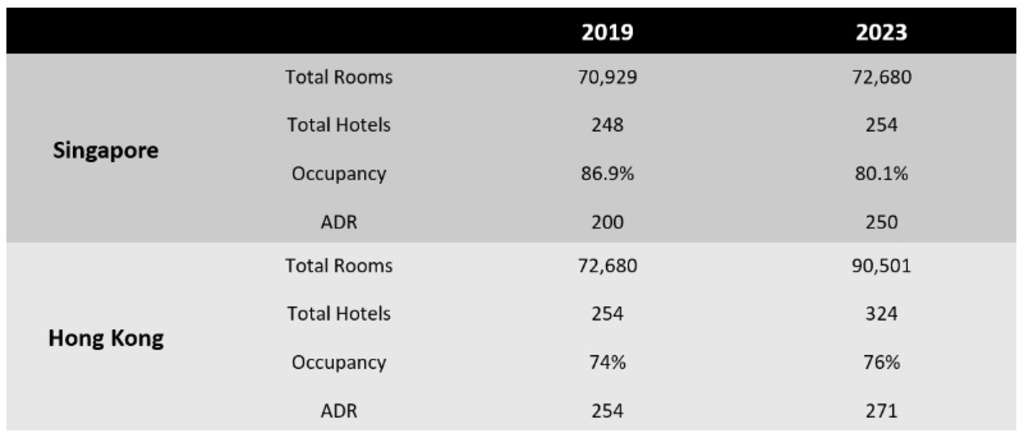

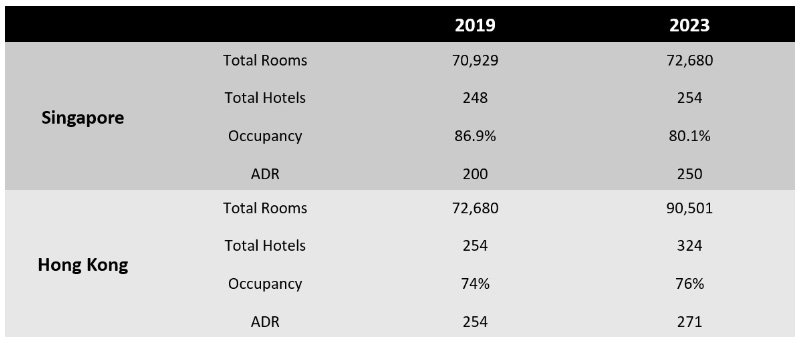

Looking specifically at the key metrics both pre and post-Covid we note the following:

In the year before Covid (2019), Singapore had achieved a long sought-after goal of exceeding Hong Kong in terms of annual RevPar.

Throughout 2023, Singapore experienced a slight decrease in occupancy compared to 2019, but as of April 2024, it has achieved the highest occupancy levels in the Asia Pacific region. In March, occupancy surpassed 83.8%, just below the 84.3% recorded in the same month in 2019.

This increase was driven by guests’ willingness to pay higher rates and an influx of international tourists, facilitated by improved air traffic conditions and major events like the Coldplay and Taylor Swift concerts. Singapore’s ability to attract such events is a key strength, especially as Hong Kong is working on completing a new 50,000-seat stadium scheduled to open in 2025.

The primary difference between the two destinations is how they conduct their business. In Singapore, luxury hotels have experienced a significant increase in both occupancy and rates, reaching a record high of US$282 in revenue per available room (RevPAR) in 2023. The data for the year-to-date March 2024 suggests that hotels are on track to set another record year.

On the other hand, in Hong Kong, there is a contrast in terms of hotel categories. High Tariff A Hotels (upscale, upper upscale, and luxury) have lower occupancy rates in the high 70% range compared to 87% for High Tariff B Hotels and 88% for Medium Tariff Hotels. This reflects the trend of more budget-conscious inbound visitors and the impact of the US Dollar rate peg with the Hong Kong Dollar, which is making the destination less attractive for consumers, especially luxury goods when compared to mainland China.

The average daily rates (ADR) for the respective categories were at US$309, US$144, and US$97. Looking specifically at the pure luxury end of the market with ADRs significantly over US$385, occupancy rates ranged from 45% to 70% depending on the hotel, although some luxury operators maintained high rate levels.

Recently, there has been significant scrutiny of the decrease in spending by visitors coming to Hong Kong as the city works to revitalise its tourism, retail, and hospitality industries. On the other hand, outbound travel from Hong Kong is picking up, reaching levels similar to those before the pandemic. This trend is being driven by improved accessibility within the Guangdong-Hong Kong-Macau Greater Bay Area and the weaker currencies in mainland China and popular destinations like Japan. With the strong dollar, people’s Hong Kong Dollars can go further in these markets, while Hong Kong has become more expensive for many incoming visitors. In terms of full-service accommodations, hoteliers may need to adjust their budgets to align with the uncertain performance of both room and non-room revenue compared to the initial optimism at the beginning of the year.

If we look at performance – from a global perspective STR data for Q1 2024 – points to Hong Kong’s average occupancy of around 73% with ADR at US$204, and Singapore 77% with ADR at US$314. Dubai, London, Mumbai, Singapore and Sydney were all at 80% occupancy or just over for the quarter.

In terms of ADR, Paris (US$309), New York (US$231), Dubai (US$226) and were the key gateway cities leading the charge. Both Singapore and Hong Kong have significant potential to shift up both in terms of rate and occupancy when compared to other global gateway markets. The challenge remains in attracting higher spending visitors for longer and embracing and balancing the attention across both Mainland and international visitors. (Source: STR)

From a global perspective, STR data for Q1 2024 indicates that Hong Kong’s average occupancy stands at approximately 73%, with an ADR of US$204, while Singapore reports an occupancy rate of 77% and an ADR of US$314. Dubai, London, Mumbai, Singapore, and Sydney all recorded occupancy rates of around 80% for the quarter. In terms of ADR, key gateway cities like Paris (US$309), New York (US$231), and Dubai (US$226) are leading the market. Both Singapore and Hong Kong possess considerable potential to enhance both rate and occupancy, particularly when compared to other global gateway markets. However, attracting higher-spending visitors and balancing attention between Mainland and international tourists remain key challenges.

As part of our research for this article, we consulted industry experts for their perspectives on these markets. Kevin Croley, Senior Vice President of Development at Pan Pacific Hotels Group, shares optimism about Singapore’s luxury sector: The luxury sector in Singapore is performing well, we remain bullish on the future, and we are currently developing another property on Orchard Road and the company remains positive on the market.

Meanwhile, in Hong Kong, Dan Voellm, CEO and Founder of AP Hospitality Advisors, confirms the strong performance of mid-scale hotels, noting that 2018 remains the benchmark year. The luxury sector is sluggish at this time. The Hong Kong currency peg to the US Dollar has meant the destination has become more expensive for the majority of visitors

. He feels the local government is being proactive in trying to generate events and draw people to the city and is optimistic about prospects in 2025.

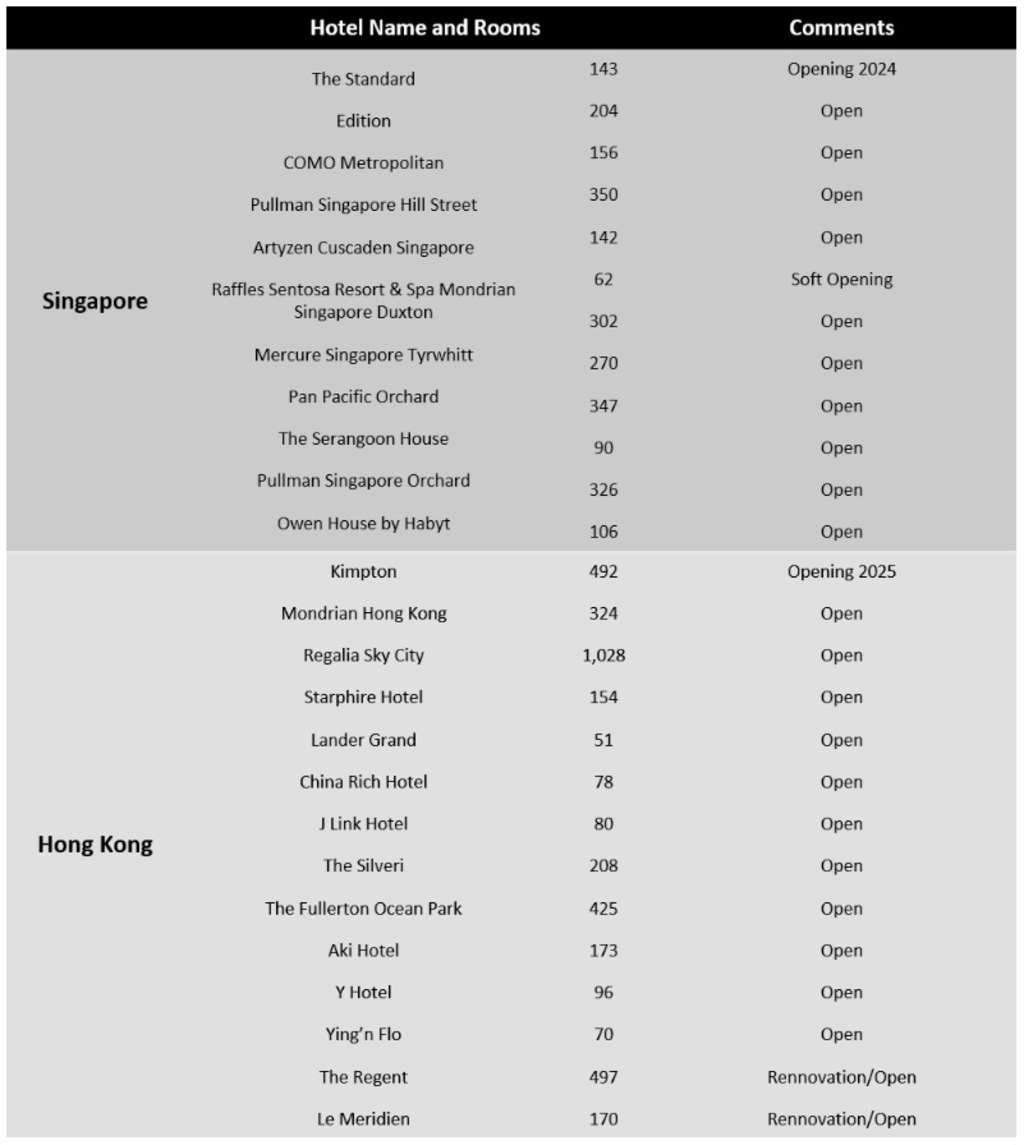

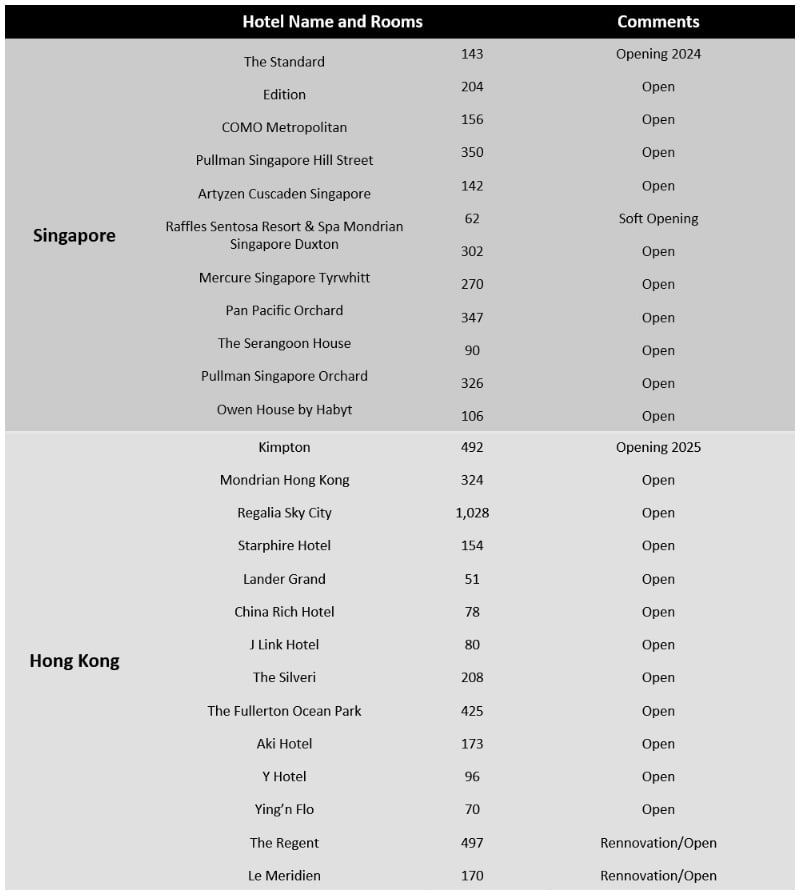

New Supply

New inventory into both destinations remains muted. Hong Kong is seeing a number of established properties undergoing significant renovations, including Regent, Lanson and Le Meridien Cyberport.

Transactions

In terms of transactions, the sale of ParkRoyal on Kitchener Road was the largest single-asset transaction in Singapore in the past 12 months, although transaction volumes declined by 45% in 2023, amounting to US$500 million.

In Hong Kong, there are ongoing discussions about several hotel deals, but actual transactions are limited at the moment. This is partly due to the expectation of higher interest rates for an extended period and the limited availability of bank financing. As a result, buyers are not feeling a sense of urgency to act quickly unless there are strategic reasons or if pricing becomes favourable enough to offer strong risk-adjusted returns.

The prolonged period of elevated interest rates increases the likelihood of downward pricing pressure on assets, particularly for properties with high debt levels. This trend is not unique to Hong Kong but is also observed in London and New York, where capitalisation rates have already started to increase. The uncertainty surrounding the Federal Reserve’s stance adds to the complexity of the market conditions, and rumoured reductions in interest rates could have a positive impact on the market.

In Hong Kong, while the valuation metrics, such as price per square foot, are becoming increasingly favourable, purchasing at a 3% to 4% cap rate is challenging, especially when commercial debt costs are around 7% or higher, with private debt starting at low double-digit rates. Private Equity Real Estate Funds are considering credit strategies over pure equity, and family offices are evaluating options, including acquiring properties with all-cash first and then refinancing later. The buyers in the market are primarily strategic end-users or opportunistic investors.

There is also a growing interest in acquiring underperforming hotels to convert into student accommodation. This is driven by the significant undersupply of larger professionally managed student accommodation offerings.

Labour

Labour continues to pose significant challenges for both destinations, particularly in Singapore, where attracting young talent to the hospitality industry remains difficult in the post-COVID world. This issue has led to some dissatisfaction among visitors, who feel that the customer experience does not align with the premium prices of the hotels.

Outlook

The outlook for Singapore and Hong Kong’s hotel markets is cautiously optimistic. Both cities are witnessing an increase in RevPAR, driven by robust international travel and strategic event hosting. However, growth may be tempered by global economic uncertainties and geopolitical tensions. Singapore’s momentum, supported by record occupancy rates, positions it as a regional leader, while Hong Kong faces the dual challenge of revitalising its luxury sector and adapting to budget-conscious visitors. As flight capacities return to pre-pandemic levels, both markets have the potential to reach new heights, though careful navigation of economic headwinds will be crucial for sustained success.

Disclaimer

The information and analysis presented in this report are gathered from various sources. No warranty or representation as to accuracy or completeness is made by Global Asset Solutions Europe SL, which shall have no obligation with respect to it. All rights reserved ©2024 Global Asset Solutions.

CBRE https://www.cbre.com/insights/briefs/apac-hotels-hospitality-market-update-singapore

Knight Frank https://www.knightfrank.com.hk/research/hong-kong-hotel-report-11031.aspx

Singapore Tourism Board https://www.stb.gov.sg/content/stb/en/media-centre/media-releases/Singapores-tourism-sector-posts-strong-recovery-in-2023-exceeds-forecasts-for-tourism-receipts.html.html#

Jones Lang La Salle https://research.jllapsites.com/appd-market-report/q1-2024-hotels-singapore/

Colliers https://www.colliers.com/en-xa/research/hong-kong-hospitality-blog-may-2024

STR https://str.com/press-release/eras-tour-led-march-records-singapore-hotels

STR https://str.com/data-insights-blog/regional-update-2023-data-and-year-ahead

DOWNLOAD HERE COMPLETE MARKET COMPARISON – SINGAPORE VS HONG KONG

About Global Asset Solutions

Global Asset Solutions operates worldwide providing independent hotel asset management services. Clients include PE firms, institutional investors, sovereign funds and family offices, with over $20bn of assets managed in Europe, Asia and the Middle East. The company leans on decades of experience in the luxury sector to deliver bespoke solutions which allow investors to grow their asset value and realise the potential of their assets. www.globalassetsolutions.com

Alex Sogno

CEO & Senior Hotel Asset Manager

Global Asset Solutions